Ethereum Miners Spent $15 Billion on GPUs Alone During Latest Cryptocraze

That doesn't include mining rigs, either

While GPU makers are reluctant to talk about sales to miners, analysts from Bitpro Consulting estimate that Ethereum miners purchased $15 billion worth of GPUs over the last 1.5 years, Bloomberg reports. When combined with the prices of other parts for their mining rig (CPUs, PSUs, chassis), the amount of money spent on Ethereum mining hardware globally would look even more impressive. Miners might have consumed about 10% of discrete GPU supply in the last 1.5 years.

When Ethereum pricing rose steeply in October-November 2020, millions of people started mining Ethereum coins to make some easy money. They used graphics cards bought at retail, and their purchases coincided with skyrocketing demand from gamers as both AMD and Nvidia released very competitive Radeon RX 6000 and GeForce RTX 30-series cards in late 2020. Those GPUs are still the best graphics cards around.

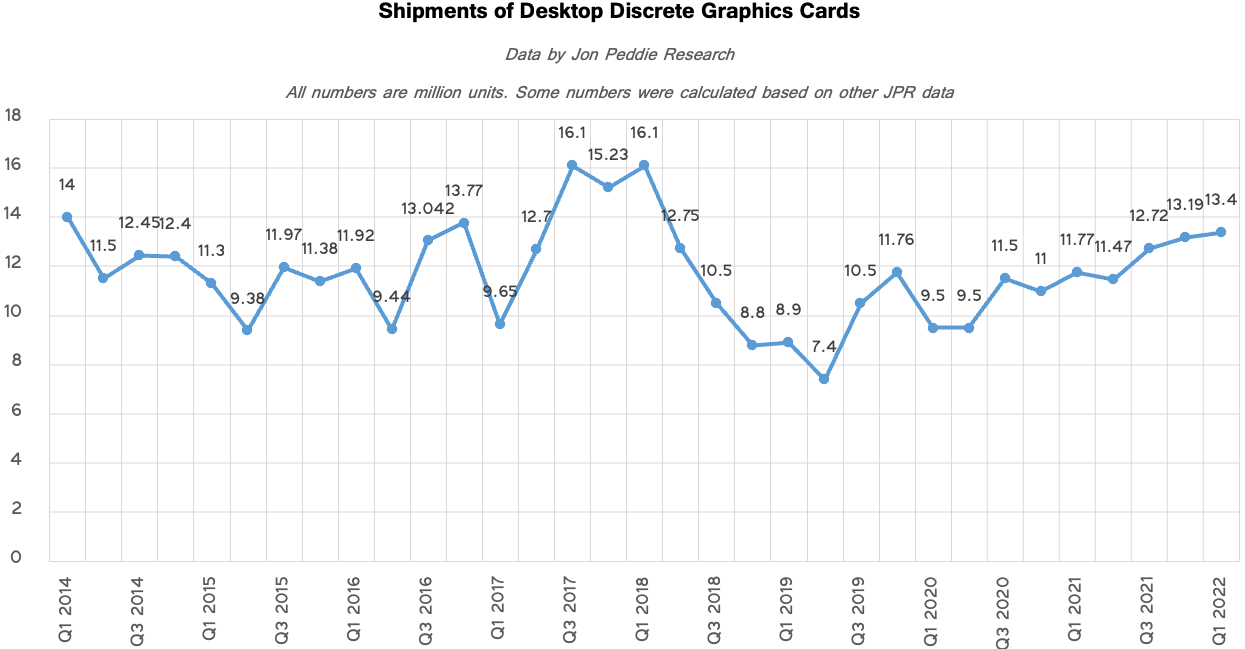

Demand from both gamers and miners exceeded supply, so prices shot through the roof. This is why the average selling prices of GPUs, which were already high in late 2020 due to the rise of PC gaming during the COVID-19 pandemic, increased to unprecedented levels. In Q1 2021, a high-end graphics card (which carries an MSRP of $649 or above) cost $1,358 on average, whereas the average selling price for a lower-tier GPU was $1,062, according to Jon Peddie Research.

