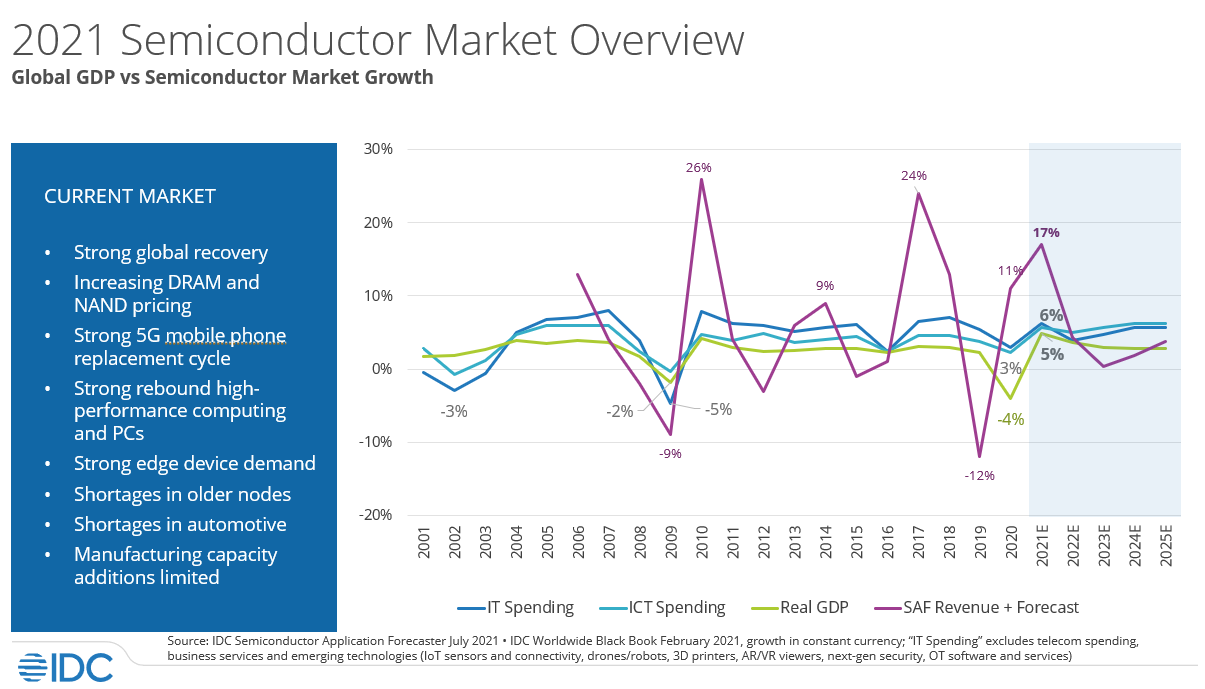

IDC Report: Semiconductor Market to Grow by 17.3% in 2021, Overcapacity by 2023

The semiconductor market shows no signs of slowing down.

IDC yesterday published a report on the health and expectations of the semiconductor market, noting an expected growth of 17.3% for the current calendar year. The forecast beats the historical growth of 10.3% registered for 2020, which saw overwhelming demand for semiconductors from almost all related industries due to the COVID-19 pandemic.

The report indicates that foundry capacity throughout 2021 is allocated at nearly 100%, albeit issues remain from back-end manufacturing and materials procurement. By mid-2022, supply should return to normal, following production capacity expansions coming online. IDC expects this growth to be driven by mobile phones, notebooks, servers, automotive, smart home, gaming, wearables, and Wi-Fi access points.

Another element of the report is cause for trouble however: IDC forecasts memory price increases as well, driven by increased demand and mounting capacities for consumer electronics (larger internal storage and RAM, alongside the transition from 4G phones to 5G and its related consumption increase are partly responsible).

IDC points out that most revenue growth will be led by 5G semiconductor revenues (a whopping 128% increase). Mobile phone semiconductors are expected to grow by 28.5%. Game consoles (34%), smart home (20%), and wearables (21%) will join the automotive semiconductor revenue increase (expected 22.8%) as shortages are mitigated towards the end of the year and throughout 2022. Notebook semiconductor revenues are expected to grow by a more constrained 11.8%, while X86 server semi revenues will increase by 24.6%.

All in all, IDC expects the overall semiconductor market to reach $600 billion by 2025, with an expected CAGR (Compound Annual Growth Rate) of 5.3%, higher than the historic 3-4% growth rate. However, an expectation of overcapacity by 2023 (as manufacturers finish bringing online capacity expansions initiated throughout the 2020-2022 period) could bring about a tipping point related to the supply and demand equation.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

bigdragon Having supply return to normal in mid-2022 confirms that the chip crisis will carry over into 2023. There's always lag time between the OEMs and retailers. Some sort of natural disaster or power outage is guaranteed to delay projections too.Reply

There will be no oversupply -- that's pure BS coming from analysts hyper-focused on min/maxing everything. They've learned nothing from the current crisis.