AMD Financial Analyst Day 2020: CPU and GPU Roadmaps, X3D Die Stacking Revealed

AMD shares its plans for the future

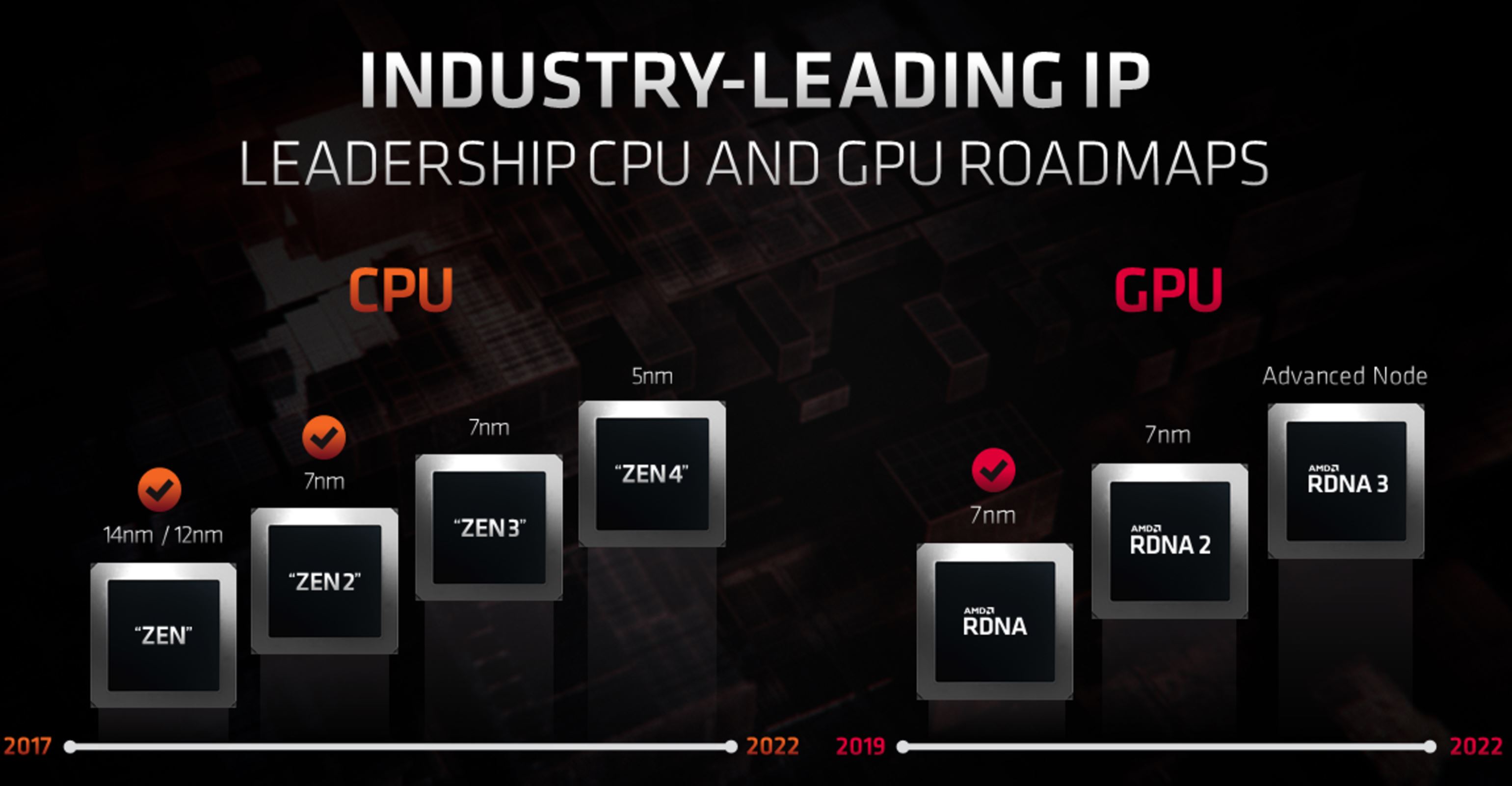

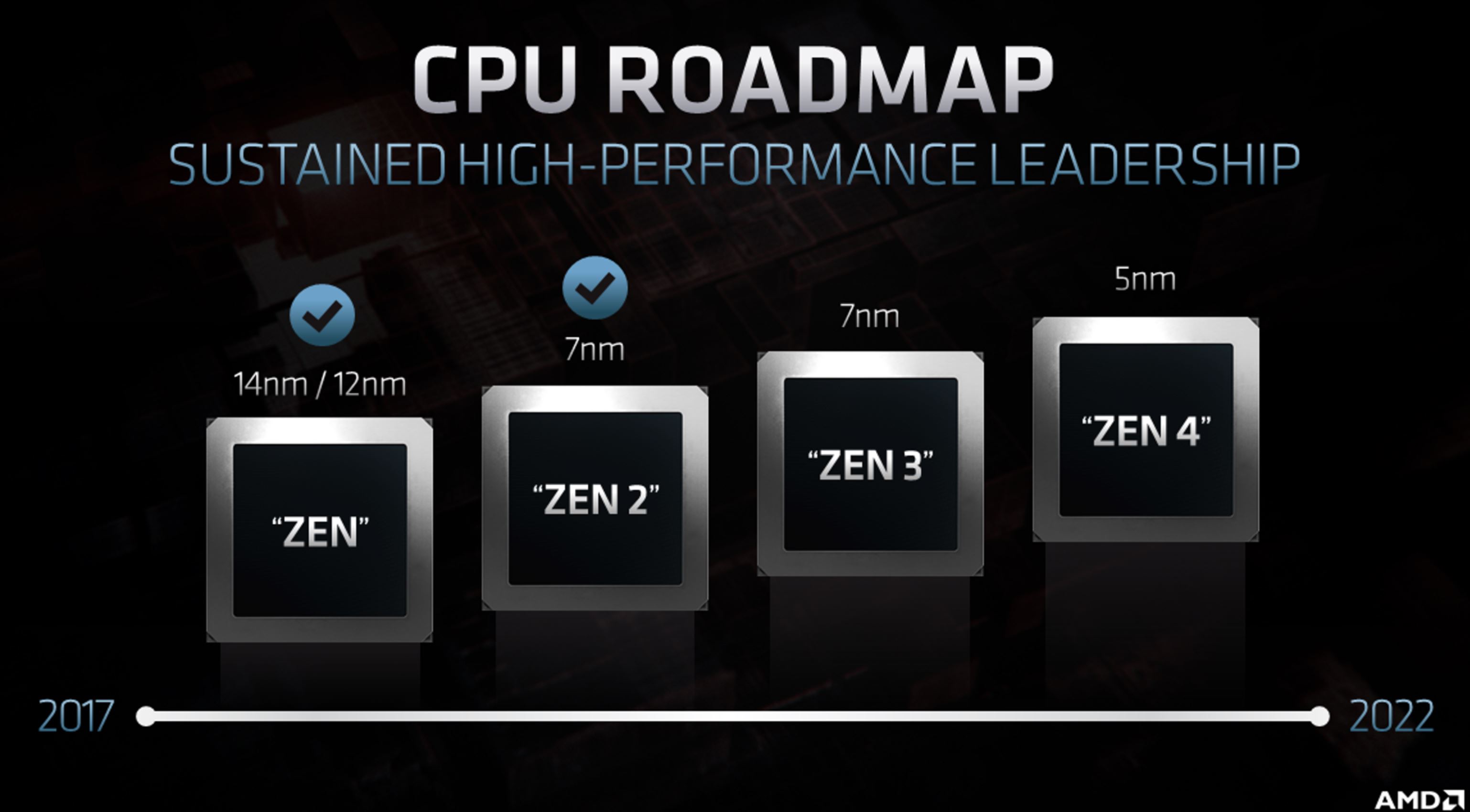

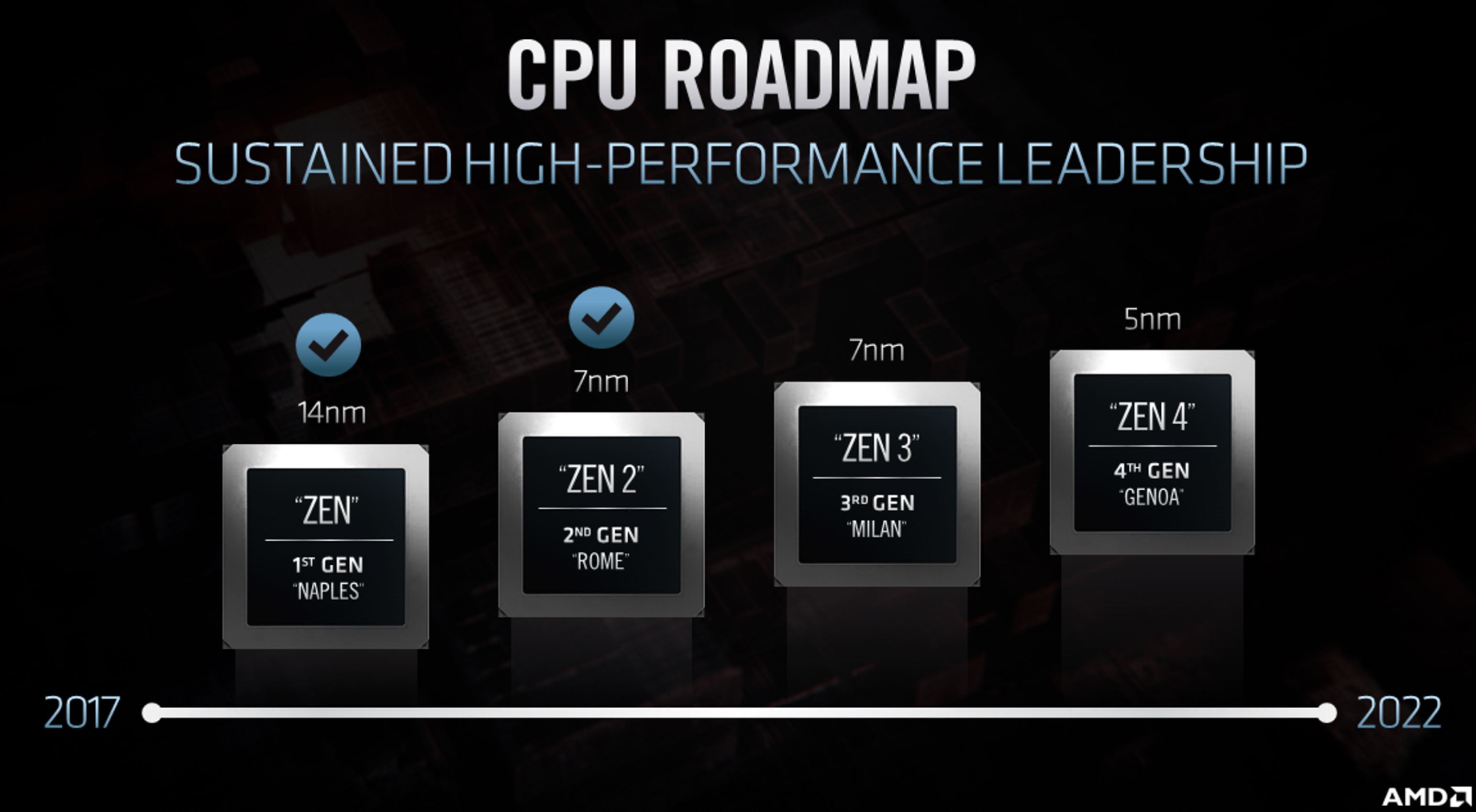

AMD held its Financial Analyst Day 2020 today to update the investment community on both the current state of the company and its future plans. The livestream ran from 1:00pm PT to 6:00pm, and there were plenty of exciting announcements during the course of the event, including new roadmaps for Zen 3 and Zen 4 processors, with Zen 3-based processors first arriving for the consumer market in 2020. AMD will flesh out the remainder of the Zen 3 Ryzen product stack by the end of 2021.

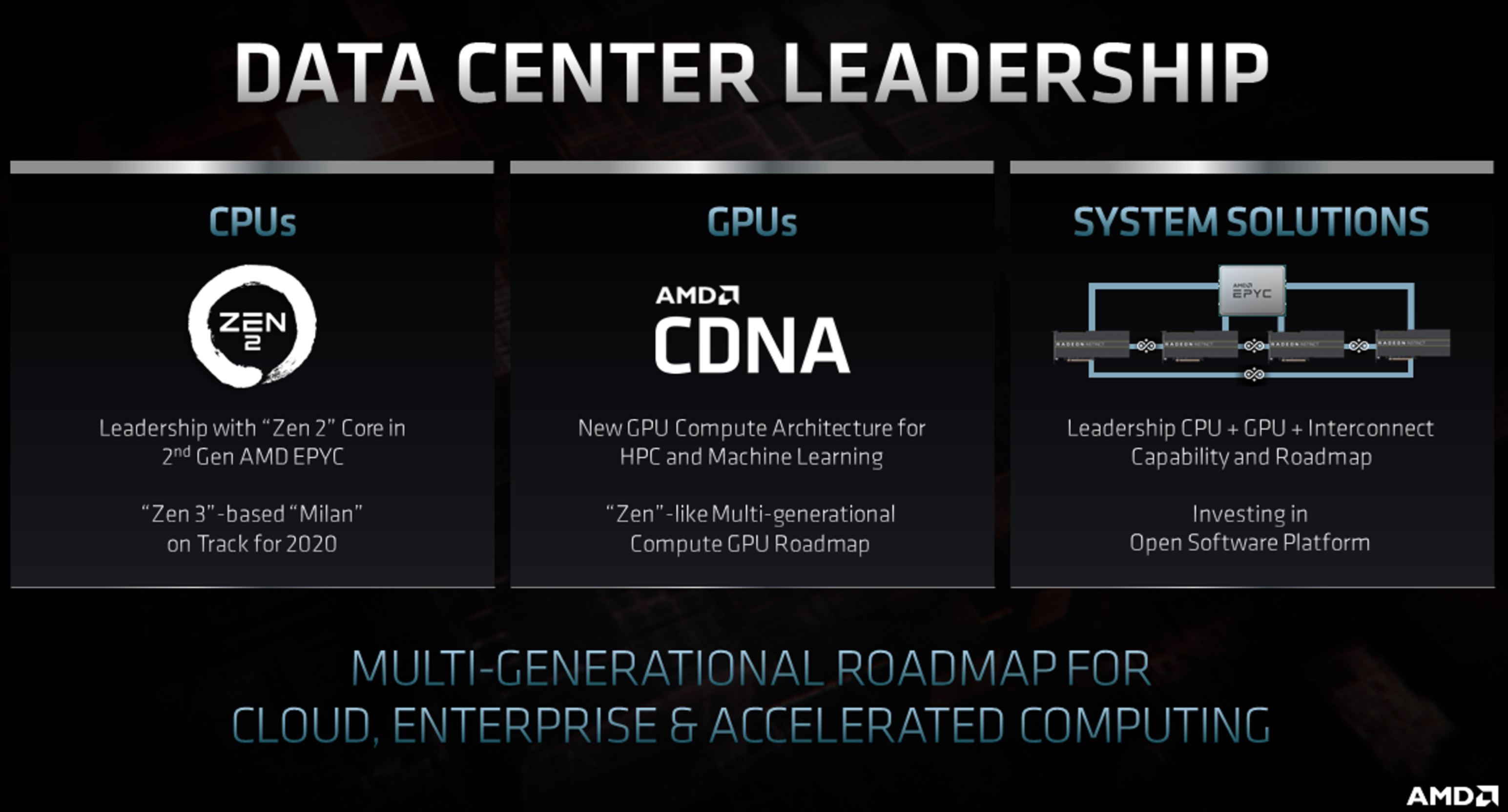

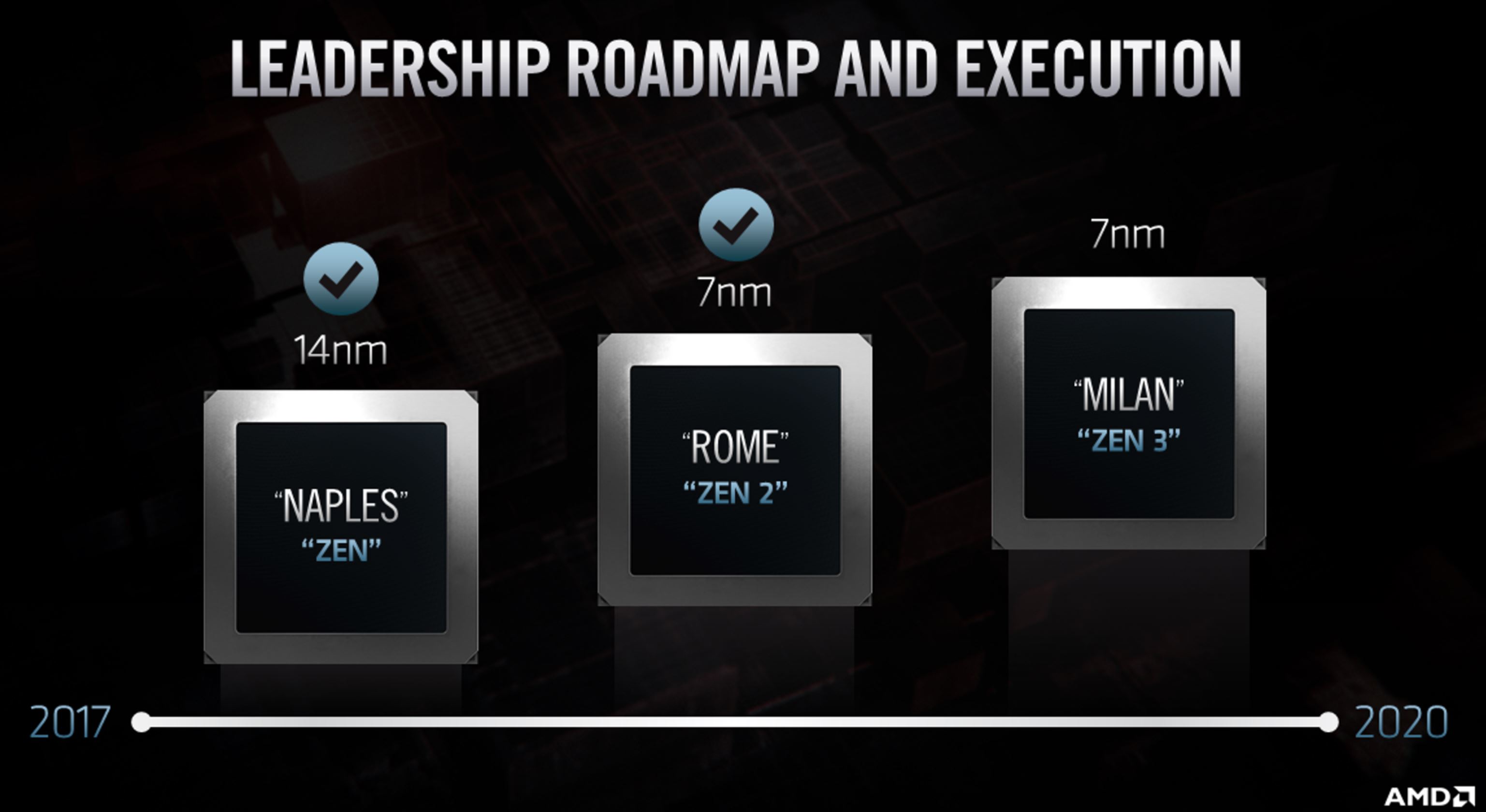

AMD also shared a more complete data center roadmap that includes the 7nm EPYC Milan processors that will debut by the end of 2020, and 5nm EPYC Genoa processors that come to market by the end of 2022.

