The Week In CPUs And Storage: AMD Rising

Yet another week is in the books, and AMD's earnings call yesterday indicated that the company is doing surprisingly well as it continues its resurgence. AMD shouldn't expect to see the $1.6 billion that Intel owes to it from the 2009 (yeah, that long) EU anti-trust case any time soon, as the EU backed Intel's appeal, leaving one to wonder if Intel will have to pay interest. Speaking of Intel, researchers have found a critical bug in the branch predictor, which is an interesting yet devastating attack vector for malware. We'll hit those topics after this short commercial break.

The week began with Samsung's announcement that it has taken the pole position in the 10nm FinFET race, which purportedly places it ahead of its competitors. Unfortunately, all semiconductor fabs leverage different criteria for their measurements, which morph the actual measurements into an exercise in marketing prowess. In either case, Samsung has claimed to be the first to 10nm FinFET, and it plans to ship in 2017. The company also released an 8GB LPDDR4 package with "10nm-class" (ah, that) process technology, as well.

The University of New South Wales outlined a recent advance that might bring quantum computing to a wider range of devices, as opposed to the current development efforts that leverage liquid nitrogen cooling or lasers. The technique uses a novel electromagnetic noise protection scheme to boost the amount of time the qubits (quantum bits) last before they dephase. The university also recently demonstrated that it could build quantum chips with silicon, which is another important step to bring quantum computing to prime time.

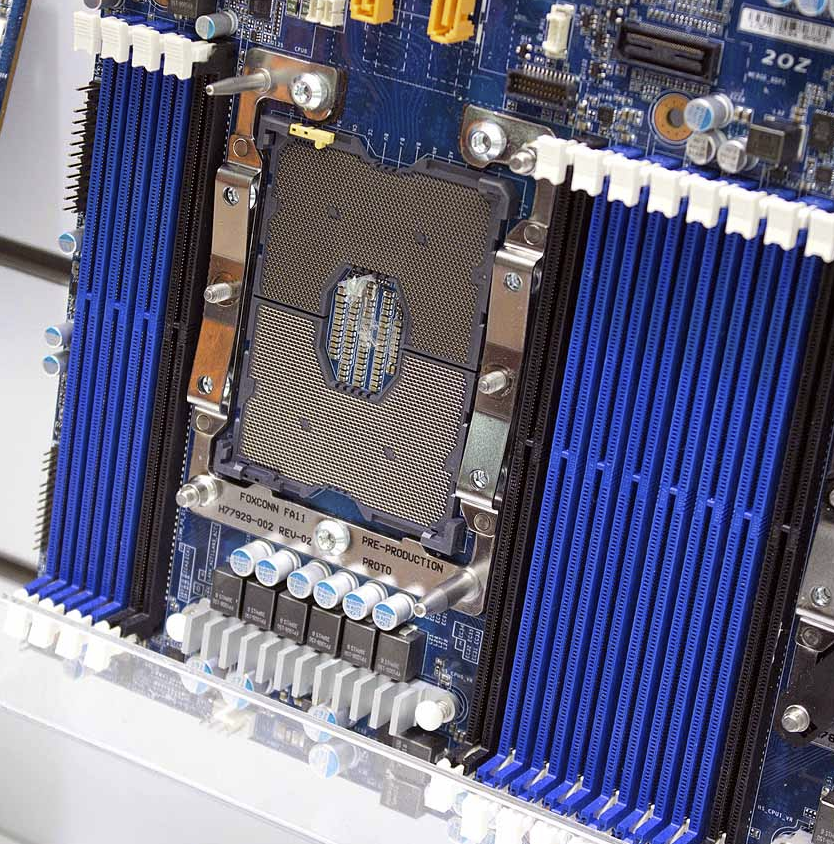

Intel's recent earnings call shed light on some of its plans for its next-generation Purley platform. The company plans to bring 3D XPoint, FPGAs, and Omni-Path into the tightly-integrated Xeon picture. The only problem with Intel's ambitious goals is the industry's almost overwhelming agreement that proprietary interfaces are bad for, well, all of us. Three new industry groups have aligned to battle the evils of proprietary interconnects, but Intel has a head start and already laid the groundwork with its Knights Landing products. The interconnect wars will be interesting to watch as the industry heavyweights battle it out in the data center.

