Intel Posts Largest Loss in Its History as Sales Plunge 36%

Intel expects a modest recovery in 2H 2023 but will keep losing money in Q2.

While Intel's sales beat its own expectations in the first quarter, the company on Thursday posted the largest loss in its history as its margins plunged to a new low over the last several years. The company expects its short-term results to continue suffering from weak demand for PCs and servers but remains optimistic about its prospects in the coming years once its next-generation products hit the market.

Biggest Loss Amid Low Margins

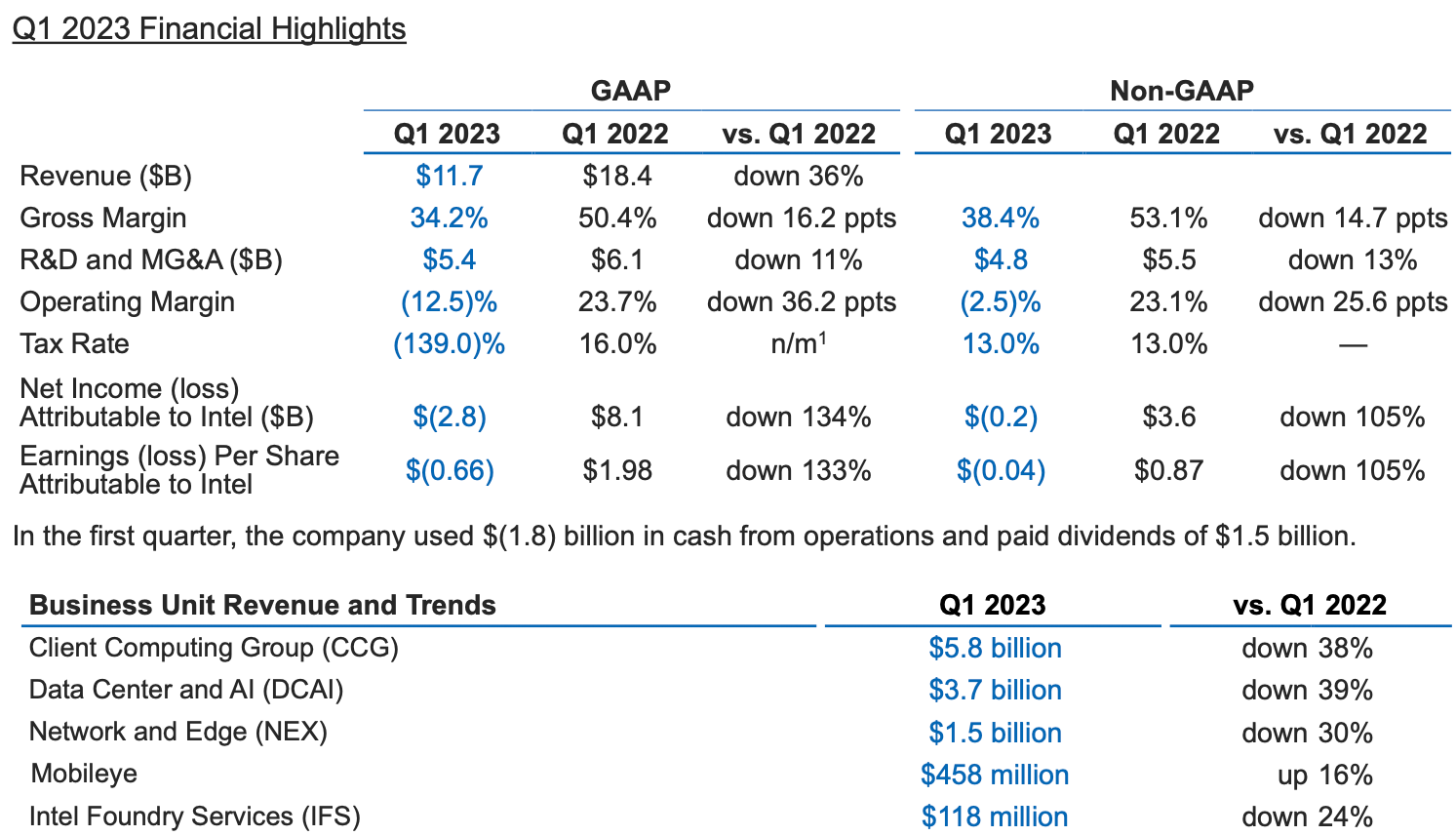

Intel's revenue for the first quarter dropped to $11.7 billion, which is $200 million higher than the company predicted back in January, but which is still down 36% year-over-year. The company lost $2.8 billion during the quarter as its gross margin declined to 38.4%. Despite posting the largest loss in its history, Intel paid $1.5 billion in dividends.

"While we remain cautious on the macroeconomic outlook, we are focused on what we can control as we deliver on IDM 2.0: driving consistent execution across process and product roadmaps and advancing our foundry business to best position us to capitalize on the $1 trillion market opportunity ahead," said Pat Gelsinger, Intel's chief executive.

