Intel CEO Revisits TSMC to Secure Extra Production Capacity

Visited Taiwan briefly on Thursday, to ensure foundry's commitments.

Taiwanese media reports that Intel CEO Pat Gelsinger stopped briefly on the island on Thursday for face-to-face discussions with TSMC's top executives. The topic of discussion didn't take very long to leak out if a report published by DigiTimes today is correct. In summary, sources say that Gelsinger was on a quest to secure additional sub-7nm production capacity and mature-node output in support of Intel's roadmaps and overall business aims.

The DigiTimes sources indicated that Gelsinger flew in to double-check commitment to orders placed with the world's largest contract chipmaker. In its headline the report mentions Intel sought greater capacity commitments from TSMC, but it didn't mention anything about extra orders for CPUs, GPUs, or other products.

One of the matters on Gelsinger's mind was said to be mature node orders for supporting computer components. There is talk that Intel's server shipments are slower than they could be due to tight supplies of components like LAN chips (produced on mature nodes), so it seems reasonable that the Intel CEO added these kinds of chips to his TSMC shopping list.

After his brief quarantine-swerving stay in Taiwan, Gelsinger flew off to Japan to talk to companies, including Tokyo Electron, and will return to the US after a stop in India.

Reflections on the December Visit to TSMC

Gelsinger's decision to visit TSMC in Taiwan on Thursday was a surprise to industry watchers, as entering Taiwan isn't a trivial task with its Zero-Covid policy still in place. Additionally, Gelsinger visited TSMC only a few months ago, in mid-December 2021. However, the DigiTimes report, quoted above, sheds a little light on Gelsinger's aims.

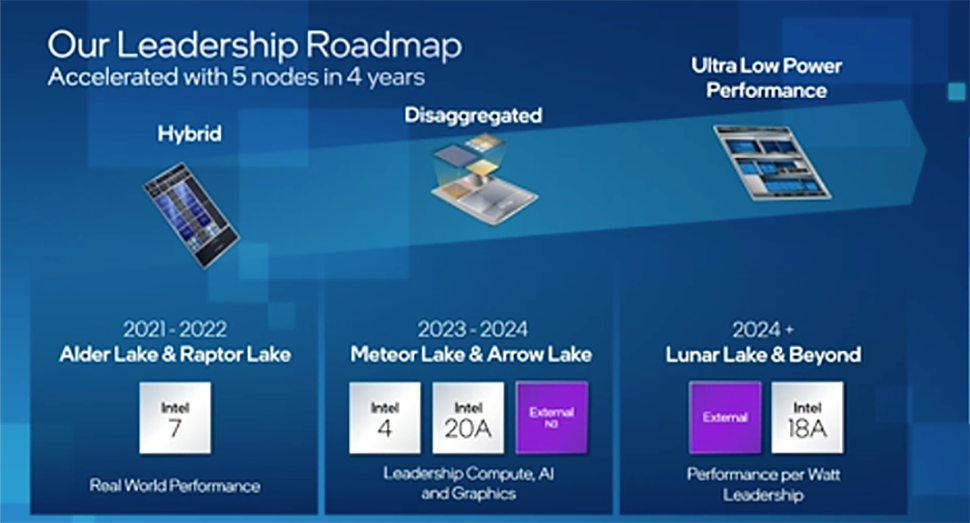

During the December visit, the Intel CEO wasted a significant amount of time on necessary matters of diplomacy. For example, he had to backpedal on comments about Taiwan being a geopolitically unstable risk just days before his visit. Thus Gelsinger decided flattery was the best policy on TSMC's home turf. Before flying off, he ironed out an agreement to secure various TSMC output lines to support Intel's ambitious product roadmaps.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

watzupken It’s ironic that amidst all the news that Intel is very aggressively expanding their fabs business, the CEO had to go down personally to TSMC in bid to secure more allocations. While it is true that the fabs don’t get ready overnight, but in reality, I feel a lot of these expansion plans will be in jeopardy for a longer time because of supply limitations with equipments, raw materials and manpower.Reply -

jkflipflop98 This is a very interesting situation we have here.Reply

We have multiple companies completely 100% reliant on TSMC to produce anything. Let's just say a competitor with deep pockets were to enter the race and outbid the other customers for all the leading-edge node wafer starts. You could effectively pay to freeze out the competition. Then you end up with Apple and Intel with all of TSMC's starts and AMD sitting on the outside wishing they made friends with Samsung. -

alceryes Reply

Wondering if Taiwan has any anti-trust laws to prevent this from happening.jkflipflop98 said:This is a very interesting situation we have here.

We have multiple companies completely 100% reliant on TSMC to produce anything. Let's just say a competitor with deep pockets were to enter the race and outbid the other customers for all the leading-edge node wafer starts. You could effectively pay to freeze out the competition. Then you end up with Apple and Intel with all of TSMC's starts and AMD sitting on the outside wishing they made friends with Samsung. -

Co BIY Replyjkflipflop98 said:This is a very interesting situation we have here.

We have multiple companies completely 100% reliant on TSMC to produce anything. Let's just say a competitor with deep pockets were to enter the race and outbid the other customers for all the leading-edge node wafer starts. You could effectively pay to freeze out the competition. Then you end up with Apple and Intel with all of TSMC's starts and AMD sitting on the outside wishing they made friends with Samsung.

While some competitors would be cut out for a while TSMC has been growing capacity at such a rate that it would not be a sustainable plan.

Every price rise at TSMC makes Intel's own competitive fabs more valuable and fuels TSMCs growth.

Apple/Google could probably start a Fab team and be up and running in few years. Just the announcement and threat could defeat the abusive behavior.

alceryes said:Wondering if Taiwan has any anti-trust laws to prevent this from happening.

Not just Taiwan but dozens of countries would be able to take action on an abuse like this. But if Intel has legitimate business needs for 20% of TSMCs current production (not unimaginable with new GPUs and global growth) then it's not really actionable.

Lower margin products (low end CPU) just won't get made.

We need some articles about ASML. Why are they not able to meet demand for their products ?