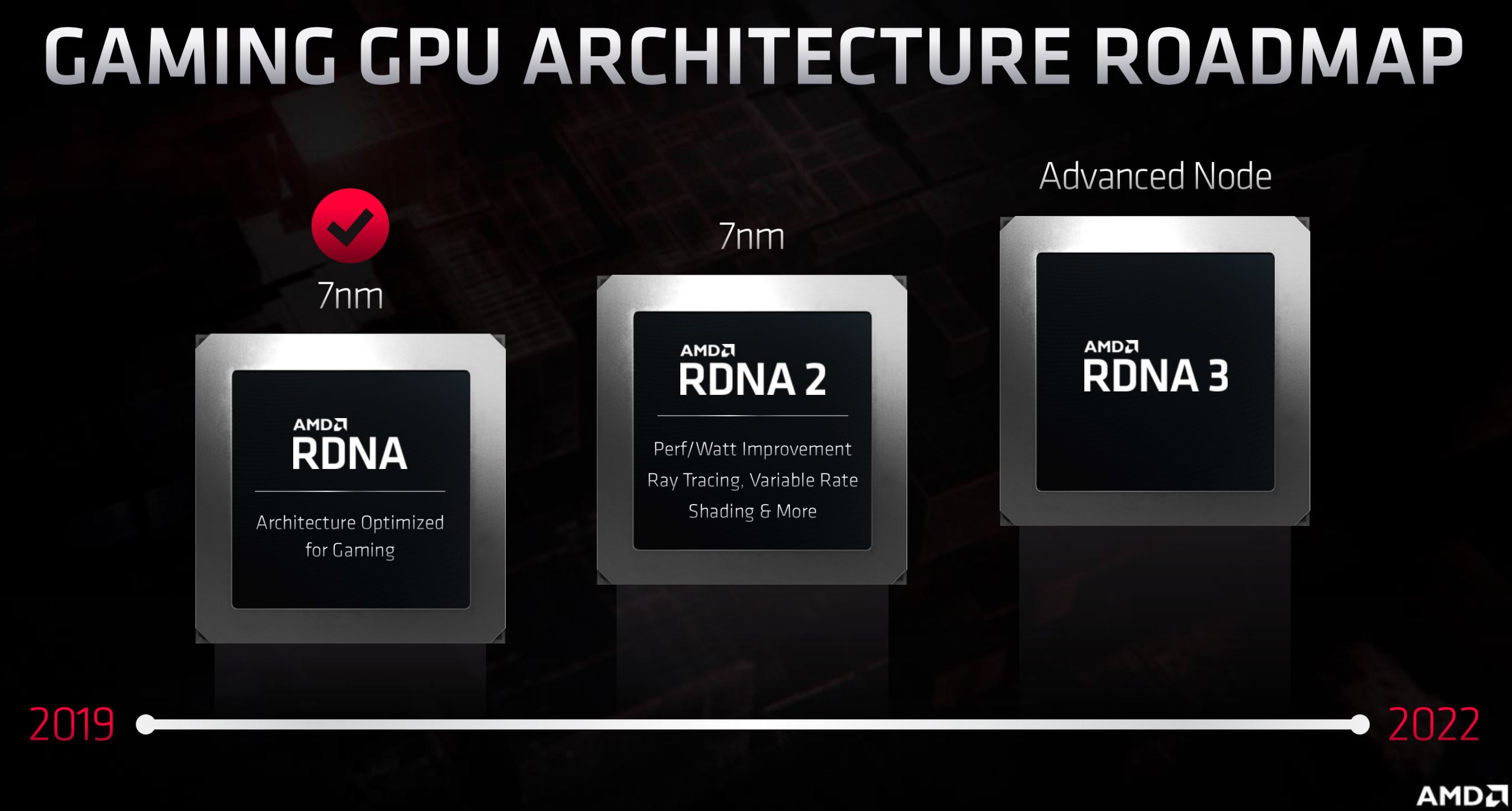

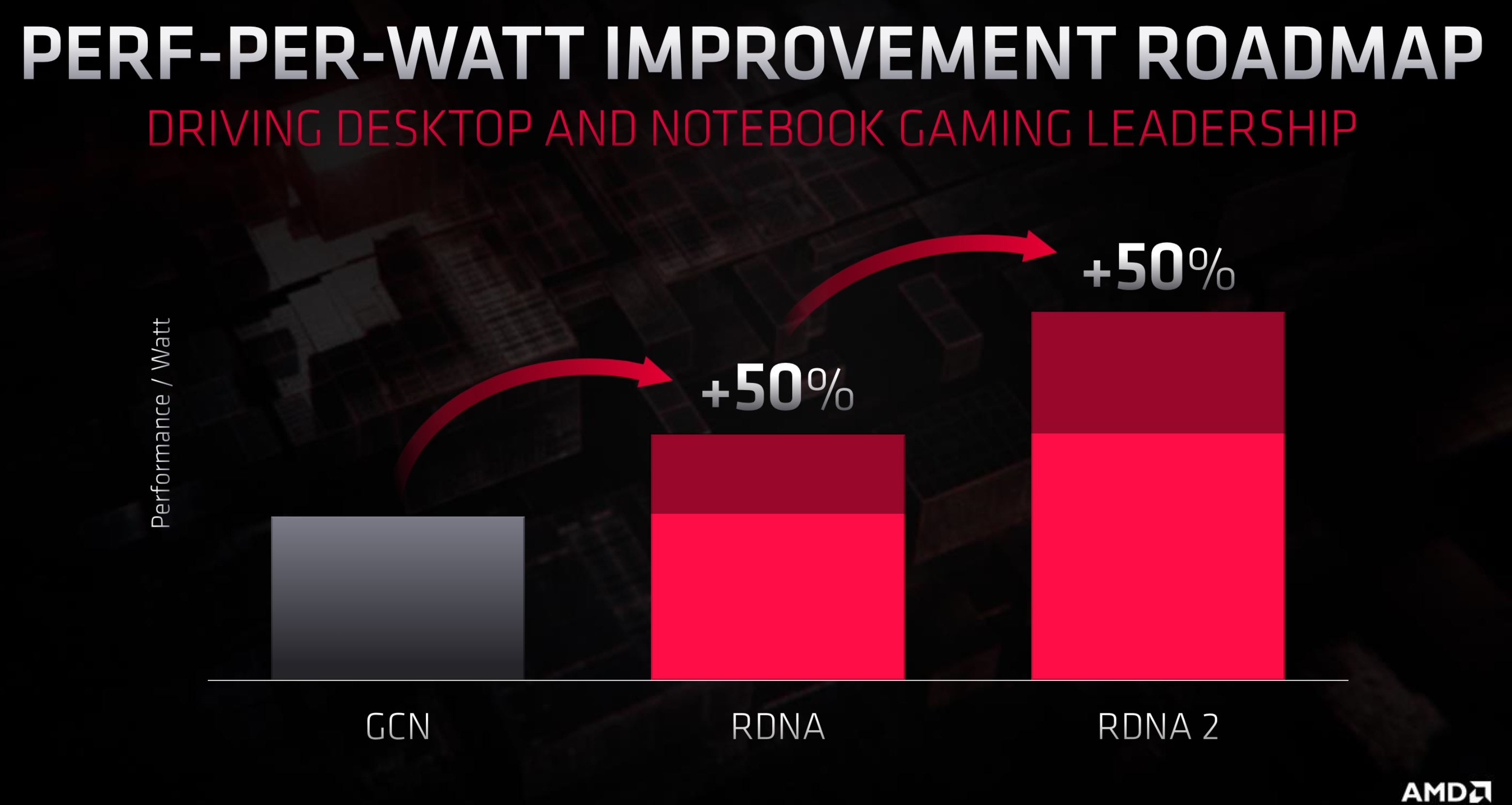

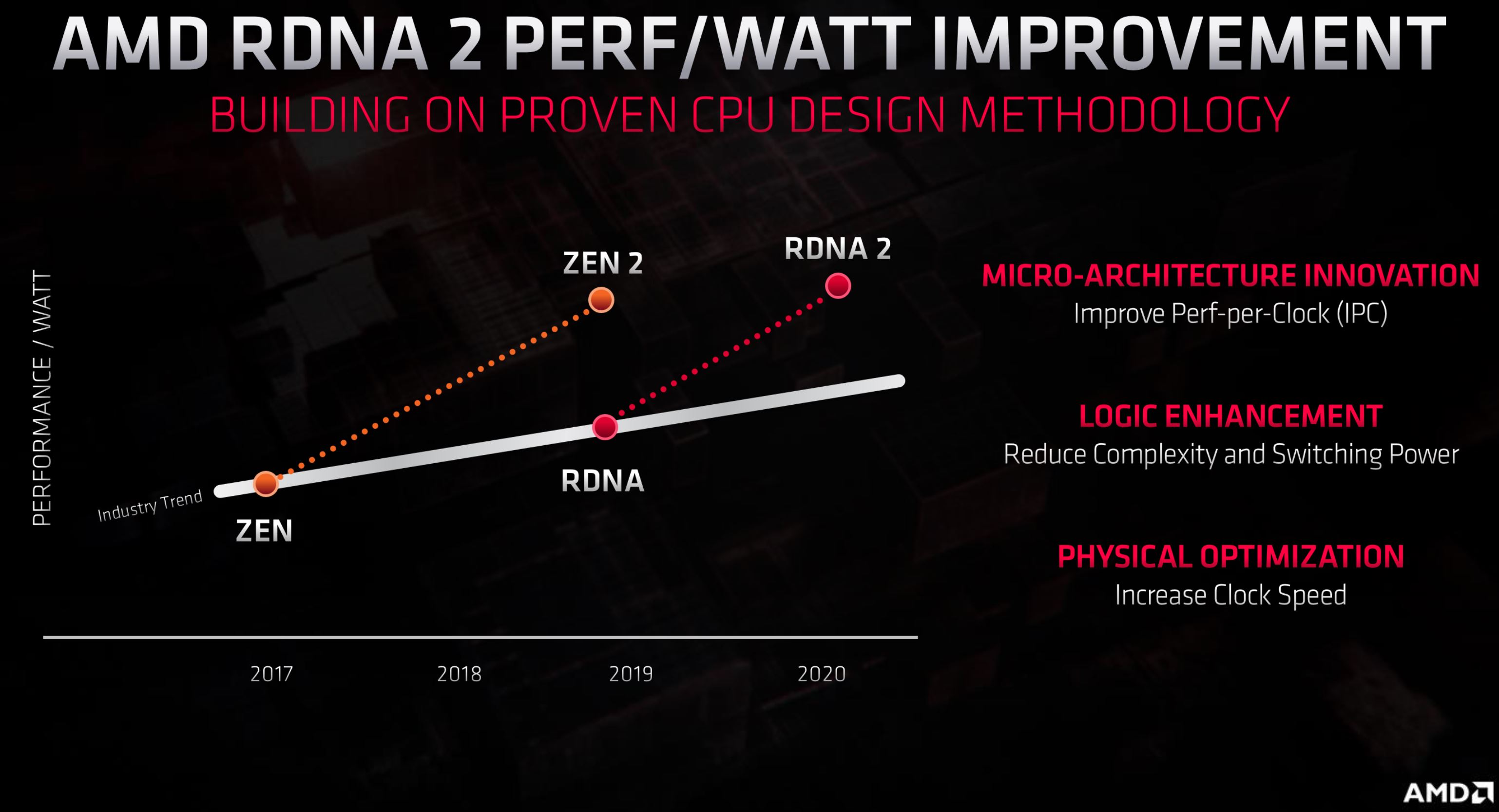

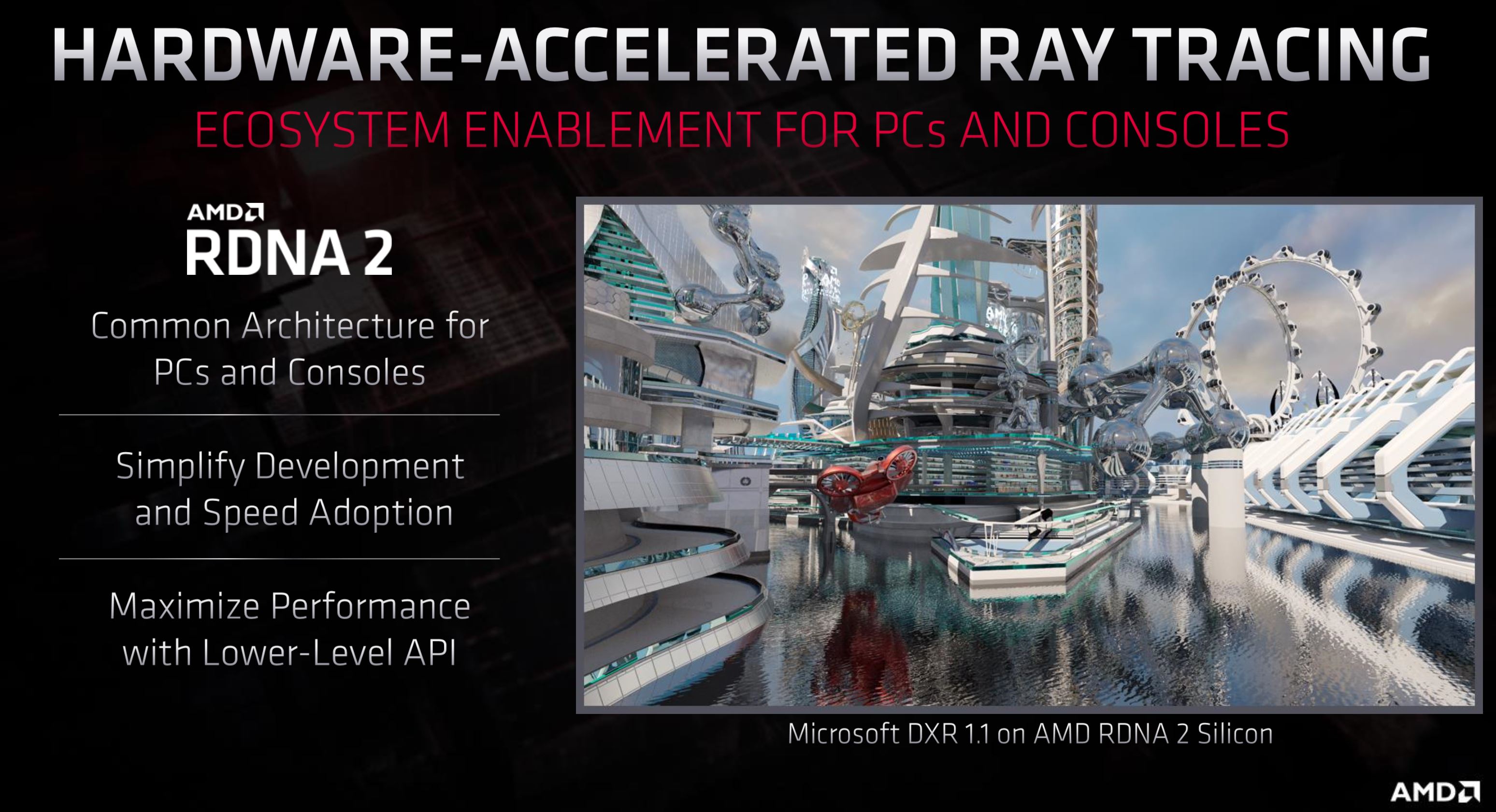

AMD also revealed that Navi 2X and Navi 3X will come with RDNA2 and RDNA3 architectures, respectively. AMD says RDNA 2 GPUs will boost performance per watt by 50% over the first-gen RDNA architecture and come to market in 2020.