The declining PC market has been a nagging issue for quite some time, but Intel announced it's experiencing revenue growth in the flagging segment, and noted that 3D XPoint samples are "shipping in the thousands," which lends some credence to recent leaks that it's readying it for the desktop. It appears that some 3D XPoint use cases will require platform integration, which means we may need newer rigs to unlock the purportedly life-changing performance. 3D XPoint might be the stimulus to reinvigorate the PC market, as Windows 10 was not.

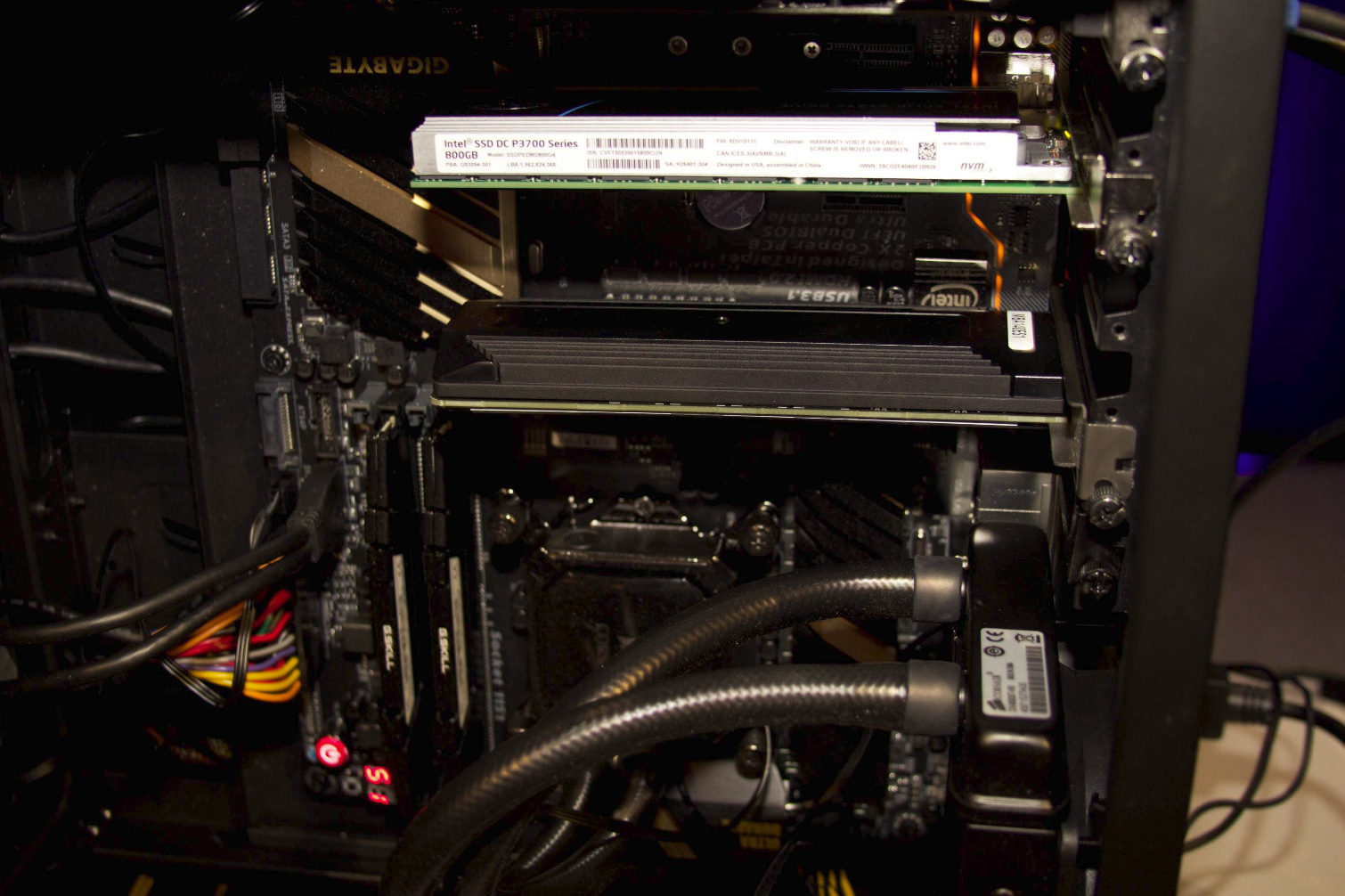

We put Samsung's 960 Pro through the Tom's wringer and found it to be faster than you-know-what, but the price is a steep climb for the average user. Samsung leverages a shedload of new tech in the little fire-breathers, including a PoP controller and, believe it or not, an innovative copper-infused sticker that has amazing heatsink qualities that reduce thermal throttling. Of course, everyone will be happy to see these new techs on the forthcoming 960 EVO, which we might actually be able to afford.

