AMD and Intel CPU Market Share Report: Recovery on the Horizon (Updated)

Hope is on the horizon, mostly.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Update 5/12/2023, 4:40am PT: We've now added analysis from Dean McCarron of Mercury Research in the relevant areas below.

Original article 5/10/2023, 8:20am PT :

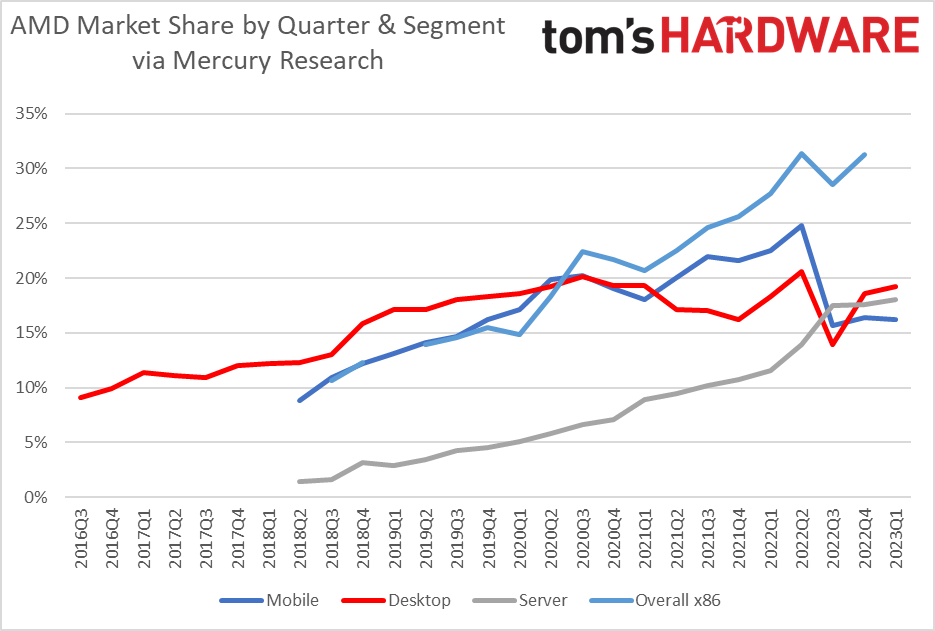

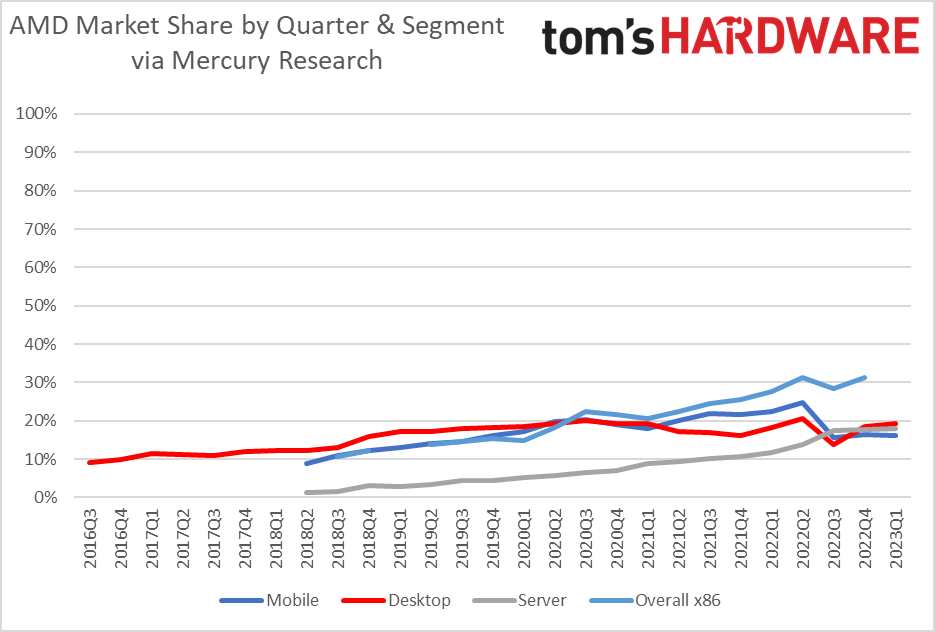

The Mercury Research CPU market share results are in for the first quarter of 2023. Although the extreme turbulence in the bottoming PC market continues, signs of recovery appear to be emerging. Though the data is still muddled due to an ongoing inventory correction, this month's numbers show that Intel has lost sub-single-digit percentage points of share in the three major categories — desktop PC, mobile, and data center — therefore maintaining more than 80% of unit share in each of those categories. That's actually a surprisingly resilient unit share considering it has been six years since AMD launched its incredible comeback with its first-gen Ryzen PC chips back in 2017. Moreover, another report indicates that Intel and AMD's revenue share of the segments is also shifting as we emerge from the worst CPU downturn in history.

