Gaming and Home Working Drive Demand for PCs and Graphics Cards

PC Gaming and WFH drive record demand for graphics AIBs.

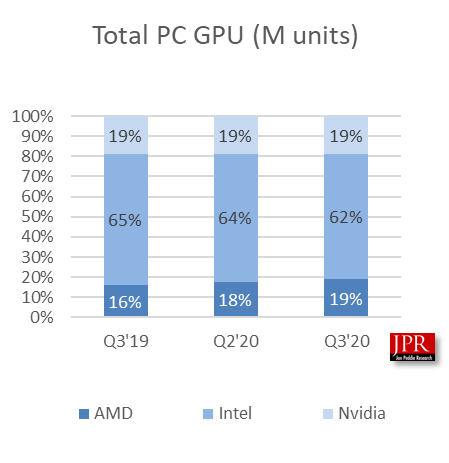

When sales of personal computers are on the rise, shipments of graphics processing units (GPUs) — either in integrated or discrete forms — are automatically increasing. Shipments of all GPUs for client PCs rose by 10.3% sequentially in Q3 2020 with all three players posting sales increases, according to Jon Peddie Research (JPR). Intel continues to lead the pack, but AMD is gaining ground. Meanwhile, sales of discrete graphics cards are more robust than in 2019.

PC & GPU Sales Soar

Sales of PCs increased significantly this year as many people had to outfit their home offices or buy additional PCs for learning. Global PC sales totaled 71.4 million units in the third quarter of 2020, up 3.6% from the third quarter of 2019 and a 10.13% increase over the second quarter of 2020, according to Gartner. All of these PCs featured an integrated or a discrete graphics processor (or both) from AMD, Intel, or Nvidia.

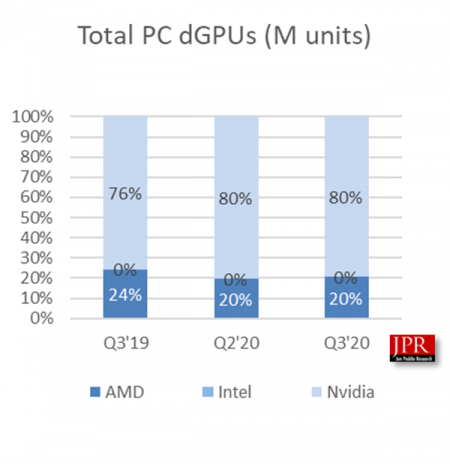

Since GPUs integrated into CPUs dominate the PC market and Intel is the world's No.1 microprocessor supplier, it is not surprising that it also controlled 62% of GPU shipments in Q3 2020. Meanwhile, shares of AMD and Nvidia were around 19%.

Market dynamics favored AMD in the third quarter, which can probably be attributed to the success of AMD's Ryzen 4000-series 'Renoir' processors with built-in Radeon GPUs that were formally launched early in 2020 and which are now widely available in dozens of notebook and compact desktop designs. AMD's market share increased by 1.3% sequentially in Q3, Intel's share dropped by 1.4%, whereas Nvidia posted a 0.09% uptick.

Since Q3 tends to be the strongest quarter of the year in terms of component sales as PC makers are getting ready for back-to-school (BTS) and holiday seasons, all three GPU suppliers increased their unit shipments. AMD's GPU unit sales increased by 18.7% sequentially, Nvidia's shipments rose by 10.8%, whereas Intel boosted its unit sales by 7.8%.