Client PC and Mobile Eye Business Units Make Profits, Others Bleeding

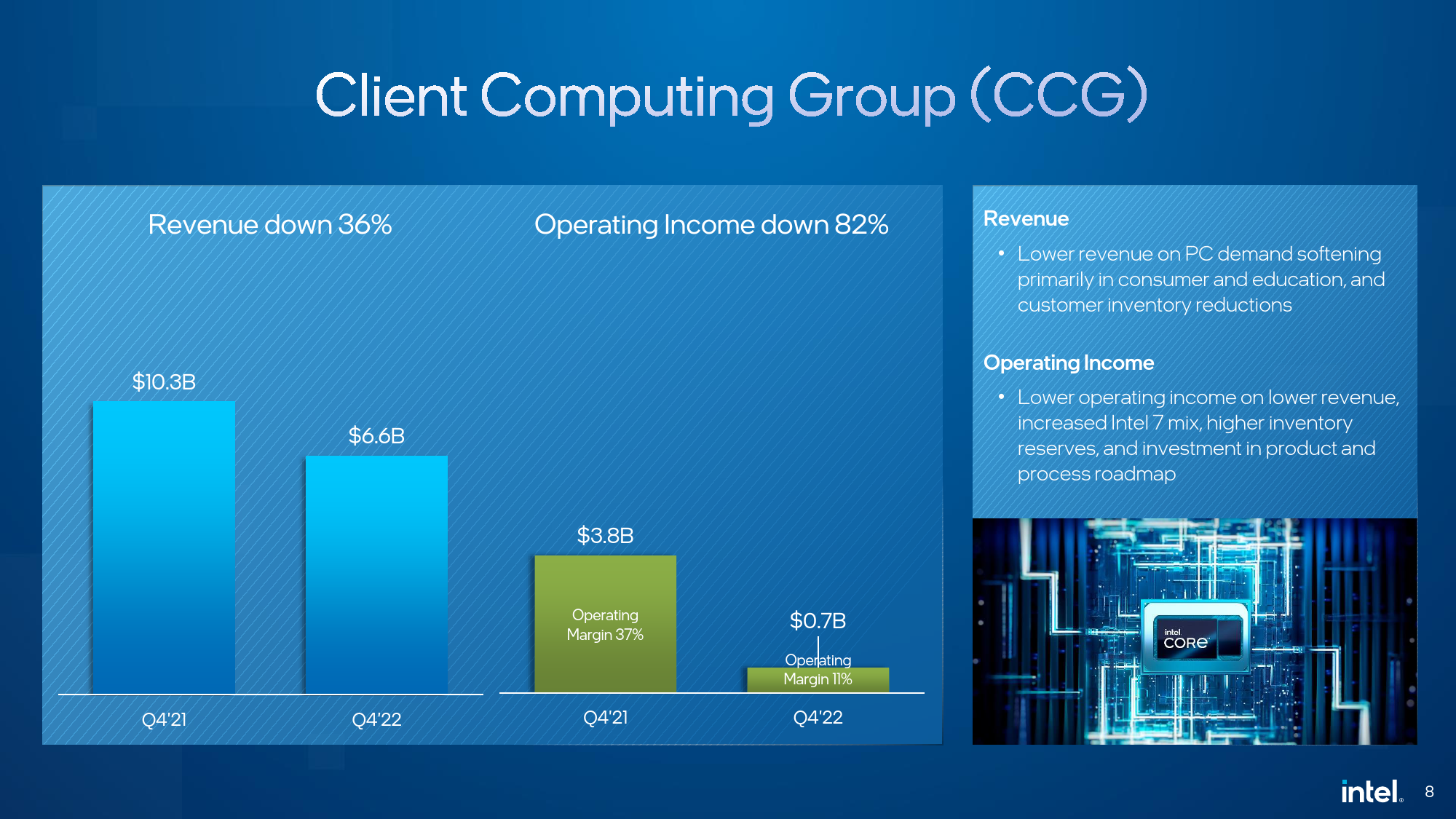

Intel's Client Computing Group (CCG) retained its position as the company's largest source of revenue, but in Q1 FY2023 it only earned $5.8 billion (down 38% YoY), a sharp decline from $9.3 billion in the same period of 2022. The company blames lower revenue on the declining total available market (TAM), continued inventory corrections by PC OEMs, and the increasing popularity of inexpensive CPUs as consumers remain cautious about their spending. CCG was still a profitable business unit for Intel as it generated $520 million, but its operating margin declined to 9%.

"We continue to see a challenging demand environment especially in our consumer and education segments," said David Zisner, chief financial officer of Intel, at the company's earnings call with financial analysts and investors. […] As discussed last quarter, we saw significant inventory burn at our customers in the period. While inventory levels remain elevated, we anticipate the market will be closer to equilibrium as we exit Q2. ASPs were down sequentially due to mix."

