Kioxia Slashes 3D NAND Production as SSD Sales Plummet

Kioxia is among the first to acknowledge the adjustment of 3D NAND output.

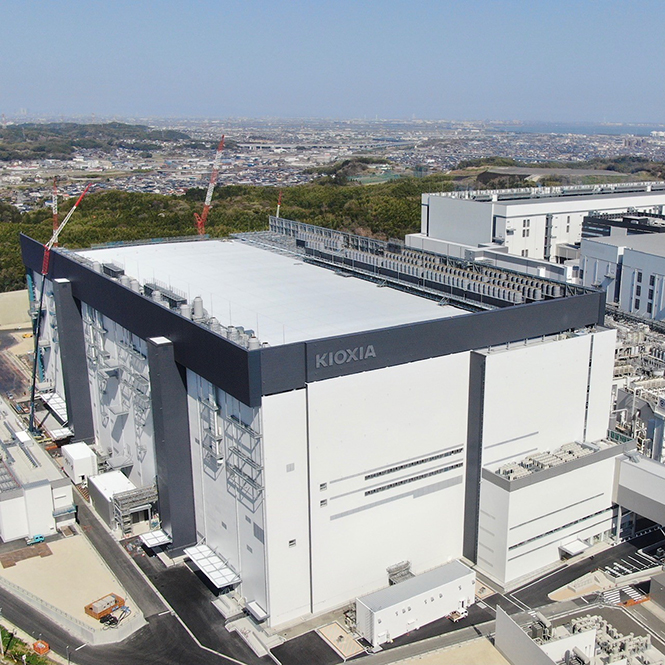

Kioxia said it would cut down production of 3D NAND memory at its fabs located at its Yokkaichi and Kitakami sites. Demand for PCs and many other devices is slowing due to high inflation rates, geopolitical tensions, and macroeconomic factors, producers of commodities like 3D NAND want to reduce inventories and avoid oversupply, so they have to cut down production.

Kioxia said it would reduce its wafer starts by approximately 30%, starting from tomorrow. However, a 30% reduction of wafer starts does not automatically mean a 30% reduction of 3D NAND bit output, as depending on the exact process technologies used to process wafers, the effect on bit output can be quite different. In addition, Kioxia did not say how long it plans to cut its 3D NAND wafer production.

Kioxia operates its fabs and shares its output with Western Digital, and while the American company has not issued any similar statements as of the time of writing, we would expect it to follow suit.

Kioxia is not the first to slash 3D NAND output, yet it is the first company to put the cards on the table and make a more or less detailed announcement. Micron said on Thursday that it was ‘reducing utilization in select areas in both DRAM and NAND,’ which essentially means a production cut. Meanwhile, there is no word (again) about NAND bit output, but only about the utilization of fabs, which reduces bit output per se. Perhaps nobody outside of Micron knows exactly what output was cut, so it is not our business to make such assumptions.

Also, Micron said it would slow down the production ramp of its latest 232-layer 3D NAND memory devices to reduce costs associated with the ramp and avoid oversupply on the market, which will inevitably affect the prices of flash memory and storage devices like solid state drives (SSDs), including the best SSDs aimed at enthusiasts.”

In fact, earlier this week, analysts from TrendForce said that the price of 3D TLC NAND and 3D QLC NAND wafers dropped by 30% ~ 35% in the third quarter compared to the second quarter and would decline by another 20% ~ 25% in Q4 compared to Q3 because of slowing demand for new PCs, servers, and consumer electronics.

Given such drastic 3D NAND price reductions, it is not surprising that Kioxia is cutting down its output to reduce its inventory levels. It is unclear how other 3D NAND makers will react, but in the end, they have two options: keep production of flash memory at the current levels and grab market share from Kioxia by offering lower prices and potentially lose money, or reduce the output to keep supply and demand in balance to at least fix prices at current levels.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

nitrium Is creating artificial scarcity something that actually works over anything other than short-term?Reply -

Co BIY It's not artificial scarcity to only make as much as you can anticipate selling. It would be wasteful to make more. It's the buyers sending the signal that we don't want more right now.Reply

They may have a lot of efficiencies at lower production levels rather than maximum production.