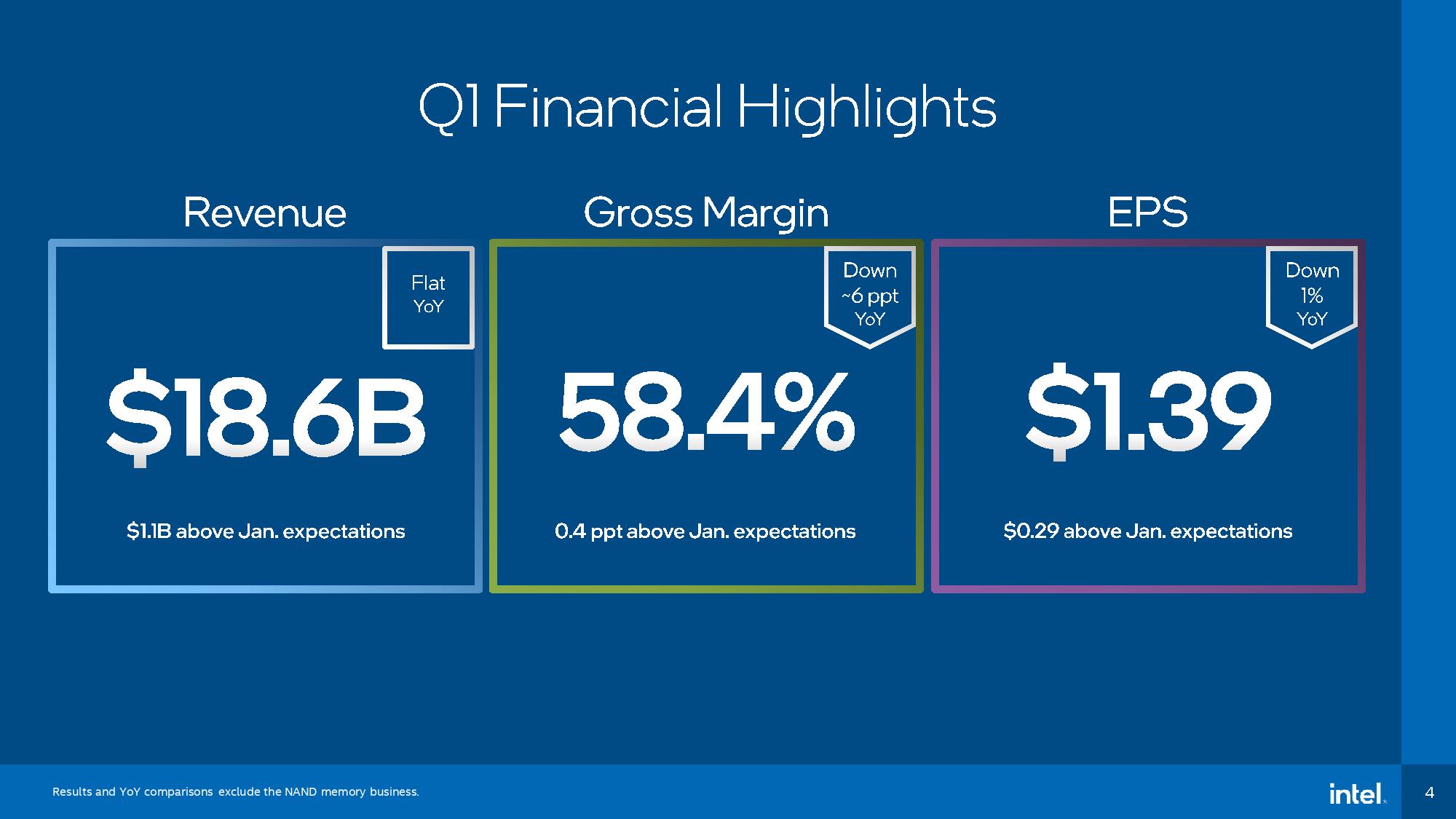

Intel's Q1 2021: PCs Up, Data Center Revenue and Profit Plummets

The data center drop

Intel's new CEO Pat Gelsinger helmed his first full earnings call for the company yesterday, echoing other industry leaders in saying that the ongoing industry-wide chip shortages could last several more years. Intel also reported that it set a quarterly record for the most notebook PC chips sold in its history, but also reported a sudden slump in data center sales that found revenue dropping 20%, a record for the segment, as the number of units shipped and average selling prices both declined dramatically. Intel also posted its lowest profitability for its server segment in recent history, which surely is exacerbated by AMD's continuing share gains and Intel's resultant price cuts.