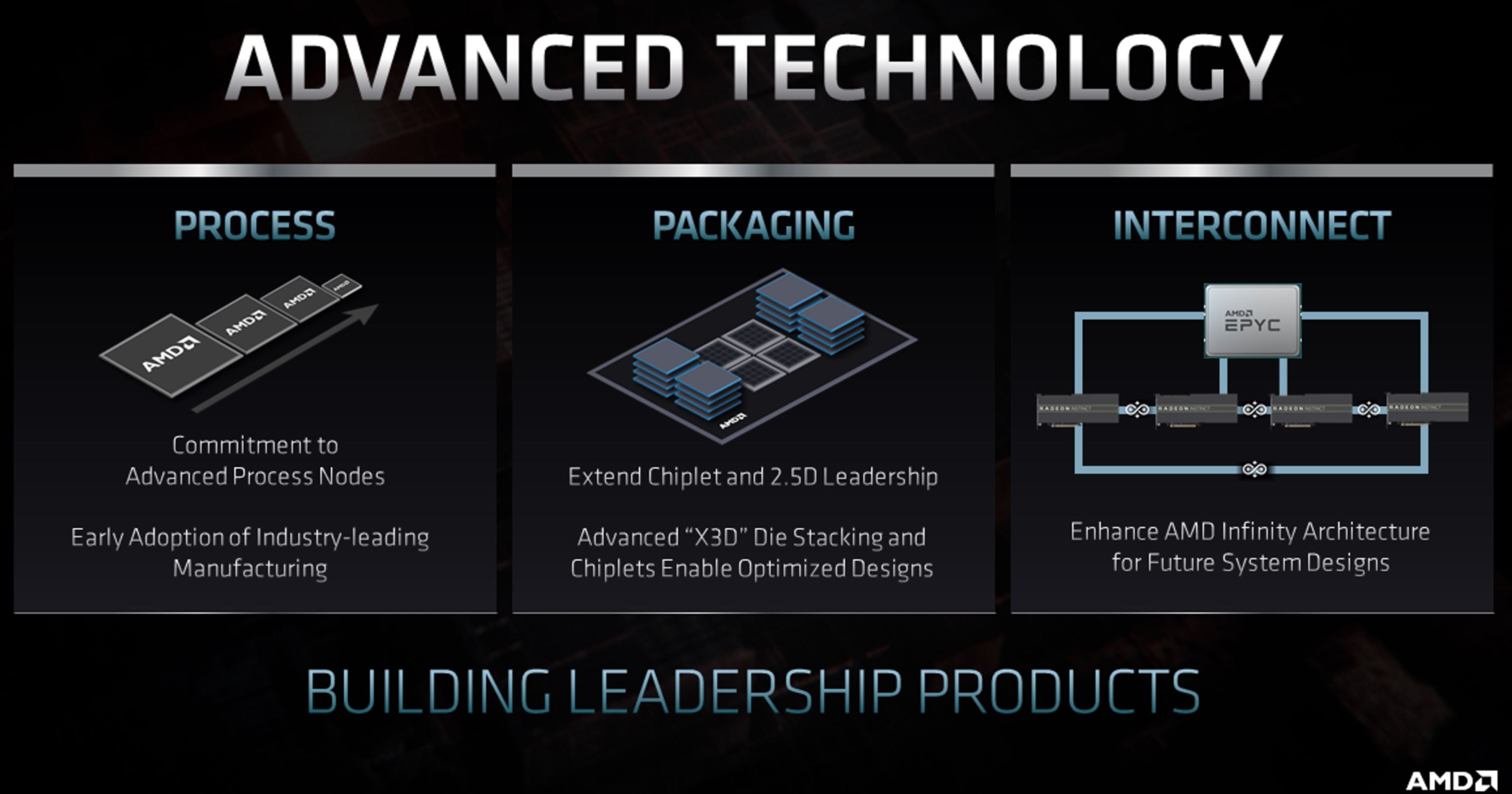

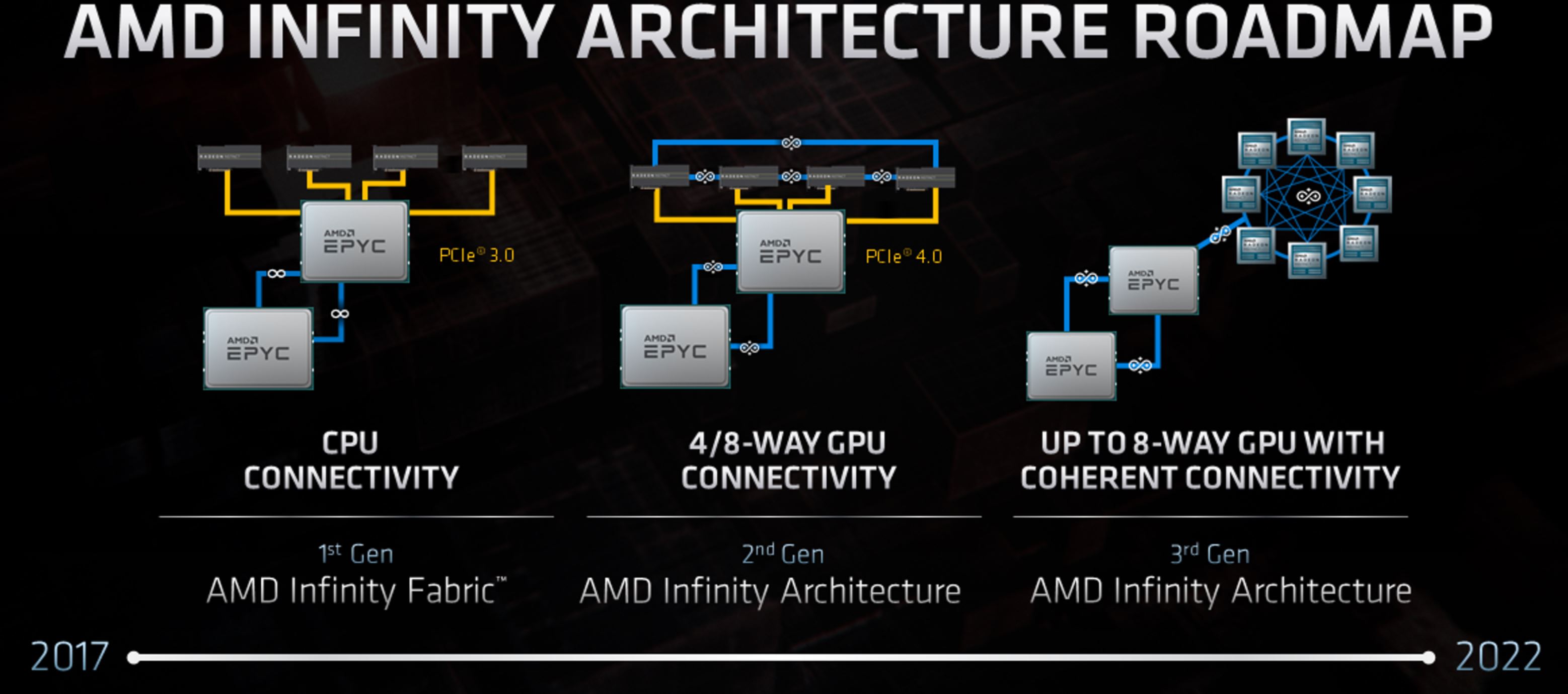

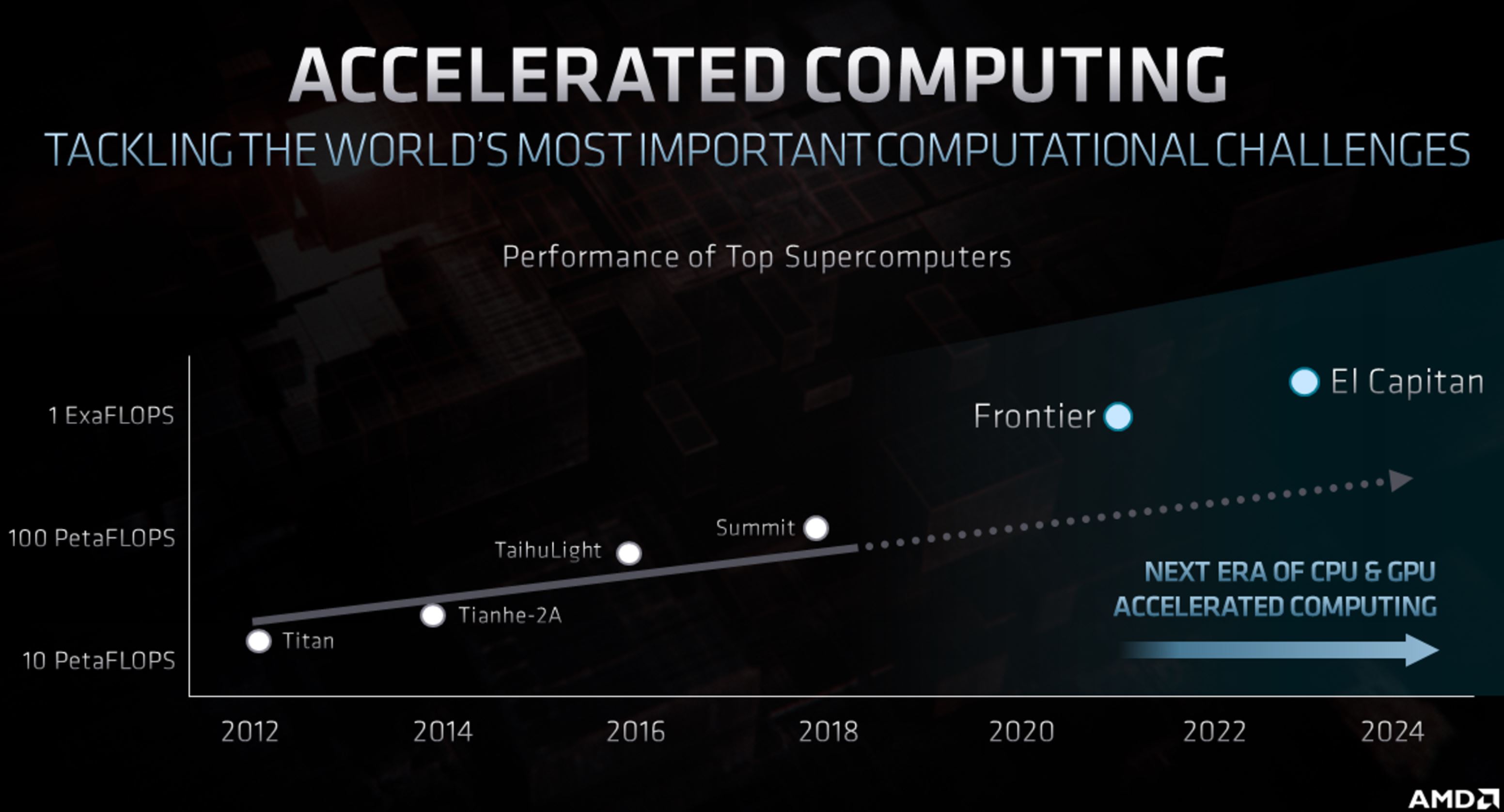

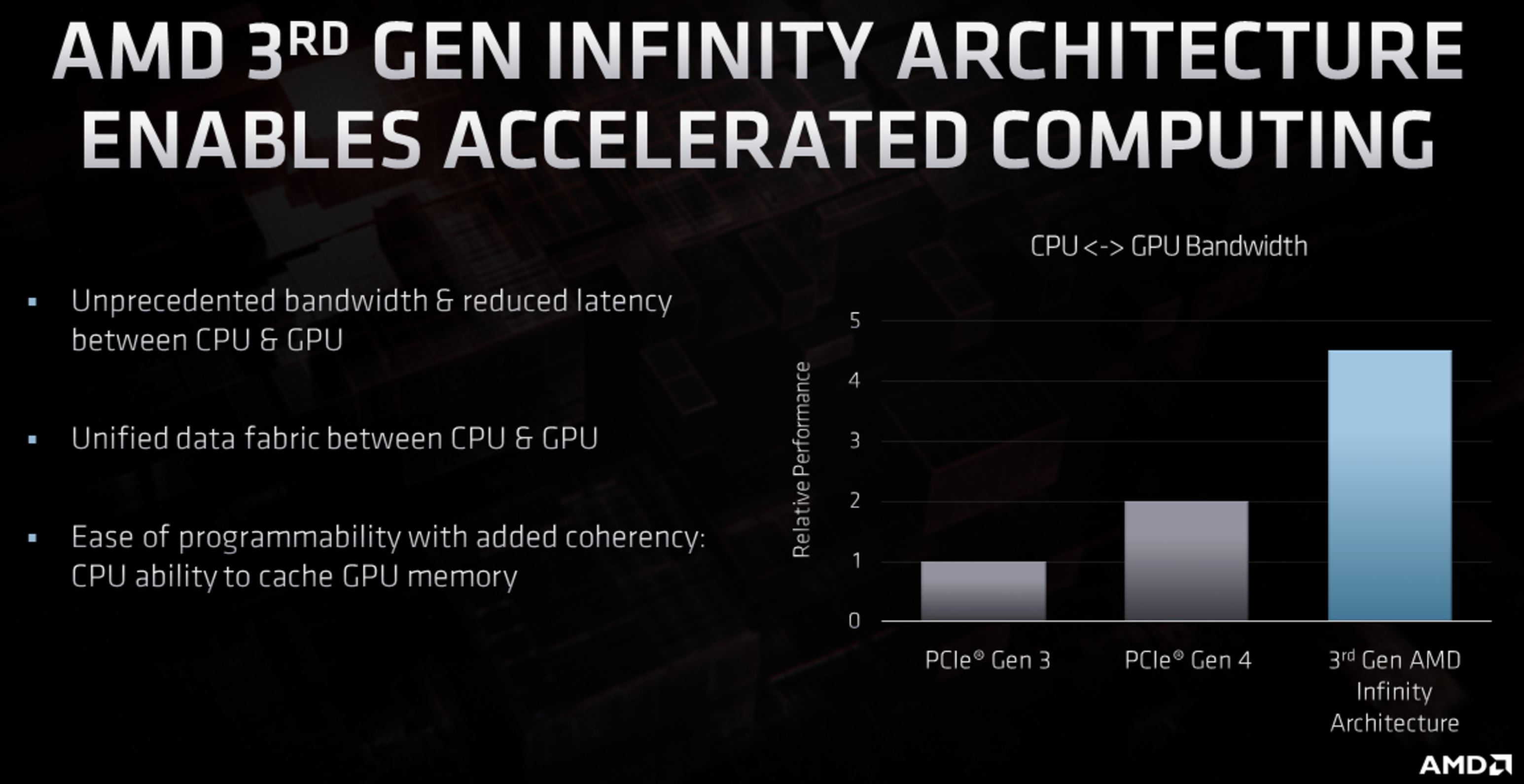

We also learned that AMD will debut its new X3D chip stacking architecture that enables scaling in the third dimension, along with a new Infinity Architecture that ties GPUs and CPUs together using a cache-coherent protocol. Finally, we also learned more about the company's big wins for the exascale-class Frontier and El Capitan supercomputers.

We've included a video of the live stream below, but also added our own commentary below and the relevant slides as the event progressed.

AMD CEO Lisa Su took to the stage and said the company would provide an overview of its past accomplishments and then include updates to its plans for the next three to five years. Su noted that the company improved its client market share by eight percentage points overall, an accomplishment that spans eight straight quarters of growth. Su also touted the company's progress in the enterprise market by doubling the number of available server platforms, with more than a 140 scheduled for this year. Su also reminded us that the company has won two exascale supercomputer wins with Frontier and El Capitan.

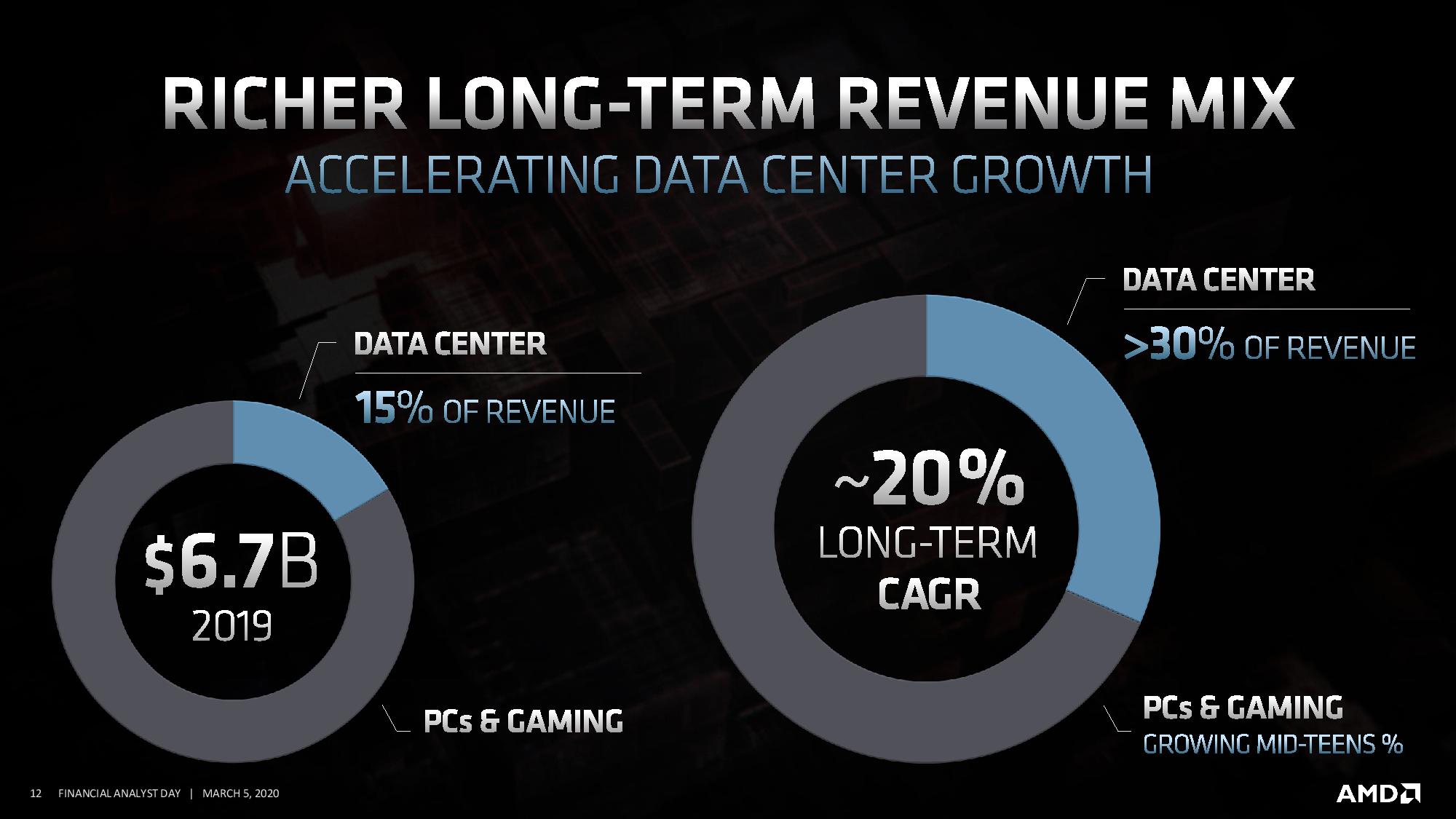

Su updated the company's total addressable market (TAM) figures. AMD estimates it has a $79 billion TAM overall, split up with $35B for the data center, $32B for PCs, and $12B for gaming.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

ADM shared a new roadmap for CPUs and GPUs. We see that the company will have Zen 4 processors based on the 5nm process in-market by the end of 2022. In the interim, we'll get Zen 3 on 7nm, presumably an enhanced "+" type revision. AMD later shared that it will use TSMC's N7+, which uses EUV for several layers.