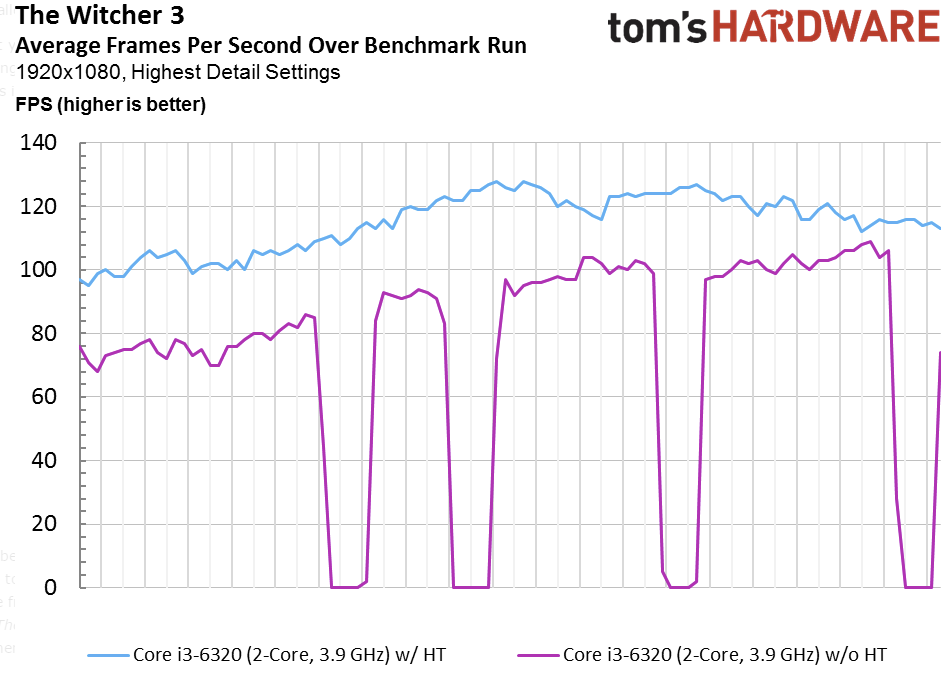

Finally, Chris Angelini put the cap on a busy week with an investigation of DirectX 11 gaming and multi-core scaling to determine if our extra cores equate to increased gaming performance. He's also working on a second part of the series with DirectX 12 games to round out the in-depth testing, so stay tuned.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Let's take a quick look at a few other news tidbits from this week.

AMD On The March

Lisa Su has been AMD's CEO for two years, and during that time she has engineered (she is an engineer, actually) a nimble series of maneuvers that promises to bring the company back into heated competition with its primary rivals (Intel and Nvidia).

AMD indicated during its 3Q2016 earnings call that revenues weighed in at $1.307 billion, which is up 27% quarter-over-quarter and 23% year-over-year. The gains come largely on the back of AMD's GPU and APU sales, along with increased sales into the semi-custom SoC segment. The company weathered an operating loss of $293 million, partially due to the recent wafer supply agreement AMD signed with GlobalFoundries. The agreement provides some measure of stability for AMD over the coming years, and allows the company to skip the 10nm node in favor of 7nm.

AMD's stock picture has been surprisingly rosy this year; it has risen from $2.10 to $6.50 (at the time of publication). Investors are bullish on the company because of several promising strategic developments, particularly AMD's joint Tianjin Haiguang Technology Investment Co. Ltd. (THATIC) venture that allows (via licensing) Chinese firms to build AMD processors.

AMD is also finally penetrating into the lucrative enterprise GPU market, which tends to feature Nvidia GPUs. Alibaba, which is the world’s largest online retailer, recently announced that it selected AMD's Radeon Pro chips for its cloud computing infrastructure, which serves as a major long-term AMD win. The GPU deployment may allow AMD to also make inroads into Alibaba with its forthcoming server platforms, as well. The company is obviously angling to capture more of the AI market; Tesla founder Elon Musk recently stated that it was "a pretty tight call" between Nvidia and AMD GPUs for his company's neural net processing. Tesla ultimately chose Nvidia Titan GPUs, but the close contest indicates AMD is shaping up to be significantly competitive in the segment. AMD also has its Radeon Pro SSG in the hopper, which should help it gain further traction in the professional segment.

