Micron, Western Digital Will Use Chips & Science Money for Memory R&D, New Fabs

Micron and Western Digital know how to spend money from the Chips & Science act.

Now that the Chips and Science act is signed into law, companies that are supposed to get subsidies on chip development and production in the U.S. can start proposing plans for their expansion. For example, Micron and Western Digital, two leading makers of DRAM and NAND memory, propose setting up a memory research and development coalition in the U.S. and then producing innovative types of memory in the country.

Bringing Memory Development and Production Back to the U.S

While the U.S. produces only about 12% of the global semiconductor output, companies like Intel, GlobalFoundries, and Samsung Foundry produce relatively advanced chips in the country. They have been used worldwide since many of them are unique. But regarding computer memory production, the U.S. is far behind South Korea, Japan, and Taiwan mainly because of North America's high fab and labor costs. It is a bit odd as many innovative memory technologies and fabrication processes are developed either in the U.S. or in the U.S. and Japan. With funds provided by the Chips and Science act, Micron and Western Digital hope to correct this wrong.

"In order to secure U.S. leadership in the critical area of semiconductor memory and storage technology, the NSTC should develop and articulate a long-term (>5 years) vision and roadmap for the enablement of the next generation of these technologies," a joint statement between the two companies reads.

One of the public-private organizations that will be set up with the help of the Chips and Science funding as well as investments from interested parties will be the National Semiconductor Technology Center (NSTC), which will bring together industry, government, national labs, and academia to conduct advanced semiconductor research and prototyping, according to the Semiconductor Industry Association. For example, Micron and Western Digital propose to form the Memory Coalition of Excellence (MCOE), which will be a part of the NSTC and will focus entirely on new memory technologies. In addition, both companies expect to get subsidies to build new manufacturing capacity in the USA.

"A Memory Coalition of Excellence (MCOE) will support this era of transformation and new technological innovations required," the statement by Micron and Western Digital reads. "This MCOE should be a focused effort across industry, academia, and government with clearly defined objectives related to overcoming the challenges outlined in this paper and should be aligned with other key coalitions of excellence (COEs) to support the overall objectives of the NSTC."

New Types of Memory Required, Let's Work Together

An avid reader of Tom's Hardware would justly note that 3D NAND and DRAM are commodities whose prices fluctuate and significantly affect the profitability of manufacturers, which is why it is crucial to make such types of memory in regions with the lowest costs and, obviously the U.S. hardly belongs there. Furthermore, both Micron and Western Digital already have DRAM and 3D NAND R&D operations in Japan, which is why MCOE in the USA may seem excessive. But there are several factors to be considered.

