GPU Prices Will Eventually Plummet, Analyst Says

In a new study posted on Graphic Speak, analyst Dr. Jon Peddie shared some data on how the best graphics cards have gotten more expensive over the years. The article also looks at the current steep pricing for AMD and Nvidia's latest graphics cards, with a prediction that the prices will eventually drop when stores have excess inventory.

The average selling pricing for discrete graphics cards increased exponentially since the Ethereum mining boom. As a result, miners started to stock up on GPUs, which led to a shortage and higher prices. The situation worsened when the pandemic hit, causing the supply chain to collapse and depleting graphics card inventory. Scalpers took advantage of the situation and used bots to buy up every graphics card to flip them on eBay later.

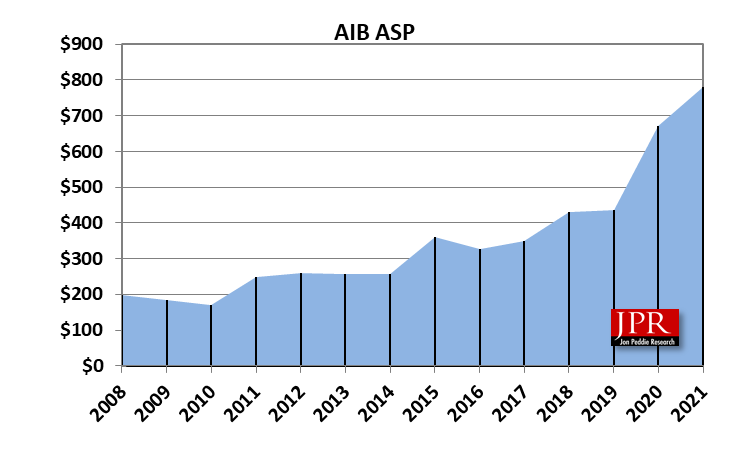

Peddie's data showed that the high demand and mining contributed to high prices. The most significant increase in the AIB average selling price happened between 2019 and 2020. Remember that the first cases of coronavirus emerged in China back in December 2019, and everything went downhill from there. For comparison, the AIB average selling price in 2019 was a little over $400, whereas it almost hit $700 in 2020, roughly a 75% price increase. Pricing continued to escalate between 2020 and 2021, but the margin was substantially lower.

PC gaming and mining AIBs had priced their products two to three times more expensive than mobile graphics cards. However, Peddie believes that the supply shortage isn't the reason for the hike in PC AIB pricing; instead, the blame is on the miners and scalpers.

According to Peddie, graphics card suppliers aren't the ones benefitting from the price surge. Instead, the retailers (Amazon, Newegg, Best Buy, etc.) and scalpers are the parties reaping the handsome profits. Meanwhile, shops like Best Buy got more creative and put Nvidia's Ampere graphics cards behind a $200 paywall. Unfortunately, the measure backfired and ended up helping scalpers, not gamers, get graphics cards.

| Graphics Card | MSRP | March 2022 Price | Price Increase | Top Price |

|---|---|---|---|---|

| GeForce RTX 3090 Ti | $1,999 | $3,820 | 91% | $3,820 |

| GeForce RTX 3090 | $1,499 | $2,129 | 42% | $3,300 |

| GeForce RTX 3080 | $699 | $1,220 | 75% | $1,800 |

| GeForce RTX 3050 | $249 | $349 | 40% | $379 |

| Radeon RX 6900 XT | $999 | $1,299 | 30% | $1,954 |

| Radeon RX 6600 | $329 | $379 | 15% | $549 |

| Radeon RX 6500 XT | $199 | $220 | 11% | $270 |

The data in the table is from Jon Peddie Research.

The overall trend is that Nvidia's graphics cards experienced higher price hikes than AMD's products. For example, the GeForce RTX 3090 Ti and GeForce RTX 3080 sell for 91% and 75% over their MSRPs. The GeForce RTX 3050, which many consider the mainstream Ampere offering, retails 40% more than the MSRP.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

In AMD's case, the highest markup is 30%, which correlates to the chipmaker's flagship Radeon RX 6900 XT. On the other hand, the Radeon RX 6600, slightly faster than the GeForce RTX 3050, only showed a 15% price increment.