Mercury Research's last few CPU market updates came amidst shocking market declines and inventory corrections that measured as the largest the firm has recorded in 30 years, ultimately forcing the chipmakers to under-ship demand to balance out overstocked inventories. That continued in the first quarter, which was the worst the firm has recorded since 1993. As such, we have to take the unit share data during these last few periods with some salt because the vendors were under shipping to different degrees and at different times, thus blurring the actual share values.

The industry is still mired in the same downturn, but most project that the PC market hit bottom during the last quarter and will stabilize and return to moderate growth through the back half of the year. In fact, AMD CEO Lisa Su recently commented that "[..], we believe the first quarter was the bottom for our client processor business," signaling that perhaps the worst of the turbulence has passed for AMD's consumer PCs business. Su's comments came as AMD announced a 64% decline in consumer chip sales and lost money for the first time in years.

During Intel's earnings, company CEO Pat Gelsinger also pointed to signs of improvement in the client PC space, saying, "We are seeing increasing stability in the PC market with inventory corrections largely proceeding as we had expected." Like AMD, Intel's message of hope came as it posted devastating results — last week, it reported its largest loss in history as sales plunged 36%.

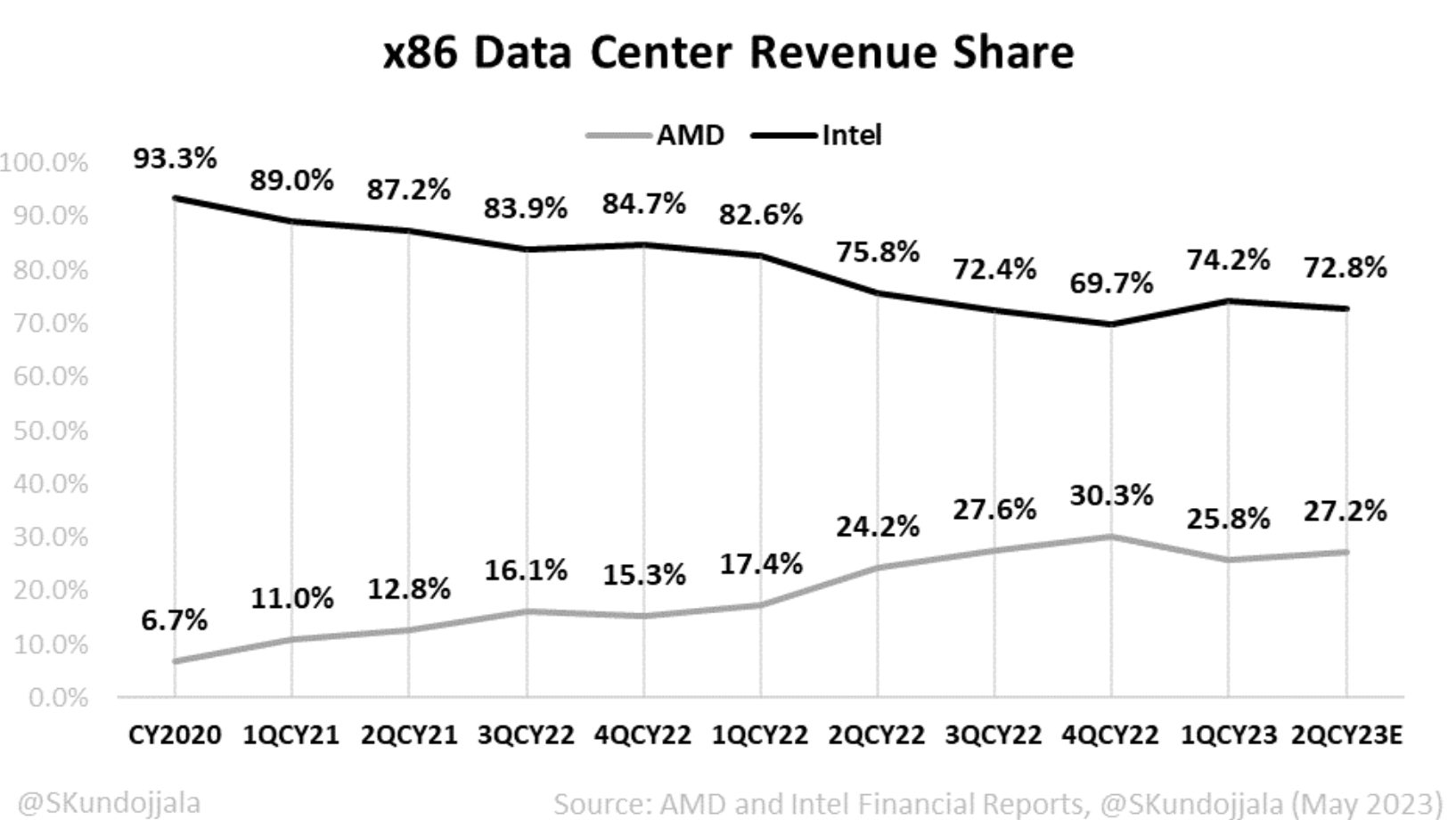

However, things still aren't too encouraging in the near term for the server market, with Lisa Su commenting that AMD expects demand to remain mixed for now, with some recovery in the second half of the year. Intel's Gelsinger also echoed that sentiment, saying, "However, the server and networking markets have yet to reach their bottoms as cloud and enterprise remain weak."