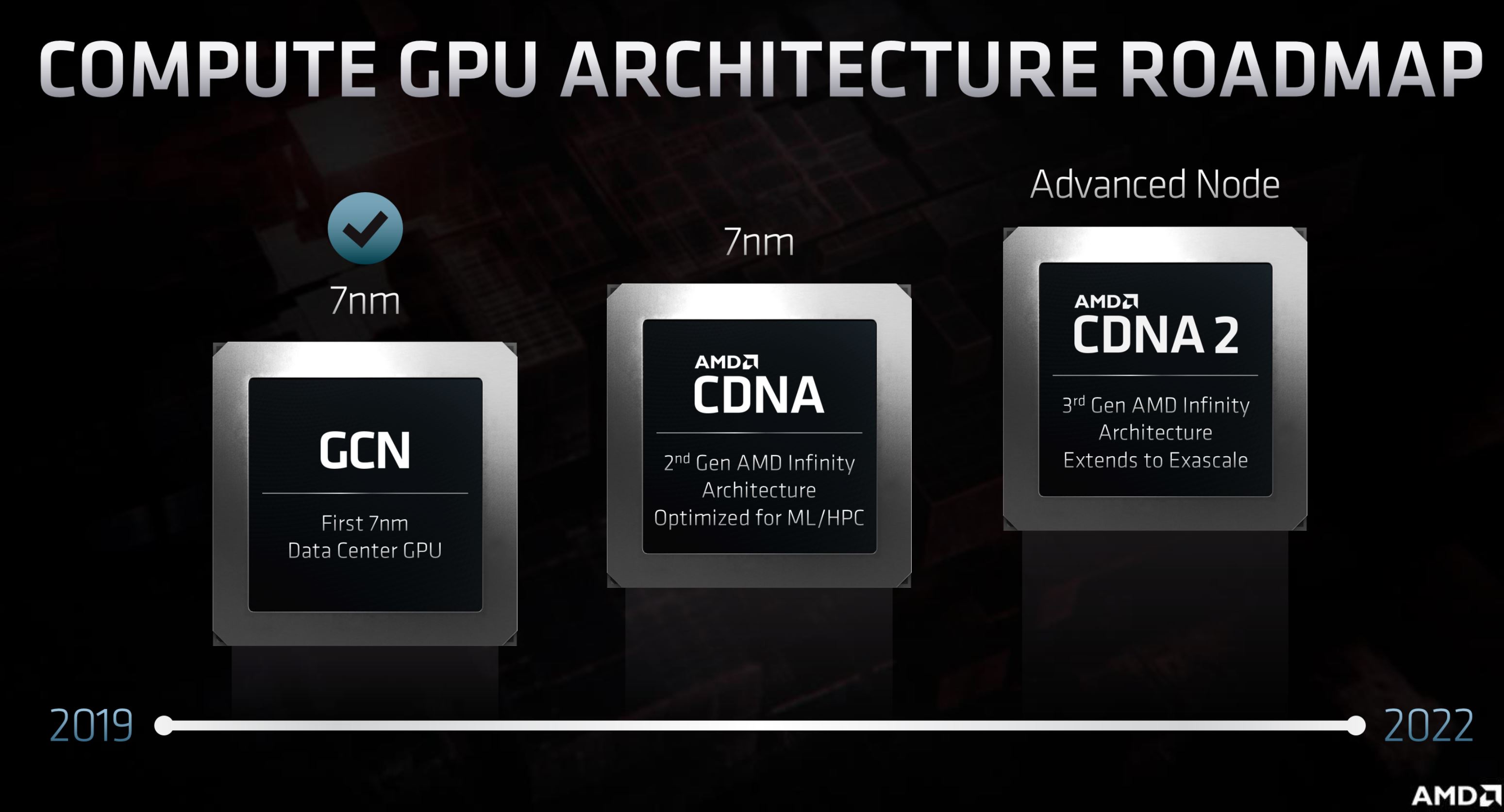

On the GPU side, we'll see RDNA 3 land by the end of 2022 on an unspecified "advanced node," with RDNA 2 on 7nm arriving in the interim.

Su teased us with a new 3D die-stacking technique called X3D die stacking. She promised more details will come soon during the live stream. This appears to be an answer to Intel's Foveros 3D stacking.

Su also mentioned a new Infinity Architecture, which is a system-level approach to tying together AMD's CPUs and GPUs. We covered this Infinity Fabric 3.0-driven approach in this recent article.

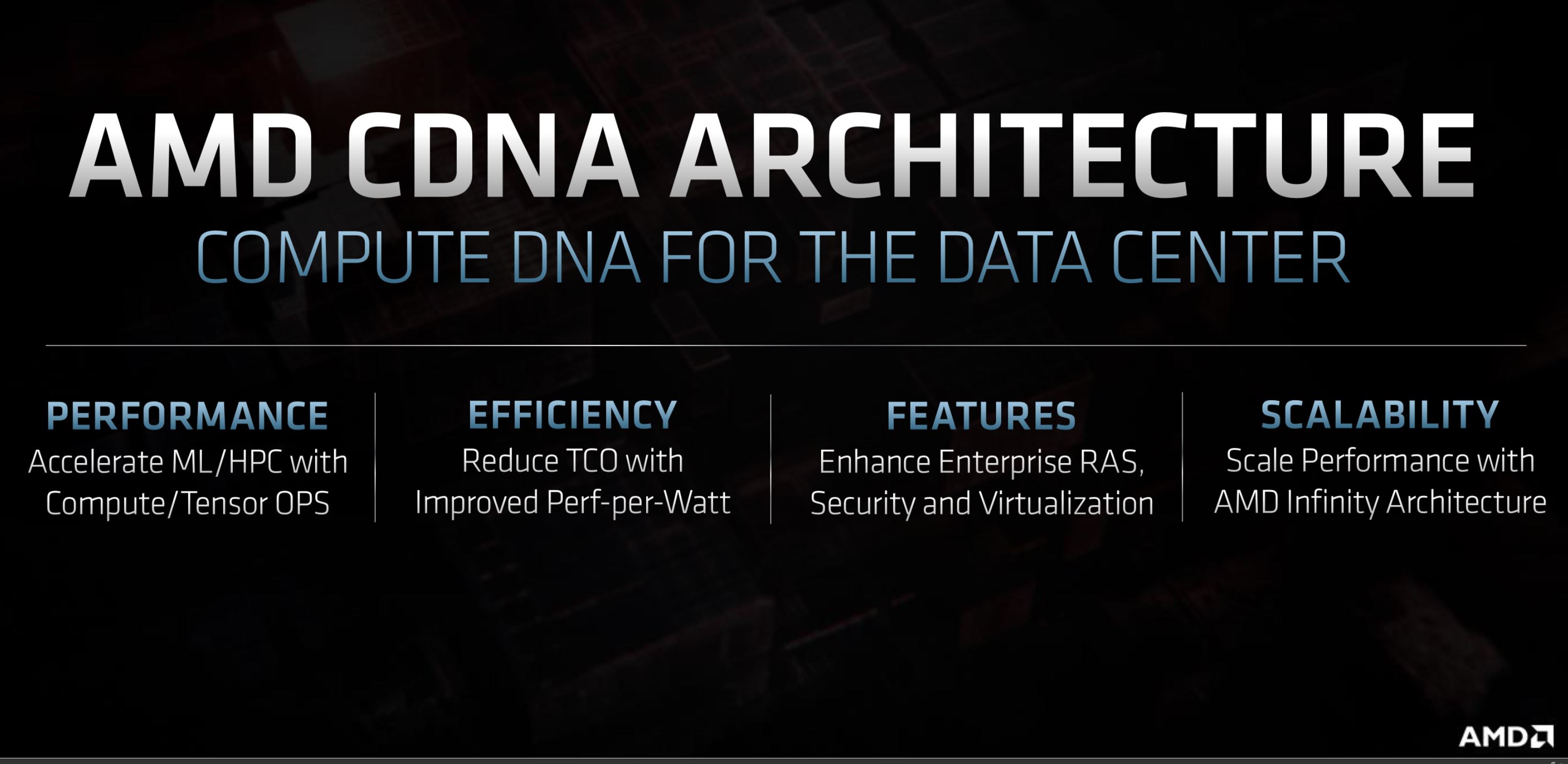

AMD says that Milan is on-track for a 2020 launch, and that it is creating the CDNA branding for its data center GPUs. In the future, AMD will develop the RDNA architecture for the gaming market, and CDNA (Compute DNA) graphics architectures for the data center.

AMD CTO Mark Papermaster has taken the stage for a breakdown on the tech.

Papermaster outlined the company's new approach to silicon design, including leapfrogging CPU and GPU design teams that allow the company to deploy new designs faster. He gave the analysts a bit of a history lesson on AMD's recent accomplishments, but we expect more new details on the tech soon.

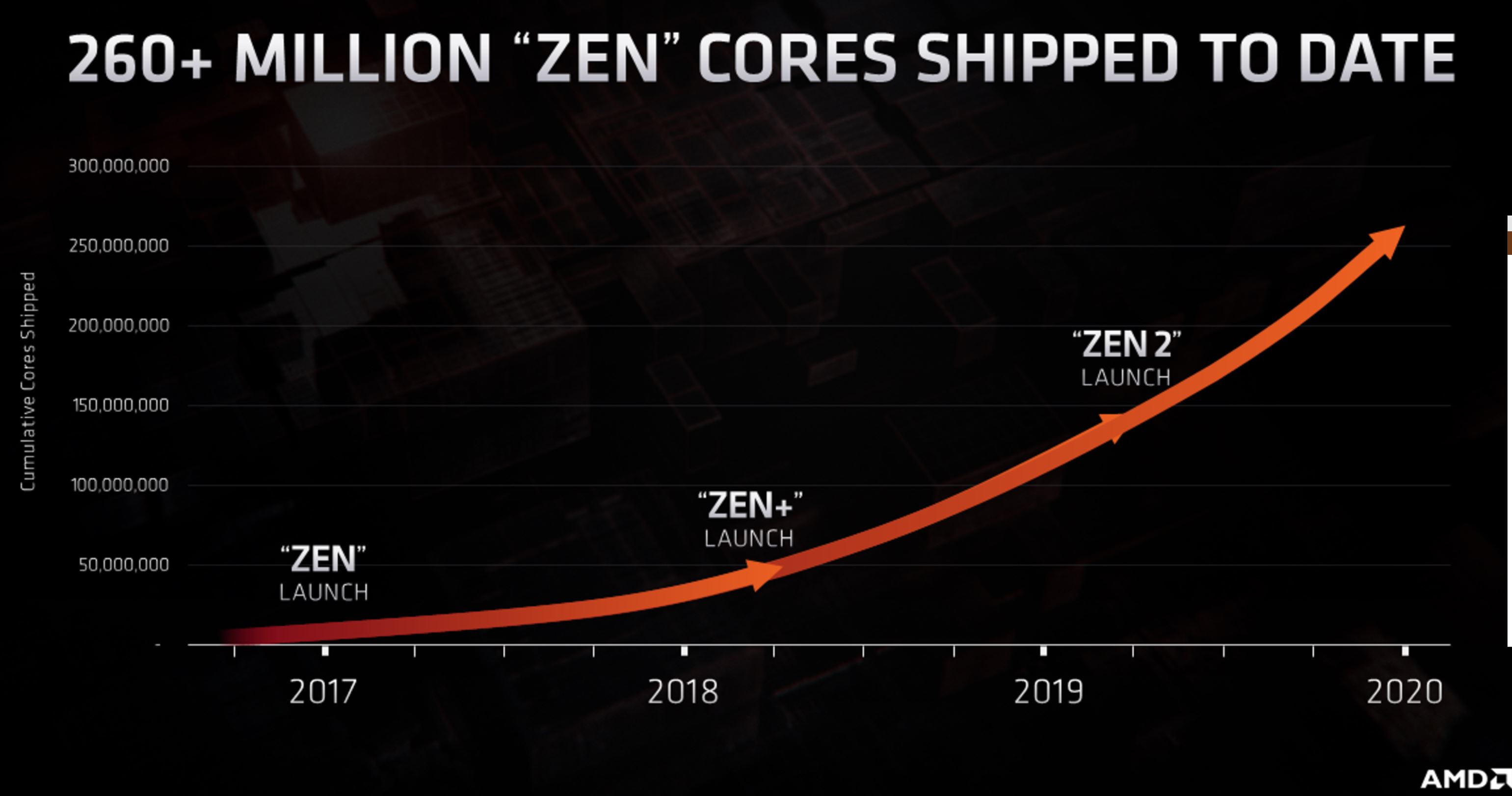

AMD has shipped more than 260 million Zen cores since the launch in 2017. That rate is doubling every two years.

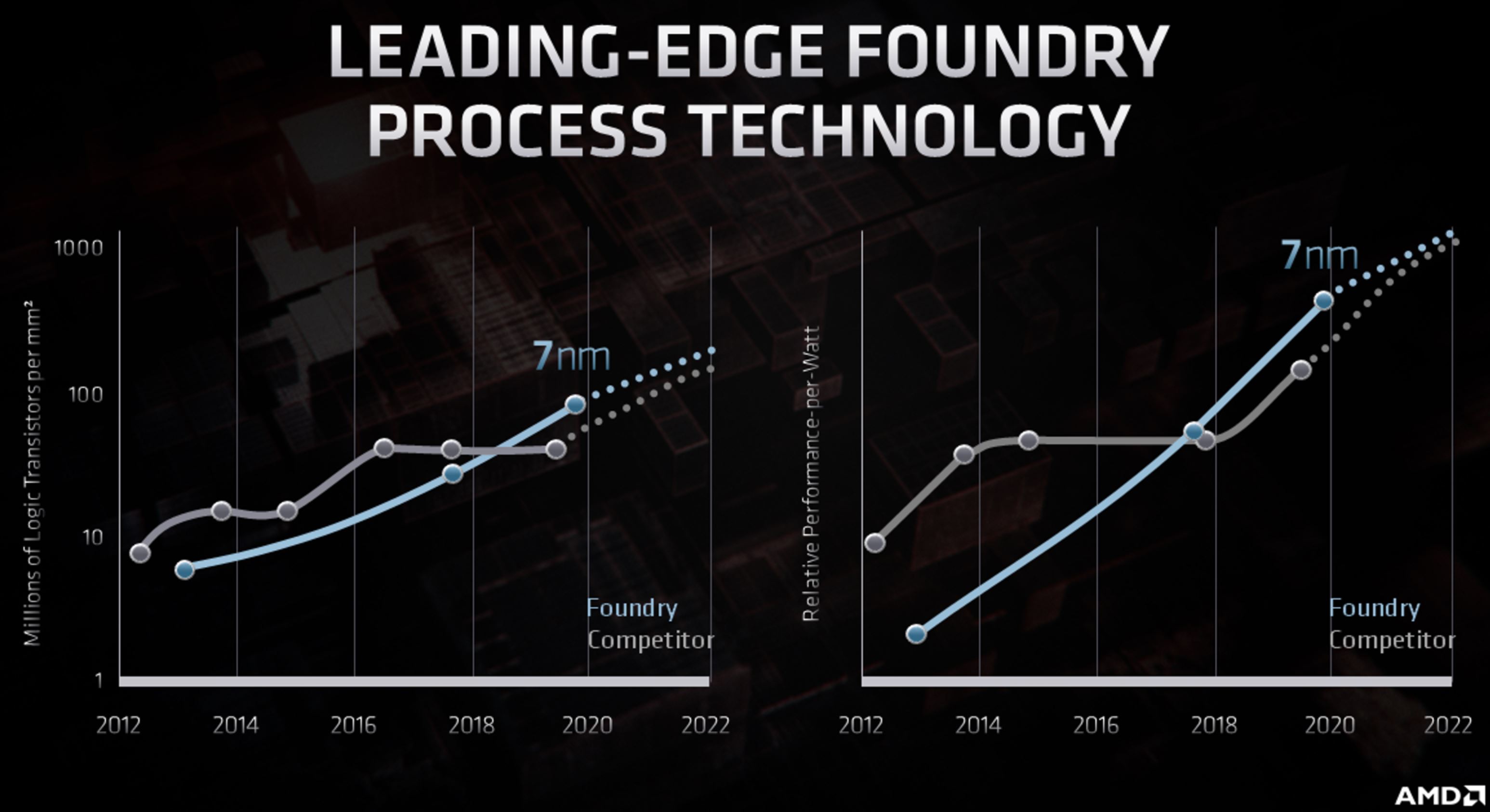

Papermaster said the company is working together with TSMC on 5nm for Zen 4 processors. He also said the company planned for "our competitor" (Intel) to continue to retain the lead in process tech, but AMD unexpectedly took the lead over Intel. However, the company still plans to fight off Intel as if it would reemerge with a process node advantage. According to Intel's latest statements, that won't happen anytime soon. Intel doesn't think it can match TSMC's process tech until 2021, and won't beat it until Intel hits 5nm at an unspecified date. That means AMD has some breathing room.

Here we can see that the new Infinity Architecture allows up to 8-way GPU connectivity with the CPU, enabling cache coherency between the CPUs and GPUs.

AMD's David Wang announced that the company will split its GPUs up into RDNA cards for consumers/gaming, and CDNA ("Compute") for enterprise use-cases. RDNA 2 cards support variable rate shading and ray tracing. AMD also shared a chart that shows big performance-per-Watt gains for RDNA 2. He also showed a chart that details a 50% increase in performance per watt for each generation.

Hardware-accelerated ray tracing lands with RDNA2. AMD has a demo at the event.

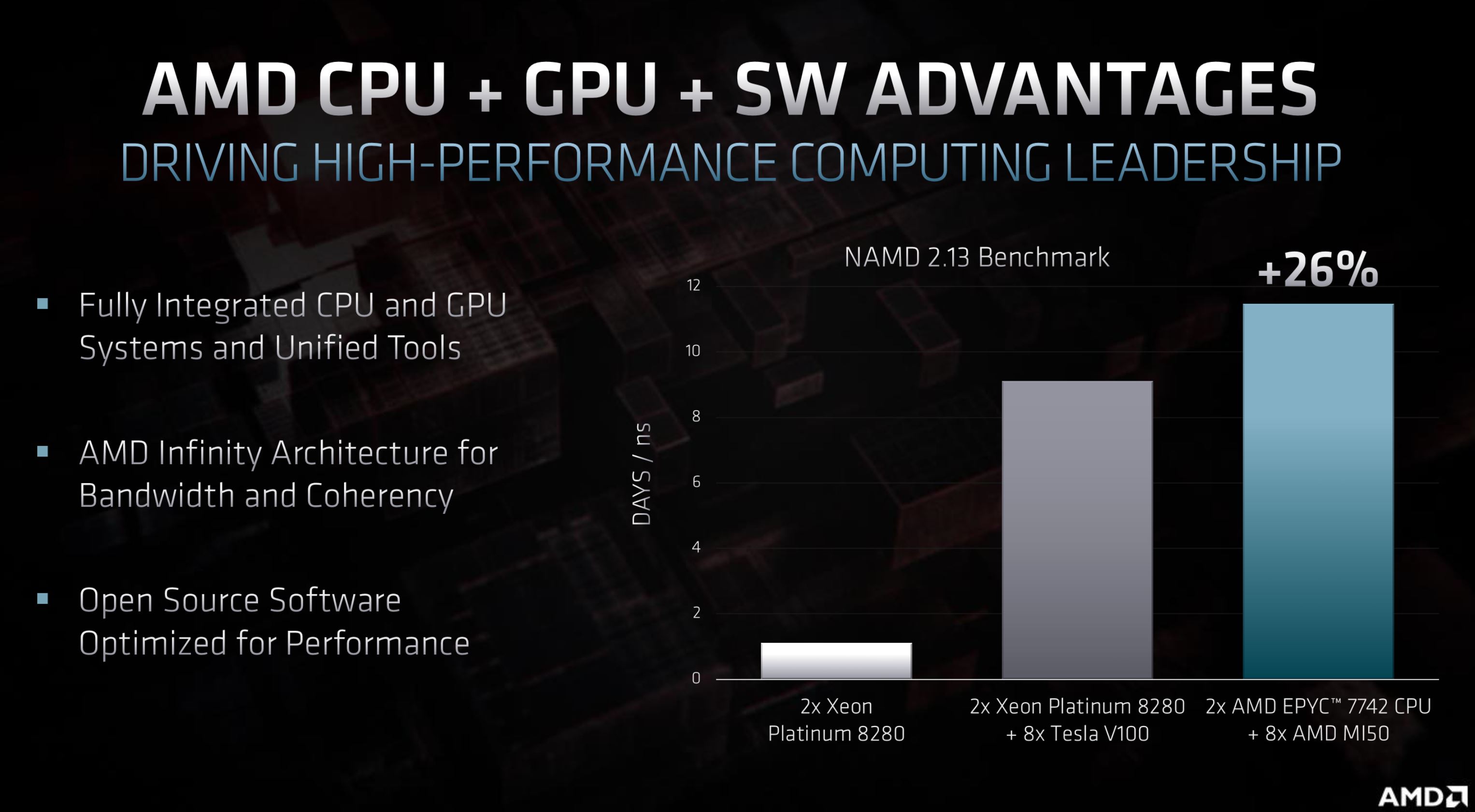

Wang revealed the big performance gains borne of the combination of AMD's ROCm software, cache coherency, and Infinity Architecture.

