Graphics Memory Prices Expected to Increase Next Quarter

GDDR6 to the moon!

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

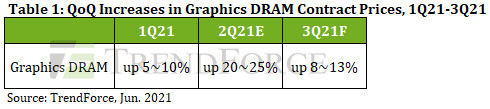

Just when you thought things were as bad in the GPU market as they could be, something new pops up. Demand for gaming graphics cards, game consoles, and GPUs used for mining cryptocurrencies have driven prices of graphics cards and graphics memory to new heights in recent months, but according to TrendForce, that's about to get even worse. Contract prices of GDDR memory are expected to grow another 8% – 13% later this year due to numerous factors. The only question is how badly the price of graphics memory will affect the prices of actual graphics cards, too.

Graphics DRAM represents a relatively small fraction of the overall memory market, which is largely dominated by LPDDR memory for smartphones, mainstream DRAM for PCs, and server DRAM for datacenters. To that end, GDDR always has to fight for limited DRAM production capacities with other types of memory. Due to relatively low graphics memory volumes and superior performance characteristics, these chips are usually fairly expensive. But that's a liability in a severe under-supply situation — the price of GDDR6/GDDR6X DRAM has increased significantly.

Memory makers traditionally serve large contract customers first. In the case of GDDR6 and GDDR6X DRAMs, the largest consumers are Nvidia (which bundles memory with some of its GPUs), contract manufacturers that produce game consoles for Microsoft and Sony (Flextronics, Foxconn), and several GPU makers (Asus, Colorful, Palit, etc.). As a result of this prioritization, smaller clients are struggling to get graphics memory.

TrendForce says that GDDR fulfillment rates for some medium- and small-size customers have been around 30% for some time, which is why spot prices of graphics memory sometimes exceeded contract prices by up to 200%. To some degree, GDDR6 spot prices were affected by increasing crypto pricing (particularly Ethereum), so a drop in the coin's value also reduced GDDR6 spot pricing.

In contrast, GDDR5 hasn't fluctuated significantly. That's mostly because it's really only used for GeForce GTX 1650/1660 and some OEM-oriented graphics boards.

There are several factors that will affect graphics memory pricing in the coming months:

- Demand for gaming PCs remains at high levels, so GPU makers will require more GDDR6 and GDDR6X SGRAM chips.

- The latest game consoles from Microsoft and Sony use 16Gb GDDR6 memory chips, whereas graphics cards use 8Gb GDDR6 devices, so makers of graphics memory are not exactly flexible.

- Since Nvidia, contract manufacturers, and select makers of graphics cards will remain the top consumers of GDDR6 and GDDR6X memory, other players will still be severely supply-constrained.

- As demand for servers and mainstream PCs is increasing, graphics memory has to fight for production capacity, affecting its pricing.

Since GDDR6 and GDDR6X pricing is set to increase, the bill-of-materials (BOM) costs for GPUs will also increase. Since there are supply constraints of other components and logistics problems in place, it is unlikely anything could offset the BOM increase in the third quarter. And with that, it will get more expensive for manufacturers to build GPUs.

Meanwhile, GPU pricing is inflated because of demand from gamers and miners. Therefore, if AMD and Nvidia increase their GPU supply in Q3 and demand from miners receeds because of lower Ethereum value, then GPU pricing could actually decrease. Unfortunately, we don't know exactly what will happen, so the future is hard to predict.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.