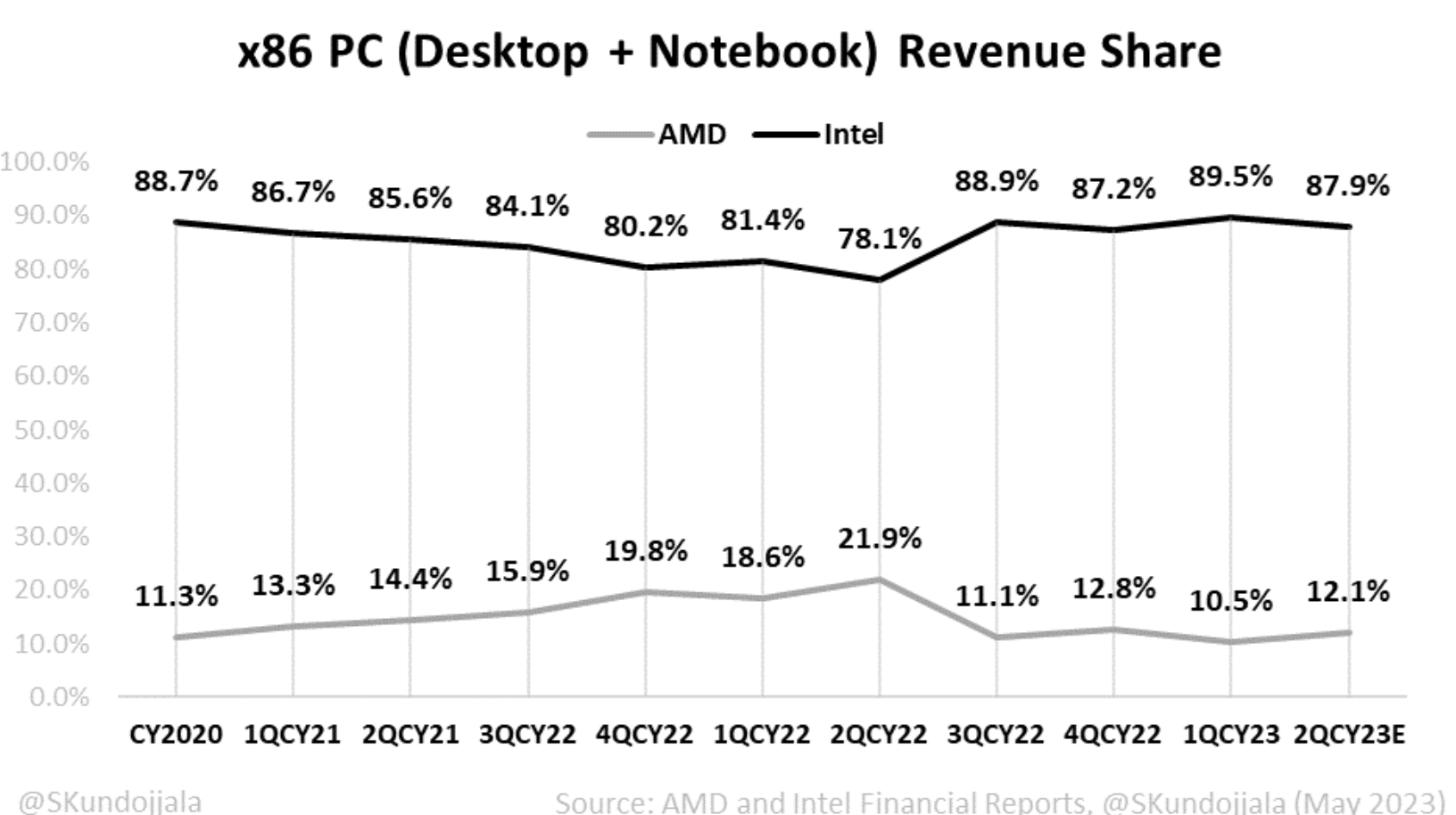

Here we can see another important metric — x86 PC and data center revenue share — posted to Twitter by independent semiconductor analyst Sravan Kundojjala. This data is composed of Intel and AMD's reported earnings for each segment, but Kundojjala warns that there is still "a lot of noise in this data" due to shipments and inventories during the ongoing correction. As you can see, AMD's peak of 21.9% of PC revenue occurred back in the second quarter of 2022, while its data center peak of 30.3% revenue share happened in the fourth quarter.

We asked Intel for a comment on the general state of the market. "Intel is seeing increasing stability in the data center and PC markets. We remain confident in our growth projections as the market recovers over the second half of 2023. Our client computing business continues to execute on its roadmap as we ramp Meteor Lake production ahead of its 2H 2023 launch," an Intel representative responded. "[..] with a strengthening roadmap and excellent execution, we believe you will see our market share grow as we deliver process and product leadership to the market. Demand for 4th Gen Intel Xeon processors continues to be strong [..]."