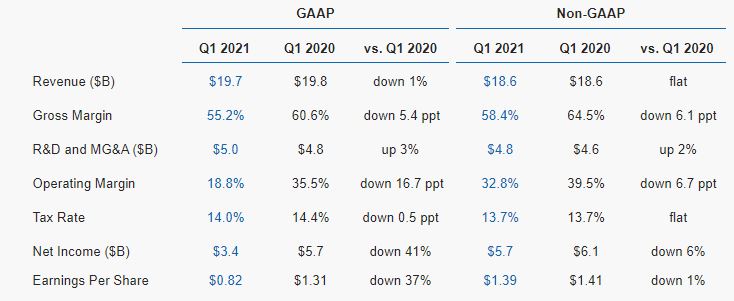

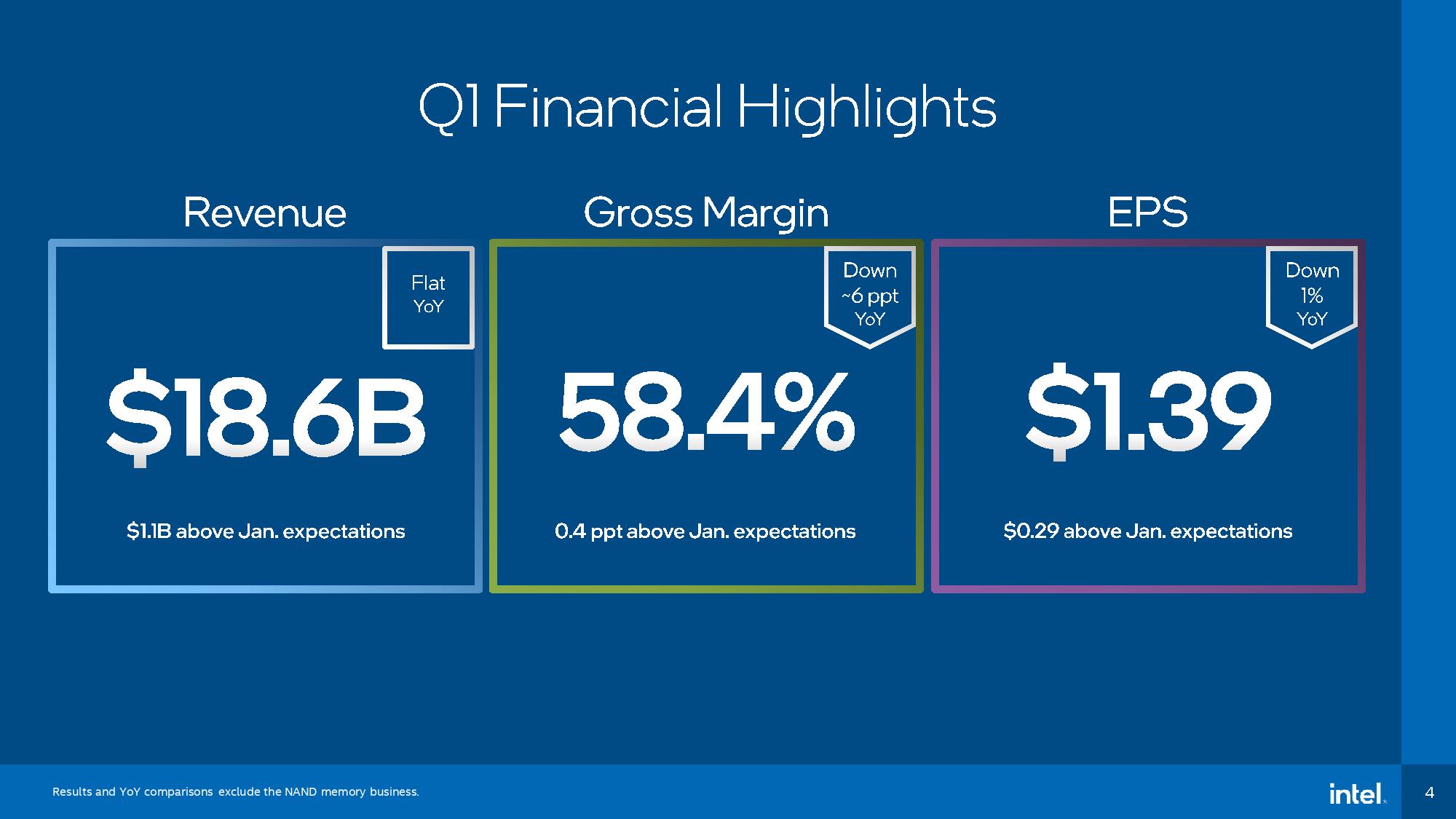

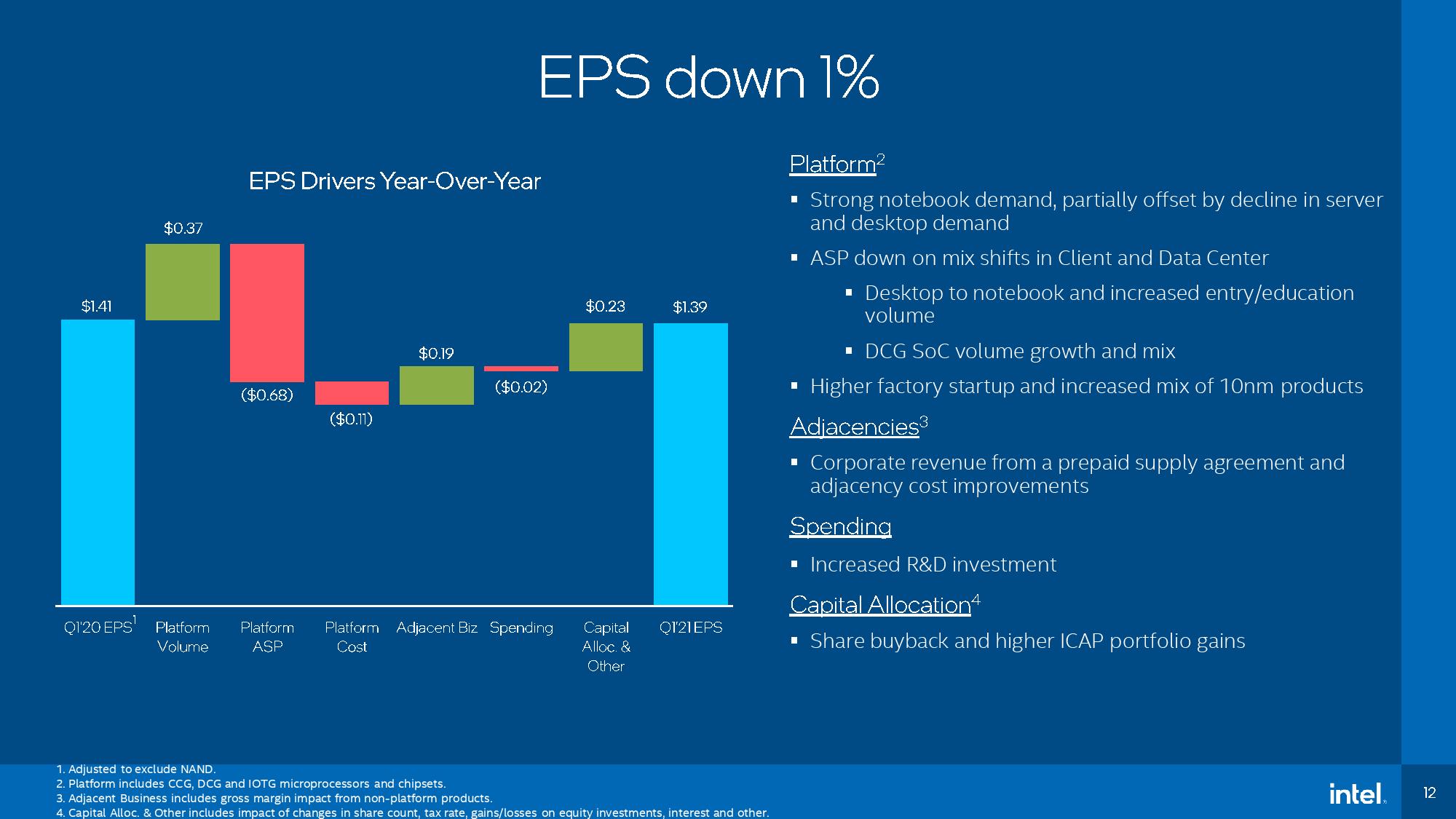

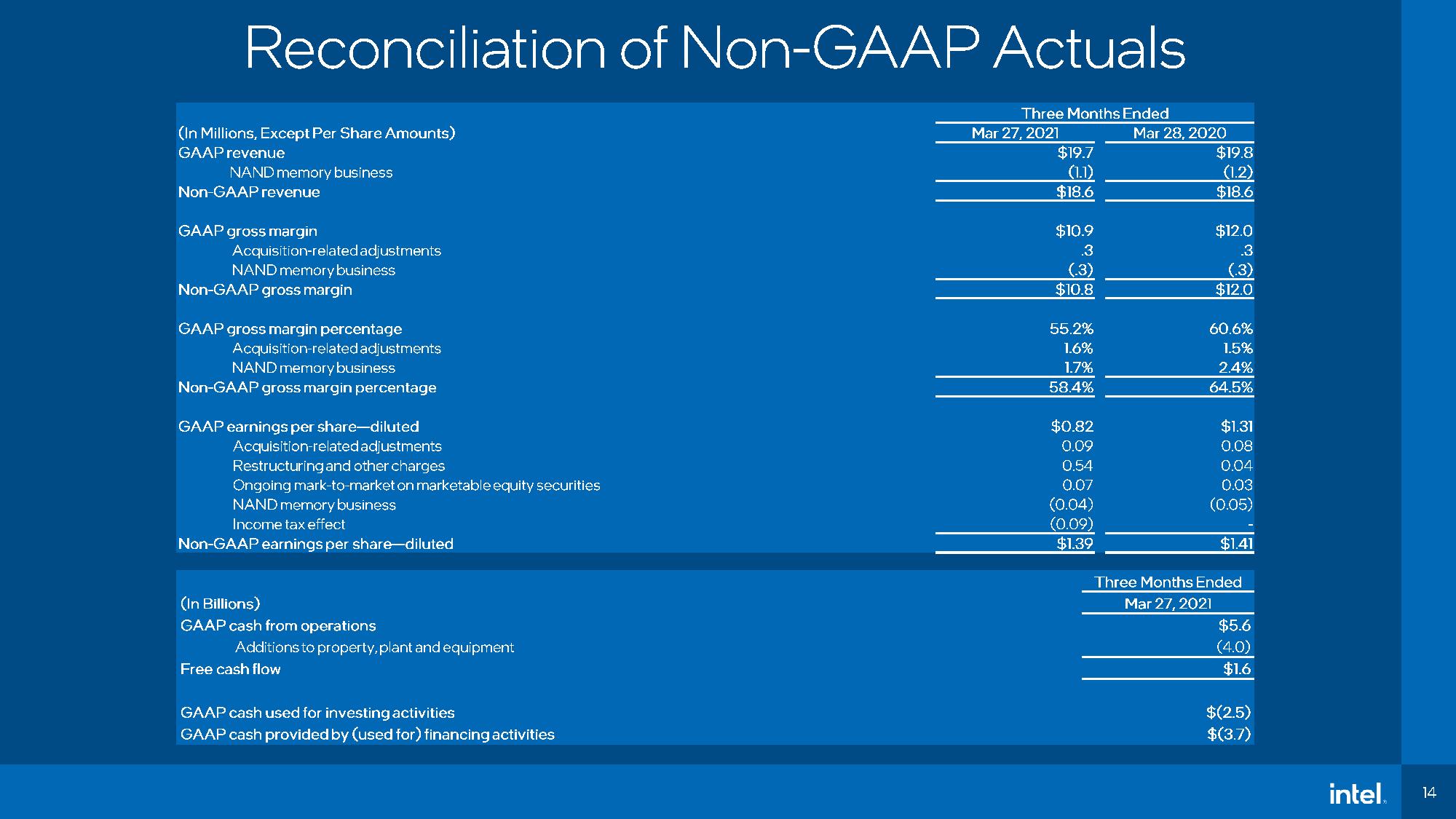

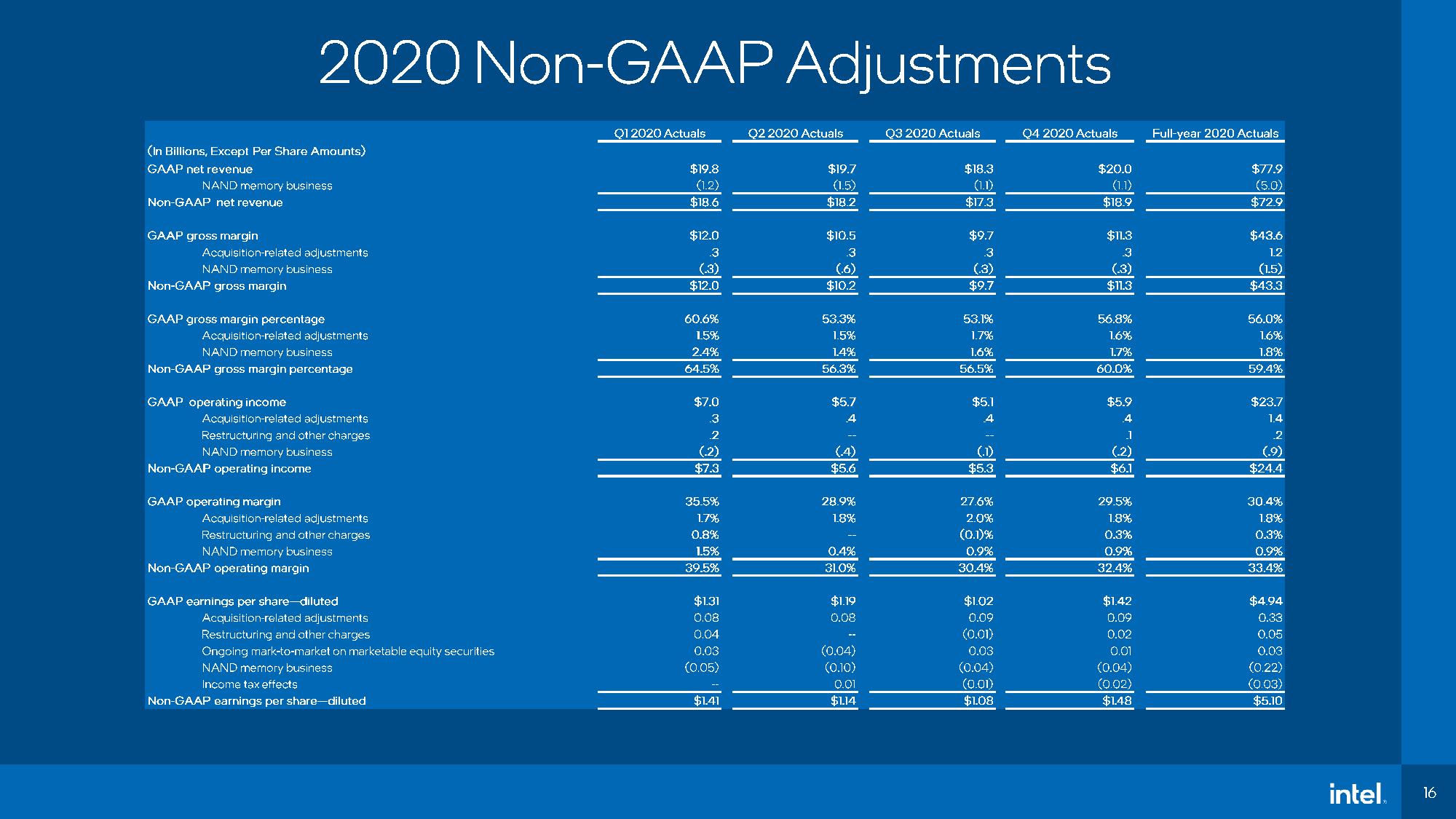

Intel's first-quarter 2021 results were strong overall; the company raked in $18.6B in revenue, beating its January guidance by $1.1B (and analyst estimates). However, the impressive quarterly revenue is tempered by the fact that gross margins dropped to 58.4%, a 6.1 ppt decline year-over-year (YoY).

