TrendForce Report: Chip Foundries Face Wave of Order Cancellations

While the pace of new chip plants opening forges ahead.

Semiconductor-focused market research company TrendForce has published an interesting report featuring observations about a "wave of order cancellations" facing chip foundries. The spectre of recession has been looming for some months, so this isn't a great surprise, but TrendForce shares some information about the actual chip foundry cancellations it is seeing now, and what it expects to see happen as we journey to the New Year.

So far this year, chip foundries have managed cancellations by adjusting and reallocating their output, says the source. The first wave of cancellations largely affected semiconductor products such as large-size Driver IC and TDDI (touch screen controllers), but that allowed reallocation of resources to ease shortages of other components. More recently cancellations have begun to roll in for PMIC (Power Management IC), CIS (CMOS Image Sensor), certain MCU (Micro Control Unit) and SoC (System on Chip) orders. Some of these were previously in short supply.

So, foundries previously managed to keep facilities running at full utilization through smartly managing its output. Now, as the option to pivot to products in short supply ends, they are starting to feel the impact, and cancellations have continued to accelerate.

No Evidence of PC CPU and GPU Order Cancellations

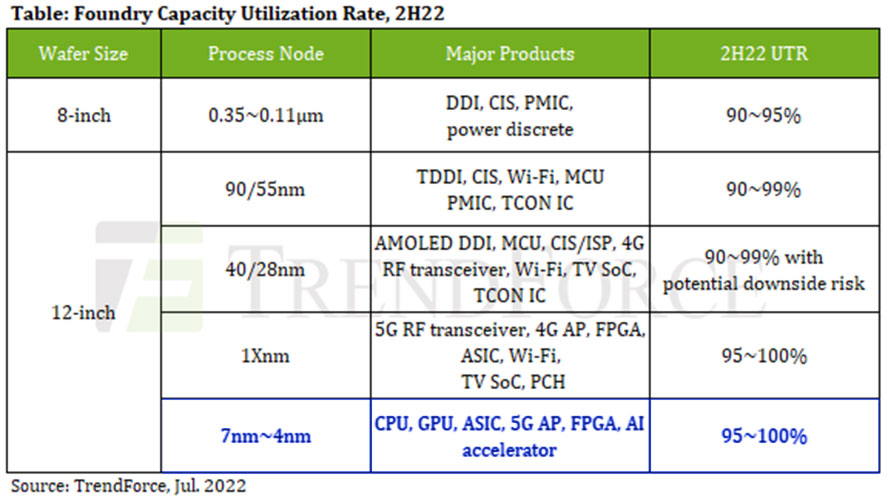

TrendForce predicts the wave of cancellations could hit the PC market in H2, warning that "not even the advanced 7/6nm processes are immune" to these order cancellations.

Specifically, with regard to foundries advanced processes, like 7/6nm, TrendForce reckons we will only see a marginal decline in capacity utilization. Such production lines will run at 95~99% capacity in H2 this year, it reckons. Product mix reallocation will help stem losses and maintain capacity utilization.

For the most advanced processes, TrendForce still sees a positive outlook. It reports that "5/4nm processes will remain near full load, driven by several new products."

If we weigh up the above, it isn't too worrisome for PC enthusiasts looking forward to the latest and greatest new components in H2 2022. Yes, some foundries might be running lines that are underutilized, but it seems like the most advanced processes still have full order books.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The above H2 2022 predictions give us hope that new CPU and GPU orders aren't being scaled back at this time, for example. With the crypto crash there have been worries about the likes of AMD and Nvidia cutting next gen GPU orders, as they are expecting fewer buyers, and perhaps lower average selling prices. But with TrendForce still seeing the most advanced processes still fully booked, there is no evidence of Radeon RX 7000 GPU family, of Ryzen 7000 CPU family, or of GeForce RTX 40 GPU family production cuts.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

Why the surprise. It was obvious, at some point the demand will lower. Shouldn't the people on high positions be aware not to overdevelop due to short bursts of demand?Reply

-

LastStanding In my opinion, this proves the birth of 2020 hysterical so-called "chip shortage" fearmongering nonsense was one of the biggest hoaxes in our lifetime that unexpectedly went bad for the suits instead.Reply

And most consumers would expect that these inevitable failures should benefit the growth of the secure parts for Sony's PlayStation 5 and MS's Series line, but noOOoo, these platform holders are still allegedly claiming that they are still having heavy supply issues. 😏 -

magbarn Reply

I'm sensing the same thing with automakers. I don't understand why they continue to produce less than pre pandemic and continue to claim chip shortages. Methinks they're purposely doing it to keep ASP artificially high and load up their dealers with cash.LastStanding said:In my opinion, this proves the birth of 2020 hysterical so-called "chip shortage" fearmongering nonsense was one of the biggest hoaxes in our lifetime that unexpectedly went bad for the suits instead.

And most consumers would expect that these inevitable failures should benefit the growth of the secure parts for Sony's PlayStation 5 and MS's Series line, but noOOoo, these platform holders are still allegedly claiming that they are still having heavy supply issues. 😏 -

InvalidError Reply

There was a shortage across a good chunk of the chipmaking industry back in 2019 before the whole COVID thing started and 2.5 years of COVID + crypto heavily distorted the market. While it is easy to blame them after-the-fact, they still had to so something. The question is: how much did the COVID+crypto mirage cause them to overbuild by?tommo1982 said:Why the surprise. It was obvious, at some point the demand will lower. Shouldn't the people on high positions be aware not to overdevelop due to short bursts of demand?