But while AMD remains a threat to Intel's market share and continues to chip away slowly, it is even more of a threat to Intel's margins. Intel has been forced to price aggressively in both PCs and the data center to staunch its share losses, which impacts profitability — as is painfully clear with the company's historically low margins over the last several quarters. AMD also just launched its Ryzen 7000X3D chips, which take the lead in gaming over Intel's competing Raptor Lake chips. While those 7000X3D chips are comparatively expensive and will likely ship in much lower volumes, AMD's ability to now claim it has the best CPU for gaming will restrict Intel's ability to command premium pricing for its competing chips.

Other forces are also in play. Arm remains a persistent threat to both Intel and AMD, but its initial bullrush into the PC unit share has seemed to cool a bit as it lost 1.3 percentage points in the fourth quarter of 2023. However, that bounced back to 14.8% of share in the first quarter, a record high for Arm. Apple's M-series processors have rapidly gained a foothold in the market. As such, despite much lower shipments recently, we should expect Arm to continue to chew away share from x86 in the client market over the longer term.

As a reminder, the Mercury numbers track the chips the CPU makers sell-in to the supply chain, not the sell-through that occurs at retail. The chipmakers continue to sell lower amounts of CPUs into the supply chain to help balance the overstock conditions, so the numbers don't currently accurately reflect the number of units sold through to consumers.

