Discrete GPU Sales Dropped, AMD Loses Ground to Nvidia

JPR reports dedicated GPU sales dropped $3.1 billion sequentially in Q2 2022

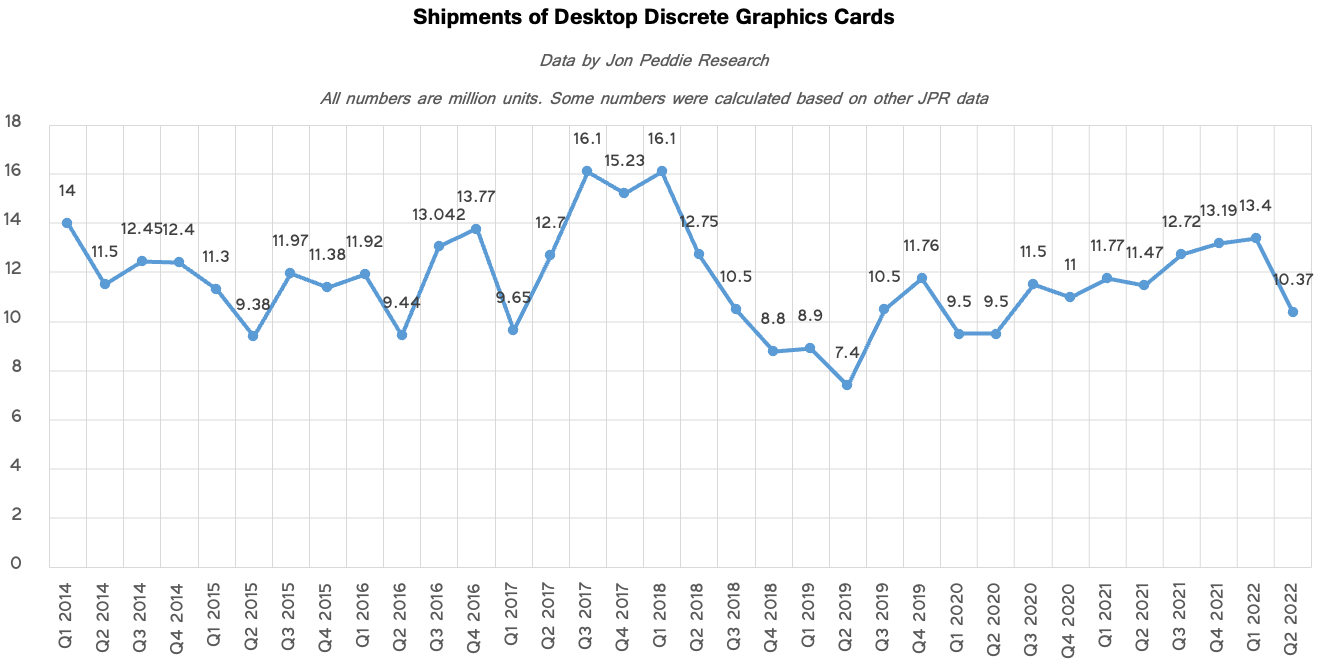

Unit sales of the best graphics cards for desktops — dedicated models, not integrated options — have been growing steadily for about two years now, but every rally comes to its end. Shipments of discrete GPUs hit a two year low in the second quarter, and dollar sales of add-in-boards (AIBs) dropped by a whopping $3.1 billion, according to Jon Peddie Research.

Partners of AMD, Intel, and Nvidia sold 10.37 million discrete graphics cards for desktop PCs in Q2 2022, according to data from JPR. Perhaps more importantly, dollar sales of standalone GPUs for desktops dropped to $5.5 billion, down 36% from $8.6 billion in Q1 2022 primarily due to lower average selling prices (ASPs) that dropped due to inventory corrections and the downturn in cryptocurrency mining that occurred in the channel. Pour one out for the "poor" GPU companies...

As ASPs (average sale prices) on graphics cards are now considerably lower than they were just several months ago, it might be a good time to get one of those current-generation graphics cards, but with GeForce RTX 40-series and Radeon RX 7000-series right around the corner, it might make sense to wait a bit longer.

Typically, unit sales of discrete graphics cards for desktops in Q2 are lower than those in Q1, but a 22.6% decline in just one quarter is a considerably more significant drop than we normally observe.