Car manufacturers dropped their chip orders due to the COVID market downturn, then couldn't order more chips when the market picked back up because all wafer allocations went into GPUs, consoles, PCs and other stuff that had a COVID and crypto demand surge.magbarn said:I'm sensing the same thing with automakers. I don't understand why they continue to produce less than pre pandemic and continue to claim chip shortages. Methinks they're purposely doing it to keep ASP artificially high and load up their dealers with cash.

Since it takes several months to go from booking wafers to actually getting chips, we're looking at 6+ months between cancelled AMD/Nvidia/Apple/etc. wafers getting handed over to automotive chip manufacturers and turned into something car manufacturers can use. It is about six months too early to cook up conspiracy theories. -

BillM12 The car mfgs caused their own issues with a knee jerk reaction to lower sales early in pandemic without considering how much the cubic volume of inventory if they purchased the brains and sensors to their cars/trucks. Not much room to store and they did not realize that semiconductor market and IC suppliers are very different from tires, batteries, etc markets and suppliers. Execs should be fired for overlooking this and making assumptionsReply

But the over ordering and then canceling has been an issues since the 70/80's that caused major financial issues within semi industry. It appears they are being thrown back into financial oscillations -

They should’ve never listened to Financial types and then vertically integrated and that way they can make everything that they need just like Tesla does and just like Toyota does. Toyota owns their suppliers. When you’re an auto maker you need to make everything yourself because if you don’t manufacture it you don’t understand it and you can’t innovateReply

Tesla has no issues producing cars they don’t are not affected by this silly shortage -

Giroro ReplyMandark said:They should’ve never listened to Financial types and then vertically integrated and that way they can make everything that they need just like Tesla does and just like Toyota does. Toyota owns their suppliers. When you’re an auto maker you need to make everything yourself because if you don’t manufacture it you don’t understand it and you can’t innovate

Tesla has no issues producing cars they don’t are not affected by this silly shortage

Keep in mind the chips that car makers were having trouble getting were primarily for their worthless, poorly designed, tochscreen-nightamre "infotainment" systems. Most of the chips in a car are automotive grade jelly beans that are not made on a modern process, so they were mostly unaffected by the surge in demand for PC parts. They always had the option to just use a normal radio as standard instead, but then they couldn't charge you $3k for a low-res resistive touchscreen with less functionality than an iPod Touch.

But some things to keep in mind about Tesla:

The driving systems of their cars are completely dependent on AMD/Nvidia chips. They can't even show the speedometer without a high powered GPU.

Tesla's value is as a tech company, not an auto manufacturer. The big car manufacturers usually make more cars in a year than Tesla has made in their entire existence. Tesla's high market cap is based on IP, not their ability to make cars.

Tesla was absolutely affected by the shortage (see the repeatedly delayed CYBERTRUCK), they just needed FAR fewer chips due to their relatively low volume production.

Tesla is hitting their "2 year threshold" for their Chinese factories, meaning all IP that they've built in that country has been reverse engineered/stolen, and soon will be openly available in knockoff products - probably by the end of this year. -

InvalidError Reply

In case you haven't noticed, practically all newer cars are using much fancier electronics than they used to. Lots of newer models come with advanced driver assist features that require lots of extra and relatively advanced chips that were hit by shortages and were part of the reason why Tesla had to go optical-only navigation for its FSD attempt. EVs need truckloads of BMS components that compete with everything else using rechargeable lithium cells, which contributed to battery pack shortages which forced many manufacturers to cut back on vehicle orders and new launches.Giroro said:Most of the chips in a car are automotive grade jelly beans that are not made on a modern process, so they were mostly unaffected by the surge in demand for PC parts.

As far as the "features on crappy resistive touch screen" are concerned, you will be tossing your phone every 2-5 years and replace it with another one in the $20-1500 range, so it doesn't matter too much if it becomes an unusable crashy slow mess for the convenience of being able to do a bunch of not really necessary things right now. Your $40 000+ car's main UI though needs to survive the car's 10-20 years useful life, especially if dedicated physical controls get replaced with screen-based ones. I'm fine with my car's control interface having limited ability to run apps and non-essential crap on a resistive display if it means it will work reliably under all circumstances within reason for the next 15+ years. -

Reply

No they are not completely reliant on anybody they make their own chips they don’t buy AMD or Nvidia anymore. You are way behind the times on your information as things are changing at the speed of lightGiroro said:Keep in mind the chips that car makers were having trouble getting were primarily for their worthless, poorly designed, tochscreen-nightamre "infotainment" systems. Most of the chips in a car are automotive grade jelly beans that are not made on a modern process, so they were mostly unaffected by the surge in demand for PC parts. They always had the option to just use a normal radio as standard instead, but then they couldn't charge you $3k for a low-res resistive touchscreen with less functionality than an iPod Touch.

But some things to keep in mind about Tesla:

The driving systems of their cars are completely dependent on AMD/Nvidia chips. They can't even show the speedometer without a high powered GPU.

Tesla's value is as a tech company, not an auto manufacturer. The big car manufacturers usually make more cars in a year than Tesla has made in their entire existence. Tesla's high market cap is based on IP, not their ability to make cars.

Tesla was absolutely affected by the shortage (see the repeatedly delayed CYBERTRUCK), they just needed FAR fewer chips due to their relatively low volume production.

Tesla is hitting their "2 year threshold" for their Chinese factories, meaning all IP that they've built in that country has been reverse engineered/stolen, and soon will be openly available in knockoff products - probably by the end of this year.

Also

https://www.forbes.com/sites/arielcohen/2021/09/22/tesla-flexes-innovative-muscle-by-manufacturing-own-chips-during-supply-crunch/?sh=7df2573a1618