The raw numbers from the Mercury Research report are broken down by segment in the tables and sections below. We've also added McCarron's observations below.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Desktop PC Market Share Q1 2023: AMD vs Intel

| Row 0 - Cell 0 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 1Q18 | 4Q17 | 3Q17 | 2Q17 | 1Q17 | 4Q16 | 3Q16 |

| AMD Desktop Unit Share | 19.2% | 18.6% | 13.9% | 20.5% | 18.3% | 16.2% | 17.0% | 17.1% | 19.3% | 19.3% | 20.1% | 19.2% | 18.6% | 18.3% | 18% | 17.1% | 17.1% | 15.8% | 13% | 12.3% | 12.2% | 12.0% | 10.9% | 11.1% | 11.4% | 9.9% | 9.1% |

| Quarter over Quarter / Year over Year (pp) | +0.6 / +0.9 | +4.7 / +2.4 | -6.6 / -3.1 | +2.2 / +3.4 | +2.1 / -1.0 | -0.8 / -3.1 | -0.1 / -3.1 | -2.3 / -2.1 | +0.1 / +0.7 | -0.8 / +1.0 | +0.9 / +2.1 | +0.6 / +2.1 | +0.3 / +1.5 | +0.3 / +2.4 | +0.9 / +5 | Flat / +4.8 | +1.3 / +4.9 | +2.8 / +3.8 | +0.7 / +2.1 | +0.1 / +1.2 | +0.2 / +0.8 | +1.1 / +2.1 | -0.2 / +1.8 | -0.3 / - | +1.5 / - | +0.8 / - | - |

"AMD gained a small amount of desktop client CPU share; both Intel and AMD experienced declines in shipments, but AMD's declines were slightly smaller than Intel's resulting in a small share gain," said McCarron.

Notebook / Mobile Unit Market Share Q1 2023: AMD vs Intel

| Row 0 - Cell 0 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | Q419 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 |

| AMD Mobile Unit Share | 16.2% | 16.4% | 15.7% | 24.8% | 22.5% | 21.6% | 22.0% | 20.0% | 18.0% | 19% | 20.2% | 19.9% | 17.1% | 16.2% | 14.7% | 14.1% | 13.1% | 12.2% | 10.9% | 8.8% |

| Quarter over Quarter / Year over Year (pp) | -0.2 / -6.3 | +0.8 / -5.1 | -9.1 / -6.4 | +2.3 / +4.8 | +0.9 / +4.4 | -0.4 / +2.6 | +2.0 / +1.8 | +1.9 / +0.01 | -1.0 / +1.1 | -1.2 / +2.8 | +0.3 / +5.5 | +2.9 / +5.8 | +0.9 / +3.2 | +1.5 / +4.0 | +0.7 / +3.8 | +1.0 / +5.3 | +0.9 / ? | Row 2 - Cell 18 | Row 2 - Cell 19 | Row 2 - Cell 20 |

"Intel gained a small amount of share in overall client processors and in mobile CPUs during the quarter, and share is up more strongly compared to a year ago," said McCarron. "Part of this was driven by a surprise uptick in entry-level mobile CPUs (mostly notebook Celeron processors, but Intel's new "Intel Processor" branded N100 CPUs also showed signs of growth.) The gains here appear to be associated with growth of Chromebook PCs after a nearly two year long decline in shipments -- we also believe a resurgence in Chromebooks helped ARM's business as well. The increase in Intel's entry-level mobile CPUs offset some of their other declines and enabled slightly higher growth than AMD experienced, resulting in mobile and client share gains."

Server Unit Market Share Q1 2023: AMD vs Intel

| Row 0 - Cell 0 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 4Q17 |

| AMD Server Unit Share | 18% | 17.6% | 17.5% | 13.9% | 11.6% | 10.7% | 10.2% | 9.5% | 8.9% | 7.1% | 6.6% | 5.8% | 5.1% | 4.5% | 4.3% | 3.4% | 2.9% | 3.2% | 1.6% | 1.4% | 0.8% |

| Quarter over Quarter / Year over Year (pp) | +0.4 / +6.3 | +0.1 / +6.9 | +3.6 / +7.3 | +2.3 / +4.4 | +0.9 / +2.7 | +0.5% / +3.6 | +0.7 / +3.6 | +0.6 / +3.7 | +1.8 / +3.8 | +0.5 / +2.6 | +0.8 / +2.3 | +0.7 / +2.4 | +0.6 / 2.2 | +0.2 / +1.4 | +0.9 / +2.7 | +0.5 / +2.0 | -0.3 / - | +1.6 / 2.4 | +0.2 / - | Row 2 - Cell 20 | Row 2 - Cell 21 |

"AMD also gained a slight amount of share in servers for the quarter, but both Intel and AMD saw steep declines in server processor shipments," said McCarron.