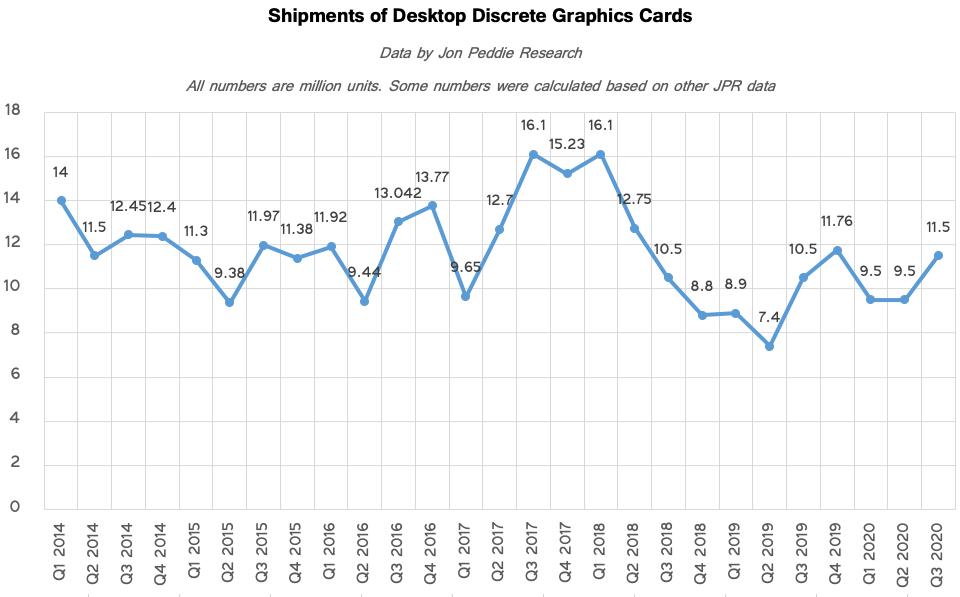

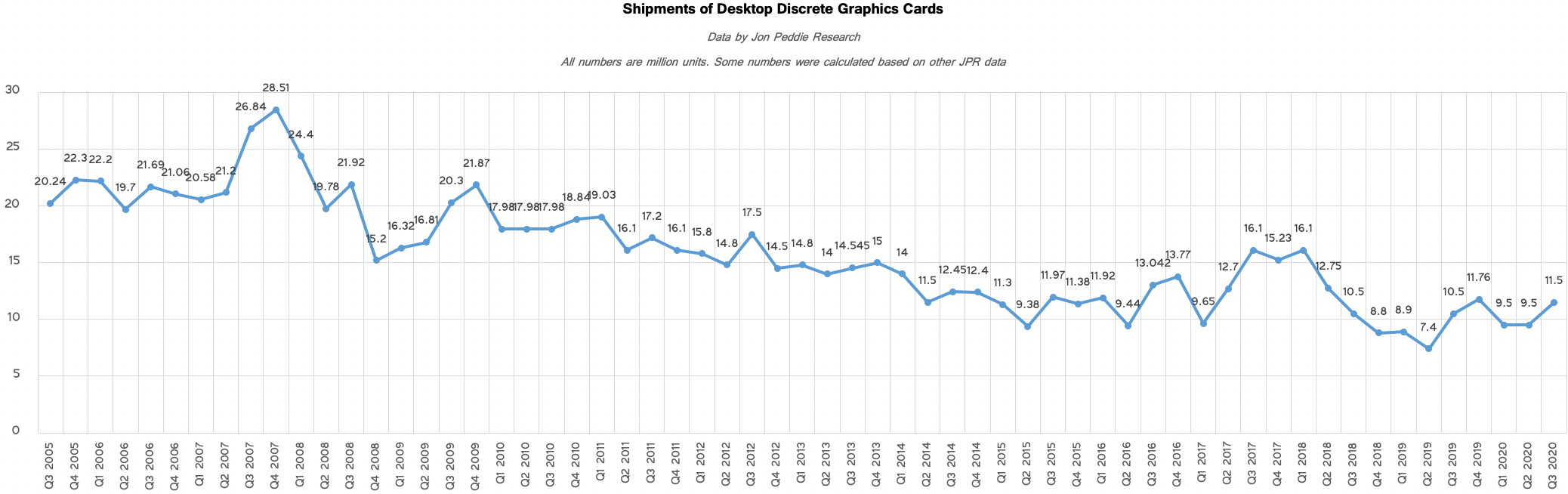

Sales of Desktop Graphics Cards High, But Not Record

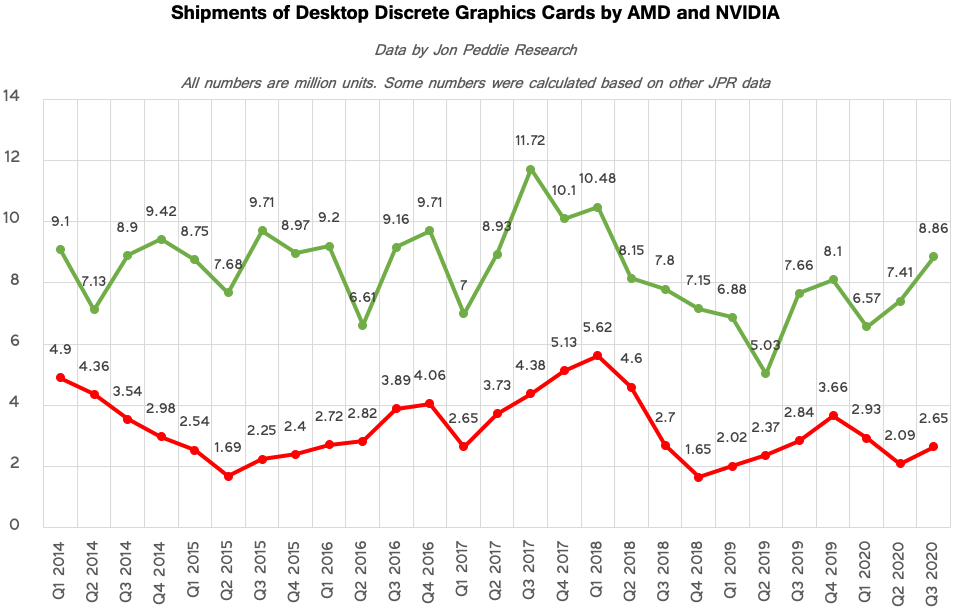

Surprisingly, shipments of discrete desktop GPUs in the third quarter were quite strong ahead of two major launches by AMD and Nvidia. Jon Peddie Research reports that 11.5 million add-in-boards (AIBs) worth $4.2 billion were shipped in Q3 2020. Based on these findings, the average selling price (ASP) of a graphics board was $365 in the third quarter.

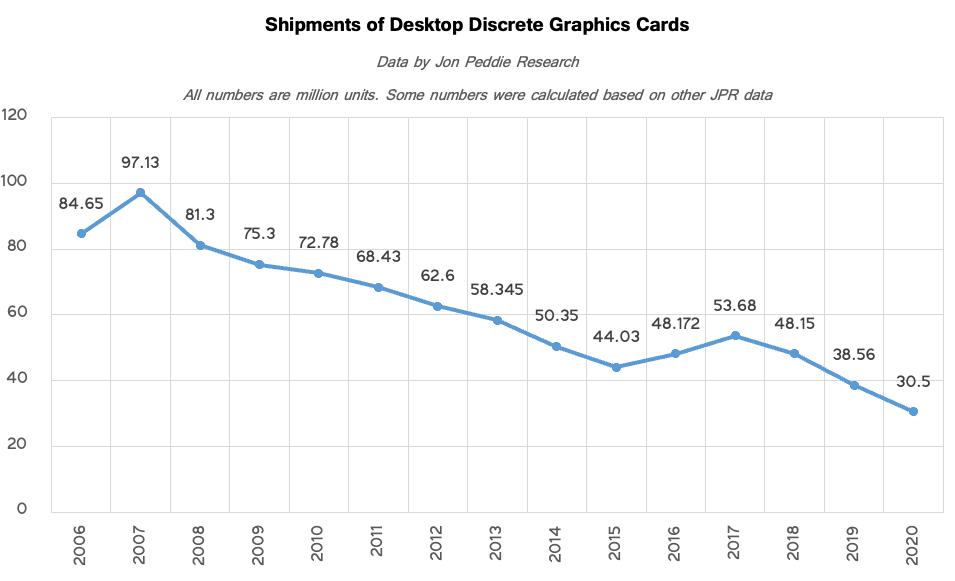

Overall, 11.5 million AIBs sold in Q3 2020 looks like a rather strong result. It is 13.4% higher when compared to 9.5 million graphics cards shipped in Q2 2020 as well as 9.1% higher when compared to 10.5 million units sold in Q3 2019. 11.5 million units sold per quarter is also more or less in line with market performance in the last couple of years, but is well below ~20 million units per quarter sold in the 2000s as well as 15~18 million discrete desktop GPUs per quarter shipped in the first half of 2010s.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

So far, about 30.5 million graphics cards have been shipped this year. This already exceeds shipments of desktop discrete GPUs in the first three quarters of 2019, but is below results for the first three quarters in 2016, 2017, and 2018.

For the sake of truth, it is necessary to note that in the last six to sever years loads discrete desktop GPUs were bought by cryptocurrency miners. Jon Peddie, the head of JPR, attributes most of AIB sales in the last couple of quarters to gamers as well as people building advanced PCs to work from home.

“Factors influencing the robust sales of AIBs in the past two quarters have clearly been increasing growth in gaming, and the need to outfit home offices due to COVID," said Peddie. "There has been speculation that there might be a renewal in demand for AIBs due to crypto-mining. Anything is possible, but the power consumption of AIBs greatly diminishes the payoff for crypto-mining. Ethereum, the best-suited coin for GPUs, will fork into version 2.0 very soon, making GPUs for mining obsolete. A person would be very foolish to invest in a high-end, power-consuming AIB for crypto-mining today.”

