Global 3D NAND Market Shrinks by 24.3 Percent in Q3 2022

Market downturn collapses 3D NAND shipments in the third quarter.

Demand for 3D NAND memory dropped in the third quarter due to softening demand for PCs and smartphones. As a result, both average selling prices (ASPs) of flash memory and its bit shipments collapsed, which severely affected the revenue of 3D NAND makers.

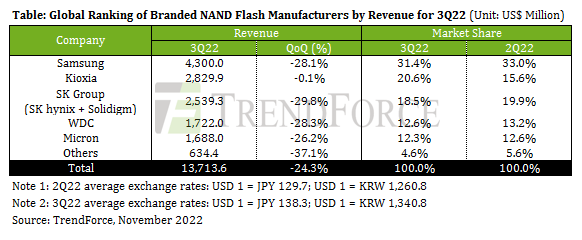

Makers of 3D NAND supplied $13.71 billion worth of memory in Q3 2022, a drop of 24.3% quarter-over-quarter, according to a report by TrendForce. This is because volumes that 3D NAND bit shipments declined by 6.7% sequentially, whereas average prices fell by 18.3% QoQ as 3D NAND makers had to reduce prices to make their products more appealing.

Samsung retained its leadership position as the No.1 maker of NAND flash during the quarter, with a 31.4% market share. Meanwhile, its 3D NAND revenue decreased by 28.1% sequentially. Samsung, which sells some of the best SSDs around, suffered from both bit shipments and ASP declines in the third quarter of 2022.

By contrast, Kioxia managed to increase its market share from 15.6% in Q2 to 20.6% in Q3. Furthermore, the company's 3D NAND revenue totaled $2.83 billion, a decrease of only 0.1% quarter over quarter, based on data from TrendForce. While Kioxia's ASPs declined significantly during the quarter, the company sold boatloads of memory for consumer applications.

SK Group's NAND flash memory sales — which controls SK Hynix and Solidigm — declined by 29.8% quarter-over-quarter to $2.54 billion. As a result, the company's share dropped 18.5% from 19.9% in the second quarter. In addition, SK Group's position weakened significantly in Q3 because sales of memory and solid-state drives for consumer products (sold primarily by SK Hynix) and shipments of enterprise-grade SSDs (sold primarily by Solidigm) slipped.

Western Digital and Micron performed similarly in the third quarter as their sales declined 28.3% and 26.2% quarter-over-quarter, respectively, and both companies lost some share to Kioxia in Q3 2022.

Smaller makers of 3D NAND suffered the most in the third quarter as their sales collapsed by 37.1% QoQ. As a result, they now control 4.6% of the market, down 1% from Q2 2022.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

TrendForce expects 3D NAND revenue to lower in the fourth quarter as demand continues to remain soft, and cuts of 3D NAND wafer starts are not forecasted to bring immediate relief. As a result, analysts expect contract 3D NAND prices to decline by 20% – 25% QoQ due to slow demand. Furthermore, Samsung's plans concerning 3D NAND output in Q4 and onwards are unclear as, unlike its rivals, it has not announced any cuts.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

drajitsh Personally I have stopped upgradation on several PC because I never found an explanation for the dramatic drop in TBW ratingsReply -

jp7189 Reply

The move to TLC and then to QLC dramatically affected drive wear. Also some manufacturers lower ratings to reduce warranty costs. It doesn't really matter to the average consumer workload. A 4TB drive with 0.3 drive writes per day is still over 1TB per day. There aren't many workloads that can sustain that nonstop. If you have a workload like that, then you 1. get pricier enterprise stuff, or 2. get more consumer drives than you need and spread writes around, or 3. plan to replace early.drajitsh said:Personally I have stopped upgradation on several PC because I never found an explanation for the dramatic drop in TBW ratings -

drajitsh Reply

I have come to realise the problem is probably the MS Direct storage, which increases the TBW by something like an order of magnitude. So the warranties are being reduced ii n respond-- somewhat similar to what happened during the CHIA blipjp7189 said:The move to TLC and then to QLC dramatically affected drive wear. Also some manufacturers lower ratings to reduce warranty costs. It doesn't really matter to the average consumer workload. A 4TB drive with 0.3 drive writes per day is still over 1TB per day. There aren't many workloads that can sustain that nonstop. If you have a workload like that, then you 1. get pricier enterprise stuff, or 2. get more consumer drives than you need and spread writes around, or 3. plan to replace early.