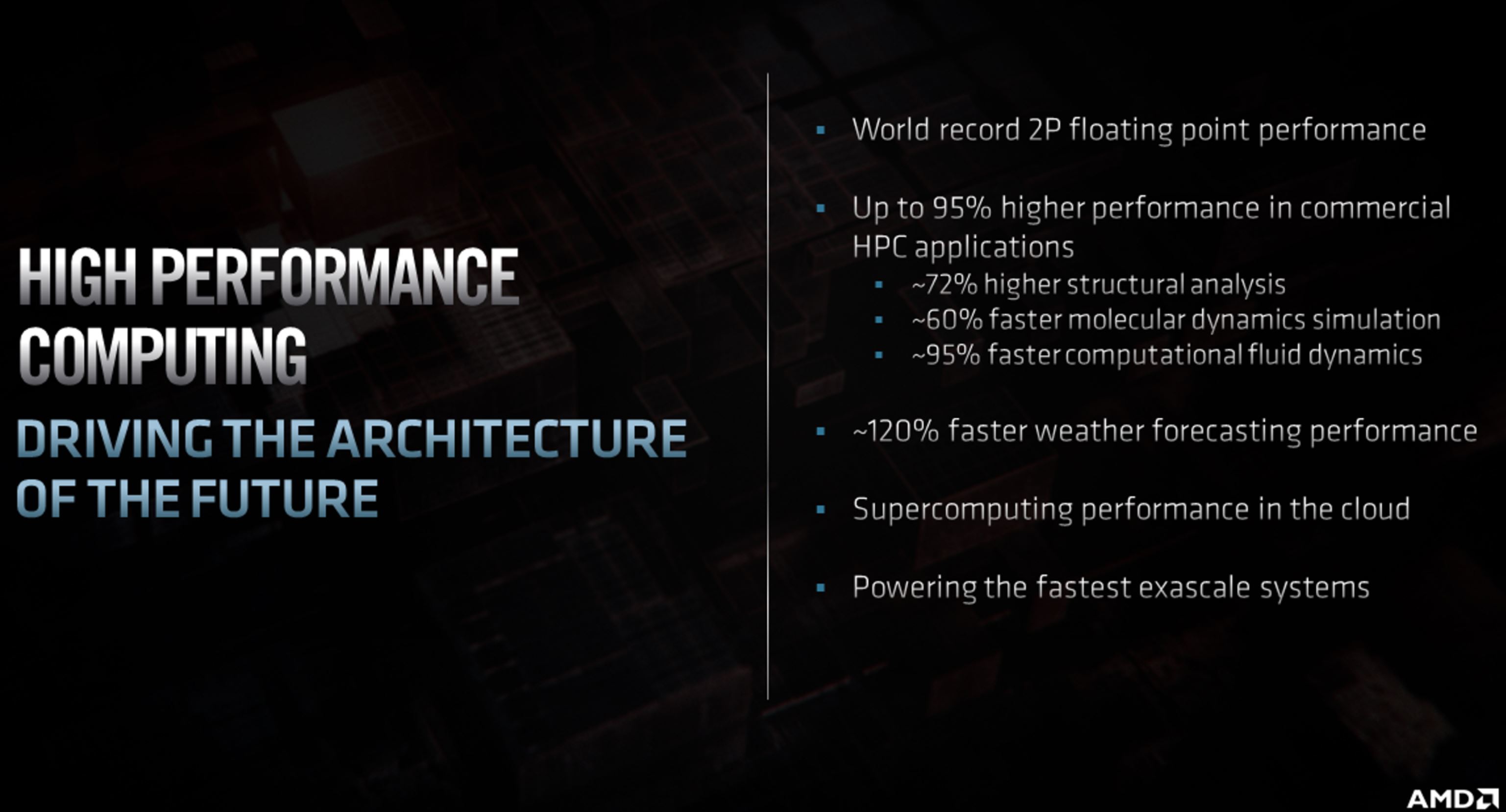

Forrest Norrod took the stage to cover the data center side of AMD's business. We expect lots of EPYC details. EPYC Milan, with Zen 3, is on track for release this year. AMD is moving quickly. AMD's EPYC Rome has taken 140 world records for performance thus far.

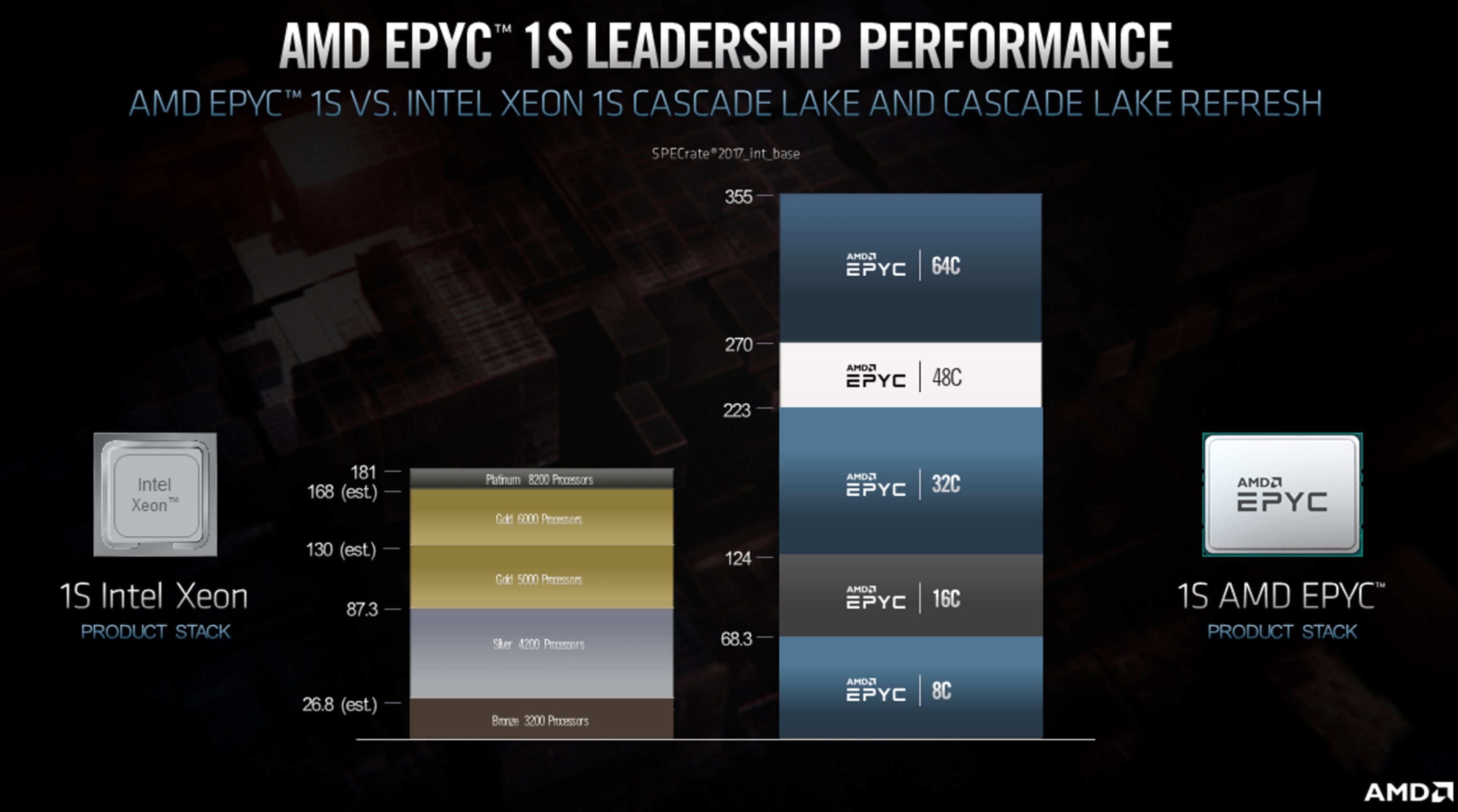

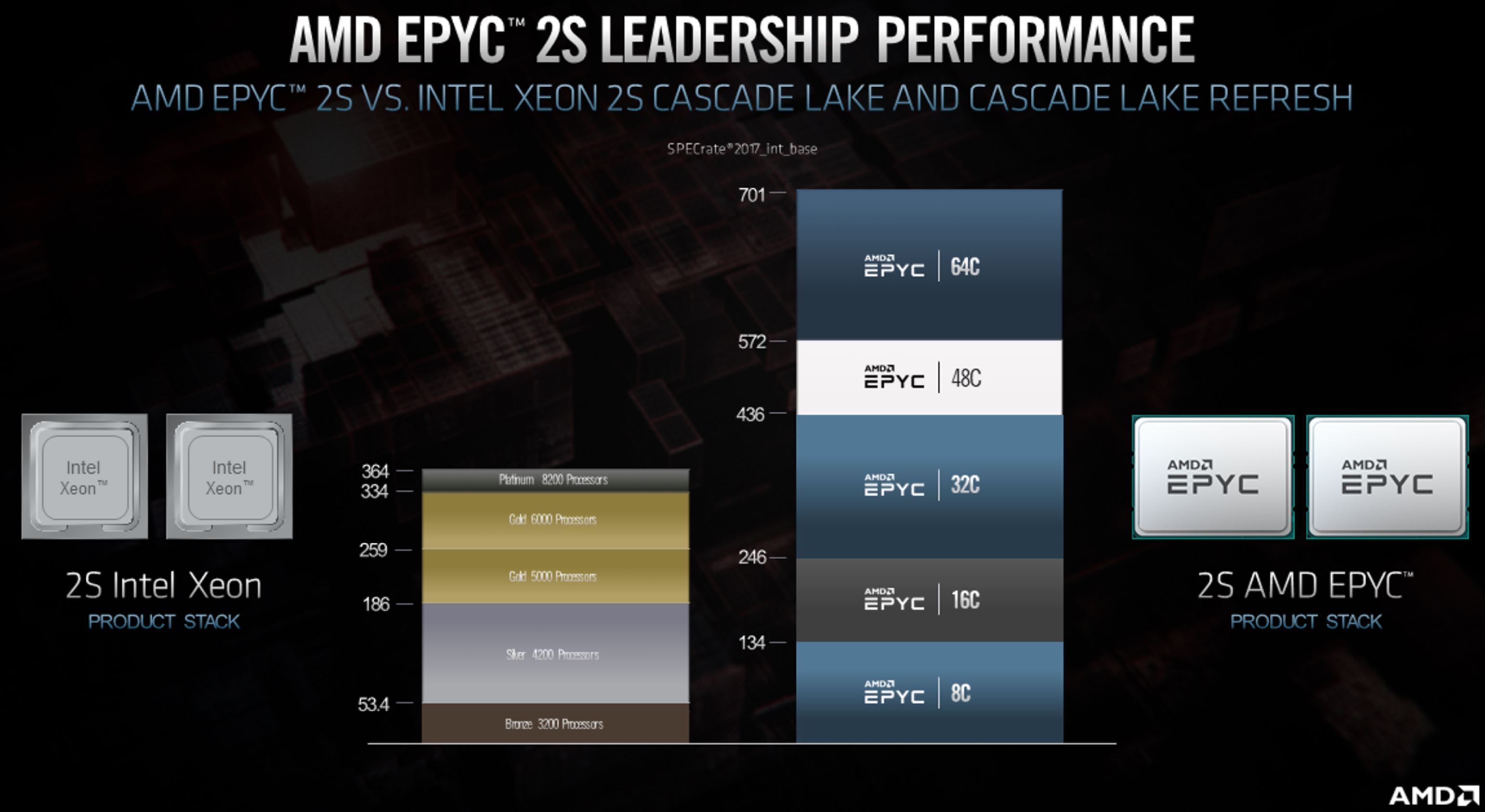

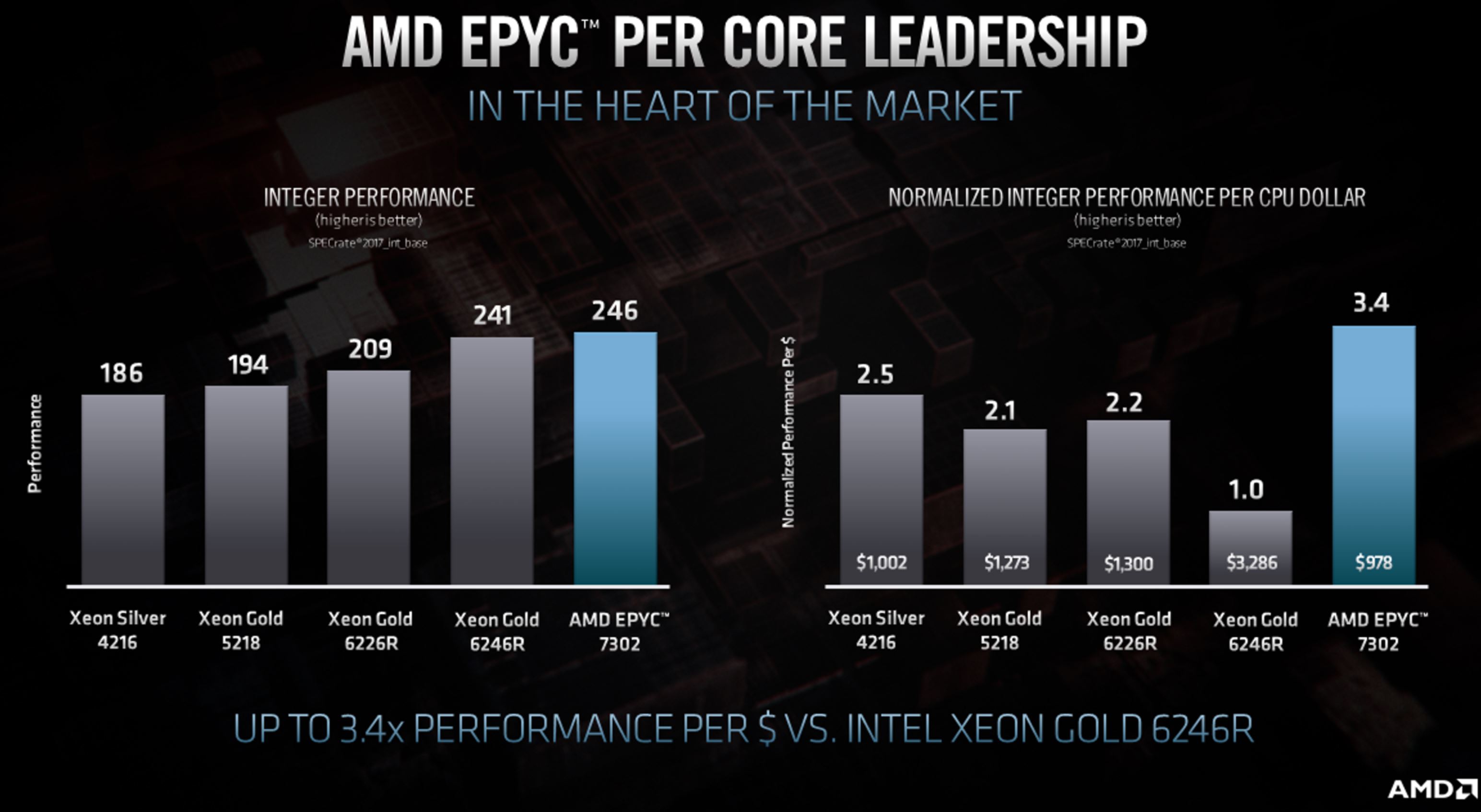

Norrod revealed some new charts with EPYC Rome against Intel's new revised (and cheaper) Cascade Lake Refresh lineup. Norrod says that AMD still offers a 3.5X performance-per-dollar advantage over Intel's new chips, and shared a comparison of EPYC Rome against Intel's dual- and single-socket server platforms.