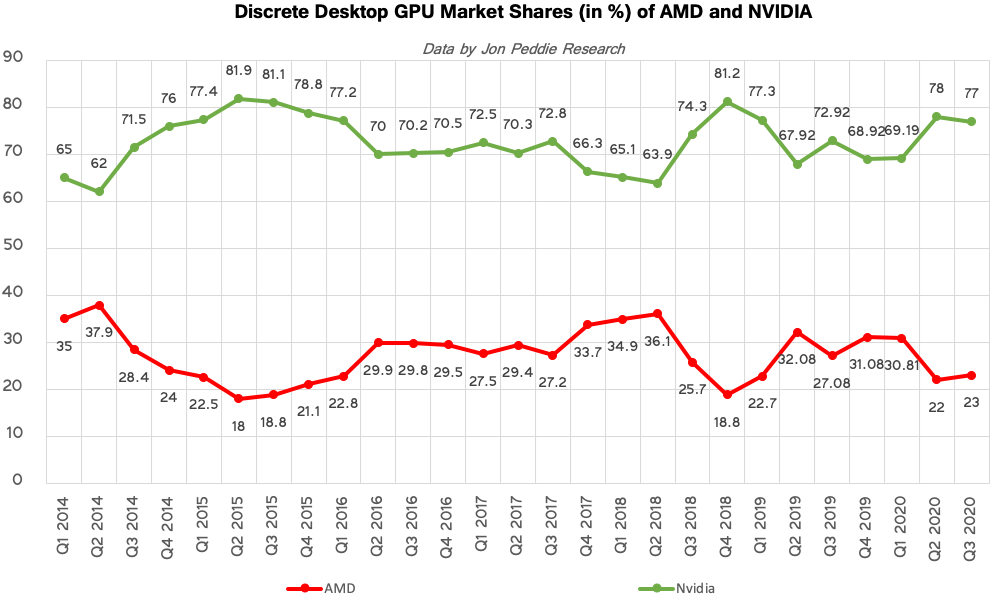

Nvidia Leading the Discrete GPU Market

Nvidia continued to dominate the market of discrete desktop graphics cards commanding an 77% share with about 8.855 million desktop GPUs shipped. In fact, the company sold more desktop GPUs per quarter than it did in the last couple of years. Perhaps, this is a result of the company's draining down its Turing inventory in a bid to free the channel for the new Ampere generation.

AMD's share on the market of desktop graphics cards in Q3 was 23% (a 4% drop from Q3 2019) with approximately 2.65 million desktop graphics cards sold in the third quarter, according to Jon Peddie Research.

Nvidia's positions on the discrete laptop GPU market are traditionally very strong, so overall, Nvidia sold 80% of all discrete GPUs in Q3 2020, leaving about 20% of the market to AMD, the report from JPR reveals.

Nvidia introduced its GeForce RTX 30-series graphics cards on September 1, but sales of actual boards started later that month. The model RTX 3080 go to the shelves on September 17, whereas the model RTX 3090 became available on September 24. Demand for these products was high and Nvidia failed to meet it, but it is unclear how many 'Ampere' AIBs Nvidia shipped in Q3.

AMD unveiled its 'Big Navi' GPU based on the RDNA2 microarchitecture on November 1 and started shipments of actual products later in the month, so it is pretty safe to say that very few (if any) commercial RDNA2-based products shipped in Q3.

Interesting Prospects

Traditionally, sales of desktop graphics cards in the fourth quarter are in line (slightly up or slightly down) with shipments of discrete desktop GPUs in the third quarter driven by launches of new games.

This year two leading GPU designers started sales of their new high-end offerings in the fourth quarter. Both AMD Radeon RX 6800 and Nvidia GeForce RTX 30-series are sold out, suggesting that millions of these AIBs have been sold. The two companies also say that demand for their latest products greatly exceeds supply.

Given the ongoing situation with shortages of graphics cards, it will be particularly interesting to see how the market performs in Q4 2020. Based on the sales numbers for the year so far (approximately 42.26 million discrete desktop GPUs sold), it is safe to say that 2020 will be a better year for AMD and Nvidia than 2019 was. But will sales of graphics cards this quarter be high enough to sell a record number of AIBs in the last five years? Only time will tell.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.