Intel quad-core processor pricing makes unexpected drop

Analysis: Four cores below the trend curve

Click image to enlarge

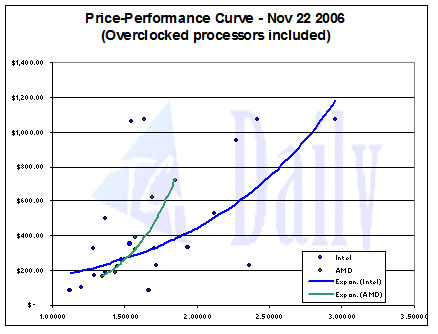

The trend lines are even more interesting to look at this week. AMD's price rebound actually helped out its price/performance correlation, with its coefficient value climbing back to 0.892, the highest it's been since October 20, stretching it out more horizontally and giving it back the overall advantage on the lower end by a little more than the past few weeks.

Intel, on the other hand, continues to fall when it comes to price/performance correlation. Though price changes have been very minimal in the past several weeks, there's been an overall trend in lack of correlation, no matter which way it's viewed. This week, when we include overclocked processors, the correlation coefficient is 0.583.

Click image to enlarge

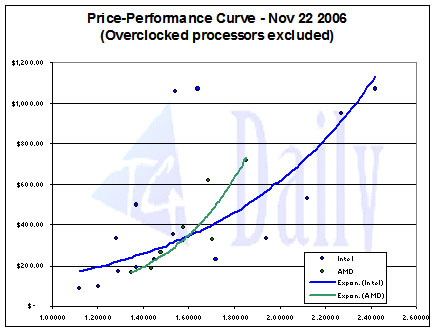

When overclocked processors are taken out, Intel's correlation is 0.639, which is again near the lowest it's been over the past eight weeks. Prices are still adjusting to the newly released QX6700, which clearly is still trying to find its own reasonable price level.

Click image to enlarge

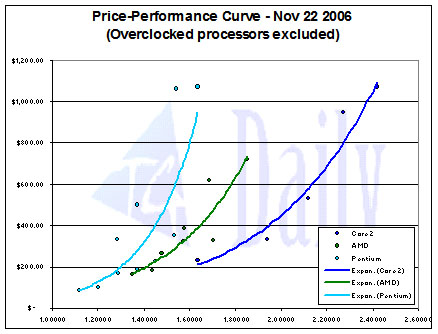

Most evidently seen on this graph is the fact that it's Intel's lower-end processors that are really beginning to sway. The Pentium D processors, when looked at separately from everything else, show a price/performance correlation of 0.786, a significant fall from the high 0.8 range that was seen just a couple weeks ago. As can be seen in the data chart on the previous page, there was a lot of discord in prices on these models this week. Some of the Pentium Ds saw price jumps, while others fell in price. It caused them to jumble around the trend line a little bit. The high-end products, on the other hand, had a relatively constant correlation from what we've seen previously, at 0.919.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

And again, it is a rather unusual sight that the fastest processor on record, the QX6700 in fact checks in below the price/performance curve, which would indicate that it is a rather good deal right now.

Mark Raby is a freelance writer for Tom's Hardware, covering a wide range of topics, from video game reviews to detailed analyses of computer processors.