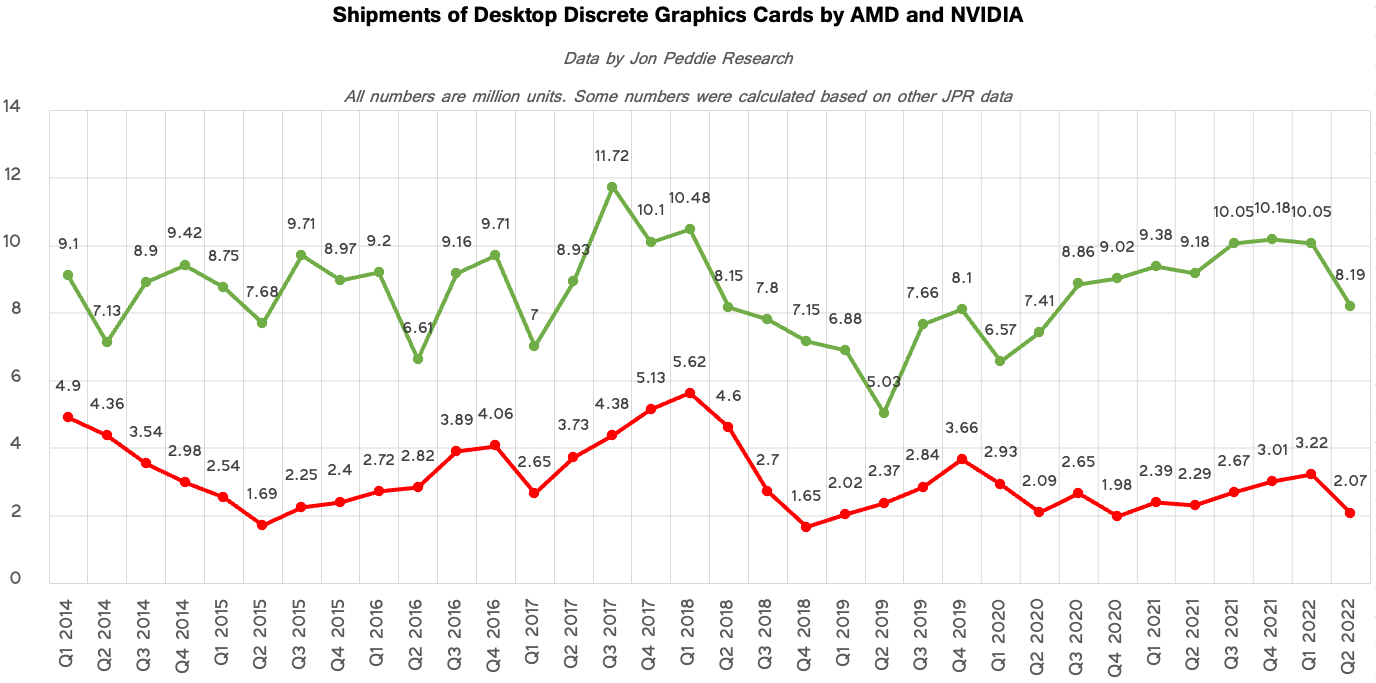

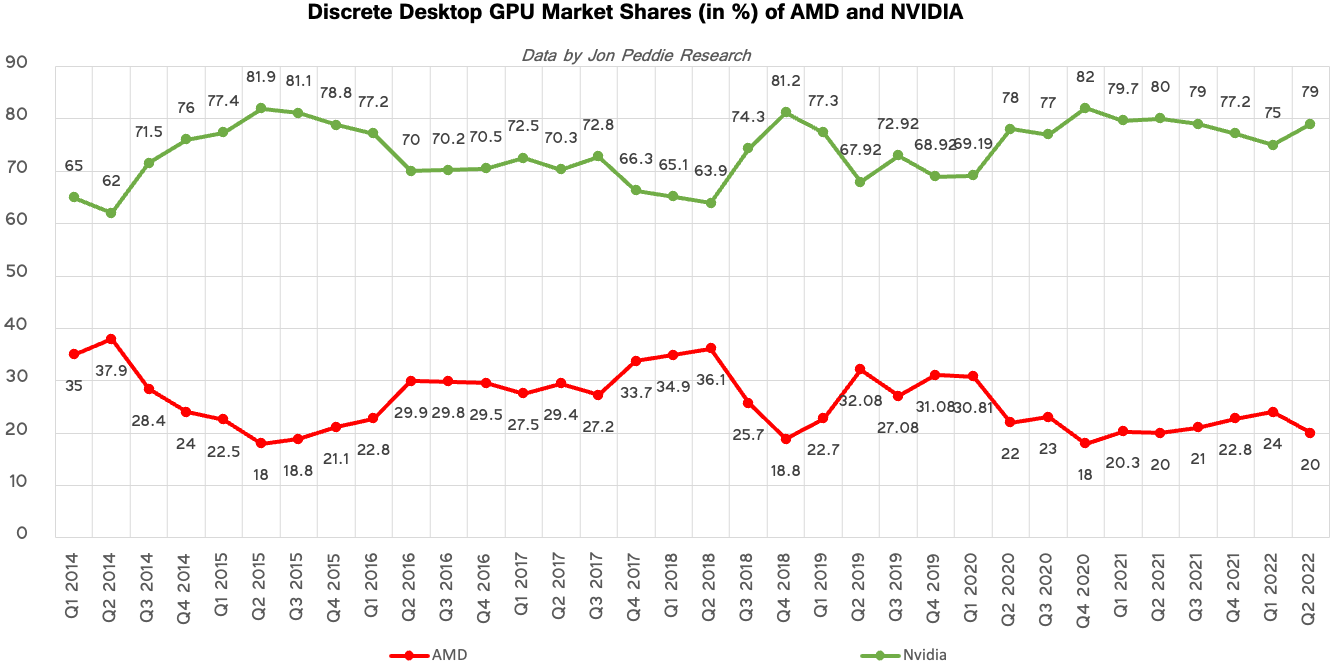

Shipments of Nvidia GeForce graphics cards decreased by a substantial 18.5% in Q2 when compared to Q1, whereas unit shipments of AMD Radeon boards dropped by a rather whopping 35.5% in the second quarter, according JPR.