Our best advice is to wait it out if you do not desperately need a graphics card. While graphics cards are not exactly at the MSRP level, they're getting there. Our eBay GPU pricing tracker revealed that pricing continues to drop. We registered a 9% drop in the first half of March. Peddie thinks inflated prices will likely plummet when retailers and scalpers have excess inventory that they can't move, and we agree with the analyst. The issue is that what Peddie suggests won't happen soon, so we must exercise enormous patience to avoid temptation.

Zhiye Liu is a news editor, memory reviewer, and SSD tester at Tom’s Hardware. Although he loves everything that’s hardware, he has a soft spot for CPUs, GPUs, and RAM.

-

bigdragon I agree with this analysis. GPU prices are poised to plummet. Crypto mining, stimulus funds, travel restrictions, scalpers, and supply chain constraints all conspired to wreck the GPU market. Mining is no longer crazy profitable, there hasn't been any more stimulus, people are traveling again, and production is up. Scalpers are finally getting squeezed, but it's going to take a while for retailers to wake up and start dramatically undercutting them. Prices go up like a rocket and fall like a feather.Reply

Just wait several more months, gamers and content creators. You can hold. Just wait it out. You'll feel terrible in a month or two if you buy now. -

hotaru251 counter view: Scalped market shows AMD/Intel/Nvidia that ppl are willingly to pay higher for gpu's thus raise prices worse than the rtx 2000 series prices.Reply -

Kridian "..prices will eventually plumet."I'm playing the long game, when they start giving away GPUs for FREE. 😎Reply -

InvalidError "Prices will drop when retailers have excess inventory."Reply

You need a freakin' doctorate degree to figure that one out? I could have told you this much from home economics back in high school. Almost anyone with a working brain should know basic supply-and-demand.

Then again, supply-and demand is kind of broken when Apple tells Amazon to destroy inventory instead of doing clearance sales. -

Reply

I know you're joking, but even in the worst case they won't. Since it's cheaper to destroy those GPUs than to give them out for free, that's what they'll do. It's a disgusting waste of resources, but that's where capitalism has led us today.Kridian said:"..prices will eventually plumet."I'm playing the long game, when they start giving away GPUs for FREE. 😎 -

TerryLaze Reply

That's the definition of supply and demand, they increase demand since people know that there is no reason to wait for sales since they never go on sales and they also decrease supply (mainly to the secondary market) .InvalidError said:Then again, supply-and demand is kind of broken when Apple tells Amazon to destroy inventory instead of doing clearance sales. -

SyCoREAPER "Something is expensive now but will eventually get cheaper, I just don't know when"Reply

How insightful and intellectual of the analyst. Pointing out how the world works is apparently news... -

InvalidError Reply

Normal supply and demand assumes the manufacturer won't sabotage its own supply and manufacturing capacity.TerryLaze said:That's the definition of supply and demand, they increase demand since people know that there is no reason to wait for sales since they never go on sales and they also decrease supply (mainly to the secondary market) .

When you have a handful of suppliers who can afford to say "our price or nothing" then you have an oligopoly situation where oligarchs set prices regardless of market conditions since they have a captive audience. -

Alvar "Miles" Udell And that's what we saw before this insanity when nVidia and AMD DOUBLED the base prices of their video cards from the RX series to the 5000 to 6000 series and 1600 to 2000 series instead of doing what they had done in every generation past and kept the prices close to the same for the models they replaced and decided to price match each other instead of competing, it was pure and simple price fixing by a duopoly, then cryptocurrency and a component shortage exacerbated the situation.Reply

It's sad to say that the only hope customers have of returning to a PROPER competitive market is for Intel to actually come in and be both competitive in price and performance, which is strangely not as unthinkable as it was just a couple of years ago if Alder Lake is anything to go by.