AMD Confirms Ryzen And Vega Launch Schedule, Developing 7nm Zen Products

Lisa Su, AMD CEO, announced during the company's Q4 earning call that Ryzen CPUs would debut in early March, while Vega GPUs will come to market in Q2. AMD has a busy 2017 launch schedule that also includes Naples server chips in Q2 and the Zen core-based Raven Ridge APUs in the second half of the year.

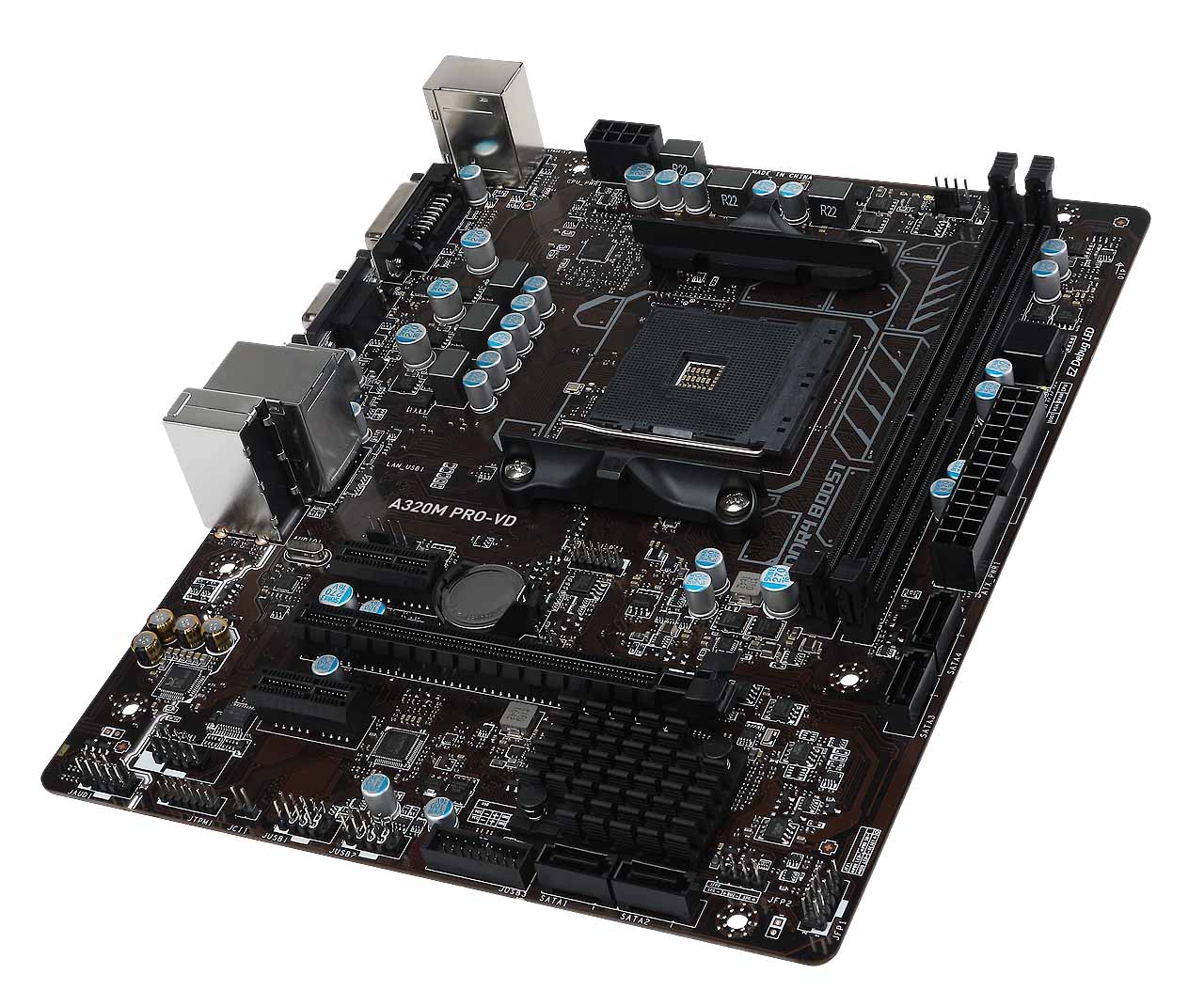

Su said the company would initially offer its leading Ryzen products in conjunction with a wide range of system integrators, and a staged OEM launch will commence shortly thereafter. We've already seen a growing range of motherboards and systems during CES 2016 along with a rash of AM4-compatibility announcements from various cooling solutions vendors, so it's clear AMD has worked feverishly to enable the Ryzen ecosystem.

AMD's messaging during its New Horizon event made it clear that it plans to assault the i5 and i7 space with its leading products, but the company also has plans to address the entire desktop spectrum with future Ryzen processors. Su noted that the combination of high-end Ryzen CPUs and Vega GPUs would allow the company to quickly grab share in the high-performance segment, in which it has notably suffered for several years, and the forthcoming lower-end SKUs will presumably fill out the high-volume mainstream portfolio.

