Nvidia becomes the world's most valuable company by market capitalization — Chipmaker dethrones Apple for the second time this year

Nvidia is now worth more than Meta and Amazon combined.

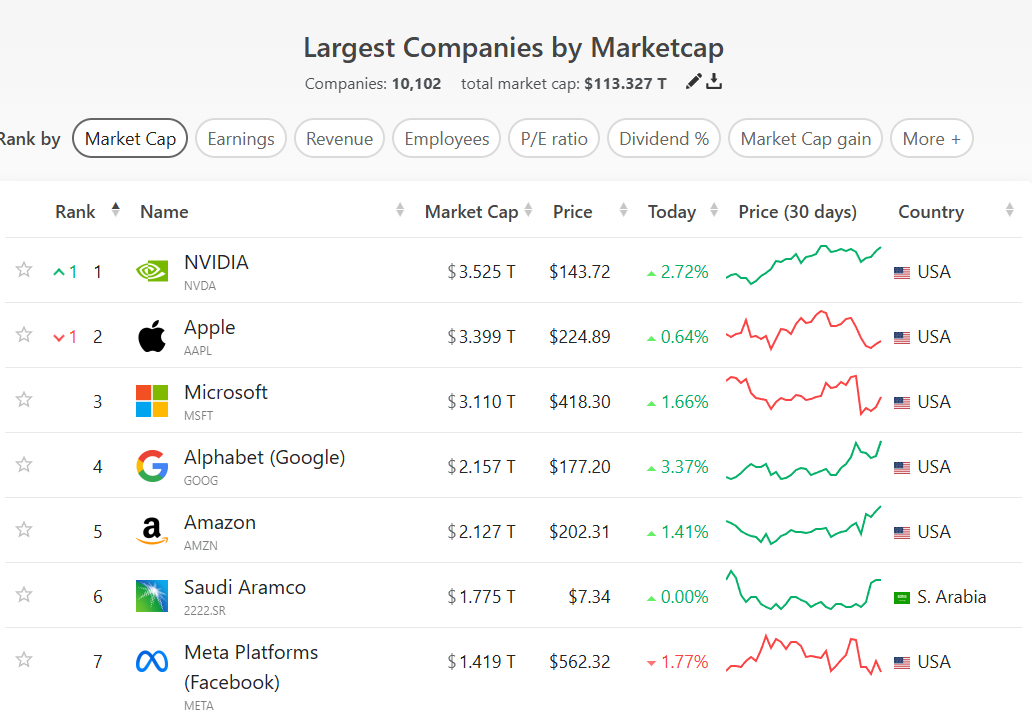

The AI hype is in full throttle, as Nvidia is now the largest company in the world by market cap. With a market capitalization of $3.52 trillion, Nvidia has effectively dethroned Apple for the second time this year.

This news follows developments in the stock market, with Nvidia's shares surging by 2.72% this morning. All top leaders had a bullish start to the day, but a 0.64% uptick wasn't enough for Apple to hold off the green storm. Nvidia now stands as the world's largest company by market cap, but will it be able to defend its position? If so, for how long?

A deeper dive into Nvidia's stock shows that just one year ago, its market cap stood at roughly $1.1 trillion, netting us a 214% increase in the stock price within just 365 days. This is genuinely unprecedented growth, most of which can be attributed to Nvidia's ventures in the AI market as the chipmaker's accelerators continue to fuel the hype train. Q2 24 earnings show that Nvidia's revenue rose by 141% QOQ, increasing to $10.3 billion in data centers, while gaming was a measly 11% at $2.5 billion.

With virtually every company planning to get a piece of the AI pie, they still require chips specifically tailored for Artificial Intelligence training and inference. Nvidia's latest Blackwell-based B100 and B200 GPUs are reportedly sold out for the next 12 months. Companies revolving around AI, such as OpenAI, Microsoft, Alphabet, Meta, you name it, are all in an arms race to procure the latest chips from Nvidia.

AMD's CDNA3-based MI325X and the upcoming CDNA4-based MI355X could shake things up somewhat. For the time being, companies might still be inclined to prefer Nvidia due to its better software stack; however, more competition is good for evsuitablene - even multi-trillion-dollar conglomerates. The question boils down to mass-scale production since data centers and supercomputers require 10,000 to 100,000 GPUs, so it ultimately depends on whether either company can fulfill the required demand within the required time.