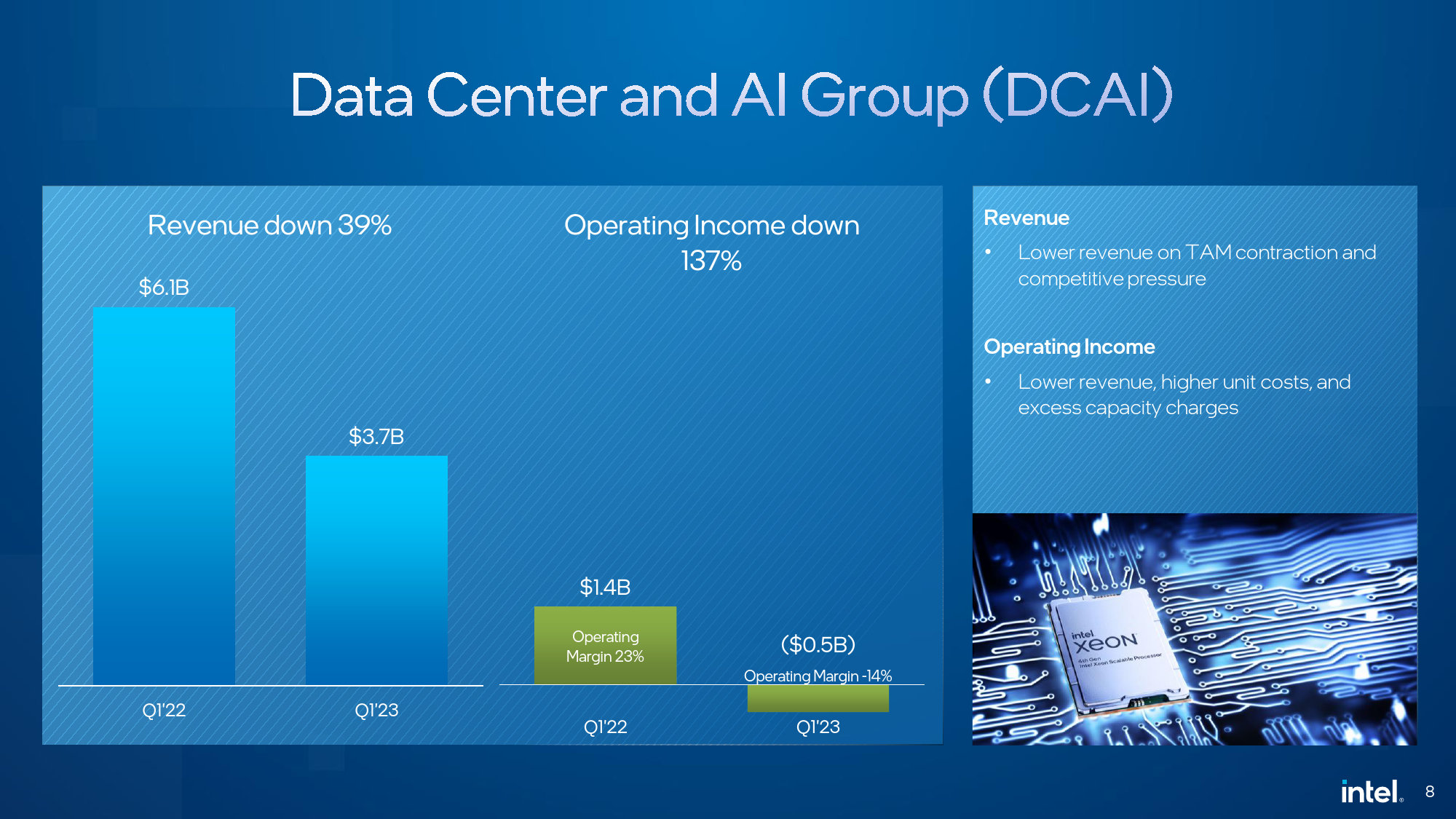

In Q1 2023, Intel's Datacenter and AI Group (DCAI) experienced a whopping 39% year-on-year decrease in sales of data center hardware, with revenue falling from $6.1 billion in Q2 2022 to $3.7 billion last quarter. The unit lost some $580 million as its operating margin collapsed to -14%.

Intel blames poor DCAI results on higher product costs, investment in next-generation products on new process nodes, the merge of the AXG business, and inventory reserves tied to its service system business which the company sold to Mitac earlier this month.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"We saw significant sequential and year-over-year TAM contraction across all CPU market segments and expect demand to remain soft in the second quarter," said Zisner. "We saw stable CPU market share in Q1 and are excited by the broad market ramp of our 4th Generation Xeon Scalable processor 'Sapphire Rapids.'