Chips shortages are top of mind, and Gelsinger said he expects the industry-wide chip shortages to last for several more years. A shortage of substrate materials and chip packaging capacity has hamstrung the industry, and Gelsinger said that Intel is bringing some of its chip packaging back in-house to improve its substrate supply. That new capacity comes online in Q2 and will "increase the availability of millions of units in 2021."

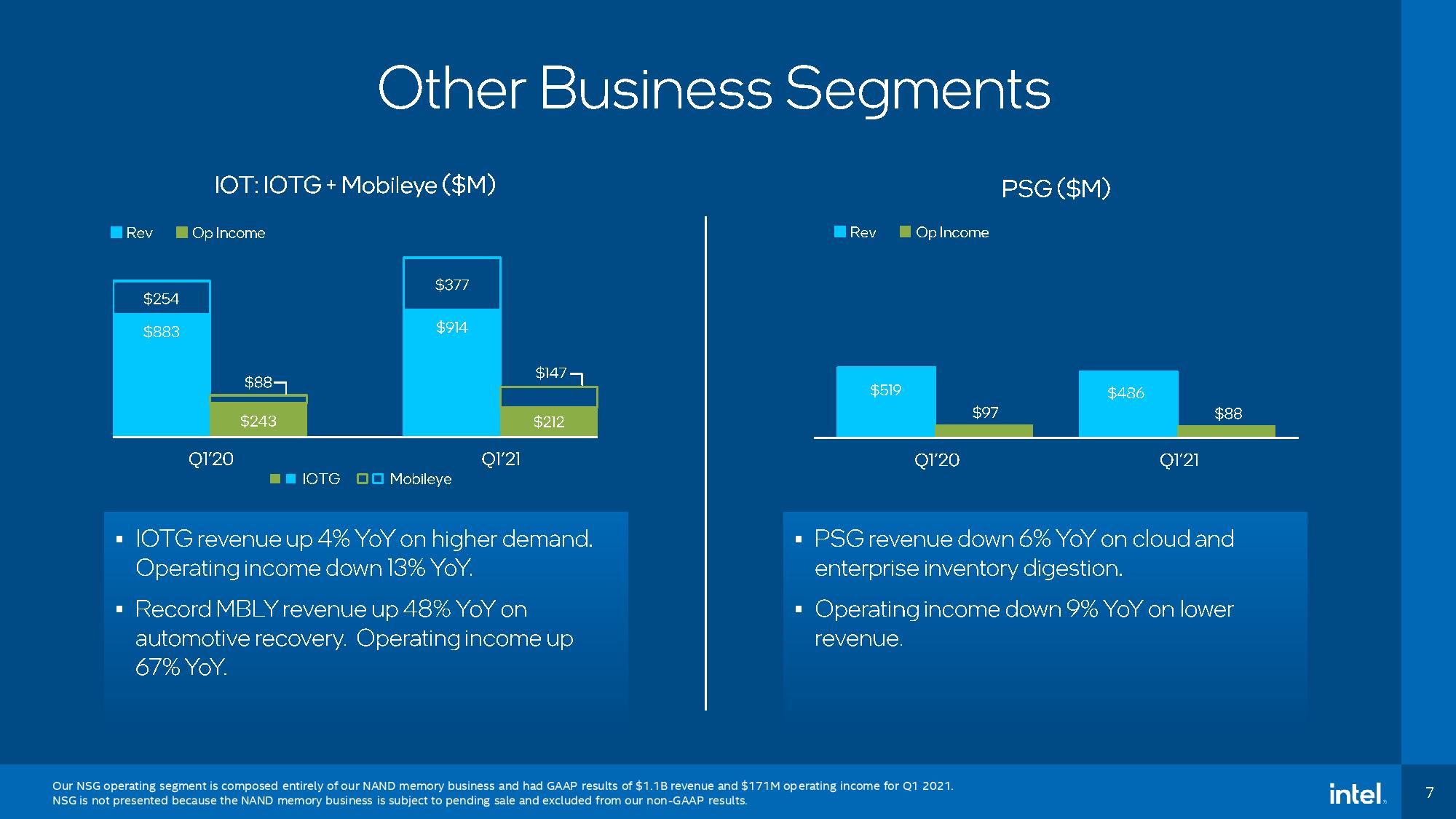

Intel's Client Computing Group (CCG), which produces both notebook and desktop PC chips, posted record notebook PC sales that were up 54% YoY. However, average selling prices (ASPs) dropped a surprising 20% YoY, which Intel chalked up to selling more lower-end devices, like low-end consumer and education (Chromebooks). Competitive pricing pressure from AMD's Ryzen 5000 Mobile processors also surely comes into play here.

