PC Sales Dropped Nearly 30% in Q1 With Apple the Biggest Loser

Lenovo remains the world's largest PC supplier.

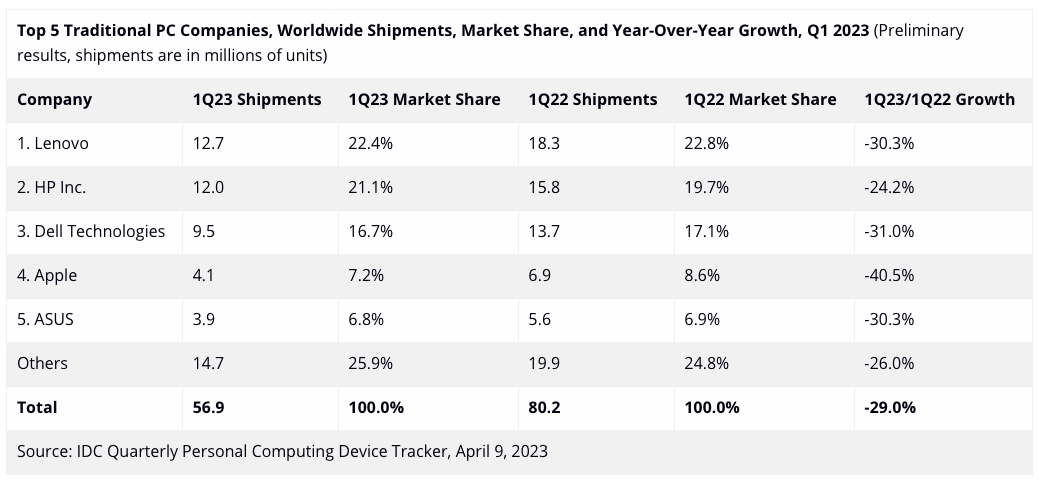

IDC reports that diminished demand, surplus stock, and a declining macroeconomic environment all played a role in the significant decline in traditional PC shipments in the first quarter of 2023. Shipments of PCs declined by 29% year-over-year, hurting all PC makers. Yet surprisingly, Apple was hurt the most.

Global PC shipments totaled 56.9 million, a 29% decrease compared to the same period in 2022, based on initial data from IDC. Analysts believe these results signify an end to the COVID-induced demand period and a temporary revert to pre-COVID trends. Shipments in Q1 2023 were substantially lower than the 59.2 million and 60.6 million units in Q1 2019 and Q1 2018, respectively.

While all PC makers lost sales in the first quarter, Apple was perhaps the biggest loser, with a 40.5% year-over-year decline. Apple's primary focus in recent years has been on its iPhones and services businesses, which could have diverted resources and attention away from its traditional PC lineup. Indeed, the company launched its M2 Pro and M2 Max-based laptops in early Q1 (a slow season typically) and never updated its desktop lineup that still features its M1-series system-on-chips from 2020.

Even though Apple's M1 may still offer great performance-per-watt and single-thread performance (given its eight-wide decoding architecture), it is now three years old, and those customers who wanted to get an M1-based PC have already obtained one.

As far as the whole PC market is concerned, the rankings did not change. The top five PC manufacturers by market share were Lenovo (23.9%), HP (21.5%), Dell (16.0%), Apple (7.5%), and Acer (6.4%).

"Though channel inventory has depleted in the last few months, it's still well above the healthy four to six week range," said Jitesh Ubrani, research manager for IDC's Mobility and Consumer Device Trackers. "Even with heavy discounting, channels and PC makers can expect elevated inventory to persist into the middle of the year and potentially into the third quarter."

IDC says that the stagnation in growth and demand allows supply chains to adapt as PC OEMs investigate manufacturing alternatives outside of China. Concurrently, PC manufacturers are adjusting their strategies for the rest of the year and placing orders for Chromebooks in anticipation of increased licensing fees later in the year. Nevertheless, short-term PC shipments will probably struggle, with a resurgence expected by year-end due to global economic improvements and users considering upgrading to Windows 11.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

IDC notes other factors in the PC market's stagnation. Analysts believe that the stall allows supply chains to adapt as factories investigate manufacturing alternatives outside of China and adjust their strategies for the rest of the year.

Nevertheless, short-term PC shipments will probably struggle, with a resurgence expected by year-end due to global economic improvements and users considering upgrading to Windows 11, according to IDC.

"By 2024, the aging installed base will be due for a refresh," stated Linn Huang, research vice president, Devices and Displays at IDC. "If the economy is on an upward trajectory by then, we anticipate a significant market boost as consumers upgrade, schools replace worn Chromebooks, and businesses transition to Windows 11. However, if economic stagnation persists in key markets into next year, recovery may be a slow process."