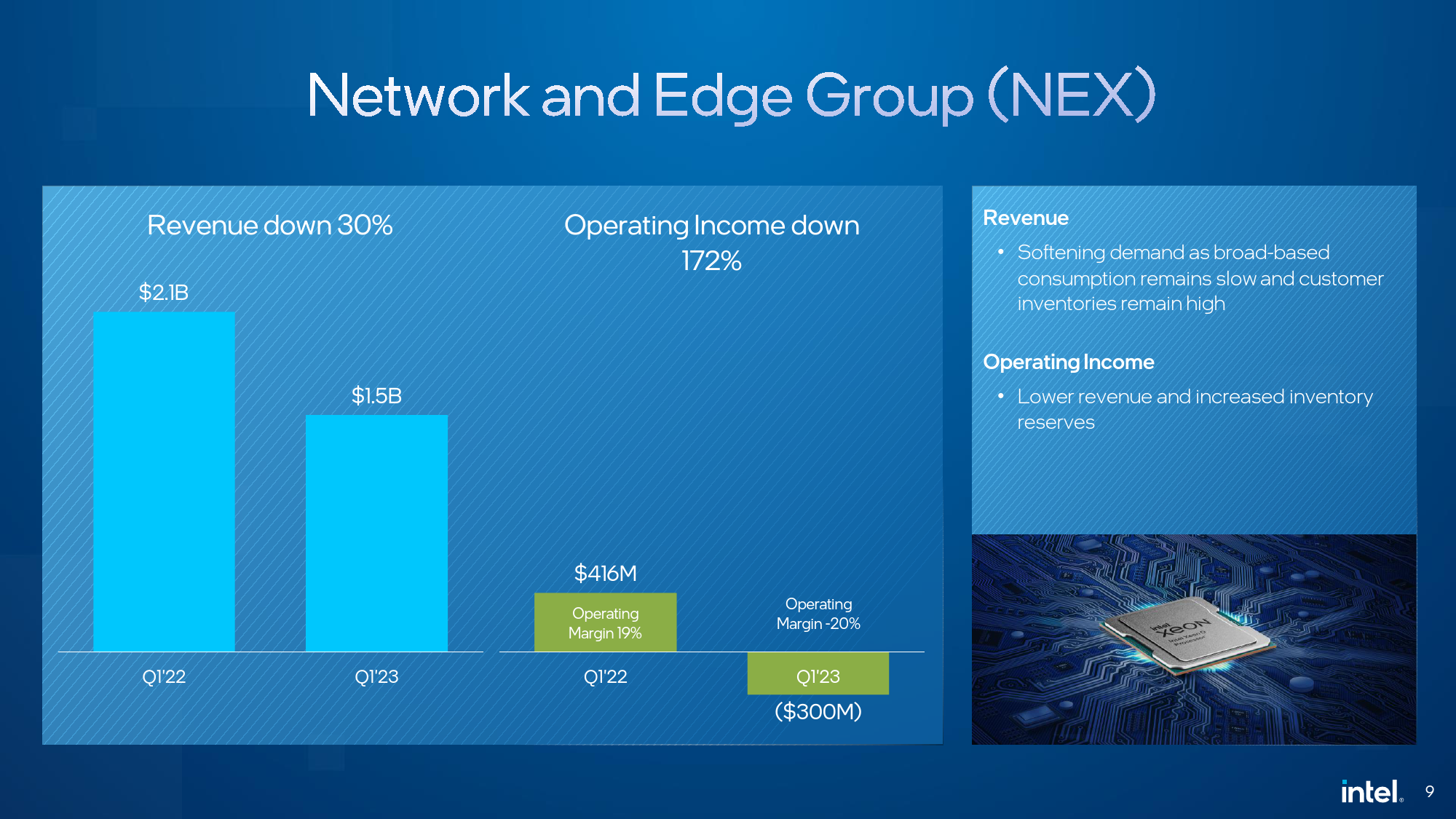

While Intel's Network and Edge Group (NEX) was able to sustain its revenue in recent quarters, in Q1, its sales dropped to $1.5 billion, and it lost $300 million. The gross margin of this business unit decreased to -20%.