Meanwhile, desktop PC volumes dropped 4% YoY while average selling prices dropped 5%, a continuation of an ongoing trend that's exacerbated by tough competition from AMD's Ryzen 5000 processors. All told, that led to CCG revenue being up 8% YoY. Intel's consumer chips now account for 59% of its revenue.

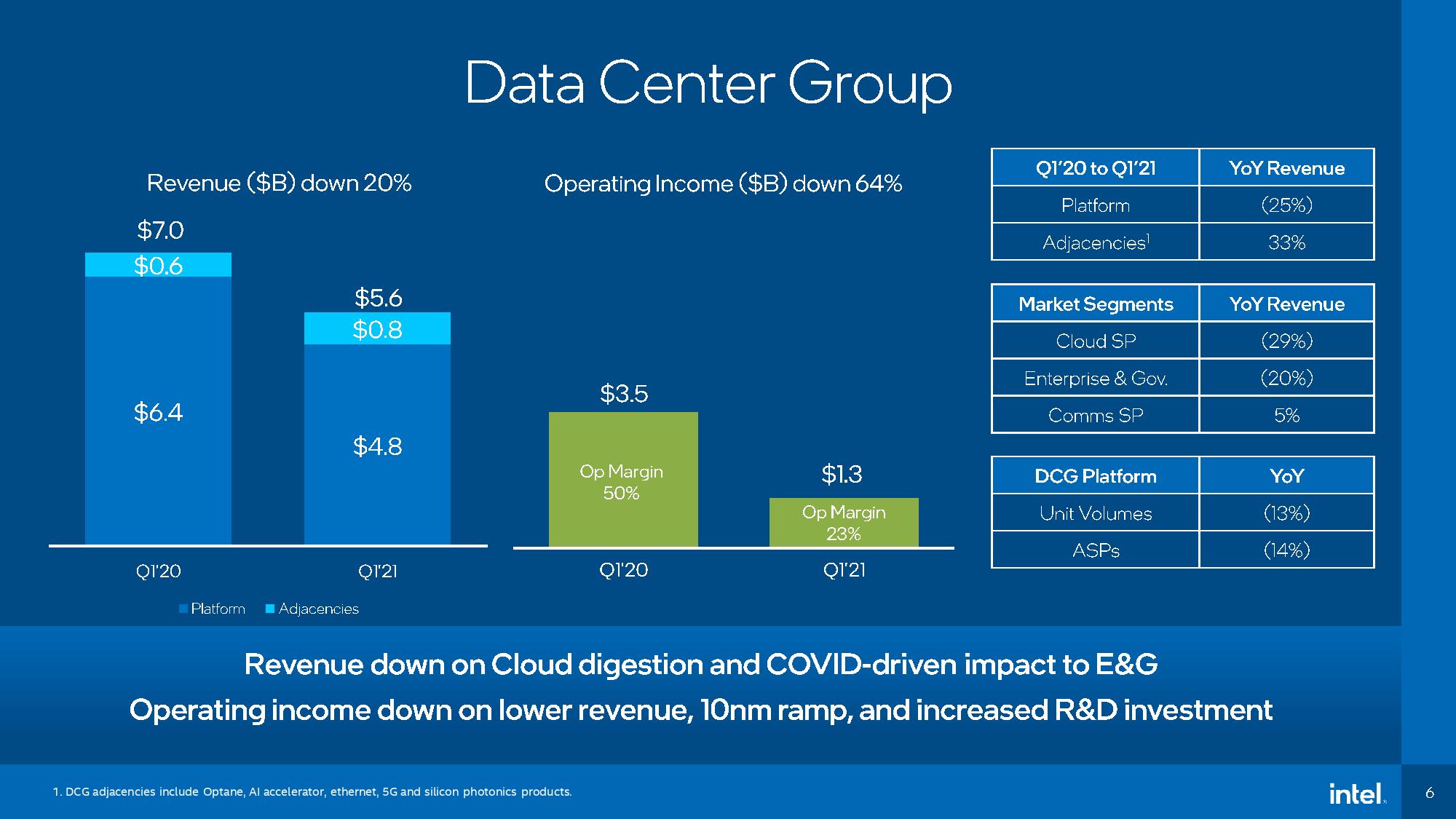

Intel's Data Center Group (DCG) results were far less impressive. The unit's $5.6B in revenue was down 20% YoY, and Intel also shipped 13% fewer units than last year. Intel chalks this up to cloud inventory digestion, meaning that companies that ordered large numbers of chips in the past are still deploying that inventory. This is the second quarter in a row Intel has cited this as a reason for lowered revenue.

Intel formally launched its Ice Lake Xeon processors earlier this month, and it isn't unheard of for large customers to pause purchases in the months before large product launches that bring big performance and efficiency gains. A complex mix of other factors could also contribute, like cloud service providers moving to their own chip designs and possible continued market share gains by AMD. Still, Intel expects its server chips sales to rebound in the second half of the year. We'll learn more when AMD releases its results, also with the market share reports that will arrive in a few weeks.

Intel's average selling prices for its server chips also dropped 14%. Intel cites an increase in sales of lower-cost networking SoCs as a contributor, but the company has also cut pricing drastically to compete with AMD's EPYC processors, which ultimately has an impact.