AMD bases its server share projections on IDC's forecasts but only accounts for the single- and dual-socket market, which eliminates four-socket (and beyond) servers, networking infrastructure, and Xeon D's (edge). As such, Mercury's numbers differ from the numbers cited by AMD, which predicts a higher market share. Here is AMD's comment on the matter: "Mercury Research captures all x86 server-class processors in their server unit estimate, regardless of device (server, network or storage), whereas the estimated 1P [single-socket] and 2P [two-socket] TAM [Total Addressable Market] provided by IDC only includes traditional servers."

Arm vs x86 Consumer Market Share Q1 2023

| Arm vs x86 Market Share | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 2Q20 |

| Arm Unit Share | 14.8% | 13.3% | 14.6% | 9.4% | 11.3% | 10.3% | 8.9% | ~7.0% | 5.9% | 3.4% | Less than 2% |

"Our estimate for ARM PC client share (including Chromebooks and Apple's M-series based Macs with X86 desktop and mobile CPUs in the total client size estimate) is 14.8 percent, a record high for ARM client processor share. [...]While Apple's ARM-based Mac business was lower than last quarter, a rise in ARM-based Chromebook volume (and a decline in X86 PC client shipments) resulted in a higher market share for ARM," said McCarron.

Overall x86 Market Share Q1 2023: With IoT and Semi-Custom, AMD vs Intel

| Row 0 - Cell 0 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 4Q18 | 3Q18 |

| AMD Overall x86 | 34.6% | 31.3% | 28.5% | 31.4% | 27.7% | 25.6% | 24.6% | 22.5% | 20.7% | 21.7% | 22.4% | 18.3% | 14.8% | 15.1% | 14.6% | 13.9% | 12.3% | 10.6% |

| Overall PP Change QoQ / YoY | +3.3 / +6.9 | +2.8 / +5.7 | -2.9 / +3.9 | +3.7 / +8.9 | +2.1 / +7.0 | +1.0 / +3.9 | +2.1 / +2.2 | +1.8 / +4.2 | -1.0 / +6.0 | -0.7 / +6.2 | +4.1 / +6.6 | +3.5 / +1.2 (+3.7?) | -0.7 / ? | +0.9 / +3.2 | +0.7 / +4 | ? | ? | - |

"For all-inclusive share, which counts not only PC client CPUs and servers but also IoT and semi-custom products used in items like gaming consoles, AMD gained 3.3 points of share in the first quarter of 2023 to reach 34.6 percent. Here Intel's much lower IoT shipments and a surge in AMD's reported semi-custom business resulted in an increase that favored AMD, especially on year as AMD's console gaming business increased compared to a year ago," said McCarron.

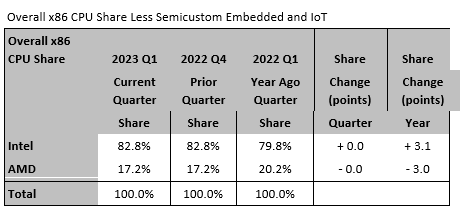

"Overall share excluding IoT and semi-custom products did not change compared to last quarter -- while shares of the different segments changed, overall they balanced out and there was no appreciable shift in total share," said McCarron.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

aalkjsdflkj I'm curious about how AMD can have an overall x86 market share higher than all of the component market shares (mobile, desktop, server). The first graph makes it look like mobile, desktop, and server market shares are all between 15-20%, but the overall x86 looks like it's about 32%.Reply

I tried to look at the Mercury website linked in the article, but didn't find the relevant information.

Also, I am color blind so it's possible I'm seeing the colors incorrectly. If anyone can explain what I'm missing I'd love to hear where I'm going wrong in looking at this chart. Perhaps there's another segment (maybe gaming consoles with the PS5/Xbox?) that isn't shown where AMD makes up the difference? If so why isn't that segment shown? -

TerryLaze Reply

From their latest quarterly report:aalkjsdflkj said:Perhaps there's another segment (maybe gaming consoles with the PS5/Xbox?) that isn't shown where AMD makes up the difference? If so why isn't that segment shown?

The Data Center segment primarily includes server microprocessors (CPUs) and graphics processing units (GPUs), data processing units (DPUs), Field Programmable Gate Arrays (FPGAs) and Adaptive System-on-Chip (SoC) products for data centers.

