Nvidia enjoys $130B annual earnings despite gaming segment 'supply constraints'

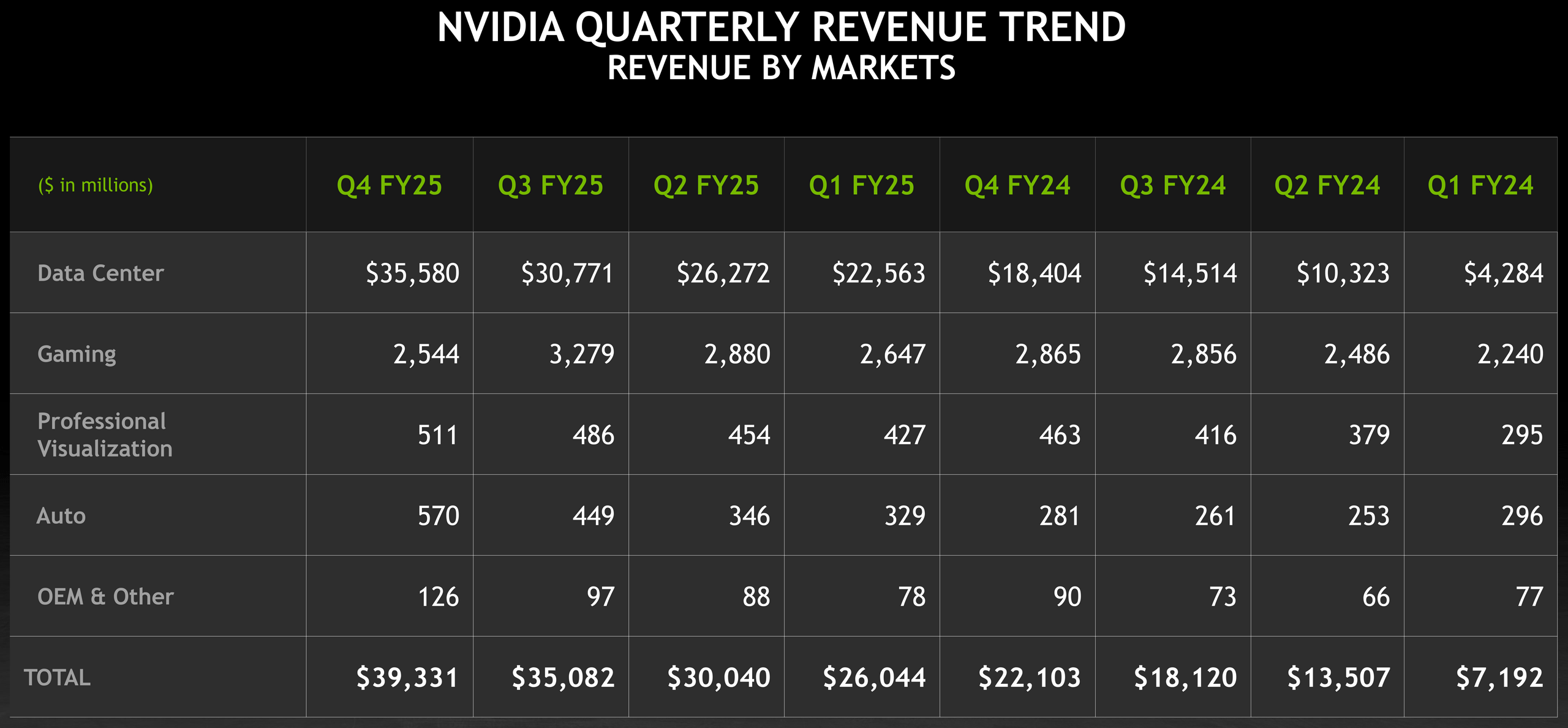

Data center brought in 14x as much revenue as the gaming segment last quarter.