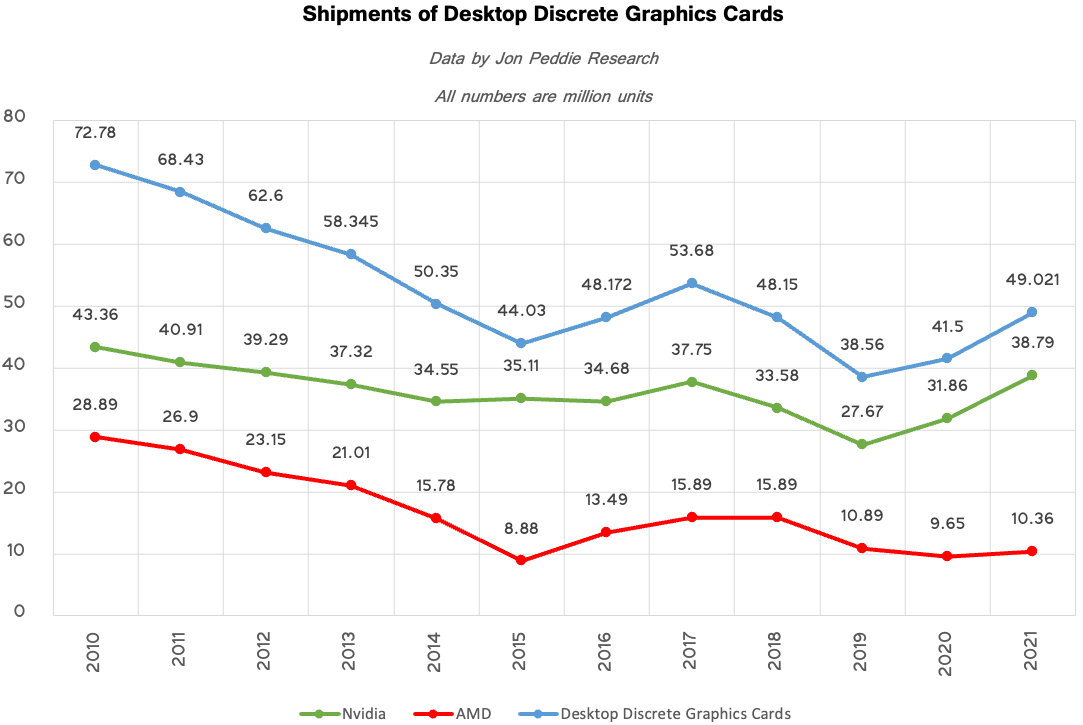

Based on data from JPR, desktop GPU sales totaled $51.8 billion for all of 2021. That was spread across the 49.021 million GPUs sold — a four-year high. As far as average pricing is concerned, we're talking about $1,056 per unit in 2021, which is about two times higher than the average price for a high-end graphics card in Q3 2019, so the inflation is obvious.

Now that we know the approximate average pricing for a graphics card in 2021 and the amount of money miners spent on GPUs, we can estimate that Ethereum miners consumed roughly 14.2 GPUs from the fourth quarter of 2020 to the end of the first quarter of 2022. The number is not completely accurate, though, as some miners used special-purpose mining cards (not counted by JPR), whereas others used gaming notebooks to mine. As such, the actual number of GPUs that went to mining farms could be different.

Nonetheless, 14.2 million is significant given that we're talking about six quarters when Ethereum mining thrived. In fact, from Q4 2020 through Q1 2022, about 73.55 million desktop discrete GPUs shipped. Keeping in mind that nowadays the market of standalone GPUs splits roughly 50:50 between desktops and laptops, it looks like Ethereum might have consumed about 10% of the whole discrete GPU output from Q4 2020 to the end of Q1 2022.

However, it's even harder to quantify how many GPUs were used for both gaming and mining.

Ethereum value has dropped by 70% this year, so it is unlikely that anyone will buy a stable of new graphics cards for mining Ethereum. People who bought their cards and rigs early enough probably earned some hefty profits on them when Ethereum was at its peak. But those who began mining last year are months, if not years, away from recoupling their investments. Bloomberg's story also includes a report about a man who invested $30,000 in cryptomining hardware in mid-2021 and has only earned about $5,000 worth of crypto so far. We're sure plenty of other miners have found themselves in the same position.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

InvalidError 49M GPUs for 51G$ averaging over $1000 per GPU and analysts estimate only 10% of those went to crypto-miners? It seems infinitely suspicious to me that there are enough enthusiasts in existence to soak up that many overpriced GPUs when enthusiasts make up less than 10% of the PC market and 1.5 years is only about 130M PCs.Reply

I would expect the share of GPUs going to crypto to be much higher once all of the different paths from manufacturers to farms are accounted for. -

10tacle These miners cost we gamers either a LOT of money trying to get overpriced almost non-existent GPUs (like me paying $1399 for an RTX 3080 Ti on a lottery shuffle win to purchase on NewEgg), or they forced people to hold out on their old GPU longer praying it doesn't die on them. I only have three words for the cryptocurrency miners and users:Reply

Heh, hehehe, hehehehe... -

digitalgriffin Reply

I find it very hard to believe only 10% went to crypto. The pricing data does not support this. Historic trends in a non-mining market shows that after initial demand, prices fall off ~6 months after introduction. A 10% shortage would have met market demand of normal users by month 7/8. While in fact prices were only heading to doubling suggesting not a 10% normal buyer shortage but a SEVERE shortage.Admin said:Tens of billions of dollars were spent on GPUs for Ethereum mining and the other gear, according to a new report.

Ethereum Miners Spent $15 Billion on GPUs Alone During Latest Cryptocraze : Read more -

huntelaar187 Wouldnt this imply the total market for GPUs was $100bn last year? That doesn't make sense...Reply -

MrStillwater I agree the figures in the article don't seem to stack up at all. $15b is a lot higher than the figures previously indicated from Nvidia in their earnings calls (around $450m if I remember correctly?) and due to the fact supply to regular buyers was virtually zero for months on end I don't believe only 10% went to cryptominers. More like 90% went to them and 10% made it's way to the wider market.Reply -

edzieba Don't forget the GPU market is, in roughly descending order of units sold:Reply

OEMs adding GPUs to pre-builds, both desktop and laptop (highest volume, but usually lowest margin)

HPC (highest margins, but also high volumes)

Enthusiasts (also high margins, but only due to skew towards higher end SKUs)

Miners

The first two are the ones who will be able to swing guaranteed-quantity-guaranteed-delivery contracts (with penalties for failure to deliver) with GPU suppliers, so in a supply constrained market they will be getting their orders filled in preference to enthusiasts and miners. -

watzupken The numbers may be right but clearly skewed. The reason is because Nvidia also sells low end cards like GT 730, GTX 1050, GTX 1650, MX350, MX450, etc, which miners are not interested. The mid and high end cards mostly ended up with miners, but the numbers will pale in comparison to these low end GPU sale. Chances is that if we ask for split of miner vs gamer sales for mid end cards or higher, I feel it’s more like 90% gone to miners. That explains why cards were super duper rare when cryptocurrency is booming, and now, we see so many cards at MSRP or lower when crypto crashed. I doubt Nvidia and AMD actually ramped up supply knowing that they will be announcing next gen GPUs later this year. So the only explanation is that demand plunged.Reply