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Alvar "Miles" Udell The "problem" with Apple is that since they hold their values so well, people like me who would like an M1 Macbook Air or M1 iPad is that a base M1 Macbook Air (13.3", 8GB/256GB, 7-core) is still $870 on sale and an M1 iPad (WiFi, 64GB) is $600. For hardware going on 3 years old that's still 85% of its launch price in a world with rampant inflation and full of computers which are "fast enough" so you don't need to upgrade is a tough pill to swallow.Reply -

InvalidError Analysts still failing to acknowledge the reality of the post-COVID demand lull, blaming on-going reduced demand on anything else that pops up to avoid admitting depressed demand will stick for a while longer no matter what. Economic recovery later in the year may help a bit but consumer and office PC sales won't be returning to normal until people rejoin their pre-covid upgrade cycles well beyond 2023.Reply

Also, since most people who had to upgrade out of cycle due to COVID likely ended up with a much faster system than whatever they previously had and couldn't be bothered to upgrade, chances are that their next upgrade cycle will be many years longer than what they had in mind for their previous system. -

Heat_Fan89 Reply

That's how I see it as well. During the lockdowns, I purchased an HP Omen with an i9-10850K, 32GB of RAM, 1TB SSD, RTX 3080. It's still good enough for decent 4K gaming and will still be good enough for high-end 1080P for at least another 4-5 years.InvalidError said:Also, since most people who had to upgrade out of cycle due to COVID likely ended up with a much faster system than whatever they previously had and couldn't be bothered to upgrade, chances are that their next upgrade cycle will be many years longer than what they had in mind for their previous system. -

SSGBryan Yep.Reply

I built a Ryzen 2700 based system right before Covid hit. A couple of months ago, I replaced the 2700 with a 5700x and the RX 570 (8Gb) with an RTX 3060 (12Gb).

My only upgrade for this year is replacing the RTX 3060 with an A770 (16Gb). And maybe another data SSD.

Taking a pass on AM5, will upgrade to AM6 in 2024. -

newtechldtech The PC hardware reached a very high level of performance , the need for upgrade is becoming less and less each generation. even gaming notebooks today can play as good as gaming desktops today with acceptable fps. so expect to see more and more sales decline until the software demands faster hardware. rendering as well was a dream on a notebook , now it is possible wit acceptable rendering time ... so ...Reply -

Pyrostemplar ReplySSGBryan said:Yep.

I built a Ryzen 2700 based system right before Covid hit. A couple of months ago, I replaced the 2700 with a 5700x and the RX 570 (8Gb) with an RTX 3060 (12Gb).

My only upgrade for this year is replacing the RTX 3060 with an A770 (16Gb). And maybe another data SSD.

Taking a pass on AM5, will upgrade to AM6 in 2024.

AM6 will almost certainly not come out in 2024. 2026 is far more likely. -

shady28 COVID pulled forward upgrades for a ton of home users.Reply

That said the stats for current sales taken in a vacuum are misleading. PC sales globally are in line with where they were pre-covid.

We went from ~250M sales in 2019 to 275M in 2020 and 350M in 2021. The boom continued into early 2022, so this is our first YoY view of sales from the peak.

So yes, a 30% drop would put us right at or just slightly below 2019 levels for 2022 going into 2023. It's not like 2019 was a horrible year though.

All this is not at all surprising and any PC centric companies who were not aware of the possibility of a reversion to the mean are probably too dumb to keep going.

The real question is, what happens now. -

InvalidError Reply

The tug-of-war between companies wanting to reduce inventory but not cut prices to whip up sales and people waiting for price cuts because they cannot justify the expense at current prices is up!shady28 said:The real question is, what happens now.

Perfect time for a third-party to make a play for market share and initiate a good-ol'-fashioned price war like we haven't seen in ~20 years. -

ikjadoon Replyshady28 said:COVID pulled forward upgrades for a ton of home users.

That said the stats for current sales taken in a vacuum are misleading. PC sales globally are in line with where they were pre-covid.

We went from ~250M sales in 2019 to 275M in 2020 and 350M in 2021. The boom continued into early 2022, so this is our first YoY view of sales from the peak.

So yes, a 30% drop would put us right at or just slightly below 2019 levels for 2022 going into 2023. It's not like 2019 was a horrible year though.

All this is not at all surprising and any PC centric companies who were not aware of the possibility of a reversion to the mean are probably too dumb to keep going.

The real question is, what happens now.

That's actually precisely what happened to Apple, according to these IDC numbers. Technically, Apple is still a tiny bit above their pre-pandemic average.

7.2m → 4.1m is a 40% drop, but it's also more than Apple solid in Q1 2019 and Q1 2018. -

bigdragon Looks like we're coming back to pre-pandemic sales levels. It's hard to justify pricey computers with barely incremental performance upgrades when consumers are spending more money on necessities due to inflation, working more from the office or worksite, spending on trips and experiences, and are not receiving stimulus funds. The industry has a lot more competition for funding now.Reply

I wonder if the situation is about to get worse for the PC industry. A lot of tech-focused companies are laying off large numbers of employees, venture capital that backs smaller tech firms is drying up, and crypto mining is no longer a significant factor. Ripple effects from "macroeconomic challenges" may not appear in the sales data yet. Can't buy a new iPad if you just lost your tech job.

Personally, I'm looking for a new 2-in-1 with dedicated graphics. The machines I'm looking at haven't released yet probably because the previous models aren't selling well. Apple is likely facing the same issue with their M1 systems. Can't clear way for the M2 systems when you're unwilling to discount the older hardware to the level necessary to meet market expectations. Way too much greed in vendors still.