The Client segment primarily includes CPUs, accelerated processing units that integrate microprocessors and GPUs (APUs), and chipsets for desktop and notebook personal computers.

The Gaming segment primarily includes discrete GPUs, semi-custom SoC products and development services.

The Embedded segment primarily includes embedded CPUs and GPUs, FPGAs, and Adaptive SoC products.

There are another two: Gaming and embedded that would include consoles(semi-custom) but also steamdeck and the likes(embedded-soc) .

Mercury is a PC parts analyzer so maybe they don't have the connections or just the know-how to analyze the console market. -

Paul Alcorn Reply

Hi, thanks for reading. The section at the bottom of the article with the 'overall x86 market' breakdown has the explanation underneath. It reads:aalkjsdflkj said:I'm curious about how AMD can have an overall x86 market share higher than all of the component market shares (mobile, desktop, server). The first graph makes it look like mobile, desktop, and server market shares are all between 15-20%, but the overall x86 looks like it's about 32%.

I tried to look at the Mercury website linked in the article, but didn't find the relevant information.

Also, I am color blind so it's possible I'm seeing the colors incorrectly. If anyone can explain what I'm missing I'd love to hear where I'm going wrong in looking at this chart. Perhaps there's another segment (maybe gaming consoles with the PS5/Xbox?) that isn't shown where AMD makes up the difference? If so why isn't that segment shown?

"Whereas the other segments above exclude IoT and semi-custom units (like AMD's game console business), this accounting of the overall x86 market also includes those products."

You'll also see that there are tables at the bottom for each segment, with the full raw numbers presented. -

ikjadoon ReplyThat's actually a surprisingly resilient unit share considering it has been six years since AMD launched its incredible comeback with its first-gen Ryzen PC chips back in 2017.

I frequently find these reports kind of meaningless because it's all MARKET share, not usage share. Market share just counts unit sales.

For servers, sometimes procurement buys 1x new CPU-A to replace 3x old CPU-Bs. But for market share, CPU-B had a higher market share than CPU-A, even though 3x CPU-B is no longer being used. It was sold, so it gets counted.

Ideally to answer how "resilient" Intel (or AMD or Arm or anyone) is, we'd need quarterly usage, not quarterly sales. Sales #s are still neat, but they can be misleading. -

suryasans This report explains why AMD's consumer marketshare is decreasing. The DDR5-DDR4 RAM price crossover has not been reached yet while DDR4 is unsupported with AMD's new AM5 socket. Almost new entry level DIY consumers will buy PC based on Intel Core i5 13400 with cheaper Dual 16 GB DDR4-3200 SDRAM than new DDR5 based AMD's AM5 based Ryzen.Reply -

msroadkill612 Reply

DDR5 remedies one of the biggest bottlenecks to improved perf - ram bandwidth. The consensus is u would be a mug to get a new rig w/ ddr4 at current prices... if u were recycling a big investment in ddr4 from ur old rig maybe.suryasans said:This report explains why AMD's consumer marketshare is decreasing because DDR4 has beeb unsupported with its new AM5 socket. Most new entry level DIY consumer will buy PC baee on Intel Core i5 13400 with cheaper Dual 16 GB DDR4-3200 SDRAM than new DDR5 based AMD's AM5 based Ryzen. -

msroadkill612 ""Intel is seeing increasing stability in the data center and PC markets."Reply

Why cant they say anything sensible?

This could mean its flatlining at the lowest point. -

suryasans Reply

Almost entry level DIY PC Buyers do not plan an upgrade to their new build PC rigs. With limited budget They prefer to buy NVME SSD with hard drive than fastest RAM available. AMD's wrong prediction on DDR4-DDR5 price crossover resulted with its marketshare dwindled. https://www.pcgamer.com/amd-ddr5-pricing/msroadkill612 said:DDR5 remedies one of the biggest bottlenecks to improved perf - ram bandwidth. The consensus is u would be a mug to get a new rig w/ ddr4 at current prices... if u were recycling a big investment in ddr4 from ur old rig maybe. -

TerryLaze Reply

It's not a wrong prediction, they knew this, this is just a business decision, they couldn't afford to make both work so they focused on which will have a longer life time.suryasans said:AMD's wrong prediction on DDR4-DDR5 price crossover resulted with its marketshare dwindled.

At least that's my opinion because I don't hink that lucy lu is that stupid.