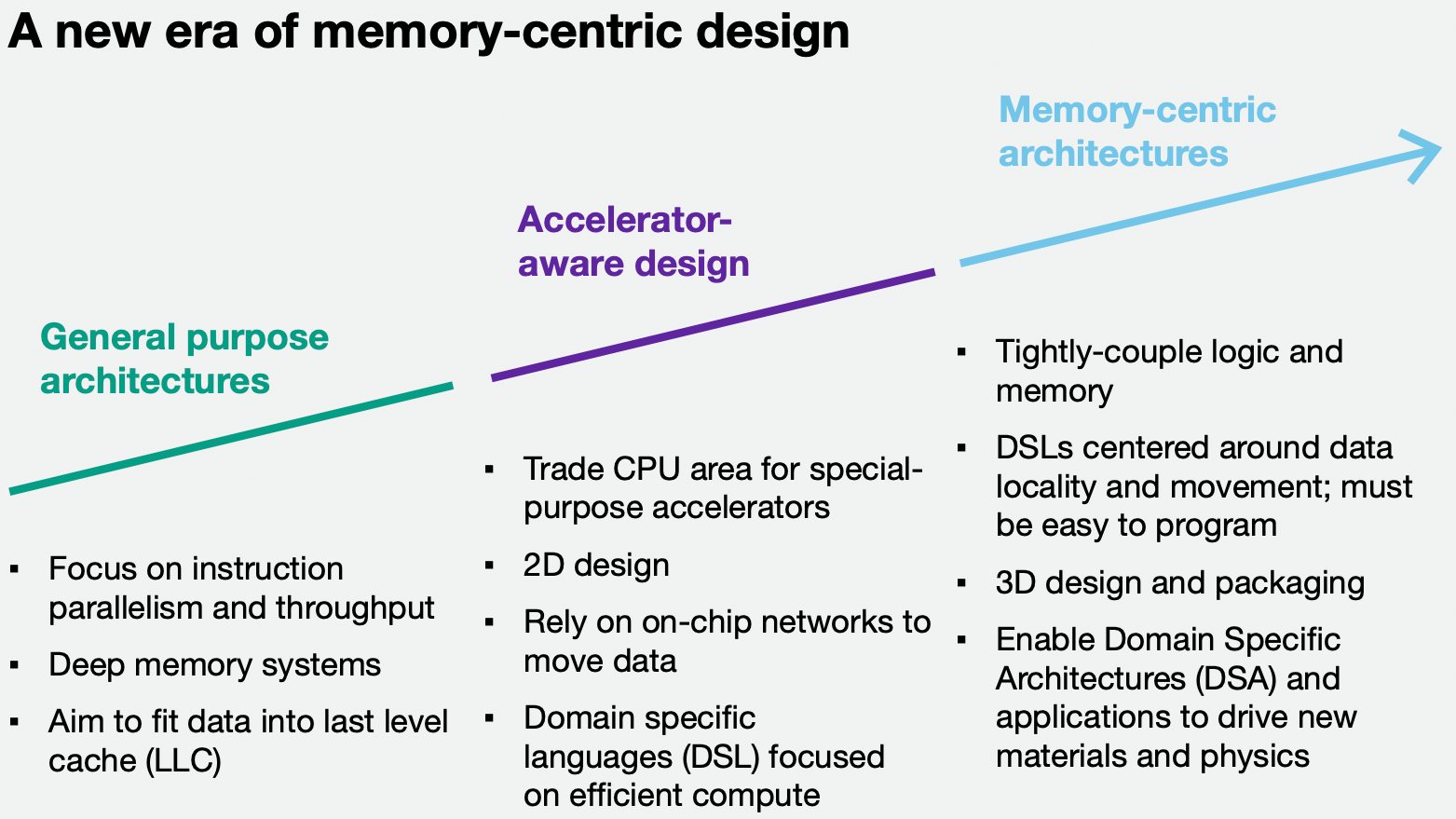

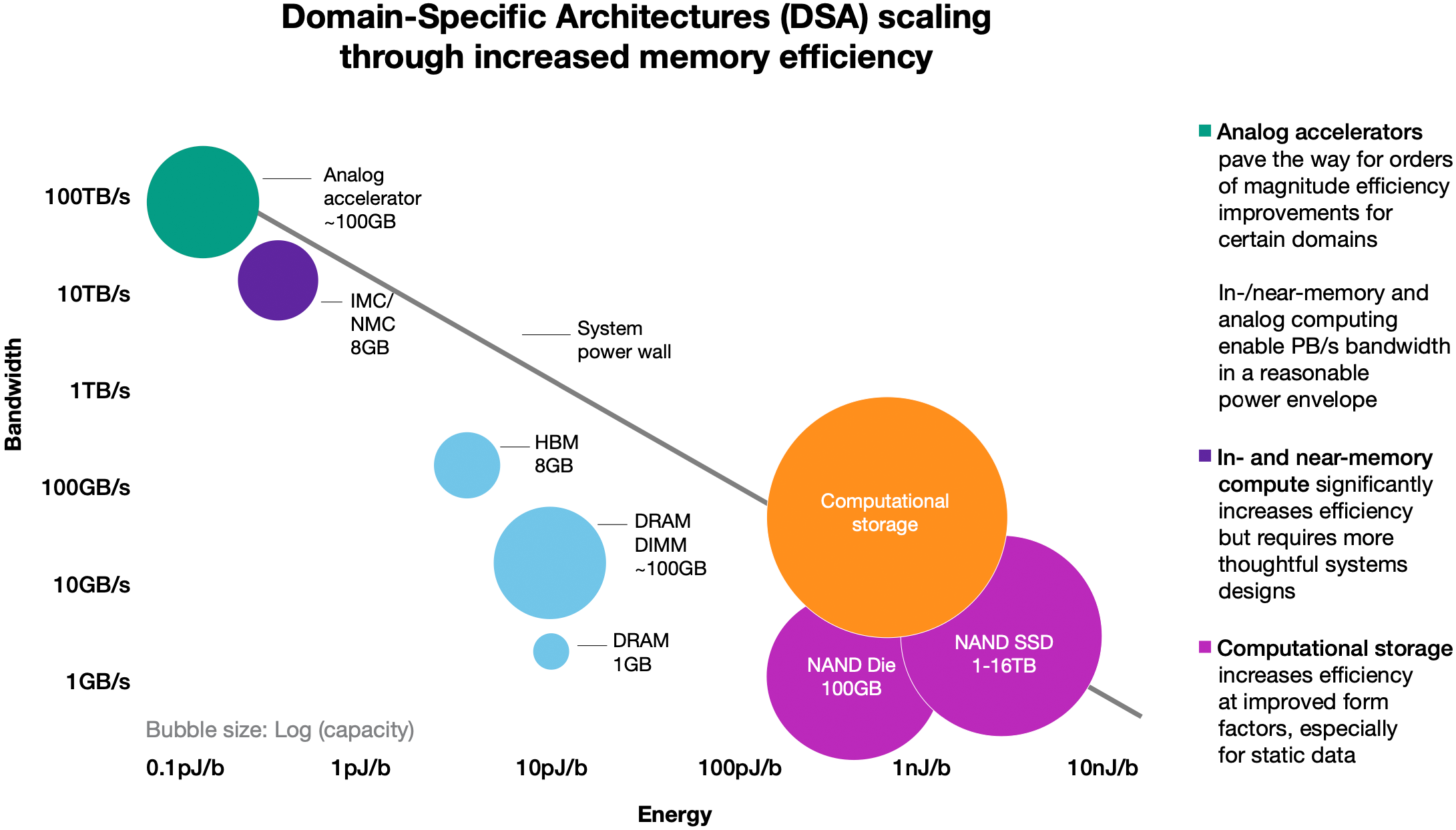

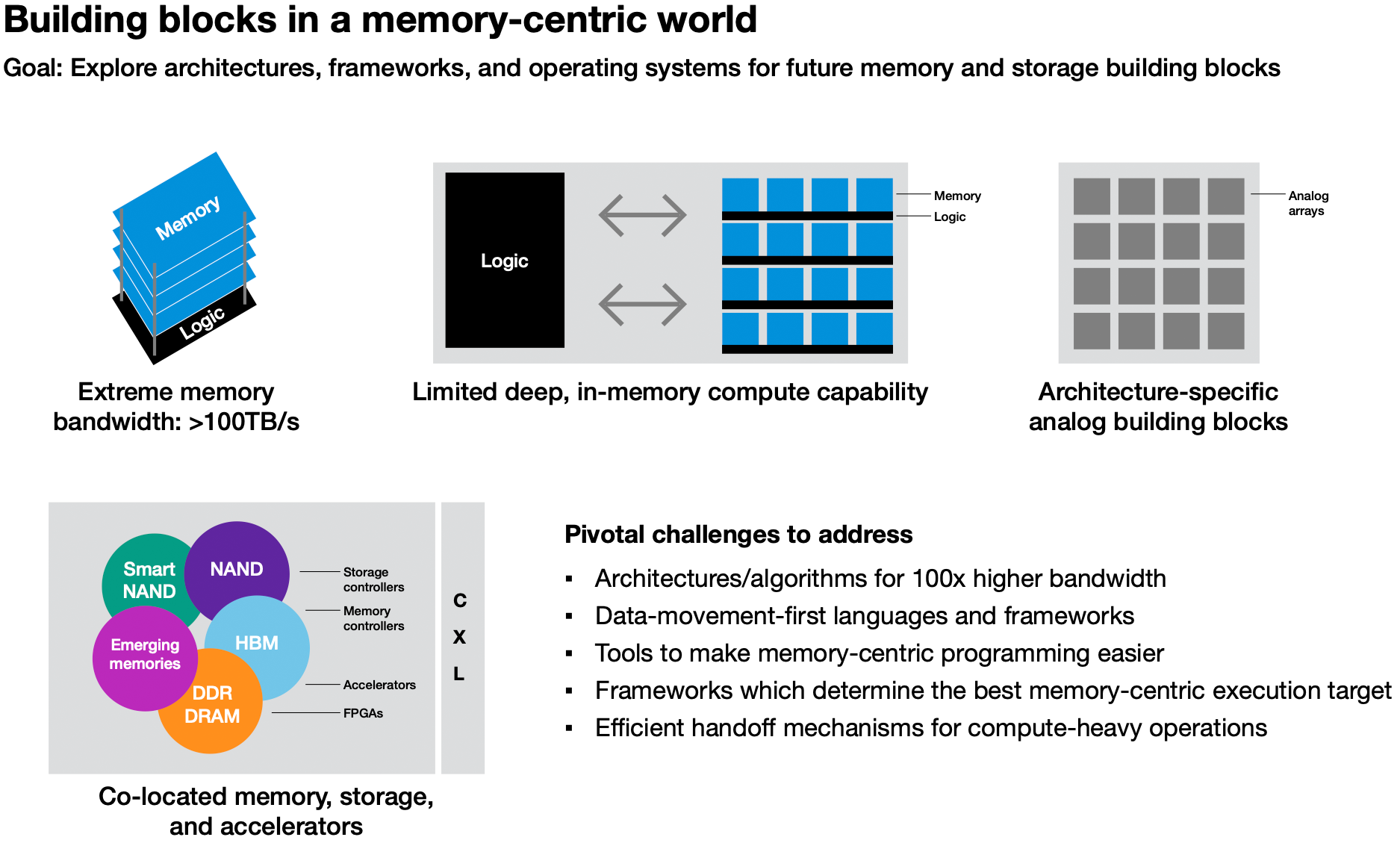

Firstly, next-generation compute devices, which Micron and Western Digital call domain-specific architectures (DSAs), will require all-new types of memory. In particular, the two memory manufacturers mention general purpose compute architectures that use different kinds of memory, accelerator-aware designs that use high-speed memory, and memory-centric architectures that tightly wed compute (logic) and memory. While traditional architectures will continue to use things like 3D NAND, DRAM, and HBM, emerging architectures will need new types of memory, which will have to provide across-the-board benefits in a variety of device metrics, including performance, power, area, functionality, cost, and complexity, according to the companies.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Secondly, those new memory types do not exist today, which means that companies like Micron and Western Digital have to invest in fundamental memory research in a bid to design them eventually. For example, Western Digital has been investing in ReRAM — a perspective storage class memory (SCM) type — for years, but without success. Meanwhile, Micron has not even adequately commercialized 3D XPoint that it co-developed with Intel. The industry has identified several promising technologies for SCM applications (PCM, MRAM, FeRAM, etc.), but none of these technologies has become widespread. That said, it makes a lot of sense to develop fundamental technologies behind innovative types of memory by R&D consortiums/coalitions in collaboration with academia to share costs and speed up time-to-market.

