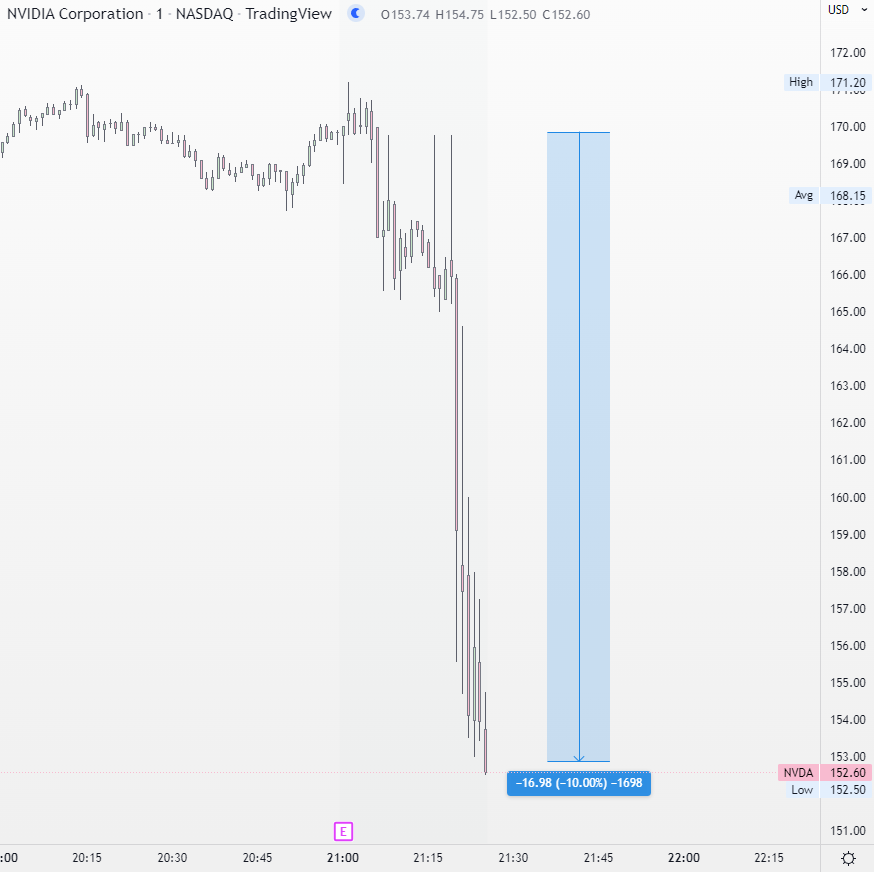

Nvidia Stock Plunges, Q2 Revenue Outlook Below Expectations

Dropping 10% after-hours, despite strong 1Q results.

Nvidia stock took a beating in after-hours trading on Thursday, after the company shared [PDF] its Q1 results and guidance for Q2 expectations. Investors were seemingly not happy with 4% lower than expected revenue for 2Q ($8.1 billion); $500 million of which Nvidia attributed to the Russian-Ukranian conflict and COVID-19 lockdowns in China.

Perhaps more telling, however, is the reduction in Nvidia's CMP (Cryptocurrency Mining Processor) cards' revenue, which the company introduced into the market as a way to lure cryptocurrency miners away from gaming-oriented GeForce cards.

Following the downturn in the cryptocurrency market and macroeconomic / geopolitical events, alongside increasing odds of Ethereum's Merge event, revenue from CMP cards has been declining at a breakneck pace, showcasing the fickleness of blockchain-related demand. From $266 million in Q2 2021, CMP revenues declined to $105 million in Q3, ending in a comparatively measly $24 million for Q4 2021, further falling in Q1 2022 towards an unspecified, "nominal" value, according to Nvidia. As per usual, Nvidia states that it can't accurately forecast how much of its gaming GPU revenue comes from cryptomining.

The stock fall happened despite strong QoQ (quarter-over-quarter) results for the green giant. Buoyed by its bread and butter markets, Nvidia posted an 8% increase in quarterly growth for 1Q2022 alongside a 3% increase in earnings per share to $1.36 compared to Q4 2021.