DCG operating margins weighed in at 23%, a record low for a segment that typically runs in the 40% range, with Intel citing the impact of its 10nm Xeon ramp as a contributor. It's also noteworthy that 10nm is less profitable than Intel's 14nm process, so moving from 14nm Cascade Lake to 10nm Ice Lake will further impact margins.

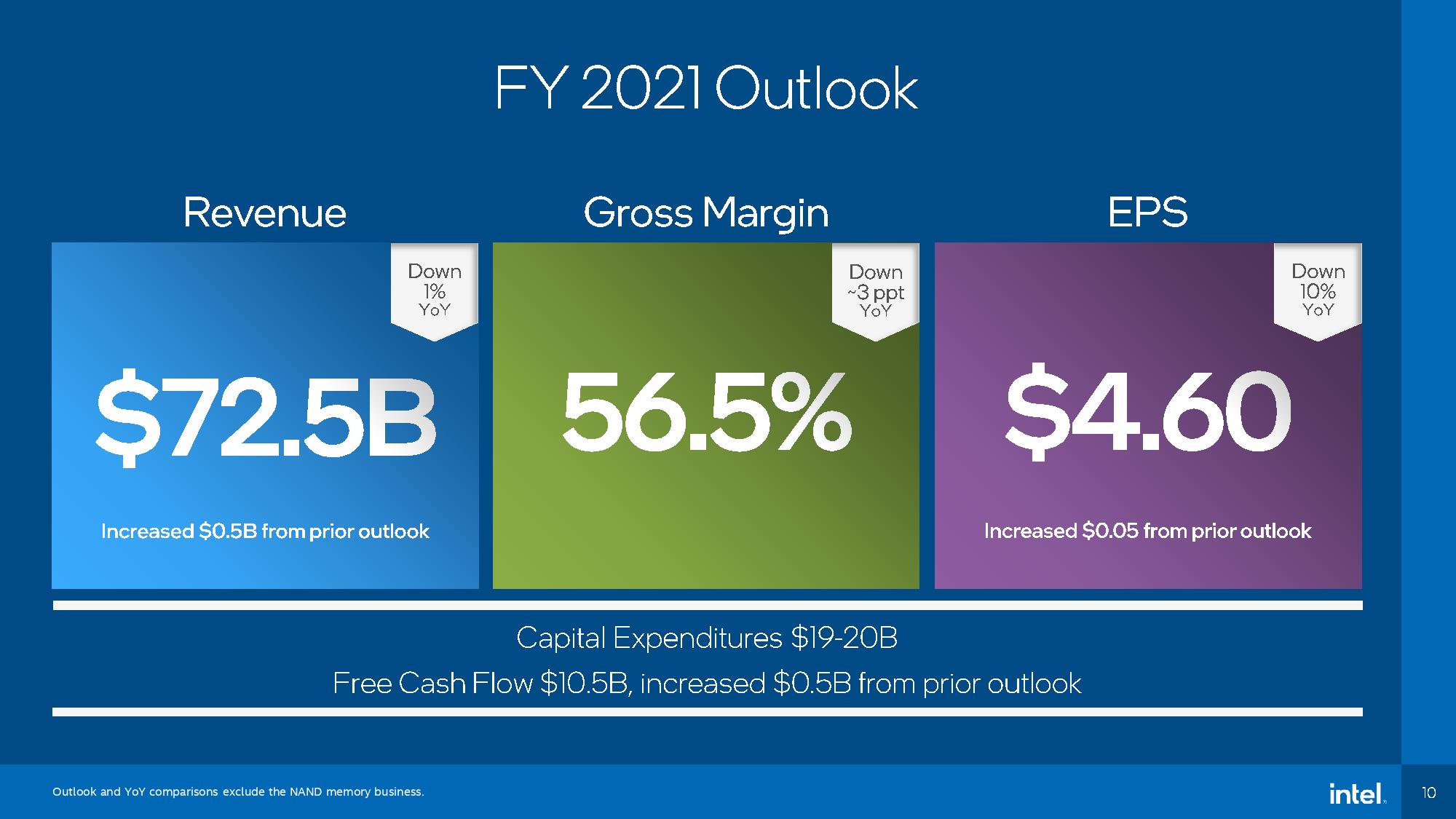

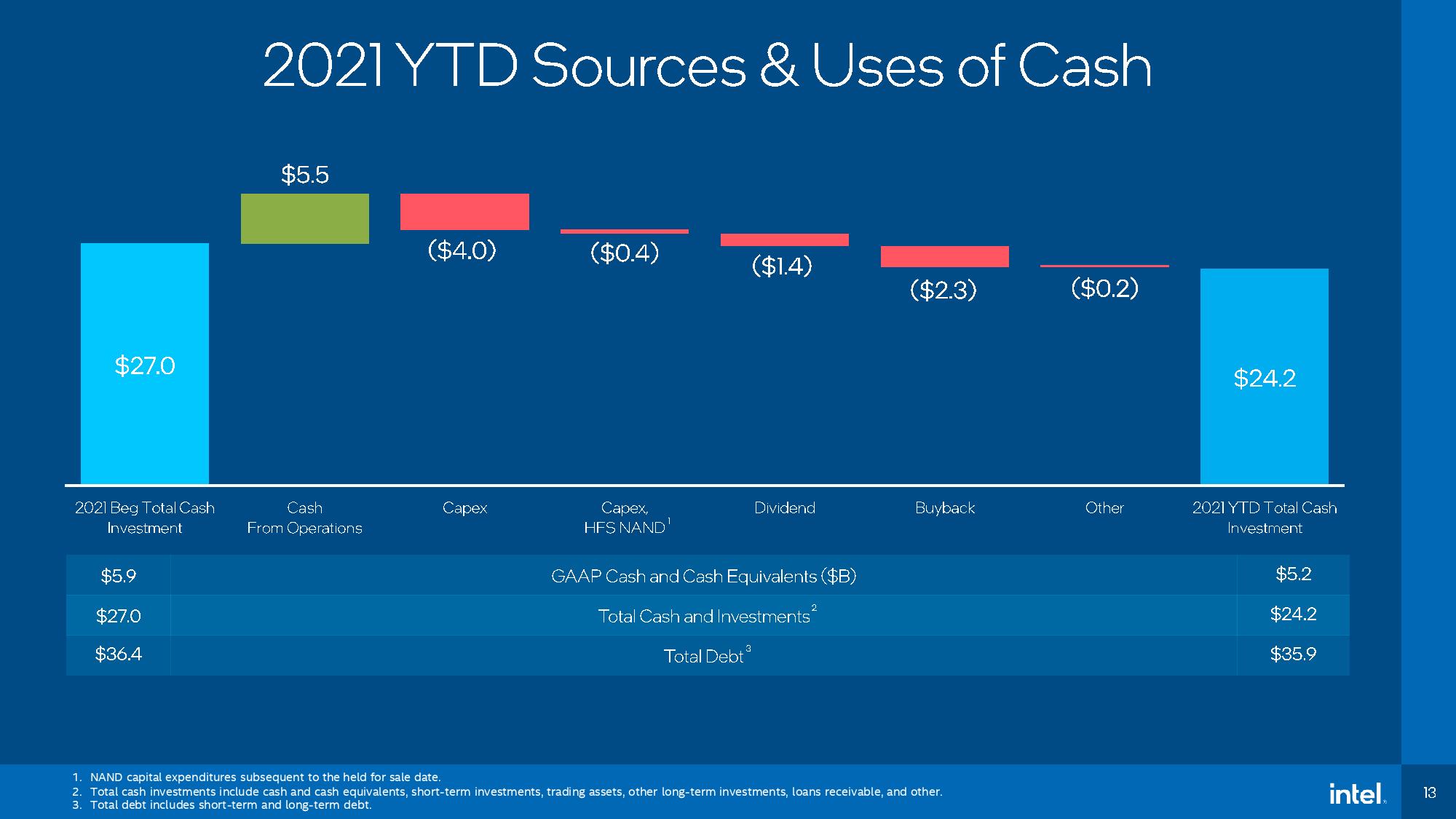

Intel is moving forward with its plans to invest $20 billion this year as it expands its manufacturing capacity, with a good portion of that dedicated to its Intel Foundry Services (ISF) that will make chips for other companies, much like we see with other third-party foundries like TSMC. Gelsinger says Intel is engaging with 50+ potential customers already.

Gelsinger also noted that Intel has onboarded 2,000 new engineers this year and expects to bring on "several thousand" more later in the year. However, he didn't provide a frame of reference as to how that compares to Intel's normal hiring rate, which is an important distinction in an engineering-heavy company with over 110,000 employees.