Nvidia on Wednesday published its financial results for the final quarter of its fiscal 2025 and shared progress of its Blackwell GPU ramp. The company's earnings for the FY2025 exceeded a whopping $130 billion, which is an all-time high for the company. Nvidia's sales of Blackwell GPUs for datacenters also significantly exceeded expectations in Q4 of FY2025. However, the company admitted that it was constrained to meet demand for its gaming products last quarter, which is why sales of GeForce GPUs dropped both sequentially and year-over-year.

Record Q4 amid drop of gaming revenue

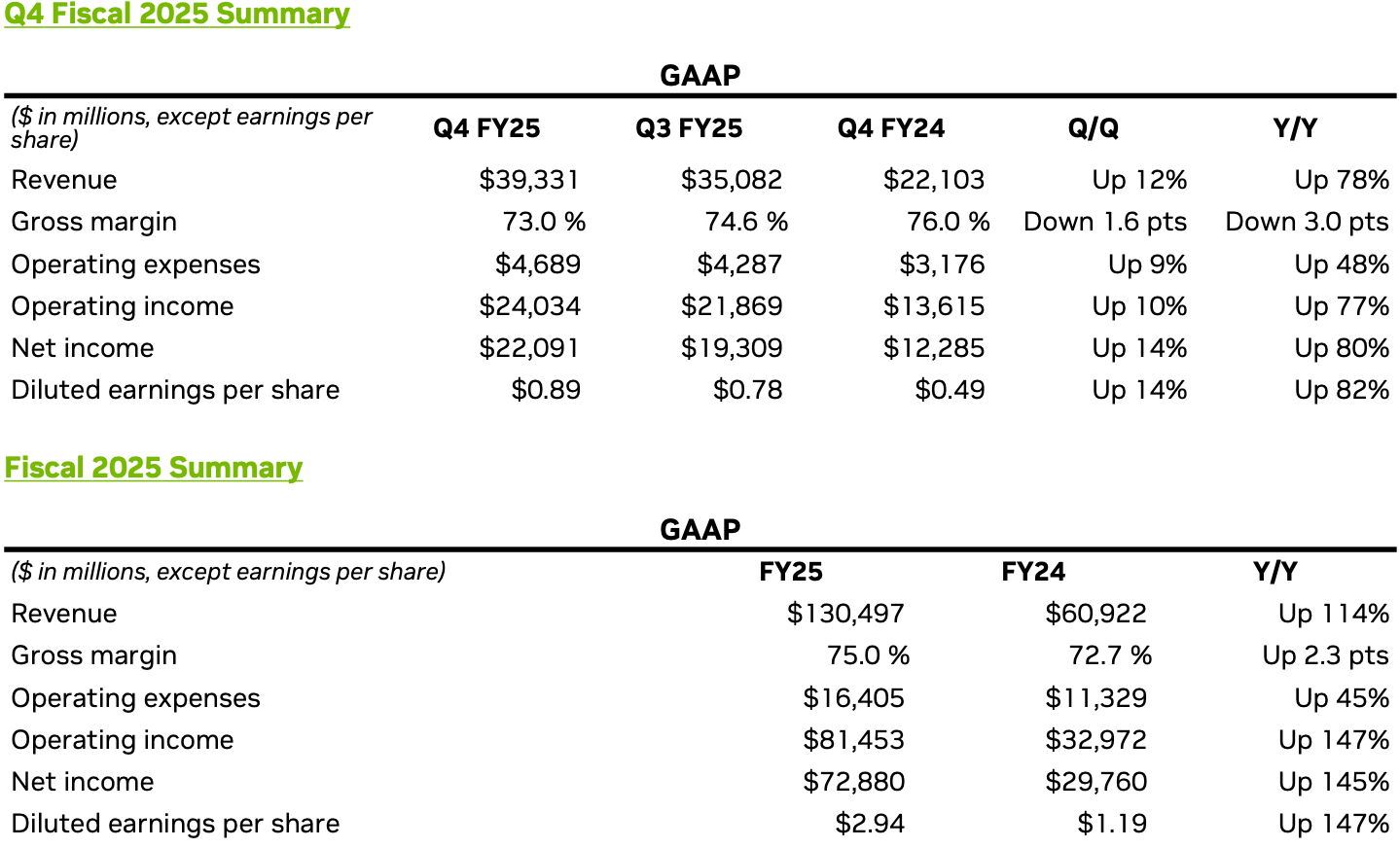

Nvidia posted revenue of $39.33 billion for Q4 FY2025, marking a 12% sequential increase and a massive 78% year-over-year (YoY) growth. The company's net income achieved $22.091 billion as its gross margins hit 73%, down 3% compared to the same quarter a year ago due to Blackwell ramp as well as production of low-yield Blackwell material in the previous quarter. For the year, Nvidia earned $130.497 billion, up 114% YoY. The company's net income was $72.88 billion and its gross margin was 75%, up 2.3% from 2024.

