Nvidia's Revenue Drops as Ada Lovelace Looms and Hopper Enters Production

The party is over for Nvidia as crypto and gaming GPU demand is down.

Nvidia on Wednesday announced its financial results for the second quarter of its fiscal year 2023. The results were a mixed bag as its client PC businesses suffered declines, but its automotive and data center businesses thrived.

Nvidia's gaming, professional graphics, mining, and OEM business segments were down significantly both sequentially and annually, which is why it had to warn investors that it expects slow sales of gaming and ProViz graphics products to persist for a while. Meanwhile, the company said that it plans to talk about its next-generation Ada Lovelace architecture next month but never revealed when actual GeForce RTX 40-series graphics boards will be available.

By contrast, Nvidia's data center and automotive hardware shipments were up significantly compared to the same quarter a year ago. They will be up again in Q3 FY2023 now that the company's Hopper H100 compute GPUs are in total production and ready to ship.

“With respect to Hopper, we are in full production now and we are racing to get Hoppers to all of the CSPs (cloud service providers) who are who are dying to get it,” said Huang. "It goes with our HGXs, which is multiple Hoppers on a on a system tray. It is really a supercomputer on the motherboard, if you will, and it goes along with networking gear and switch gear. There are enormous amounts of resources applied from all of the CSPs around the world and ourselves to to get Hopper to them. We expect to ship a substantial [number of] Hoppers in Q4.”

“We will get through this [inventory correction] over the next few months and go into next year with our new architecture,” said the head of Nvidia. “I look forward to telling you more about it at GTC next month.”

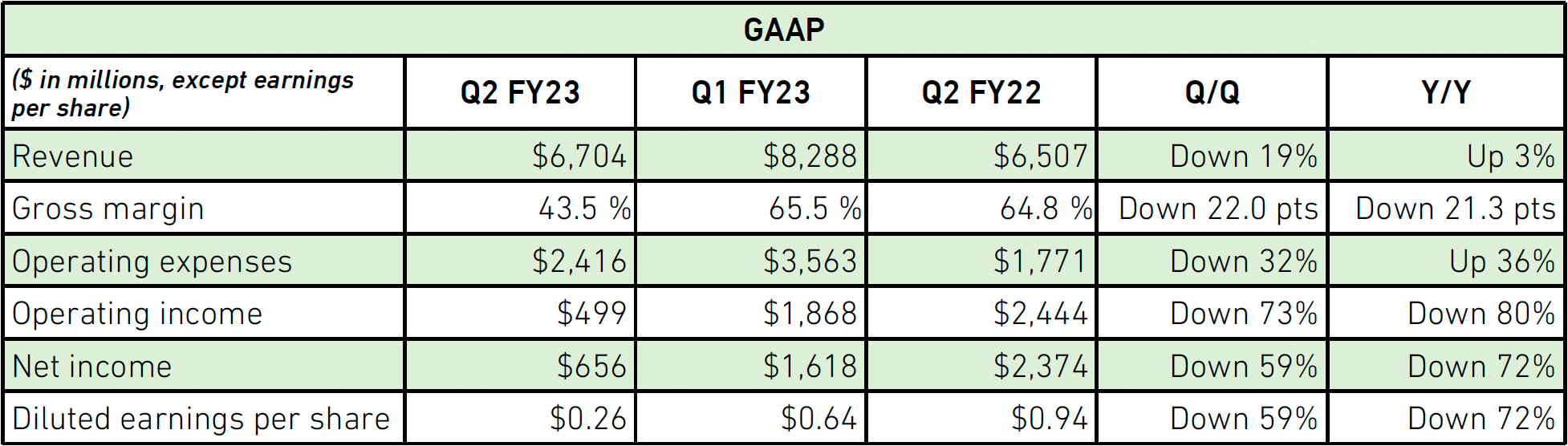

Nvidia revenue for Q2 FY2023 totaled $6.704 billion, down 19% sequentially and up 3% year-over-year. The company's net income dropped to $656 million, down 59% quarter-over-quarter (QoQ) and 72% year-over-year (YoY). In addition, Nvidia's gross margins collapsed to 43.5% from about 65% in recent quarters.