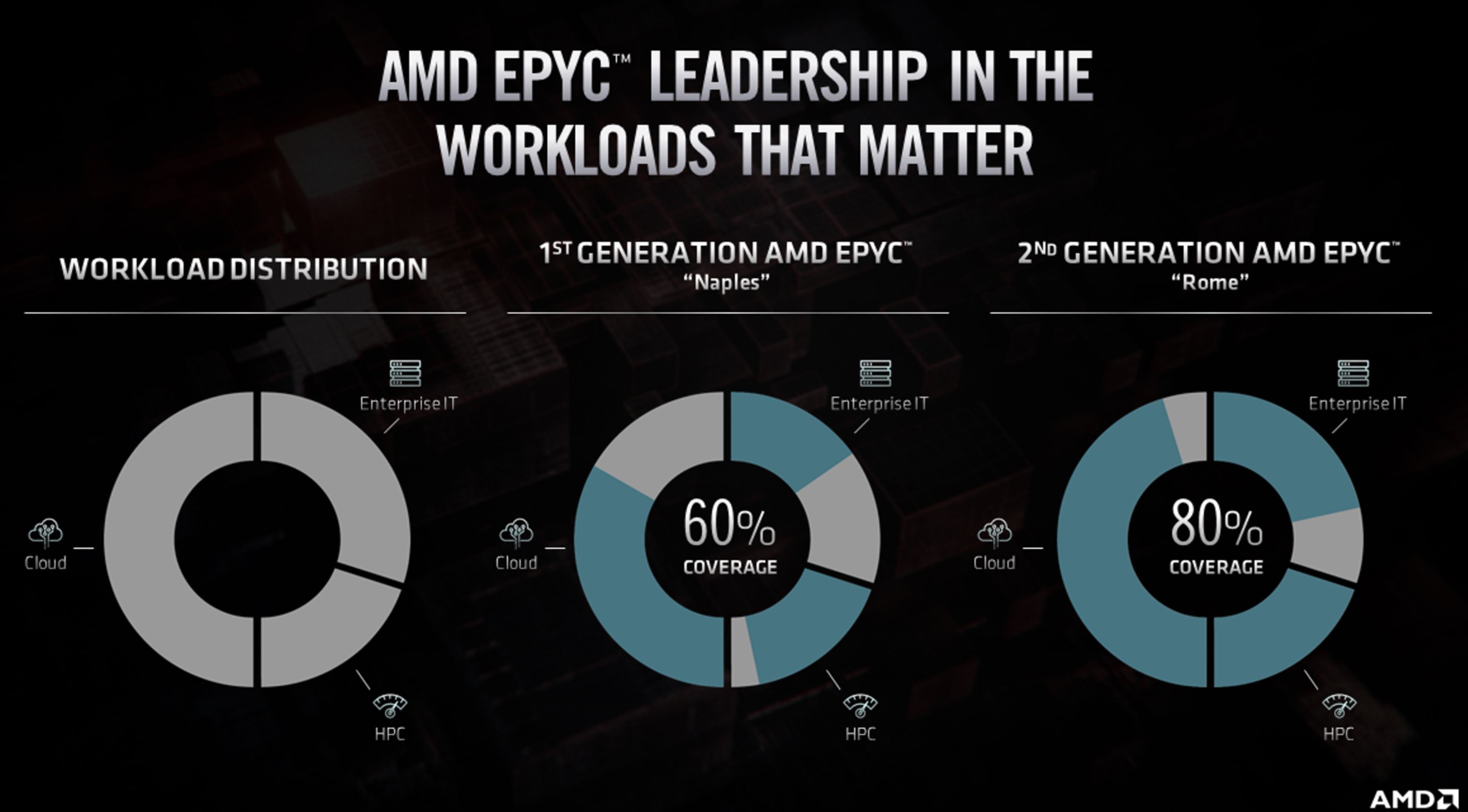

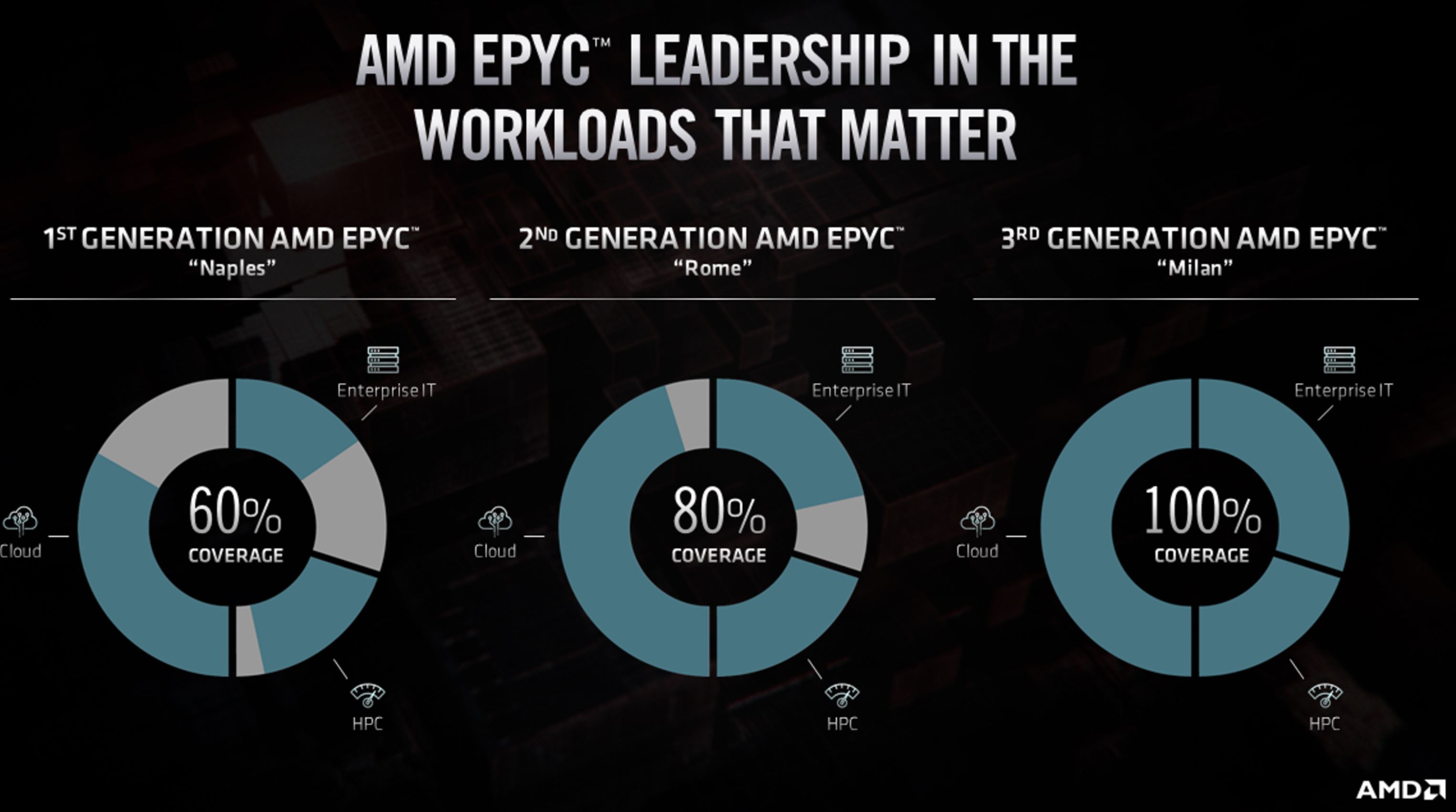

Norrod said that AMD will hit double-digit market share in the data center next quarter and provided a breakdown of the company's coverage of the biggest and most relevant market segments.

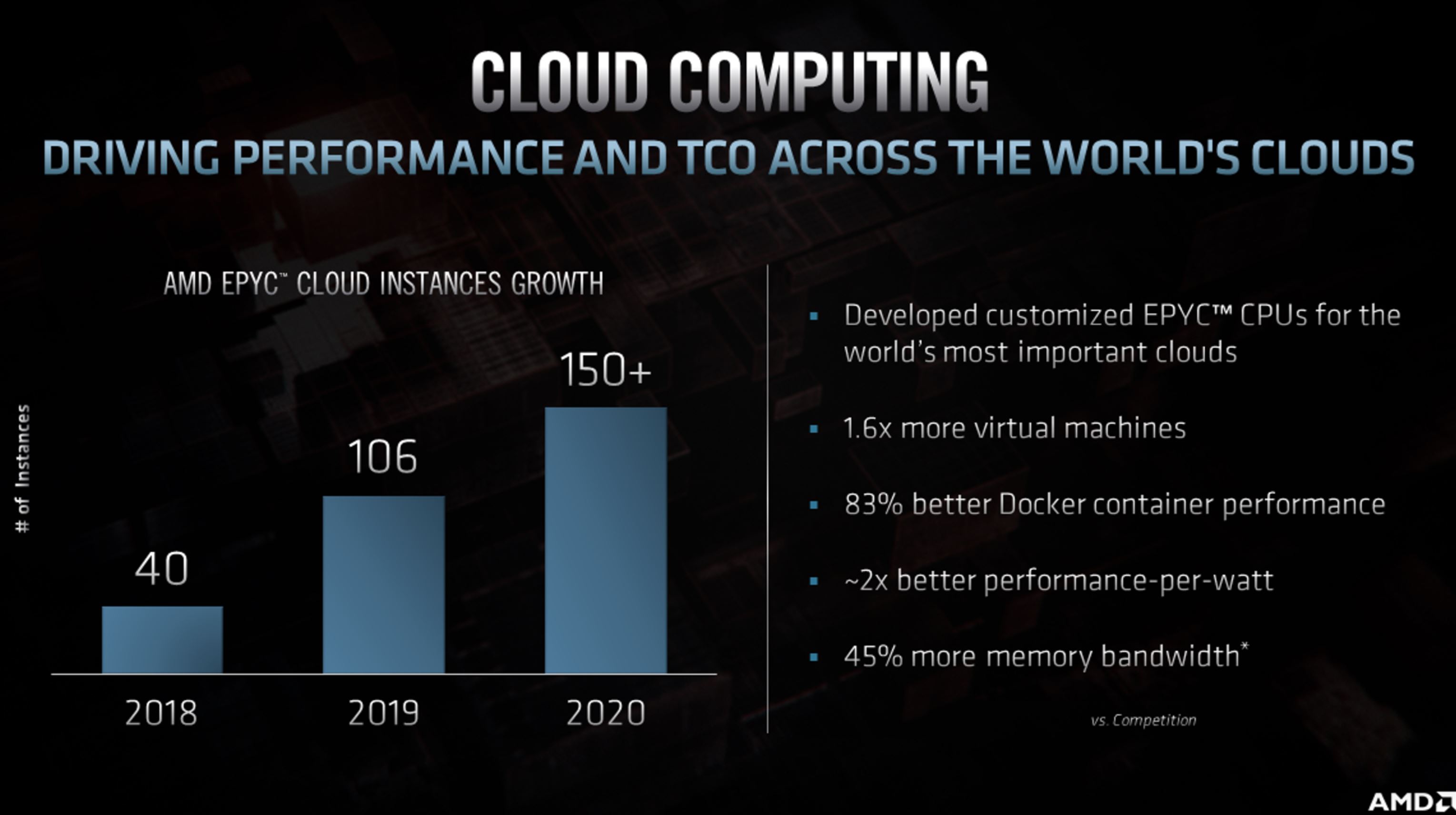

AMD shared some of its advantages over competing Intel solutions, and also announced that it will push into the telco and infrastructure market, which includes the important 5G segment.

Milan will ship this year, with Genoa on 5nm coming by the end of 2022. AMD also said that its optimizations will allow Milan will address the entire data center market.