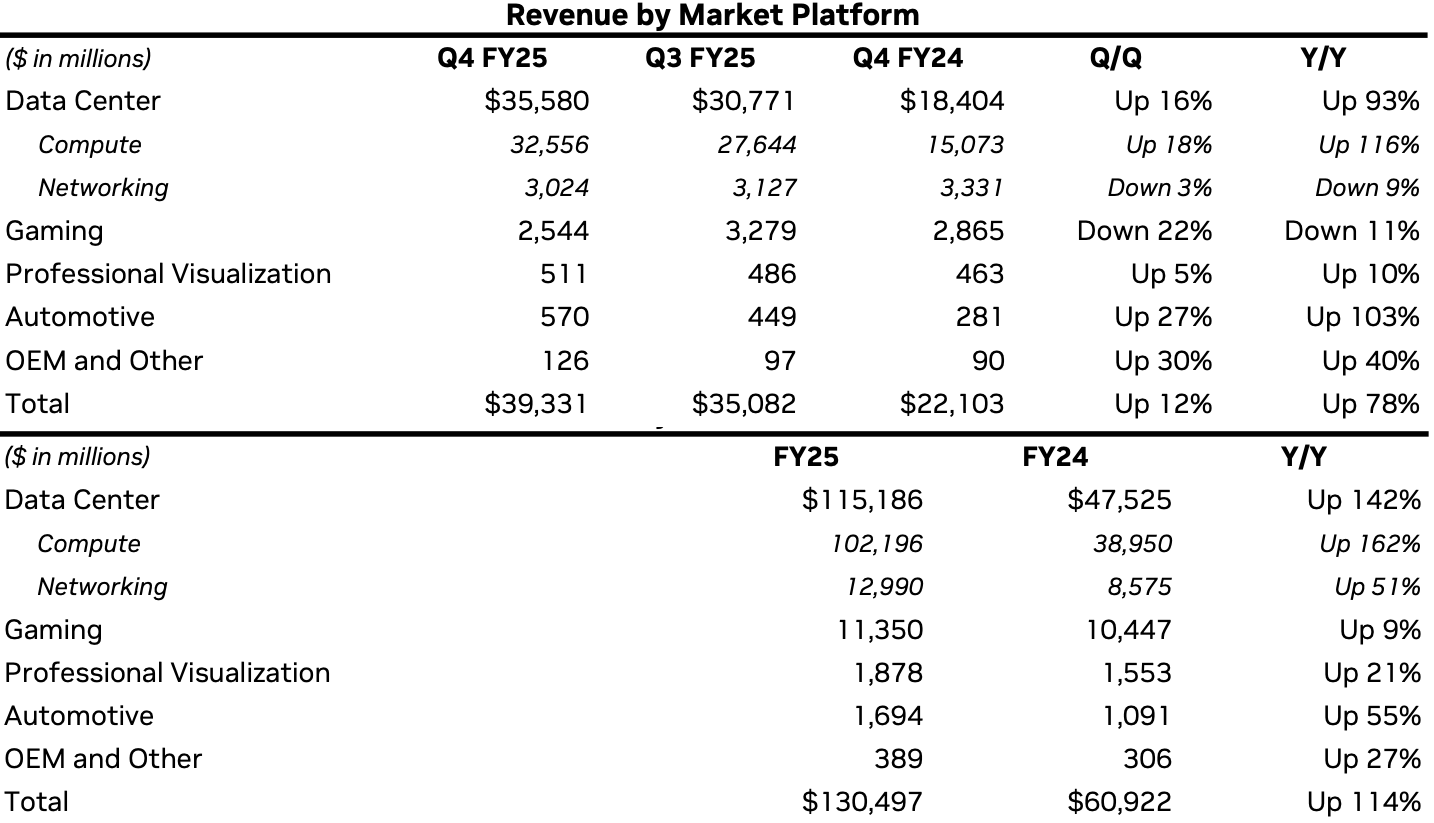

In the final quarter of FY2025, Nvidia's datacenter segment continued to dominate the company's earnings. It generated $35.58 billion, up 16% QoQ and 93% YoY. Compute GPUs accounted for the lion's share of Nvidia's datacenter sales ($32.556 billion), whereas sales of networking products totaled $3.024 billion. Nvidia says that sales of its Blackwell GPUs in the fourth quarter reached $11 billion, significantly more than Nvidia planned. The company indicated that demand for Blackwell GPUs for AI and HPC is overwhelming, which explains significant Blackwell revenue.

By contrast, Nvidia's gaming revenue dropped to $2.54 billion, down 22% QoQ and 11% YoY, due to supply constraints as demand remains strong. Considering the fact that Nvidia now uses the same TSMC production lines for AI and gaming GPUs, it is not surprising that the company prioritizes production of expensive AI processors to lower-margin client products.

" Full year [gaming] revenue of 11.4 billion increased 9% year-on-year, and demand remains strong throughout the holiday," said Colette Kress, chief financial officer of Nvidia. "However, Q4 shipments were impacted by supply constraints."

Still, Nvidia's professional visualization (ProViz) revenue reached $511 million, up 5% QoQ and 10% YoY, and OEM and other contributed $126 million, up 30% QoQ and 40% YoY. The Automotive segment saw the most significant YoY growth at 103%, reaching $570 million (up 27% QoQ), fueled by adoption of Nvidia's platforms by various automakers.

Record year

For the whole year, Nvidia's revenue totaled $130.5 billion, marking an impressive 114% year-over-year growth compared to $60.9 billion in FY2024. Nvidia's datacenter segment was of course the primary driver, generating $115.2 billion (up 142% YoY), followed by gaming revenue with $11.35 billion (up 9% YoY), ProViz business with $1.88 billion (up 21% YoY), and Automotive with $1.694 billion. OEM and other businesses earned Nvidia $389 million, up 27% YoY.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Impressive outlook