Gaming, ProViz, Mining, and OEM Down

During its second quarter of fiscal 2023, Nvidia encountered multiple challenges, including macroeconomic conditions (inflation and uncertainty among consumers), high inventory levels in the channel (as the company aggressively sold its graphics cards in prior quarters), softening demand from the end user (both because gamers are expecting Ada Lovelace to launch shortly and because of uncertainties), inventory corrections by partners, and lowering prices of graphics cards as a result of softening demand as well as increased supply from both Nvidia and its competitors.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

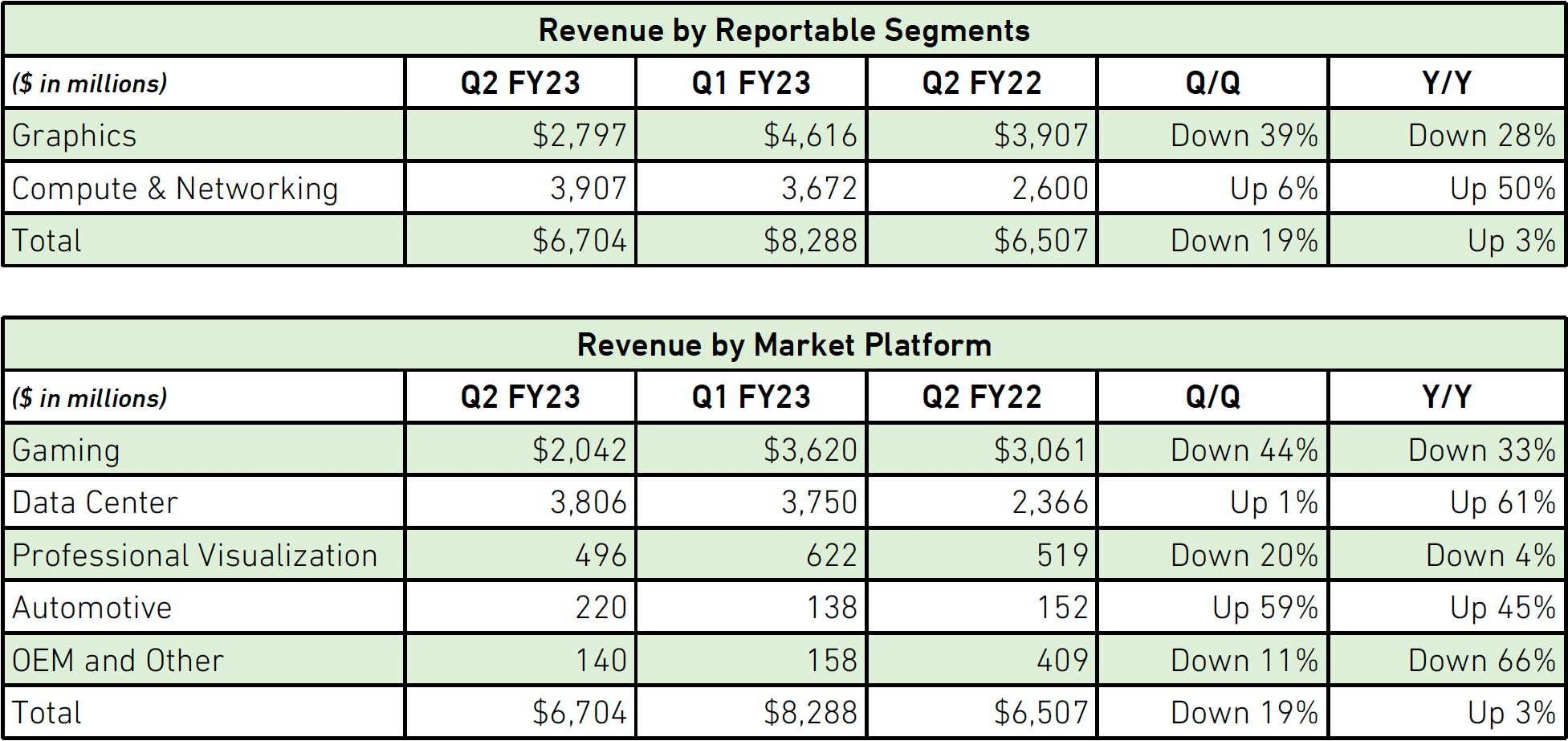

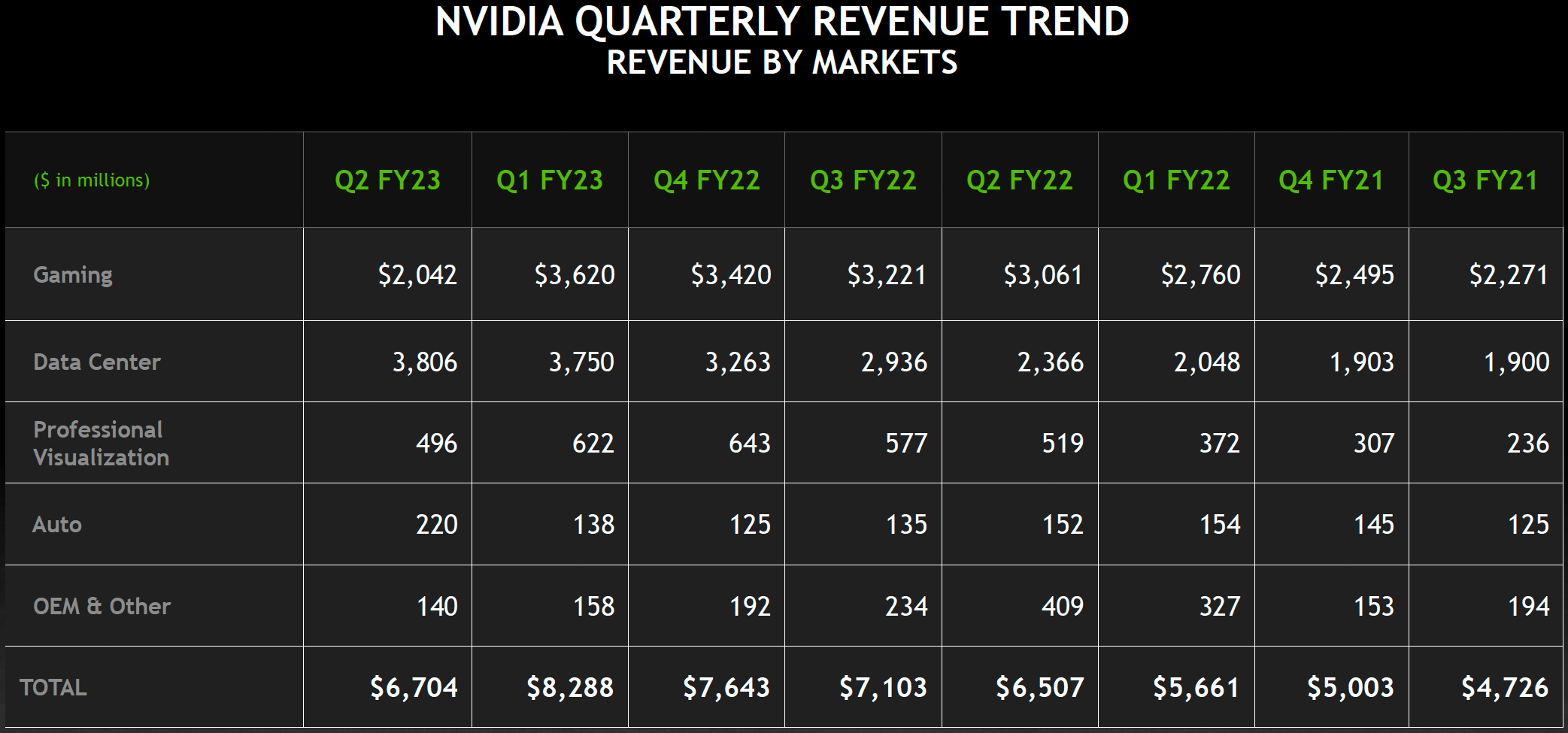

As a result of the challenging environment, Nvidia's gaming revenue dropped to $2.042 billion, down from $3.061 billion in Q2 FY2022 and $3.620 billion in Q1 FY2023.

"These decreases were primarily attributable to lower sell-in of gaming products, reflecting reduced channel partner sales due to macroeconomic headwinds," said Colette Kress, chief financial officer at Nvidia. "In addition to reducing sell-in, we implemented pricing programs with channel partners to address challenging market conditions that are expected to persist into the third quarter."

It should be noted that Nvidia's gaming revenue in Q2 was still significantly higher when compared to the $1.654 billion in the second quarter of the company's FY2021 (~calendar Q2 2020). It indicates that the chip designer benefited greatly from increased demand for discrete GPUs for gaming PCs, increased prices of standalone graphics cards, and the crypto mining craze.

Nvidia sold some $7 billion in graphics processors to partners in Q4 FY2022 and Q1 FY2023. However, it now has to ship fewer GPUs due to lowered market demands, and these will sell at lower prices. Meanwhile, it's preparing to launch its next-generation Ada Lovelace family, which it will describe next month at its GTC event, and needs to clear out existing GPUs.

"We are navigating our supply chain transitions in a challenging macro environment and we will get through this," said Jensen Huang, chief executive of Nvidia.

