Intel To Unveil Bitcoin-mining 'Bonanza Mine' Chip at Upcoming Conference (Updated)

Intel enters the Bitcoin chat

Update: Intel's Bonanza Mine chip has now appeared in a contract with a mining startup, confirming that Intel is entering the cryptomining hardware business.

Original Article:

It appears that Intel could enter the Bitcoin-mining hardware business, but not with its new upcoming GPUs. The ISSCC conference is a yearly gathering of the best and brightest minds in the chip industry. This year, Intel has a presentation scheduled in the 'Highlighted Chip Releases' category to outline a new "Bonanza Mine" processor, a chip described as an "ultra-low-voltage energy-efficient Bitcoin mining ASIC." That means Intel could soon compete with the likes of Bitmain in the market for specialized ASICs for Bitcoin mining. Intel also commented on the new chip to Tom's Hardware, saying "Intel has done design work around SHA 256 optimized ASICs for several years beginning with pathfinding work done in Intel Labs. We will share more details in the future."

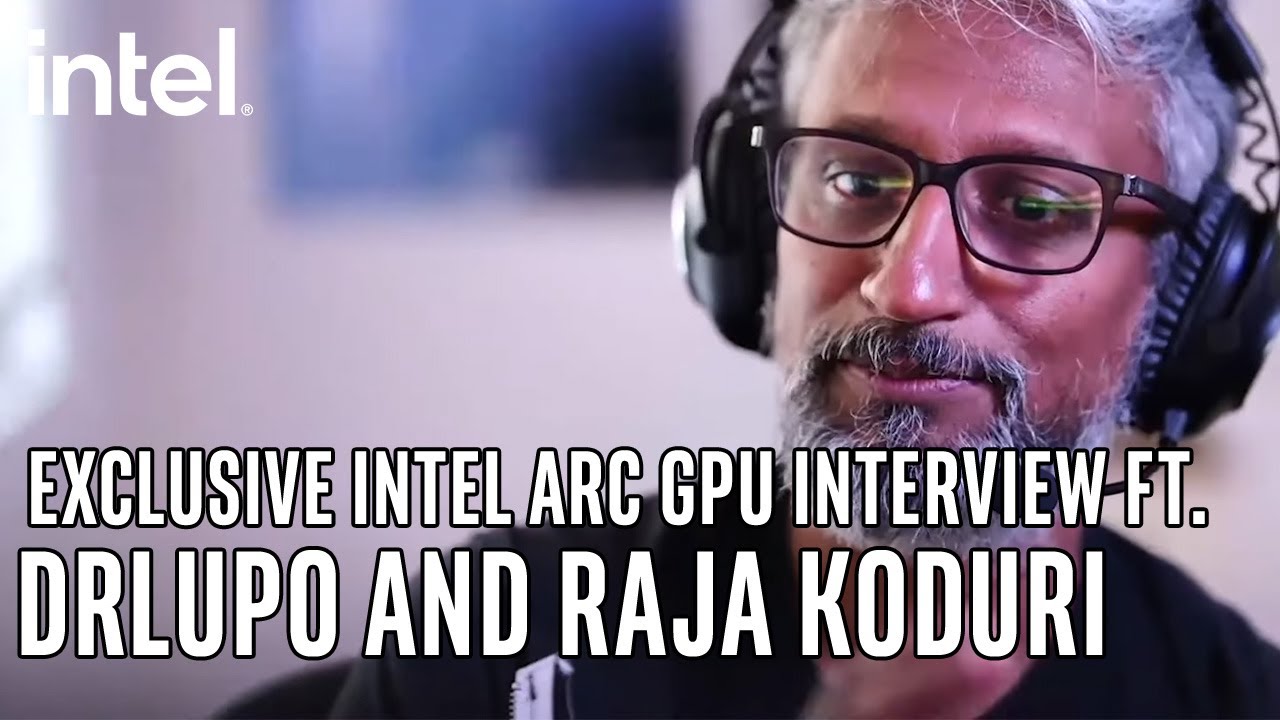

The presentation comes on the heels of comments from Intel's GPU Chief Raja Koduri during a live stream last December, indicating that the company is working on specialized hardware for blockchain/cryptocurrency technologies.