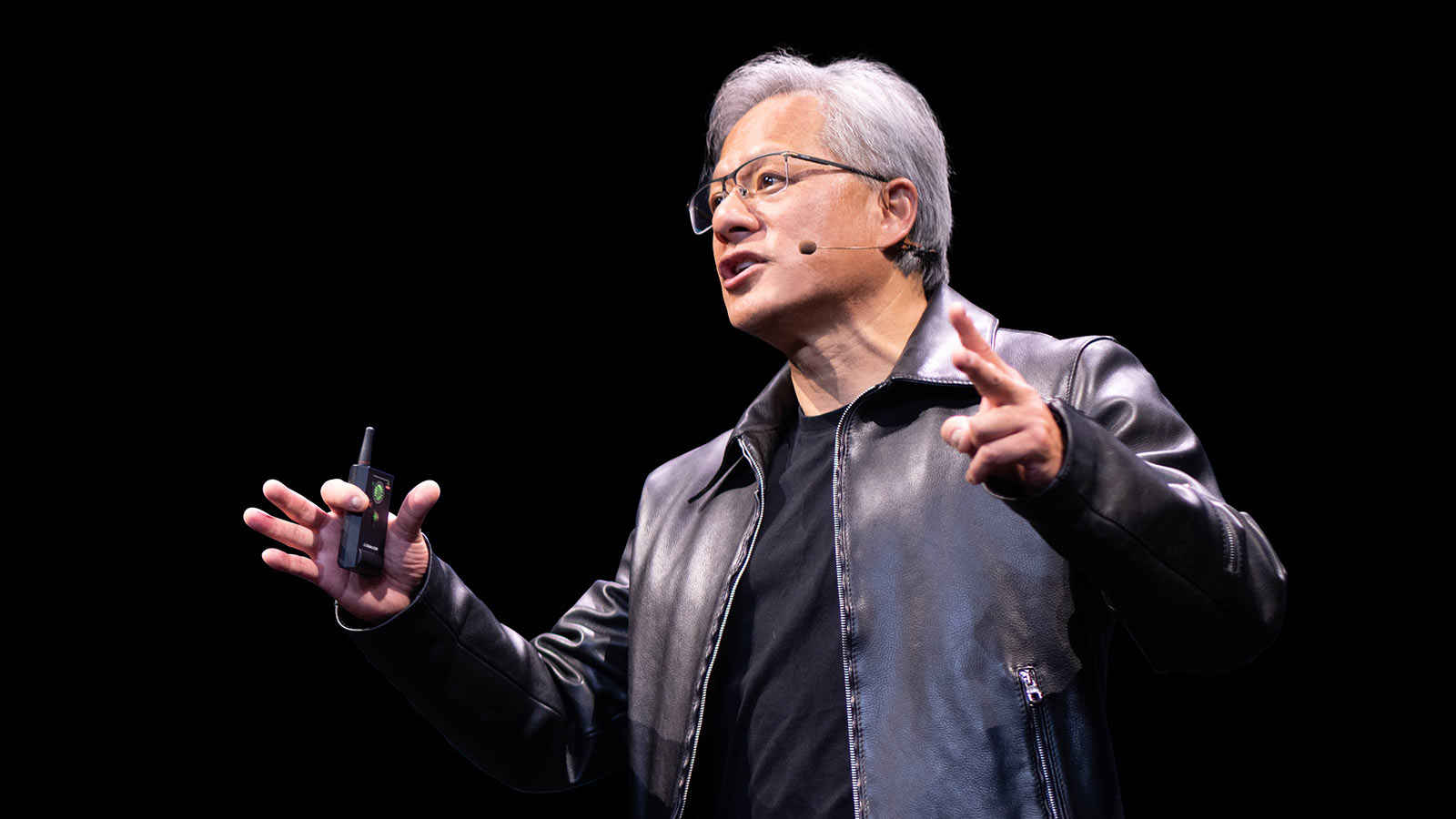

These have been two very eventful years for not just Nvidia but its CEO, Jensen Huang, who is set to receive an honorary doctorate in engineering. Financially, consumer GPUs seem to be an afterthought for Nvidia, although leaks suggest that Nvidia is eying a January 2025 reveal for the much-anticipated RTX 50 series.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Hassam Nasir is a die-hard hardware enthusiast with years of experience as a tech editor and writer, focusing on detailed CPU comparisons and general hardware news. When he’s not working, you’ll find him bending tubes for his ever-evolving custom water-loop gaming rig or benchmarking the latest CPUs and GPUs just for fun.

-

thisisaname Would they be worth more if the could acquire more of their chips?Reply

Edit their P/E ratio is quite high (current 64.77 PE ratio is 27% above the historical average) but it has been higher (Apr 2023 quarter at 146.05). If it was they would be worth about $7.937 trillion.