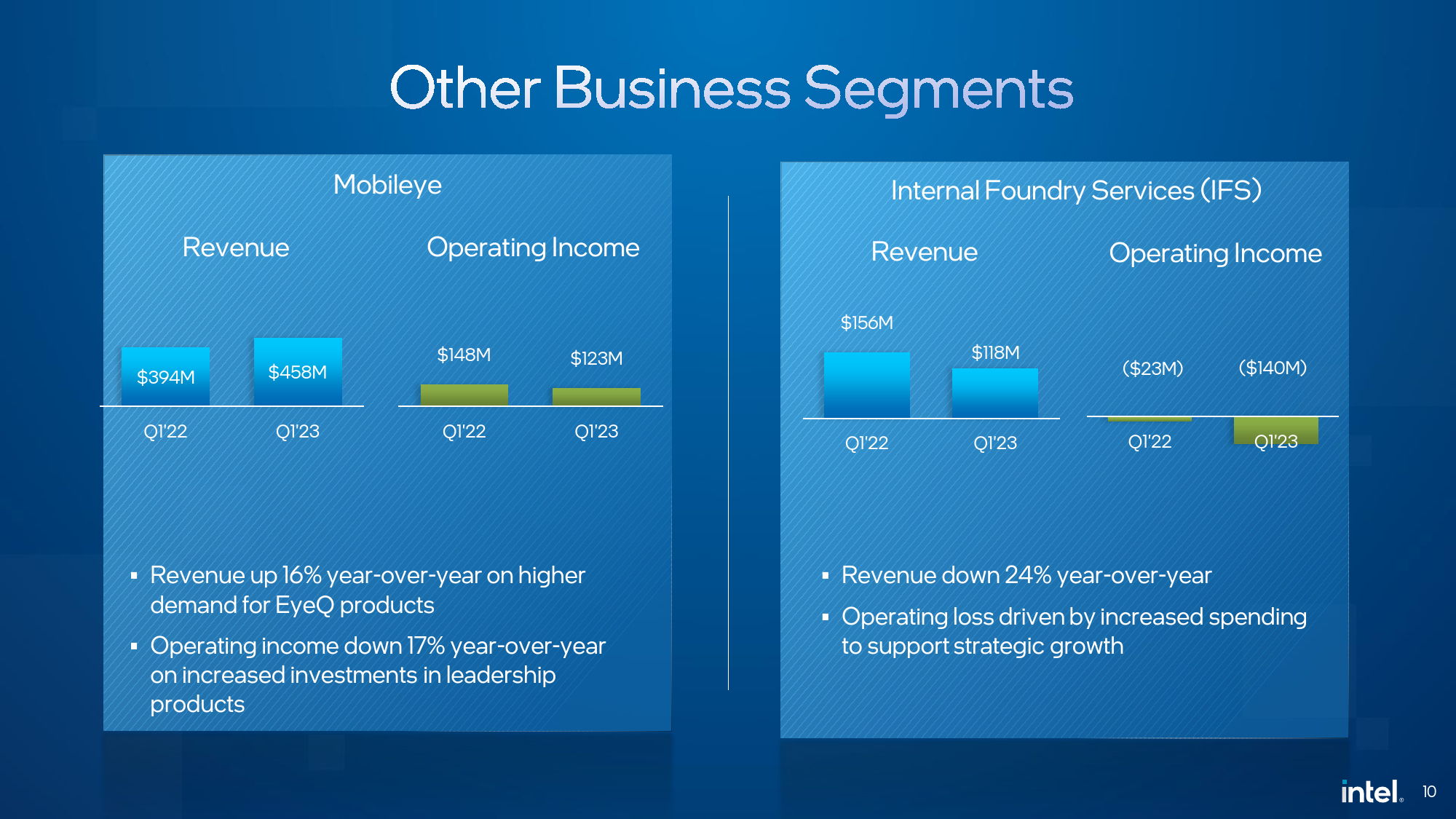

Having earned $458 million in sales in Q1 2023, Intel's Mobileye division was the company's only unit that demonstrated year-over-year revenue growth of 16%. Meanwhile, its operating income declined 17% YoY to $123 million as it increased investments in new products.

As for Intel Foundry Services business, it posted a 24% YoY revenue drop as its sales totaled $118 million, and lost $140 million, more than it earned, because of increasing fab startup costs. But while IFS revenue decreased in general, the company says that the unit posted a 67% sequential growth in packaging revenue. Meanwhile, Intel continues to work with the Chinese authorities to clear its acquisition of Tower Semiconductor in the second quarter.

Pessimistic Outlook for Q2

For the second quarter of FY2023, Intel forecasts its revenue to be between $11.5 billion and $12.5 billion, which represents a significant decline from its earnings in Q4 2022. Moreover, the company is predicting further gross margin decline to 33.2% as well as a loss of $0.62 per share.