Ryzen's launch denotes AMD's jump from 28nm/32nm to its new 14nm process. Due to fuzzy marketing math, we can't be sure how AMD's 14nm process compares to Intel's, but Su also noted that AMD is also moving forward with next-generation 7nm Zen products. Su referred to the next-generation products as "Zen 2" and "Zen 3." The company previously announced that it would provide a Zen+ variant as the successor to the original Zen core, but hasn't specified what lithography it will use for the "+" products. It's possible that Zen+ will be a tock-equivalent, while Zen 2 and 3 represent future shrinks. Meanwhile, Intel soldiers on with its commitment to its 10nm platform, so we may see its 10nm process slug it out with 7nm AMD products in the future.

AMD's move to 7nm isn't entirely surprising; the company recently signed a long-term Wafer Supply Agreement (WSA) with GlobalFoundries. The five-year agreement came on the heels of a GlobalFoundries announcement that it plans to skip the 10nm node, which it considers a half-node, in favor of moving directly to its 7nm process. AMD hopes the long-term roadmap to more efficient nodes will assuage the skittish enterprise customers that "invest in the roadmap" just as much as in the leading products.

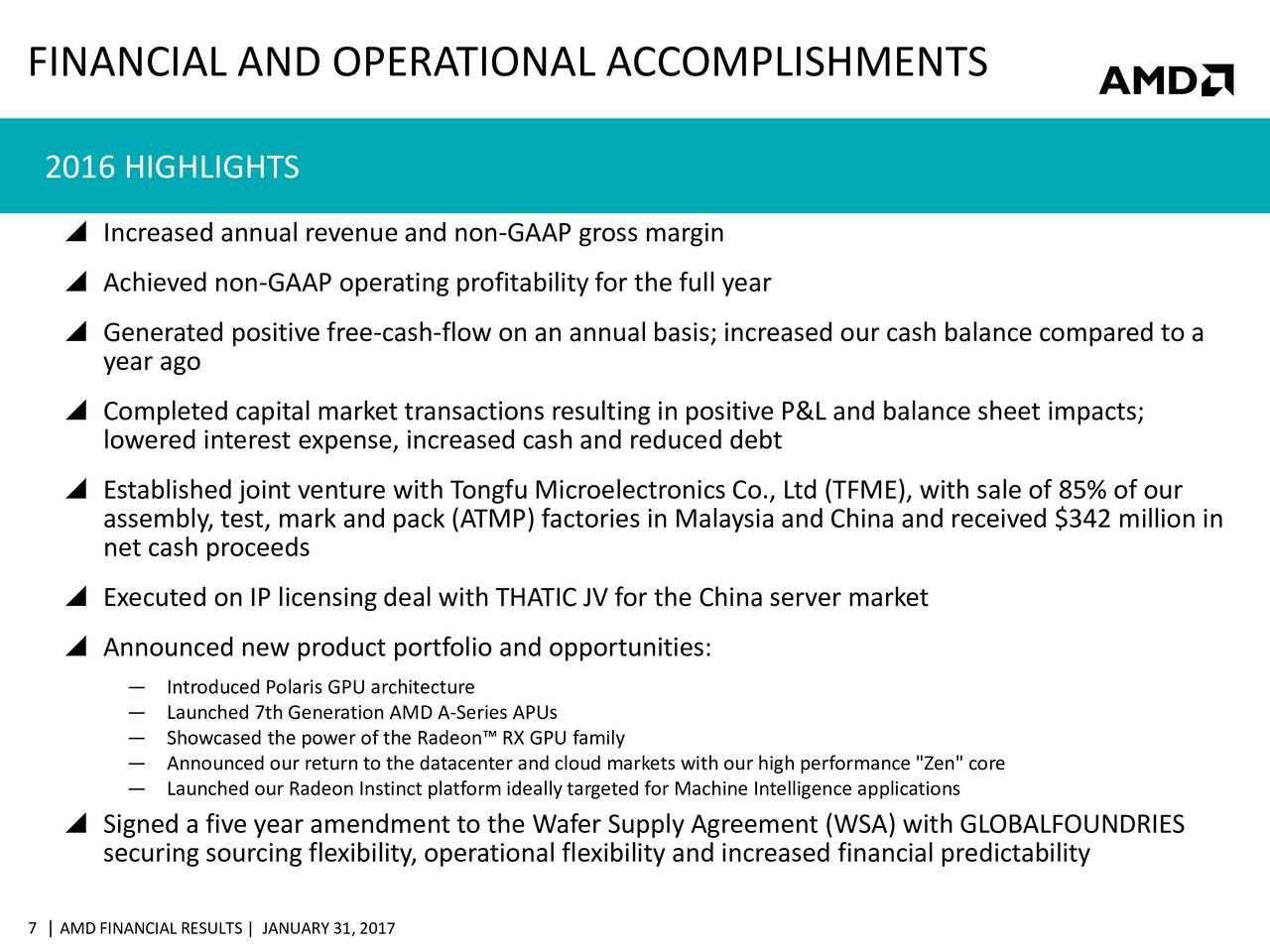

AMD is also doing well on the financial front. The company spent the last two years rebuilding the pillars of its business, which includes its technical, operational, and financial initiatives, through several strategic maneuvers. The long-term GlobalFoundries WSA immediately jumps to mind as a key enabler, but AMDs joint venture with Chinese state-backed companies also has investors crooning. AMD's stock jumped over 300% last year following its announcement that it is sharing CPU (including Zen) and SoC technology through its The Tianjin Haiguang Technology Investment Co. Ltd. (THATIC) venture.