Nvidia projects Q1 FY2026 revenue of $43 billion ±2%, reflecting continued strong demand for AI GPUs for datacenters. Gross margins are expected to be 70.6% due to Blackwell ramp up, which costs Nvidia a lot of money.

To support ramp up of Blackwell (both for datacenters and gaming PCs) as well as eventual ramp up of Blackwell Ultra (B300-series), Nvidia has to pre-purchase production capacity. As of the end of FY2025, Nvidia's purchase commitments and obligations for inventory and production capacity were $30.8 billion, including new capacity commitments and components for rackscale and other solutions. Supply and capacity prepayments were $5.1 billion.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

magbarn Unless Ai crashes, this is why the 5090 will always be in short supply until end of production.Reply -

vanadiel007 When you fly high, you will crash hard someday. They cannot sustain these numbers.Reply -

A Stoner Despite... Despite? No, because of the gaming card constraints. They can sell AI silicone for $60,000 and can sell graphics cards for $1000 to $2000. The AI is sold directly by themselves, and most of the $1000 and $2000 cards are sold by their AIB partners, meaning they do not even get the full sales price like they do for selling AI cards.Reply

The restrictions are deliberate and are why they make so much money. -

spongiemaster Reply

They don't have to. They pulled in $73 billion in profits in 2024. AMD generated $1.64 billion which was twice what they did in 2023. $73 billion is likely more profits than AMD has generated in their entire 55 years as a company with all earnings adjusted for inflation. Nvidia could see a 75% decrease in profits and still be an incredibly successful company financially.vanadiel007 said:When you fly high, you will crash hard someday. They cannot sustain these numbers.