Nvidia's professional visualization business earned the company $496 million in Q2 FY2023, down 20% quarter-over-quarter and down 4% when compared to the same quarter a year ago. Nonetheless, sales of Nvidia's professional GPUs were up 144% compared to sales of Proviz solutions in the same quarter two years ago.

In recent years, Nvidia's OEM and 'other' businesses (which started to include CMP solutions in early 2021) were never too strong as the company shifted focus to gaming graphics processors. Therefore, it was not particularly unexpected to see Nvidia's OEM revenue total $140 million, down 11% sequentially (because of lower notebook OEM sales) and 66% year-over-year (because of negligible sales of CMP mining GPUs).

Data Center and Automotive Up

But while sales of PC components were down for Nvidia, sales of its parts for data centers and automotive applications were up significantly.

After Nvidia's data center revenue reached $3.806 billion (up 1% QoQ and 61% YoY) in Q2 FY2023, it is safe to say that Nvidia is more of a data center company than a PC gaming company. Meanwhile, the company said it had to delay the delivery of specific data center orders from Q2 to Q3 due to supply chain disruptions. As a result, it could not get the components it needed to ship some of its more complex products (i.e. Hopper H100) while pulling in $287 million for orders initially scheduled for delivery.

While Nvidia has been in the automotive business for quite a while, its automotive unit has never earned a lot as it focused on infotainment systems, so many called it the company's worst-performing business. But in Q2 FY2023, Nvidia's automotive earnings totaled $220 million (and exceeded $200 million for the first time), up 59% sequentially and a 45% increase compared to the same quarter last year. The company expects its automotive business to grow as automakers adopt its Nvidia Drive self-driving and AI cockpit solutions.

Mixed Outlook

Nvidia projects its Q3 FY2023 earnings to be $5.90 billion ±2%, representing a sequential decline of 12% and an annual decline of 17%.

The company expects sales of its gaming and professional graphics processors to decline quarter-over-quarter as its partners are making inventory adjustments while the company is preparing the market for the GeForce RTX 40-series rollout. Speaking of the Ada Lovelace family, it is noteworthy that Nvidia promised to talk about its next-gen GPU architecture at GTC, which takes place from September 19 to September 2022. However, it never revealed its projections about the financial impact of the new family on its earnings this fiscal year.

But while sales of GPUs for PCs may not be impressive this year, Nvidia hopes that its data center and automotive revenues will be up. The company says its next-generation H100 (Hopper) compute GPU is now in full production. It will be able to ship its expensive SXM modules to its data center partners and pricey DGX systems to those who need an out-of-box supercomputer.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

jp7189 “We will get through this over the next few months and go into next year with our new architecture,”Reply

Does this indicate they will be holding Lovelace back until 2023? -

warezme I don't think they will hold back LoveLace and just vague or non specific statements meant to quell the fears of investors. It's not really in their best interest to hold back LoveLace since the boom of sales of the new GPU will improve their earnings as opposed to the continued drop. But you never know. I for one will wait for the 4000 series, regardless of how cheap the 3000's are.Reply -

Jimbojan Based on NVDA's own projection, its data center business is going to go down next quarter, it is not clear its future quarter business will grow either when Intel has its Sapphire Rapids and future generation to go into the market. Intel has already said its products are performing better than both AMD and NVDA's product; besides, Intel has already announced it Ponte Vecchio GPU for server is out, a strong competition to NVDA's Lovelace GPU. Because it is a tile architecture, it is cheaper to make, albeit it requires more equipment to assemble the tiles together. It will be interest to see how the GPU market to play out in the future when Intel push its dGPU into the market, with Intel’s low-price strategy to gain market share, both AMD and NVDA will be affected.Reply -

bigdragon Nvidia took full advantage of that seller's market fueled by crypto and scalpers. I don't think they've adjusted to the buyer's market yet. Overpriced 30-series cards are clogging up shelves and stockrooms here. Comical seeing companies like Asus and MSI advertise $100 off MSRP, yet the selling price is still above the Nvidia founders' edition MSRP. Nvidia's revenue is still healthy, and 40-something percent margins seem really high to me.Reply

I expect gamers to keep holding out for better deals. There aren't any big games releasing in the next 6 months. Best to wait until 2023 to think about that graphics upgrade. Nvidia made everyone -- except the streamers and influencers -- wait 2 years. I think 6 more months is no big deal. -

JarredWaltonGPU Reply

No. Elsewhere, Jensen says they'll reveal the next generation Ada architecture next month, on September 20. Most likely the hardware will launch by early October, though I suspect it will only be the 4080 and up launching this year. Maybe 4070 will launch by December, but I don't expect an RTX 4060 until 2023 sometime, and probably RTX 4050 won't come out until late 2023.jp7189 said:“We will get through this over the next few months and go into next year with our new architecture,”