AMD scored $4.27 billion in revenue during 2016, a 7% year-over-year improvement, and reduced its operating losses from $419 million in 2015 to $117 million. During Q4, AMD's net loss totaled only $51 million, which highlights its near-return to profitability. AMD also has $1.26 billion in cash and cash equivalents, which provides much-needed breathing room.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

All told, the company has done a solid job of repairing its financial and operational foundation before Ryzen makes its appearance, but the proof is always in the silicon. Much of AMD's near-term success will lay in the success of its Ryzen CPUs, which leaves us waiting until March for the verdict.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

3ogdy So where is that confirmed launch schedule? We knew it was coming in March. The only thing new to me in this article is this section:Reply

"Su referred to the next-generation products as "Zen 2" and "Zen 3." The company previously announced that it would provide a Zen+ variant as the successor to the original Zen core, but hasn't specified what lithography it will use for the "+" products. It's possible that Zen+ will be a tock-equivalent, while Zen 2 and 3 represent future shrinks. "

That is the entire article, the rest is just another Young & Restless episode - reiterating what we already knew over and over again. Is Tom's paying the writers per-article? How about getting paid for the actual content of the article, the substance? -

spdragoo "Lisa Su, AMD CEO, announced during the company's Q4 earning call that Ryzen CPUs would debut in early March, while Vega GPUs will come to market in Q2. AMD has a busy 2017 launch schedule that also includes Naples server chips in Q2 and the Zen core-based Raven Ridge APUs in the second half of the year."Reply

Very first sentence in the article. Can't get much clearer to read or easier to find than that...& if you were expecting a "hour X on day Y" announcement, that's your problem. -

WFang I had been hoping that the speculations that came from the wording of that Gamescon slide was true... But I guess with a debut in 'early March', it was not to be (unless they are pulling a quick one on us, but that seems dangerous to do in an investor meeting). Anyway, the rumor that it would be on the market immediately prior to, or during the February gamescon event is now dead, and I get to wait another week or two.Reply

It also seems like they have walked back the statements from last year where they said to launch to enthusiasts first.. now apparently it will first be available to integrators, then oem's. I'm assuming 'integrators' mean e.g. Dell, Alien, etc. and OEM is 'anyone and us'?? -

problematiq Bit of a play on words, when I read the title I read it as "AMD Confirms Ryzen And Vega Release date." But alas it's "Launch Schedule."Reply -

InvalidError Intel's 10nm products are supposed to ship this year. If AMD competes against that on 7nm, that won't be before Intel has had a roughly year-long head-start.Reply

In any case, what I'm most curious to know about Ryzen is pricing: if prices fail to provide a significant improvement in bang-per-buck, then most people will have little reason to consider AMD over Intel. Performance from six years ago (i7-2600) shouldn't still cost $250+ today. Especially in a physically IGP-less form as is supposed to be the case with the first wave of Ryzen parts. -

TJ Hooker Reply

Don't be silly, clearly no one was expecting a release hour. Hoping for a release day however is not unreasonable. We got a scheduled release date for Polaris about a month out, IIRC.19239574 said:Very first sentence in the article. Can't get much clearer to read or easier to find than that...& if you were expecting a "hour X on day Y" announcement, that's your problem. -

bentonsl_2010 I have liked intel cpu for a long time now but I hope to god AMD punches intel in the junk with this launch. I'm so sick of the BS pricing intel is getting away with nowadays with the crap performance improvements.Reply -

InvalidError Reply

Don't set yourself up for disappointment: Intel's performance per core is stagnating because there are practical limits to how much instruction-level parallelism can be extracted from software regardless of instruction set or hardware architecture. The only reason AMD could make such a large leap forward is because AMD was that far behind. Now that AMD caught up, don't expect AMD to make another similar leap forward again.19239756 said:I'm so sick of the BS pricing intel is getting away with nowadays with the crap performance improvements.

The only way performance will go up by a significant margin again is by writing well optimized multi-threaded software to leverage extra cores and threads in future CPUs.

-

shrapnel_indie Perhaps it was a poor choice of words, or perhaps it was words specifically designed to get us to examine and read the article. I had to go back and re-read it to catch the generalized release schedule. I missed it for all the extra information that came after it, especially when looking for a hard date and/or parts lineup with MSRPs.Reply