Gaming revenue for Nvidia was only 7% of their revenue in Q4. At this point, there has to be some serious thought of what Nvidia plans to do going forward. What's the point of them even staying in the market any longer? Do they spin it off and relieve themself of the headache of dealing with such a finnicky market? -

redgarl There is no constraints in the gaming segment, there is only no real motivation to do more.Reply

The dGPU market is barelly a 6B$ TAM while the Accelerator TAM is about to hit 1T$ in 2028. -

redgarl Reply

The thing is this will change eventually. The market will democratize itself and other chipmakers will get a big part of the pie. It is just a matter of time. 2030 is going to be a good indicator.spongiemaster said:They don't have to. They pulled in $73 billion in profits in 2024. AMD generated $1.64 billion which was twice what they did in 2023. $73 billion is likely more profits than AMD has generated in their entire 55 years as a company with all earnings adjusted for inflation. Nvidia could see a 75% decrease in profits and still be an incredibly successful company financially.

Gaming revenue for Nvidia was only 7% of their revenue in Q4. At this point, there has to be some serious thought of what Nvidia plans to do going forward. What's the point of them even staying in the market any longer? Do they spin it off and relieve themself of the headache of dealing with such a finnicky market? -

acadia11 Yet the markets are giving them a bruising? AMD also took a hit after a record year, so … is it just profit taking or shoe to drop? The “battle of the bit” between the west really the US and China may be weighing heavily on access to AI technology and the inevitable clever solutions that will arise to circumvent this Maginot line. Have we reached the rubicon? I say all this to say when the .… is nvidia going to get off their collective greedy a….s and get50series GPU to the masses!Reply -

acadia11 Reply

Have you looked at the world lately, the people don’t want democracy, or rather the elephants are squashing these very ideals. Across all verticals although information flows freely it has made it easy for a very few to monopolize the usage of that information, meaning, it’s easier today to quell a competitor because it’s easier to dominate a particular information space and echo it at warp speed. With the exception of ARM which I would argue is that elephant in the RISC space although many use its tech… what tech industry is democratic when it comes to key components for cutting edge? The cost of entry is simply too high … I would argue it’s the exact opposite you’ll get consolidation like every other Industrial Revolution. And only because it’s early on can little fish play … it’s like a star you got all this stuff floating about and it eventually consolidates and coalesces around the bits with greatest gravity which ironically just makes the behemoths bigger…. And so on … inertia and gravity … don’t see this changing.redgarl said:The thing is this will change eventually. The market will democratize itself and other chipmakers will get a big part of the pie. It is just a matter of time. 2030 is going to be a good indicator. -

hotaru251 Jensen himself stated years ago they are no longer a graphics company they are an AI company just havent changed the name.Reply

Gaming gpu are lost profit to them as why sell a $1200~ 90 tier gpu when can sell a multi thousand dollar ai chip? -

TerryLaze Reply

If you think gaming is finnicky....jeeshspongiemaster said:Gaming revenue for Nvidia was only 7% of their revenue in Q4. At this point, there has to be some serious thought of what Nvidia plans to do going forward. What's the point of them even staying in the market any longer? Do they spin it off and relieve themself of the headache of dealing with such a finnicky market?

GPUs will not be the best thing for AI for ever, unless nvidia comes up with the next big thing or can at least also provide it they will go back to before AI and gaming will once again be their main income.

I mean quantum makes massive improvements and could overtake normal AI in the next years, and yes nvidia is also trying hard in quantum so they might be alright, I'm just saying.