While Intel's Q1 results are certainly nothing to brag about, the company remains optimistic as its revenue exceeded its own expectations, which means that the market performs better than it thought several months ago.

"We are encouraged by first quarter revenue and expect growth to improve sequentially through 2023," said Zisner. We are not satisfied with our financial results, and remain focused on what we can control our execution and the prioritization of our owners capital toward our long term goals. We are confident that as we deliver on our roadmap commitments, we will meet and exceed our customers' expectations for our products, and our owners' expectations for strong revenue growth and free cash flow generation."

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

InvalidError Sales do tend to drop when you axe whole business units and pricing for your remaining units is kind of tone-deaf to the actual market.Reply -

Elusive Ruse I hope they manage to get things right ( in a customer friendly manner), Intel is a legendary company and I want them to be out there innovating and competing.Reply -

TerryLaze Reply

They had a super high for the last 6 years and are now basically twice the company they were then.Kamen Rider Blade said:It's like watching the Titanic Slowly Sink over the course of years.

From last quarter of 2016 to today:

property went from 36 to 85

total assets from 113 to 185

now the total bebt also increased by a lot but in general it's like if the titanic blew up like a balloon and lifted to the sky, then what intel goes through would be just like it.

They increased a lot in size which makes it necessary for them to go through their inventory and sort things out that won't make them any money in the future.InvalidError said:Sales do tend to drop when you axe whole business units and pricing for your remaining units is kind of tone-deaf to the actual market.

You don't negotiate with terrorists and you don't drop prices when the market goes down.

Intel knows the secret that many people seem to ignore, we live in a world where technology is essential, there is no way out of buying your next CPU, it might take a while longer than normal but nobody can avoid it. -

I believe you’re referring to the elasticity. Electronics are not as elastic as let’s say gasoline.Reply

It’s also interesting to note the word terrorist that you use, so the market is a terrorist?

I see them as a failing company going forward if they don’t change their ways. They only did well because of Covid in the past few years. -

Elusive Ruse Reply

Fascinating isn't it? It goes to show how Intel trains their employees and indoctrinates their outlook towards the market.Mandark said:It’s also interesting to note the word terrorist that you use, so the market is a terrorist?

-

baboma It's amusing to see people wishing Intel would somehow disappear. People can't see past their own noses. What do you think would happen to x86 CPU pricing if AMD was the sole manufacturer?Reply

Do fanboys ever grow up? -

InvalidError Reply

When you are a company with some over-inflated profit margins, you do need to debloat your margins during a market slowdown by some amount to keep sales going of your potential customers will look for exit doors never look back.TerryLaze said:You don't negotiate with terrorists and you don't drop prices when the market goes down.

Intel knows the secret that many people seem to ignore, we live in a world where technology is essential, there is no way out of buying your next CPU, it might take a while longer than normal but nobody can avoid it.

As for the "secret of buying your next CPU", ~15 years of PC sales going down by a steady 5-8%/year until COVID caused a sugar rush that is still in mid-crash right now disagree. A steadily growing number of people are moving to non-PC and stretching whatever PCs they may have some number of additional years longer.

x86 is a kludgy instruction set that should have died 15+ years ago. If Intel disappeared, it could finally give the industry a push to settle on a new open ISA like RISC-V to avoid license hostage taking like you do with ARM.baboma said:It's amusing to see people wishing Intel would somehow disappear. People can't see past their own noses. What do you think would happen to x86 CPU pricing if AMD was the sole manufacturer?

Intel chips are a critical part of US infrastructure and the US government's requirements on backup suppliers of critical infrastructure is how AMD got its x86 license. The US government won't allow Intel to fall. -

Math Geek "The company lost $2.8 billion during the quarter as its gross margin declined to 38.4%. Despite posting the largest loss in its history, Intel paid $1.5 billion in dividends."Reply

so long as the investors got money, the rest does not matter. they can just fire another 10,000 people to cover that small payout to the rich.

move along citizen, nothing to see here......