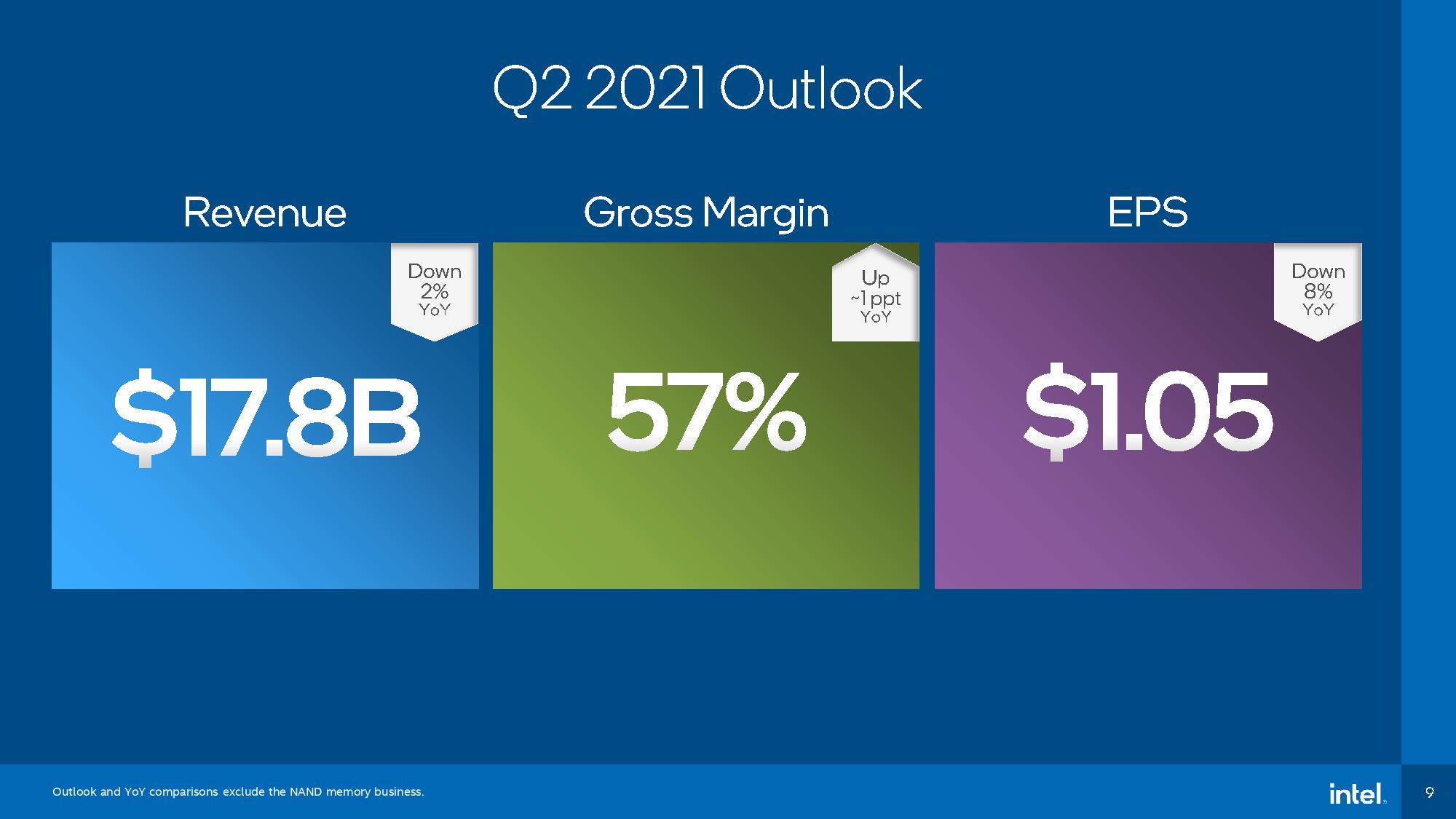

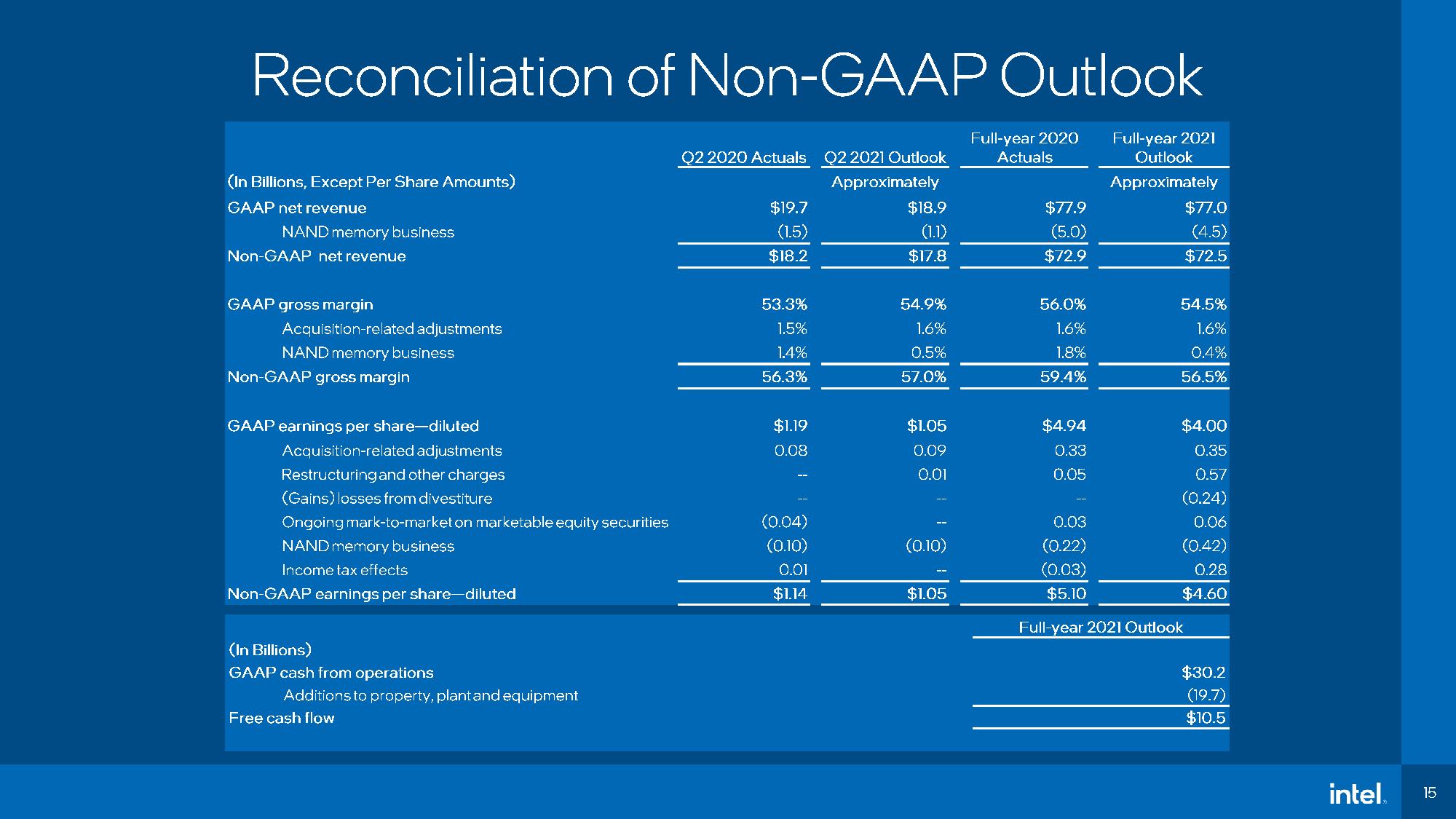

Intel expects to ramp up its investments, and noted that it would reduce its stock buybacks as it plows more money into its investments. Intel guides for a 57% gross margin for the second quarter on $17.8B and a $1.05 EPS.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

InvalidError PC sales had been down for the better part of a decade before covid, sales being down now relative to last year's bumper sales was inevitable. Losing a chunk of the enthusiast/higher-end to AMD doesn't help either.Reply -

watzupken Reply

It is not just AMD that is causing the damage. ARM is also a very capable challenger in the data center space. With big corporates looking to design their own custom SOC using ARM technology, the use of Intel's chip is likely going to drop further. Intel can counter this by reducing price, which I am sure they are already doing so. AMD is giving Intel double headache since they offer better value for more superior products.InvalidError said:PC sales had been down for the better part of a decade before covid, sales being down now relative to last year's bumper sales was inevitable. Losing a chunk of the enthusiast/higher-end to AMD doesn't help either. -

thGe17 Reply"DCG operating margins weighed in at 23%, a record low for a segment that typically runs in the 40% range, ..."

Correction: The author has most likely missed nothing, as stated before.

DCG Op Inc dropped but the large global drop in Op Inc is related to the VLSI lawsuite, where Intel has "withdrawn" 2,2 billion US$, as can bee seen in the GAAP vs. Non-GAAP sheets (-2,209 billion US$ for "Restucturing and other changes").

"After consideration of the verdicts in the WDTX cases and the additional pending lawsuits filed by VLSI, Intel accrued a charge of $2.2

billion in the first quarter of 2021. We dispute VLSI’s claims and intend to vigorously defend against them."

"The second Texas case went to trial in April 2021, and the jury found that Intel does not infringe the ‘522 and ‘187 patents. The third case is scheduled for trial on June 7, 2021, and VLSI seeks over $1.9 billion for alleged infringement of the ‘983, ‘025 and ‘485 patents, plus enhanced damages for willful infringement."

So if Intel wins at the end, the money will be put back in the balance sheet as a "one-off earning". -

dalek1234 Sounds like shorting Intel stock would have been a good idea. Than again, I don't foresee Intel's downward spiral to stop anytime soon. AMD, on the other hand, has just reported an impressive quarter on all fronts. When trading resumes later on today, we will probably see AMD stock price go up.Reply