Now AMD has its sights set on the $4 billion high-performance desktop market, and Su noted that the company had passed several important milestones with its Zen-powered Summit Ridge processors, which are on track for release early next year (Q1 2017).

AMD noted that it currently has (according to a third party reporting firm) roughly 10% of the desktop PC market, which leaves plenty of room for explosive growth, provided that Zen is as competitive as the company claims. Even if Zen isn't a world-beater, it should help put the company into a more competitive stance in the PC segment, and the other strategic maneuvers are laying a solid foundation for the diversified portfolio. Now all that's left to do is execute.

Researchers Find Critical Flaw In Haswell Processors

Researchers at the State University of New York at Binghamton have identified a flaw in Intel's Haswell processors that allows malware to circumvent the Address Space Layout Randomization (ASLR) by using a side-channel attack on the Branch Target Buffer (BTB).

ASLR typically protects the system from malicious attacks by randomizing the offset of program segments in virtual memory. Randomizing the offset prevents an attacker from learning the locations of code pages in the program's address space, which would allow an exploit to redirect the control flow and assume control of the application. Almost all operating systems for the desktop use ASLR, including Linux, Windows, OS X, and even on iOS and Android.

The scheme attacks the BTB, which stores the history of branch addresses to optimize future branch predictions. As such, it stores the actual addresses that ASLR protects, and the code can ferret out the addresses by creating BTB collisions. The attack ultimately identifies the locations of the kernel and user-level applications so that it can use the data to assume control of the application/system. The researchers used a Linux-based PC with a Haswell processor to test the technique and were able to bypass ASLR in 60 milliseconds.

The attack is likely widely applicable on the hardware side, as many processor architectures operate on similar principles. A wide spate of operating systems use ASLR, which broadens the attack surface. The attack is sophisticated (it isn't something that a script-kiddie could pull off), but the proliferation of state actors on the international stage, particularly for spying purposes and sabotage, could make this sort of attack yet another powerful tool in the hacking toolbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

LordConrad Good to hear that AMD is doing better, competition is a good thing. Are Haswell owners just screwed, or is this something that can be fixed with a firmware or microcode update?Reply -

photonboy I would expect a fix in the near future; some people have already written up a paper on how to fix this issue. This type of thing isn't new either.Reply -

falchard It's too bad AMD didn't name one of their GPU architectures Tesla. I am sure that was a deciding factor in going with nVidia. Both companies can perform exactly the same given this is a platform specific hardware piece where the buyer is developing the platform.Reply -

alextheblue Reply18761416 said:I would expect a fix in the near future; some people have already written up a paper on how to fix this issue. This type of thing isn't new either.

Of course it can be fixed. What I want to know is how the fix might impact performance! -

Mousemonkey I don't get it, how are they doing well?Reply

the company recorded a $293 million operating loss. Also thanks to that charge, AMD says its gross margin fell to 5%, down from 23% a year ago.

http://techreport.com/news/30845/strong-revenue-doesnt-stem-red-ink-in-amd-fiscal-third-quarter -

Mousemonkey Reply18762254 said:No, Mousemonkey, you don't seem to get it, at all.

Then why don't you explain it? How can they be losing money hand over fist and yet be on the rise? -

Paul Alcorn Reply18762282 said:18762254 said:No, Mousemonkey, you don't seem to get it, at all.

Then why don't you explain it? How can they be losing money hand over fist and yet be on the rise?

The majority of their losses were due to charges associated with the restructured GloFlo agreement ($340 million). The reason I consider them to be on the rise are the numerous strategic maneuverings that will have long-term payouts, such as the licencing agreement.

-

Mousemonkey Reply18763237 said:18762282 said:18762254 said:No, Mousemonkey, you don't seem to get it, at all.

Then why don't you explain it? How can they be losing money hand over fist and yet be on the rise?

The majority of their losses were due to charges associated with the restructured GloFlo agreement ($340 million). The reason I consider them to be on the rise are the numerous strategic maneuverings that will have long-term payouts, such as the licencing agreement.

Thank you for the concise explanation.