Nvidia's gaming segment registered an impressive 31% growth YoY - which the company even gloated about, claiming gamers were spending $300 more on new GPU technology, on average. But considering the ongoing back and fort between Nvidia's Lite Hash Rate limiter and several circumventions developed by mining-focused software providers, investors must be cautious - there's no way to know exactly what percentage of Nvidia's gaming growth is still attributable to cryptocurrency mining.

Investors apparently weren't swayed by the company's ongoing, $15 billion share buyback program, which will run through 2023.

Nvidia shares are down an incredible 50% YoY from their ATH of $326 in November 2021, following the worldwide economic turmoil following the COVID-19 pandemic, Russia's invasion of Ukraine, and rising inflation rates across the world prompting fears of an economic recession. They're not the only company in this state - most tech stocks have taken a beating as investors look more towards operating profits rather than speculative bets on companies' future value.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

sizzling It things like this that support my concern the 4000 series MSRP will be eye watering. Shareholders do not care if there were unusual circumstances for lasts years high performance, the next year must be higher.Reply -

2Be_or_Not2Be Replysizzling said:It things like this that support my concern the 4000 series MSRP will be eye watering. Shareholders do not care if there were unusual circumstances for lasts years high performance, the next year must be higher.

Average selling price went too high in the last two years, both from pandemic buying and by cryptominers sucking up supply. Now that they (both Nvidia and AMD) see they can sell GPUs at the much higher MSRPs, they have no financial incentive to reduce pricing, even if supply catches up fully to the demand. I think Nvidia will accept a glut on the market before selling 4000-series cheaper than what the 3000-series go for now at its elevated pricing.

The days of getting a decent high-end for $500 are over, and have been over for years now. We're still hoping, but hope has been getting punched in the face too many times. -

sizzling Reply

Yes, that’s similar to my thinking2Be_or_Not2Be said:Average selling price went too high in the last two years, both from pandemic buying and by cryptominers sucking up supply. Now that they (both Nvidia and AMD) see they can sell GPUs at the much higher MSRPs, they have no financial incentive to reduce pricing, even if supply catches up fully to the demand. I think Nvidia will accept a glut on the market before selling 4000-series cheaper than what the 3000-series go for now at its elevated pricing.

The days of getting a decent high-end for $500 are over, and have been over for years now. We're still hoping, but hope has been getting punched in the face too many times. -

bigdragon I think Nvidia is about to get caught between the crypto collapse, inflation, and lack of graphically-demanding new games. I'm sure they want to price the RTX 40-series higher, but consumers may not allow it. I think gamers are getting pinched by food and fuel and a lack of content, so they're not going to be available to pick up the demand void left by the crypto miners. Investors need to be extra cautious. If miners start dumping their cards onto the resale market then things could get extra messy. Huge risk.Reply -

Jimbojan Reply

The speculators are buying into it, but it is hard to justify the high PE ratio as some suggested.Admin said:Nvidia stocks fell by 10% in after-hours trading after the company outlined its Q1 results and reduced expectations for Q2.

Nvidia Stock Plunges, Q2 Revenue Outlook Below Expectations : Read more -

Eximo That is why I think they will keep their prices high. They will get the enthusiasts who want the latest thing and will pay any price vs trying to outcompete the used market full of 30 series cards. The question is whether they bought enough fab time to meet the expected demand and if they ended 30 series production at the right time. If they over produce they might not have an option but to reduce prices, or you'll end up with what happened last time to the AIBs. They were forced to buy and produce older 10 series cards when 20 series were failing to sell. It was that or get no chips for the new cards.Reply -

PEnns Well, that's horrible!!Reply

I mean if you can't depend on scalpers and other shady partners to quadruple the MSRP, who can you depend on these day!!

My heart aches for poor nGridia. -

InvalidError Reply

I would like to believe GPU pricing has gone off the rails and is only prevented from collapsing by crypto-mining slowly winding down. We'll see when the crypto-GPU sell-off happens with ETH going PoS.bigdragon said:I think Nvidia is about to get caught between the crypto collapse, inflation, and lack of graphically-demanding new games. I'm sure they want to price the RTX 40-series higher, but consumers may not allow it. -

watzupken Nvidia stock prices have increased significantly over the last couple of years due to pandemic lockdown and mining demand surge. Even with a 10% crash, they are still in a good place. Furthermore, people are very forgetful. So after some time, I will not be surprised that the share prices will start creeping up again.Reply