Does this indicate they will be holding Lovelace back until 2023? -

jp7189 Reply

That's good. I'm really excited to see how RDNA3 works out and how the battle plays out at the top end.JarredWaltonGPU said:No. Elsewhere, Jensen says they'll reveal the next generation Ada architecture next month, on September 20. Most likely the hardware will launch by early October, though I suspect it will only be the 4080 and up launching this year. Maybe 4070 will launch by December, but I don't expect an RTX 4060 until 2023 sometime, and probably RTX 4050 won't come out until late 2023. -

spongiemaster Reply

Isn't September 20th his GTC keynote? Why would Nvidia launch a gaming GPU there? GTC is an AI conference and the title of his keynote is "AI strategy for Business Leaders." That doesn't sound very Geforcey. Any architecture he talks about is likely to be more on Hopper. Nvidia doesn't like sharing the spotlight with others when announcing new Geforce generations. They're likely to pick their own day outside of any major conference to announce Ada.JarredWaltonGPU said:No. Elsewhere, Jensen says they'll reveal the next generation Ada architecture next month, on September 20. Most likely the hardware will launch by early October, though I suspect it will only be the 4080 and up launching this year. Maybe 4070 will launch by December, but I don't expect an RTX 4060 until 2023 sometime, and probably RTX 4050 won't come out until late 2023. -

spongiemaster Are these articles written in a language other than English and then run through Google translate for the English site without proofreading before publishing? This is one paragraph from the article:Reply

“With respect to Hopper, we are in full production now and we are racing to get Hoppers to all of the CSPs (cloud service providers) who are who are dying to get it,” said Huang. It goes with our HGXs, which is multiple Hoppers on a on a system tray. It is really a supercomputer on the in the motherboard if you will and it goes along with networking gear and switch gear. There are enormous amounts of resources applied from all of the CSP’s around the world and ourselves to to get Hopper to them. We expect to ship substantial Hoppers in Q4.”

How is it possible someone proofread this article and missed every one of those mistakes in just one paragraph? -

JarredWaltonGPU Reply

I believe Anton used a transcription of what Jensen said, and whoever edited it didn't fix things that were off. If you've ever heard Jensen talk, he'll often repeat phrases or stop mid-sentence and then restart. But I'll go proof it now and give it a proper edit...spongiemaster said:Are these articles written in a language other than English and then run through Google translate for the English site without proofreading before publishing? This is one paragraph from the article:

How is it possible someone proofread this article and missed every one of those mistakes in just one paragraph?

(And Anton's not a native English speaker, or at least that's not his first language. More like... third? I know he speaks Russian fluently, and he's from Estonia.)

Isn't September 20th his GTC keynote? Why would Nvidia launch a gaming GPU there? GTC is an AI conference and the title of his keynote is "AI strategy for Business Leaders." That doesn't sound very Geforcey. Any architecture he talks about is likely to be more on Hopper. Nvidia doesn't like sharing the spotlight with others when announcing new Geforce generations. They're likely to pick their own day outside of any major conference to announce Ada.

Nvidia has launched GPUs at various events over the years, and if Ada starts at the extreme performance end of the spectrum and also targets ProViz (similar to RTX 3090/3090 Ti), it's not a terrible venue to do so. Plus, Jensen explicitly stated, "We will get through this over the next few months and go into next year with our new architecture. I look forward to telling you more about it at GTC next month." Since he had just talked about Hopper H100, and we already know a lot about H100, he's obviously referring to Ada. -

spongiemaster Reply

You're predicting game benchmarks and Ada launch lineup announcement at GTC? I'd be willing to bet money that's not going to happen. He could announce the Ada architecture and how it performs in AI, but that would be largely irrelevant to gamers. I don't see a 4090 being announced either as that would steal pretty much all the thunder from a future announcement for gamers. Maybe they announce the briefly rumored 48GB monster as a Titan for professionals in the same vein as the Titan V CEO Edition that had no relevance to gamers due to cost and Volta never getting proper DX drivers for games.JarredWaltonGPU said:Nvidia has launched GPUs at various events over the years, and if Ada starts at the extreme performance end of the spectrum and also targets ProViz (similar to RTX 3090/3090 Ti), it's not a terrible venue to do so. Plus, Jensen explicitly stated, "We will get through this over the next few months and go into next year with our new architecture. I look forward to telling you more about it at GTC next month." Since he had just talked about Hopper H100, and we already know a lot about H100, he's obviously referring to Ada.