As a result, despite a rather massive decrease in unit and dollar sales in Q2, Nvidia managed to recapture some market share from its rival and now commands approximately 79.6% of the market. AMD controlled around 20% and Intel ended up with less than 1% as it only just started to sell its standalone Arc A380 GPUs in more or less notable quantities.

As AMD and Nvidia are poised to introduce their new RDNA 3 and Ada Lovelace client GPU architectures in the coming months, partners of both companies have a lot of current-generation inventory left. When coupled with supply chain and geopolitical issues, turmoil in the market of graphics cards is set to continue, JPR says.

"The continued intermittent disruptions in the supply chain due to China's zero COVID policy, combined with an escalating trade war between China and the Western world, is aggravating the introduction of new parts," said Jon Peddie, president of JPR. "In one sense, that is a blessing in disguise, as the AIB and GPU suppliers got caught with an inventory overhang due to a relaxation from work-at-home demand and the crash of crypto mining due to an algorithm change. As result, it doesn't look like we will see any stability in supply and demand until the end of Q1 2023."

Jon Peddie Research remains optimistic about the market of discrete graphics cards for desktops in the long term. To some degree, Intel’s entering the market of discrete GPUs will increase unit sales of standalone graphics processors in general and desktop AIBs in particular. JPR believes that this increase will start to materialize already in 2023 and the total available market of graphics cards for desktops will increase to $44 billion by 2026, up from $39.9 billion in the last four quarters

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

atomicWAR Not surprised. I've had horrid luck with AMD gpus graphics drivers over the years. Everytime I try and give them another chance their terrible drivers drive me away again (I miss ATI).Reply

Now Amd do fix things in time but things move WAY to slow. Honestly I believe thats where the adage about AMD gpus aging like fine winecomes from. It takes years for them to extract the full power of their gpus due to this driver fumbling. Where Nvidia tends to have their gpus running at full sprint within weeks or months of a launch (ie hardware and/or games) . Amd gpu users pick up on this, consciously or not and end up buying Nvidia down the road. Amd ends up kicking themselves in the teeth with what could have been superior hardware over software. Amd needs to focus on their software engineers a lot more, hire or fire. -

wifiburger AMD gpu market share will not amount to anything more than that chart regardless of prices, performance,features vs nvidia.Reply -

Reply

I see you're on a streak with your incredibly valuable insight.wifiburger said:AMD gpu market share will not amount to anything more than that chart regardless of prices, performance,features vs nvidia. -

KyaraM Reply

Superior hardware, not really. They look pretty close in that regard, minus temperatures which have been horrendous on literally every AMD card I owned so far, and RT which was simply slapped on with AMD to be able to claim they have it, but which is essentially non-functional. I fully agree with you on the software front, though. Together with the temperatures and the fact that they all died on me, I never had great experiences with AMD drivers and they improve too slow. When they finally fixed those issues I might give them a shot again, until then...atomicWAR said:Not surprised. I've had horrid luck with AMD gpus graphics drivers over the years. Everytime I try and give them another chance their terrible drivers drive me away again (I miss ATI).

Now Amd do fix things in time but things move WAY to slow. Honestly I believe thats where the adage about AMD gpus aging like fine winecomes from. It takes years for them to extract the full power of their gpus due to this driver fumbling. Where Nvidia tends to have their gpus running at full sprint within weeks or months of a launch (ie hardware and/or games) . Amd gpu users pick up on this, consciously or not and end up buying Nvidia down the road. Amd ends up kicking themselves in the teeth with what could have been superior hardware over software. Amd needs to focus on their software engineers a lot more, hire or fire. -

atomicWAR ReplyKyaraM said:Superior hardware, not really....

Current hardware with RT...agreed. some of their early GCN stuff was ahead of its time but drivers.... -

KyaraM Reply

Ah, okay. Yeah, that is true I guess. Thought you were talking about today, sorry for the misunderstanding :)atomicWAR said:Current hardware with RT...agreed. some of their early GCN stuff was ahead of its time but drivers.... -

wifiburger Reply

don't worry AMD is too busy printing money from SOC sales to MS,google,Sony for their game consolesEasyJep said:I see you're on a streak with your incredibly valuable insight.

if they didn't have those revenues, they would be more competitive in the desktop field. More features, better pricing & bigger team to fix their crap drivers. -

logainofhades I have had an RX 6800, for over a year, and not a single driver issue to be had.Reply