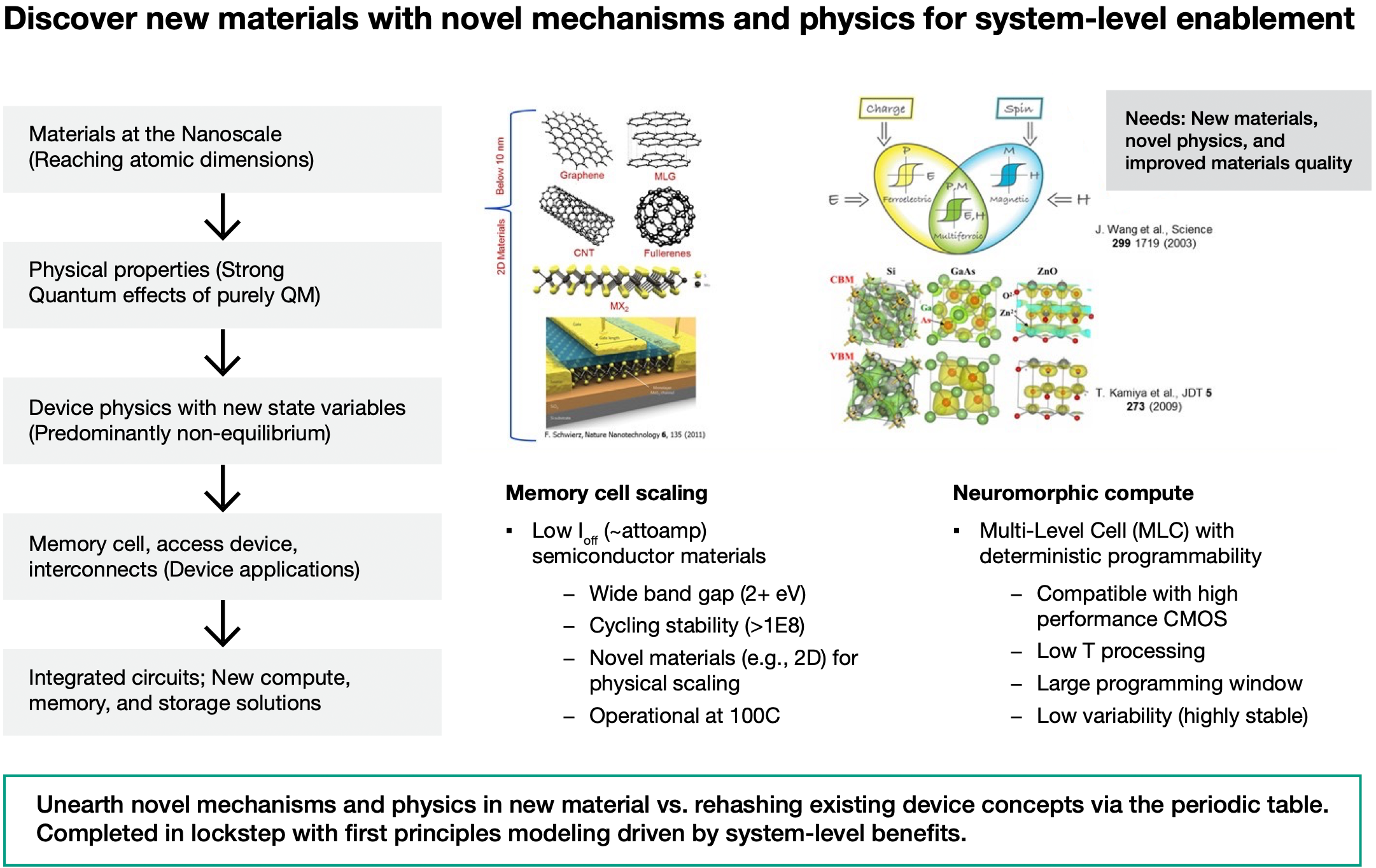

Thirdly, in many cases, innovative types of memory will require brand-new materials, new device structures, manufacturing technologies, and several other things that need heavy investments in fundamental research. Again, coalitions between commercial companies and academia generally represent a more comprehensive approach to basic science than in-house R&D operations. For example, IBM and SUNY Poly jointly conduct next-generation semiconductor R&D.

Fourthly, bringing memory close to compute logic is a significant challenge, so 2.5D and 3D packaging technologies will gain importance in the future. Developing them collaboratively will be beneficial for everyone.

Finally, there are fundamental challenges in developing and producing chips using leading-edge fabrication technologies. Therefore, Micron and Western Digital assert that it is essential to jointly develop simulation (TCAD) and electronic design automation (EDA) tools to speed up the development of next-generation solutions based on new materials, structures, and design. Furthermore, it is vital to accelerate the growth of innovative production equipment technologies, such as EUV mask and wafer patterning solutions, to increase the productivity of EUV tools and new metrology and materials analysis/characterization tools.

Micron and Western Digital expect MCOE to focus on the following activities:

- Advanced 'pre-competitive' R&D for materials, manufacturing technologies, and analysis techniques.

- Memory technologies for memory-centric computing (including in-memory compute, near-memory compute, and analog compute).

- Innovative 3D memory technologies.

- Advanced packaging and stacked memory solutions.

- Heterogeneous integration (functional and/or physical) at wafer and chip level.

- X-point array integrated with advanced CMOS for new concept validation.

- Modeling methodologies and tools for rapid development and co-optimization of complex technologies and systems.

In general, while companies like Micron and Western Digital can come up with proprietary types of memory addressing specific applications (or rather DSAs, as they put it), they want to conduct fundamental R&D as well as production enablement together with other American companies. Therefore, if the NSTC and the MCOE organizations are successful, they will improve the competitive positions of participants and, consequently, the U.S. semiconductor industry in general.

Leading-Edge Memory Fabs Coming to the U.S.

Discovering innovative materials and developing advanced memory technologies in the U.S. is one thing. But bringing memory production to the USA is a different challenge. On Tuesday, Micron announced plans to invest $40 billion in leading-edge memory manufacturing operations in the U.S. by the end of the decade.

"This legislation will enable Micron to grow domestic production of memory from less than 2% to up to 10% of the global market in the next decade, making the U.S. home to the most advanced memory manufacturing and R&D in the world."

Micron did not specify what kind of memory it plans to produce in the USA (e.g., 3D NAND, DRAM, SCM, etc.), but we can speculate that the company will attempt to create premium types of memory in the States.

Meanwhile, over the next seven or eight years, $40 billion invested in fabs could buy Micron one EUV-enabled fab that could produce virtually all types of memory or even a couple of moderate-sized EUV and High-NA EUV-enabled fabrication facilities (though we are speculating). In any case, it looks like Micron is looking forward to bringing leading-edge process technologies to the U.S. in a bid to make advanced and expensive memory devices.

Nowadays, manufacturers in South Korea, Japan, and Singapore use the most advanced memory fabrication processes. Micron plans to reverse this trend.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

_Shatta_AD_ So all I’m getting here is that there’s nothing to benefit the consumers, just more fancy proprietary IP hogging rights and tech that’ll benefit the US military so they can keep threatening and marginalizing the international market to keep these high performance tech unaffordable even by American standards.Reply

Sure, some of these so called bleeding edge tech will trickle down to consumer products and if they ever become affordable, it probably won’t be within our lifetime. -

watzupken Wow, what amazing plans. Build more fabs! You can't go wrong with more right? Or is it?Reply