Bitcoin is typically mined on ASICs, which are specialized processors specifically designed to execute one type of workload. ASICs afford efficiency and performance advantages over more complex types of chips, like CPUs and GPUs, that can perform the same task. As a result, the overwhelming majority of Bitcoin mining occurs on ASICs, with companies like Bitmain providing the specialized silicon to miners at hefty premiums.

The first signs of Intel's interest in mining hardware surfaced in 2018 in the form of a patent for a specialized processing system that uses an optimized SHA-256 datapath (a cryptographic algorithm) for high-performance Bitcoin mining. As with all patents, the end product takes some time to come to market, but Intel has a wealth of experience in hardware-assisted SHA-256 algorithms due to the use of these instructions in its CPU products. Paired with its silicon production capabilities, Intel could be a particularly competitive entrant into the Bitcoin hardware market, especially given the focus on low-power, high-efficiency operation.

Fast forward to December 29, 2021, and Intel's Systems and Graphics Architect, Senior Vice President and GM Raja Koduri appeared on popular streamer Dr. Lupo's show to promote the company's launch of its first gaming GPUs, the Arc Alchemist lineup that will launch this year.

Intel has signaled very clearly that it will not limit the mining performance of its upcoming discrete gaming GPUs, but the company still doesn't want its GPUs used for that purpose. Naturally, GPUs are used for Ethereum mining and other types of coins — not Bitcoin — but the topic led Koduri to make a few interesting statements about blockchain technology, which is the fundamental underlying tech behind crypto.

Koduri explained that Intel doesn't have an install base as a newcomer to the discrete gaming GPU market. As such, Intel would rather its GPUs be used by gamers than miners. However, Koduri's further comments are telling (28:20 in the above video):

"The other part of the answer is that we do think that this whole blockchain, as you call it, which coins are good [...], I think blockchain is a transaction thing that is run much more efficiently than the burning of hardware cycles, is something that we are working on." Koduri said, "And that's not a GPU thing, so don't try to confuse that as a GPU thing. GPUs will do graphics, gaming, and all those wonderful things. But being able to do much more efficient blockchain validation at a much lower cost, much lower power, is a pretty solvable problem. And you know, we are working on that, and at some point in time, hopefully not too far into the future, we will kinda share some interesting hardware for that."

Given the timing of the ISSCC presentation, and the subject matter, it appears that Intel will share that information about the new hardware on Wednesday, February 23rd at 7 am PST. The 'DS1' moniker in the presentation listing denotes that Intel will have a video demo of the chip.

For now, it isn't clear if Intel will release the Bonanza Mine chip as a product for the public or if it remains confined to a research project. However, given that the chip is in the "Highlighted Chip Releases: Digital/ML" track and Koduri's comments, it's logical to expect that these chips, or some variant thereof, could be offered to customers in the future.

The primary bitcoin ASIC manufacturers, like Bitmain, suffer from long lead times and charge prohibitively high pricing for their chips, largely because they have to rely on third-party foundries to make the chips. Additionally, foundries like TSMC tend to not give these companies preferential status in their fabs due to the uncertainty of the demand and sporadic nature of cryptomining — instead, the fabs prioritize longer-term steady business from bigger chip designers. All of this is to say that Intel could make a meaningful and lucrative entry into this high-margin market backed by its incredible production capacity, giving it a leg up over competitors. Whether or not that will happen remains to be seen.

We'll be there at ISSCC to learn more about the new chips. Stay tuned.

Update 1/18/2022, 11am PT: Added Intel's statement to the article.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

-Fran- Well, if they make the GPU prices to go down, I think everyone won't be mad? I wonder how much capacity they would dedicate to this though.Reply

Regards. -

TJ Hooker Reply

It won't have any impact on GPU prices. There is no overlap between the crypto that could mined with a bitcoin/SHA-256 ASIC and crypto that can be mined (profitably) with a GPU.-Fran- said:Well, if they make the GPU prices to go down, I think everyone won't be mad? I wonder how much capacity they would dedicate to this though.

Regards. -

InvalidError Reply

With ETH allegedly going PoS only a few months from now and the difficulty bomb that comes with it, the market for PoW miners would dry up about just in time for launch. Designing a whole new product for a fad that should be end-of-life doesn't make much sense.logainofhades said:They should make an Etherium one, to give us gamers a break.