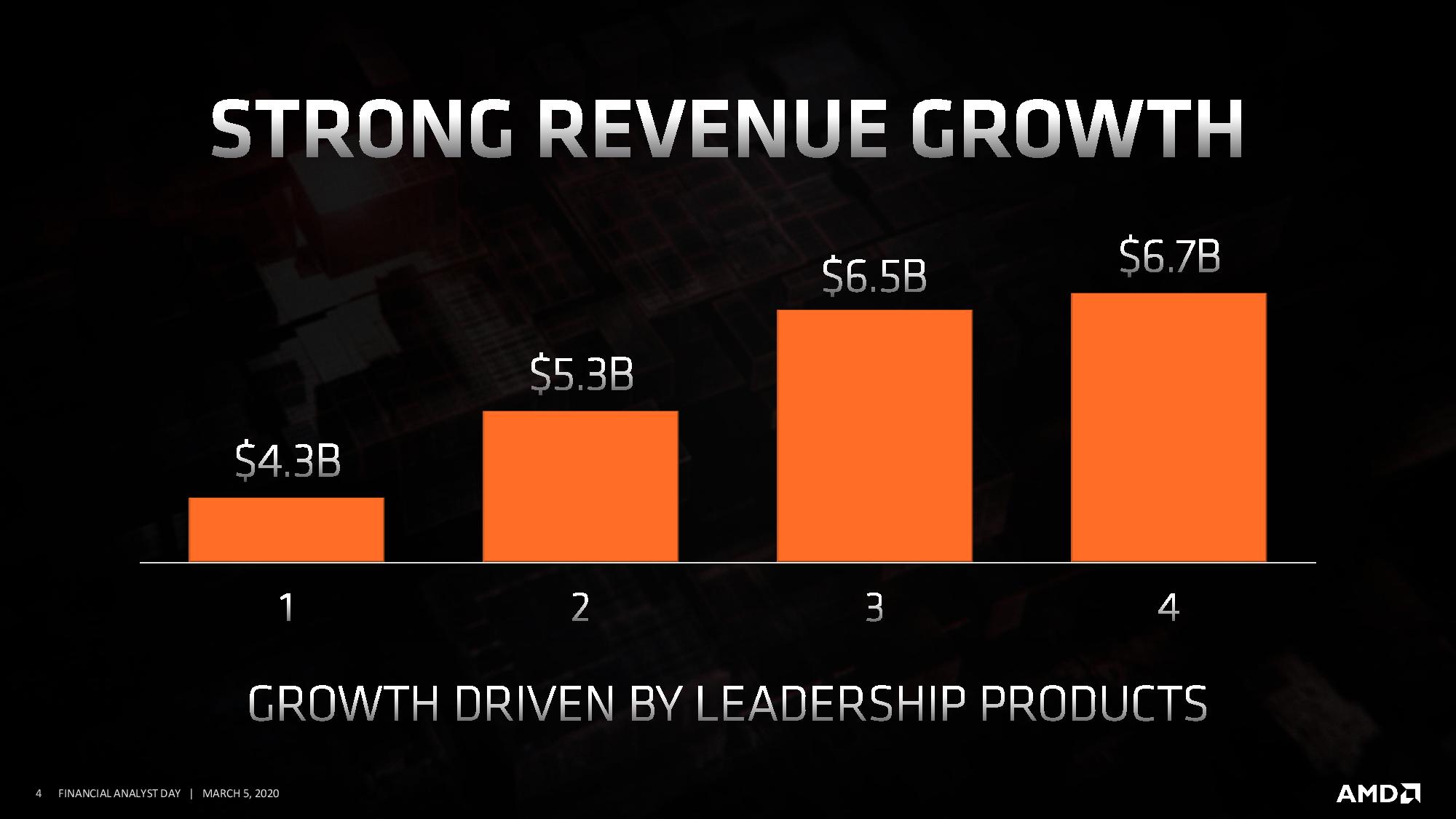

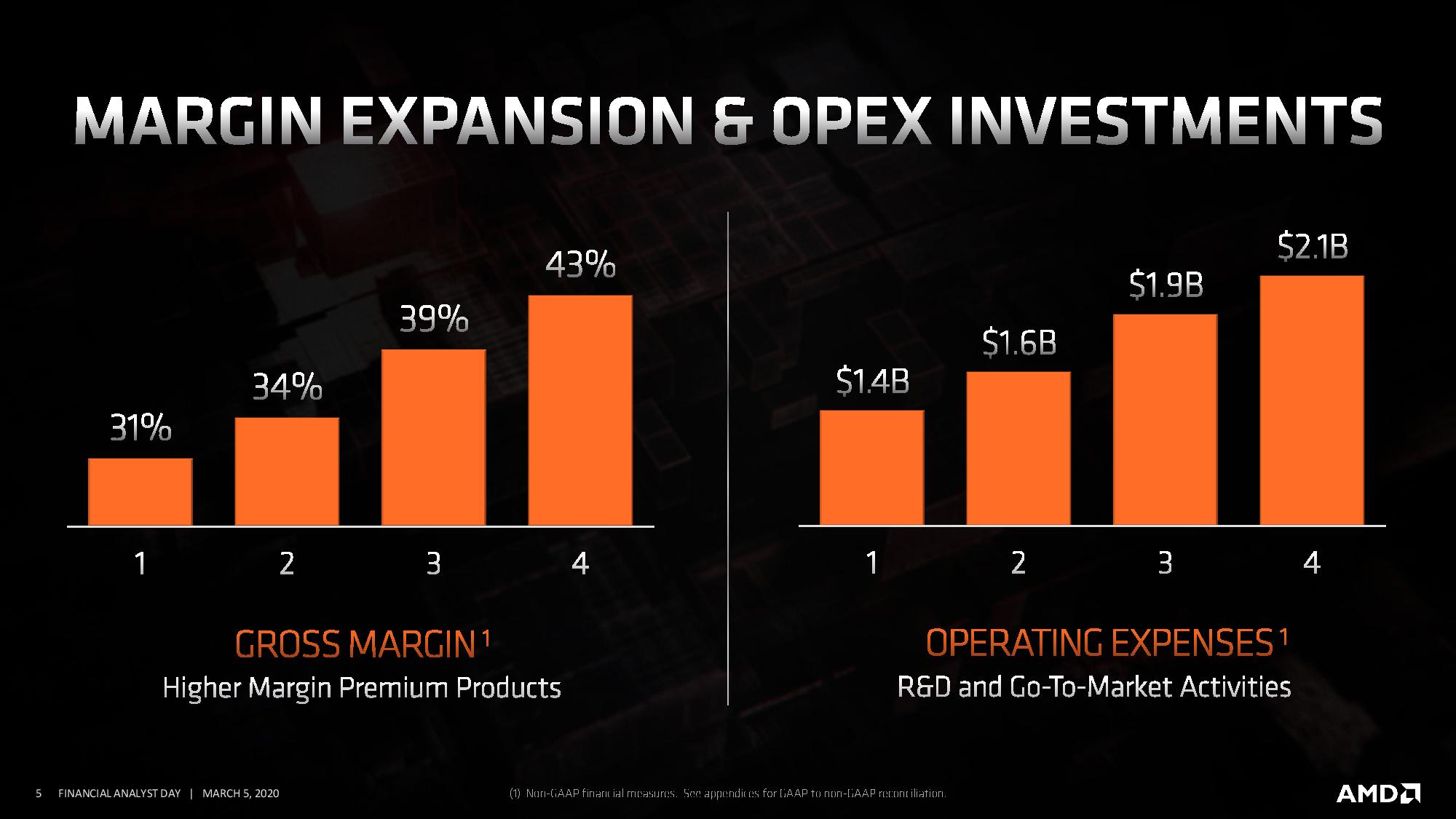

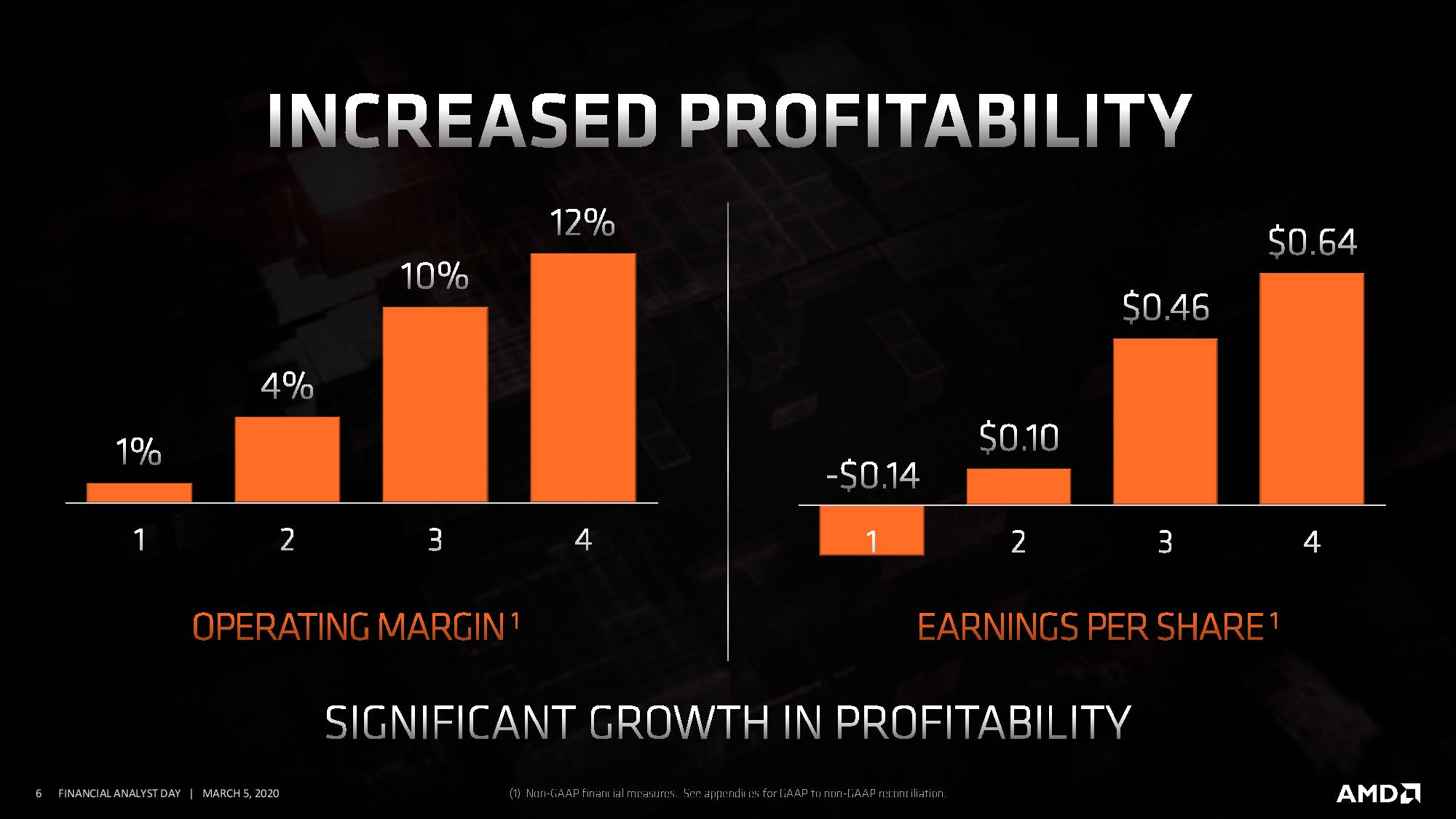

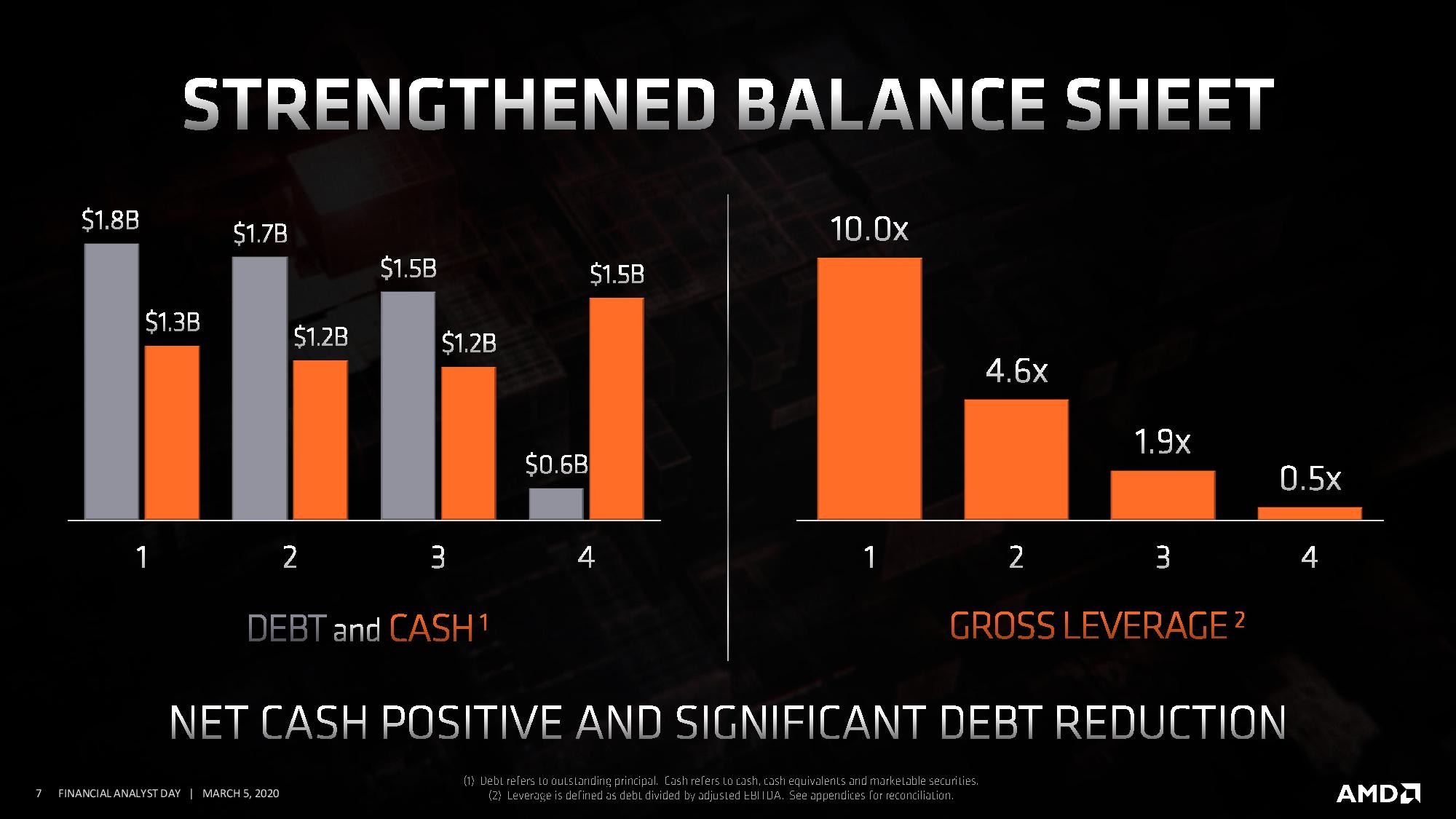

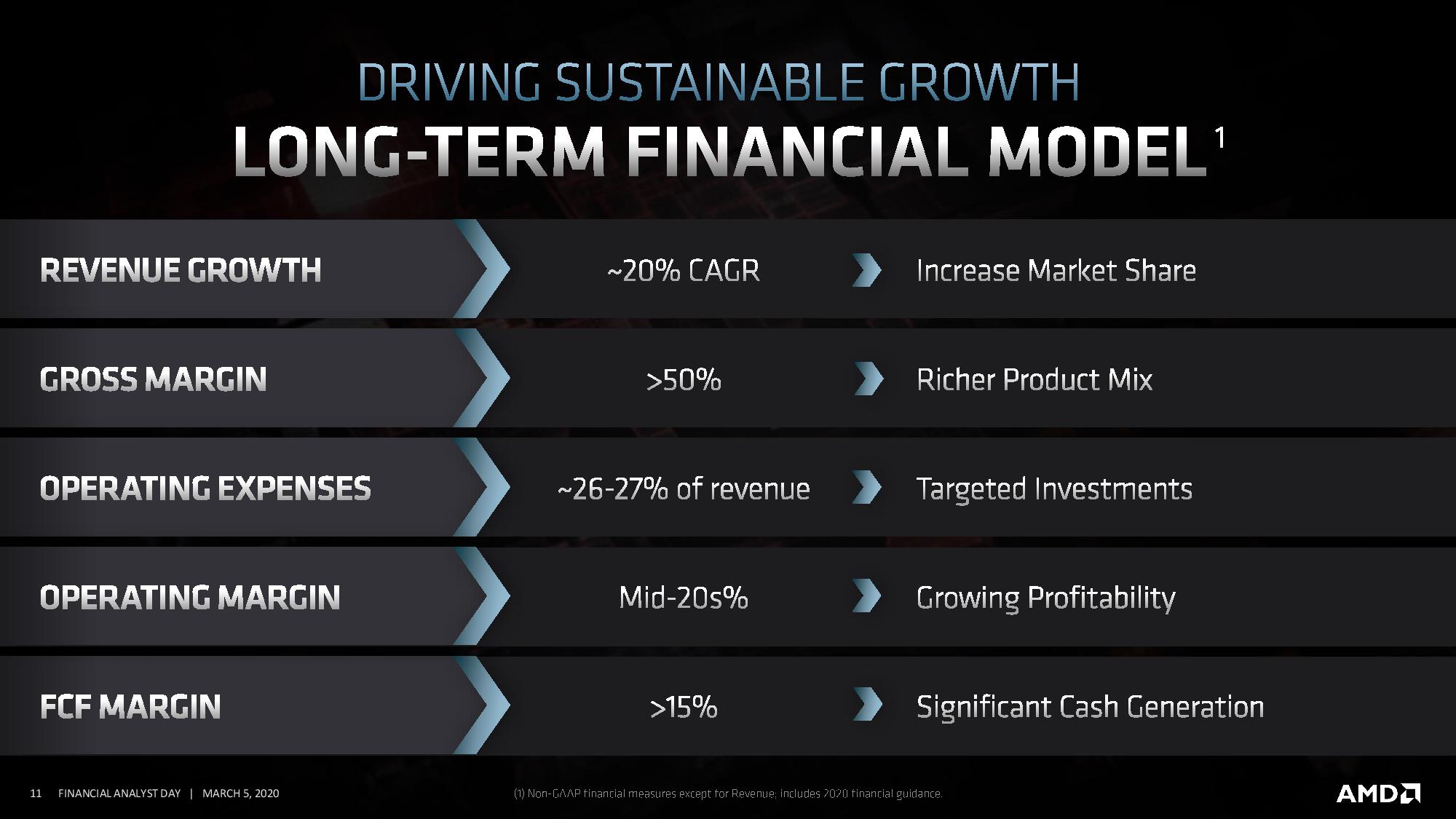

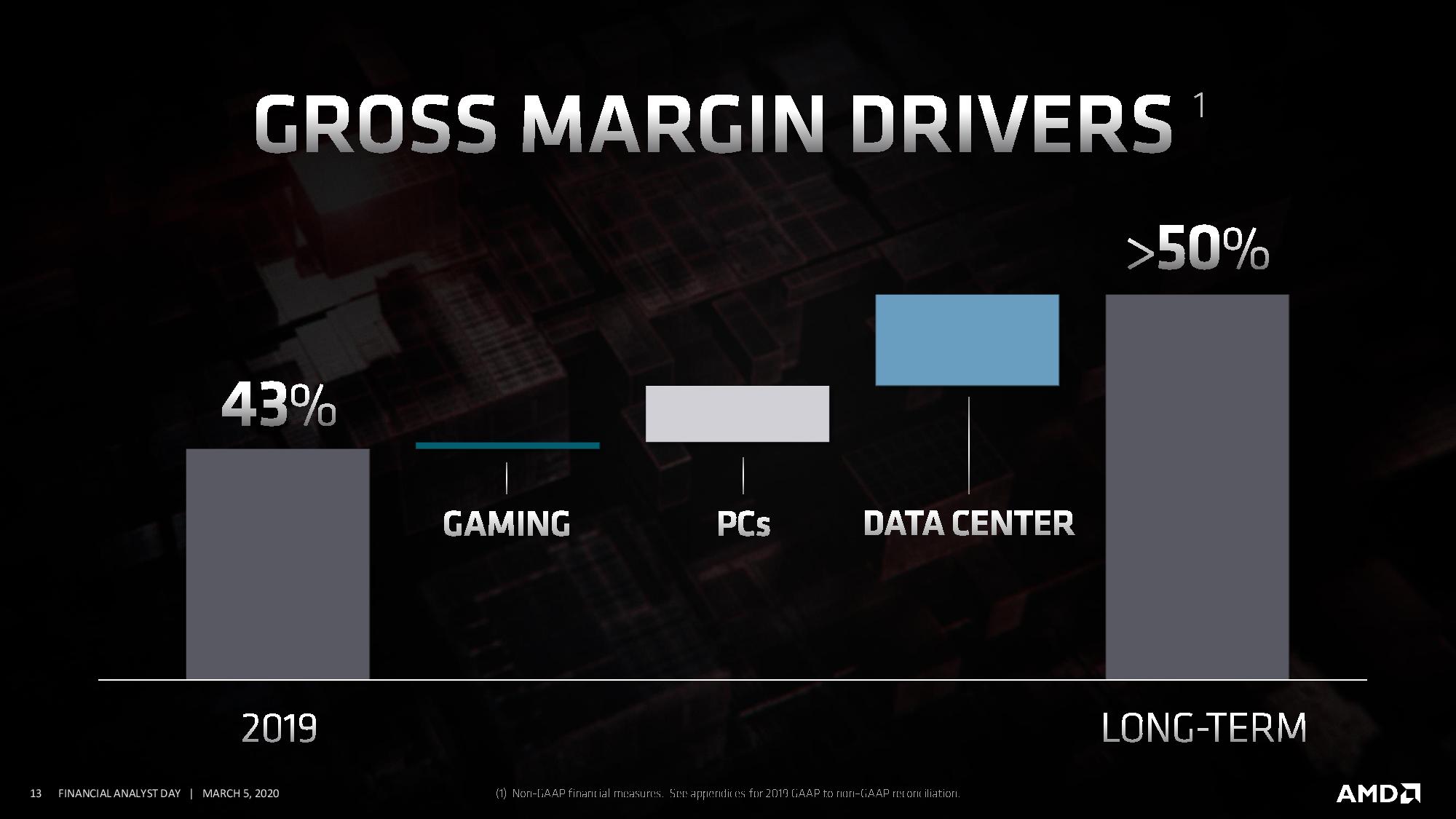

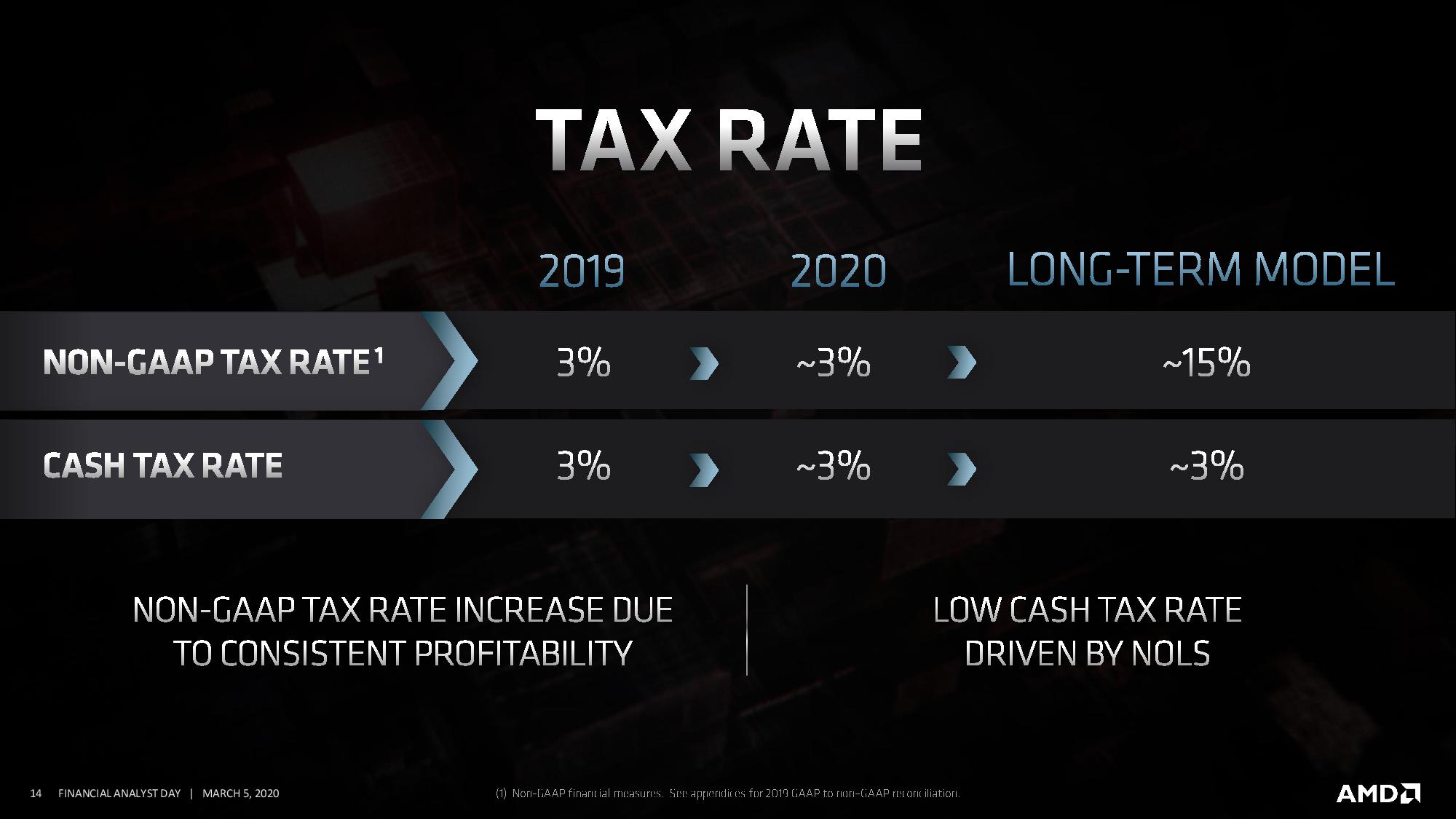

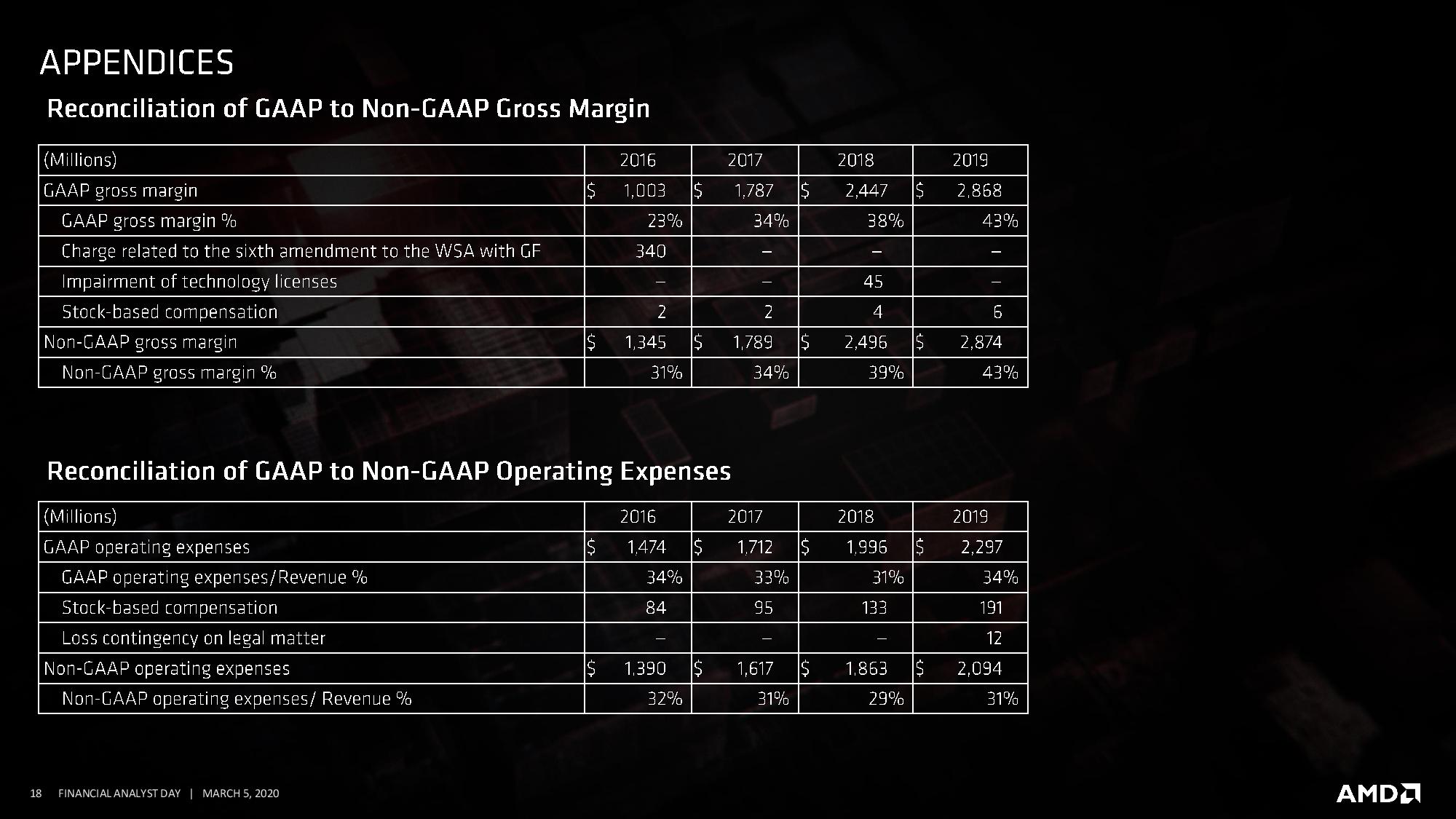

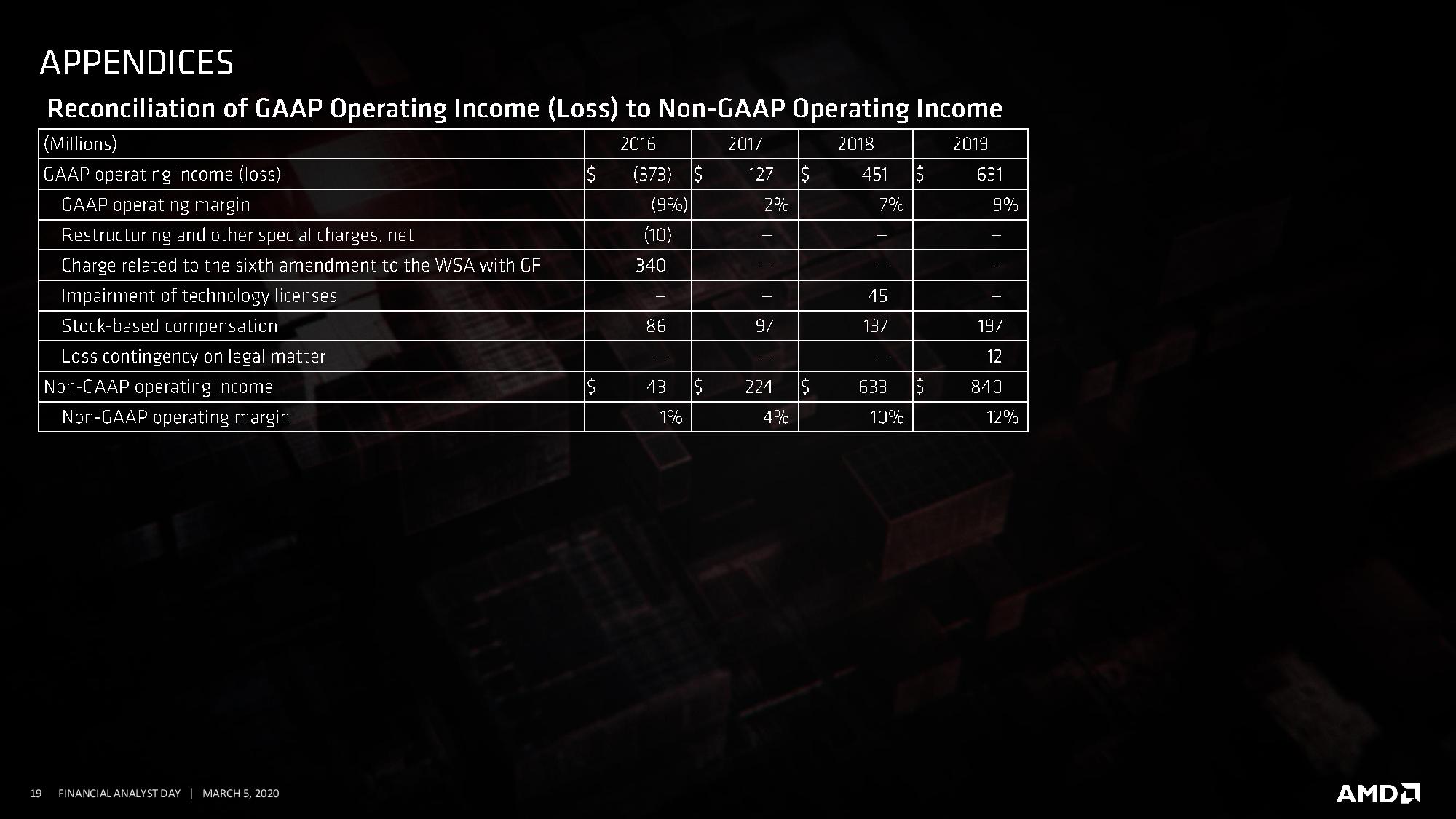

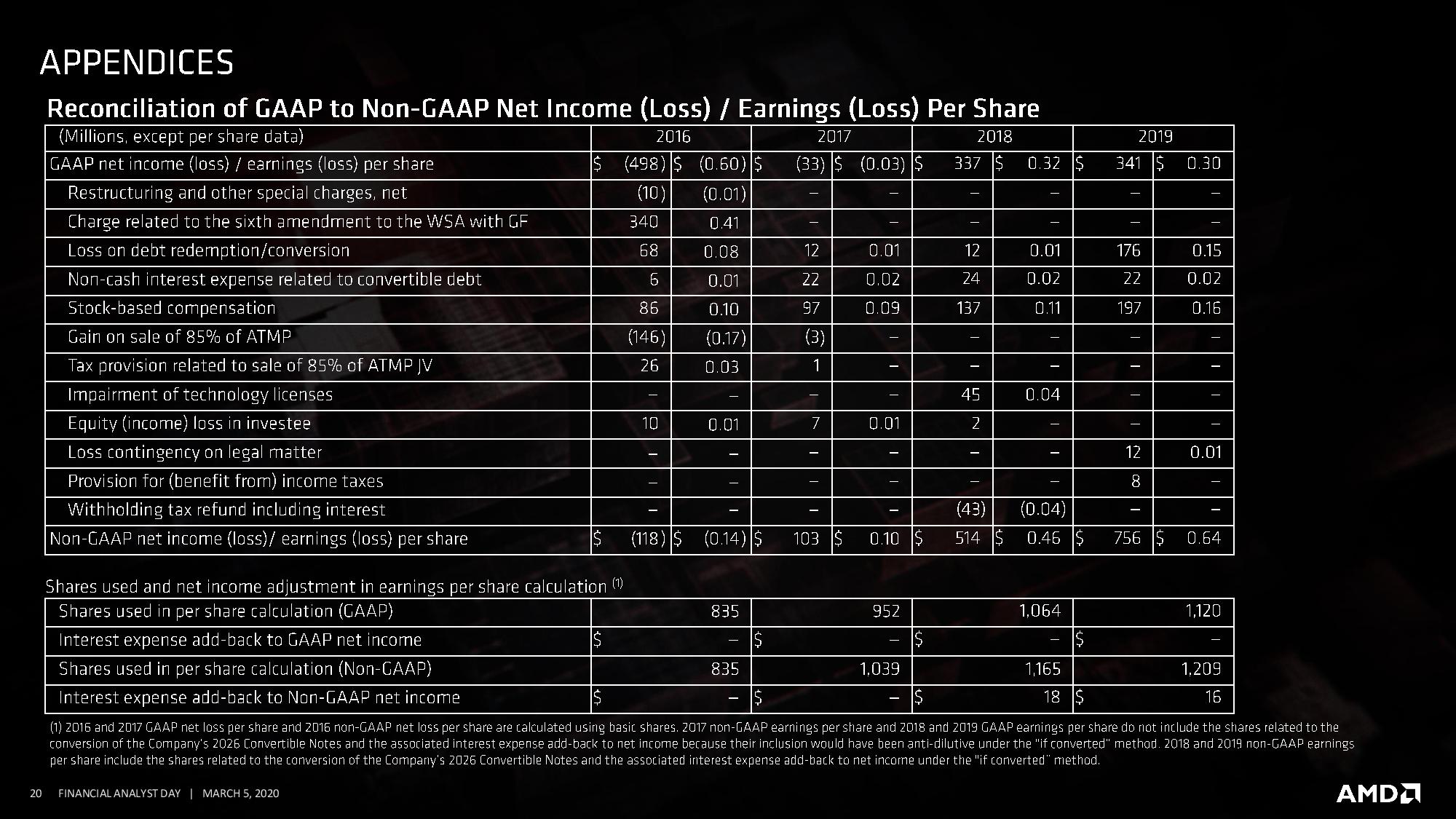

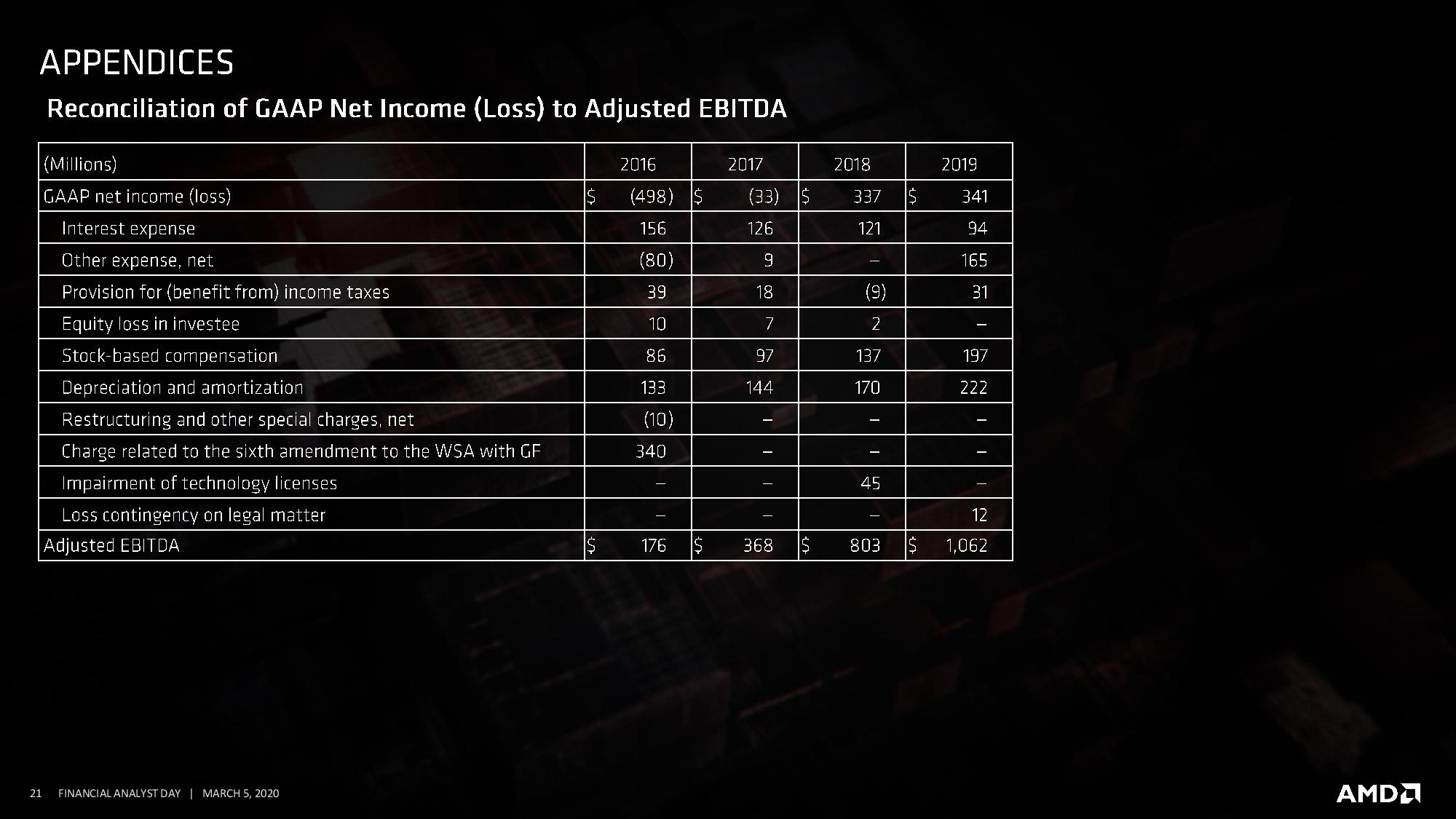

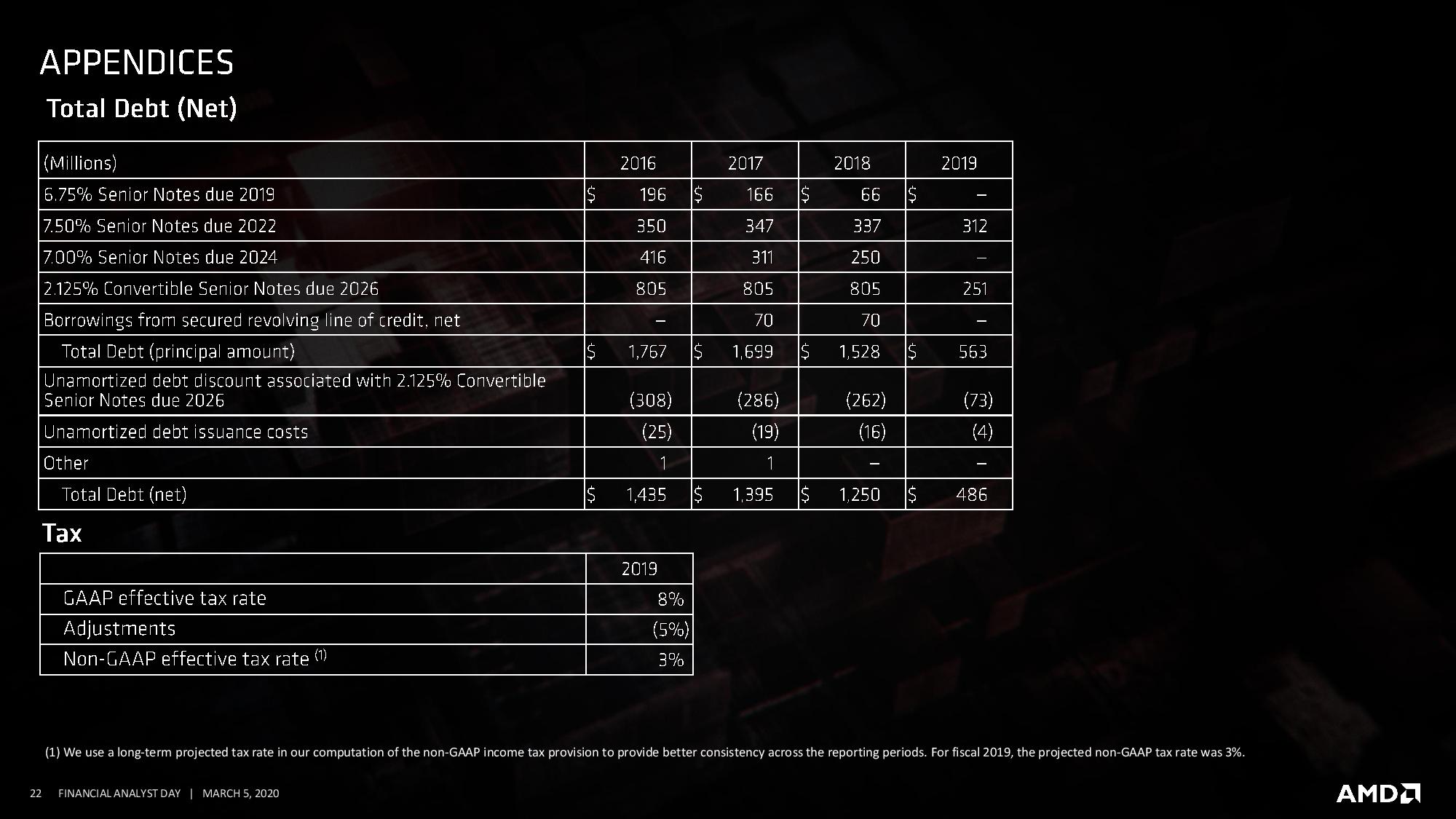

AMD covered its financial results for a period of time, and we've inserted the relevant deck above.

Lisa Su delivered her closing remarks before the question and answer session. Su started the session by covering the impact of the coronavirus on AMD's operations, with a focus on employee safety. Su said the situation is dynamic and AMD's supply chain is primarily in China, Malaysia, and Taiwan. The company has taken actions to ensure continuity and the company is back to near-normal in the supply chain. The company is also monitoring its customers' supply chains.

Su expects the situation to remain fluid, and it will have some impact on demand. The Chinese market has experienced reduced demand, but in some cases demand has increased. AMD will not alter the financial projections from its recent earnings call.

Forrest Norrod responded to a question about why AMD was selected for the GPU portion of the recent supercomputer wins, particularly because those decisions were made based on three year roadmaps of AMD, Intel and Nvidia. Norrod cited that AMD's proven track record of execution, and the strength of the unified approach of CPU+GPU compute via the Infinity Architecture. He also cited the improvements to performance-per-watt and the programming simplicity associated with ROCm.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

hotaru251 Reply$75 billion TAM overall, split up with $35B for the data center, $32B for PCs, and $12B for gaming.

image said 79.

txt said 75.

the math following txt adds up to 79. -

wexir hmm cdna for workstations and rdna for gaming, sounds like amd is finally splitting its gaming gpus and workstation gpus, that might just mean that rdna will be a very good architecture for gaming gpus which i can't wait to see.Reply

now lets hope they finally sort out their drivers boogaloo -

Zizo007 Why are clickbait ads so intrusive now? I can't even see the comments section as ads reappear on top of comments after scrolling. I had to go to forums. It wasn't like that before...Reply -

techy1966 Reply

I use ad blocker on Tom's now days. I never used to but about 2 years ago things got so bad with clickbait ad's and crap popping up every where on the page whenever I came to read stuff here I decided enough was enough and popped on ad blocker.Zizo007 said:Why are clickbait ads so intrusive now? I can't even see the comments section as ads reappear on top of comments after scrolling. I had to go to forums. It wasn't like that before...

I do not mind pages that have ad's but when the ad's out pace everything else on the page out comes the ad blocker.

Sorry Tom's I know you guys need to make money but maybe chat with your parent company that owns the site and have them relax a bit on the over use of the clickbait ad's on the page.