IDC: VR, AR Headset Sales Are Down, But Don't Panic

International Data Corporation (IDC) this week released its Worldwide Quarterly Augmented and Virtual Reality Headset Tracker, and the results paint a grim picture of the current state of the market. But don't fret--the report also points to a booming future.

According to IDC’s research, first quarter shipments of AR and VR headsets plunged by as much as 30.5% year-over-year between 2017 and 2018. The company estimates that a mere 1.2 million AR and VR headsets shipped in Q1 18, which is a paltry number for a market with more than a dozen headsets to choose from.

On their face, those figures put the immersive headset market in a damning light. However, if you dig into the factors that caused the decline in shipment volume, it becomes clear that the decline isn’t necessarily indicative of a decrease in market demand for AR and VR headsets. As counter-intuitive as it may seem, it also doesn’t necessarily mean that actual sales of these immersive headsets are down, either.

IDC noted that the reduction in unit shipments is largely because headset makers are no longer giving their products away for free. Samsung offered free Gear VR headsets with its smartphones for two years in a row, but it no longer offers those bundles. Promotions that offer free Google Cardboard handheld VR viewers, such as the New York Times’ scheme to give headsets to a million subscribers, are also a thing of the past. IDC’s report also indicated that demand for such devices would continue to decline until they are phased out of the market. The company expects that affordable portable devices, such as the Oculus Go headset, would supplant the smartphone-based devices we’re used to.

"On the VR front, devices such as the Oculus Go seem promising not because Facebook has solved all the issues surrounding VR, but rather because they are helping to set customer expectations for VR headsets in the future," said Jitesh Ubrani, senior research analyst for IDC Mobile Device Trackers. “Looking ahead, consumers can expect easier-to-use devices at lower price points. Combine that with a growing lineup of content from game makers, Hollywood studios, and even vocational training institutions, and we see a brighter future for the adoption of virtual reality."

GPU Prices Stunted VR Adoption

The AR and VR headset market is also stuck between a rock and a hard place that is limiting its growth potential. PC-connected VR headsets offer the best VR experience that you can get right now, but those experiences come at a high cost: not just for the headsets themselves, but also for the computer system required to drive the experiences. VR headsets demand high-performance GPUs, which, you may recall, were in ultra-high demand for most of 2017 and well into 2018. Graphics card prices are now settling, but last year’s inflated prices would have impacted the purchasing power of many would-be VR adopters.

Tethered AR devices aren’t as prevalent or popular as VR devices, so it’s unlikely the GPU market affected AR headset shipments in the same way.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

A Saturation Point?

It’s also worth noting that the declining shipment volume could be an indication of early adopter saturation. The Oculus Rift and HTC Vive hit the market in spring 2016, which means consumers had nearly two years to purchase a headset. The most enthusiastic early adopters made their purchase in the first few months, and by holiday season 2017, most people who were interested in VR on day one had probably already pulled the trigger by then. Consumer product sales are also usually slow in the first quarter of the year, and now many people have VR headsets in their homes. Not to mention, the reveal of HTC’s Vive Pro surely caused many people to defer purchasing a Vive headset until the new model's debut.

The Worst Is Behind Us

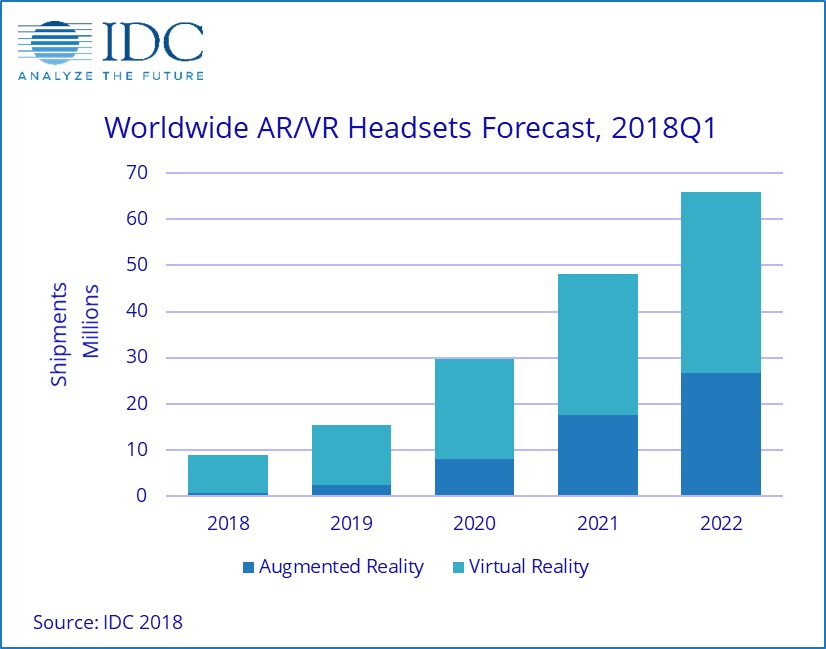

Despite the slow start to the year, IDC gives the future of the immersive headset market a positive outlook. The research firm expects that headset shipments should pick up later this year, and it expects growth to continue at a rapid rate for the next several years.

IDC believes that the enterprise market will have a major impact on AR and VR headset shipments volumes in the coming years. This year, corporate entities are on track to purchase 24% of the units shipped in 2018. By 2020, IDC believes that figure would be closer to 44% of the immersive headset market. In that period, IDC estimates the total number of devices shipped to rise from the current estimated 8.1 million units this year to a total of 39 million units.

"Momentum around augmented reality continues to grow as more companies enter the space and begin the work necessary to create the software and services that will drive AR hardware," said Tom Mainelli, program vice president, Devices and Augmented and Virtual Reality at IDC. "Industry watchers are eager to see new headsets ship from the likes of Magic Leap, Microsoft, and others. But for those devices to fulfill their promise we need developers creating the next-generation of applications that will drive new experiences on both the consumer and commercial sides of the market."

IDC also believes that Dell, HP, and Lenovo, which have long histories of supplying computer hardware to large companies, would facilitate the adoption of immersive devices at the enterprise level.

IDC’s report also indicates that the type of headset dominating the market would change. The company believes that by the end of 2018, 34.5% of AR and VR headsets would be screenless VR viewers such as Google Cardboard, Google Daydream, and Samsung Gear VR, 42.4% would be tethered VR devices such as Oculus Rift and HTC Vive, and 14.8% would be standalone VR headsets. Screenless, standalone, and tethered AR devices share the remaining 8.2%.

However, the firm estimates that by 2020, standalone AR and VR devices should hold 21.1% and 33% of the AR and VR headset market, respectively. IDC also expects tethered AR devices to gain double digit market share, whereas tethered VR devices would decline to 21.8% of the market.

| AR/VR Headset Market Share by Form Factor, 2018 – 2022 | |||

|---|---|---|---|

| Technology | Form Factor | 2018* | 2022* |

| Augmented Reality | Screenless Viewer | 5.00% | 1.00% |

| Row 2 - Cell 0 | Standalone HMD | 2.20% | 21.10% |

| Row 3 - Cell 0 | Tethered HMD | 1.00% | 18.40% |

| Virtual Reality | Screenless Viewer | 34.50% | 4.60% |

| Row 5 - Cell 0 | Standalone HMD | 14.80% | 33.00% |

| Row 6 - Cell 0 | Tethered HMD | 42.50% | 21.80% |

| Total | Row 7 - Cell 1 | 100.00% | 100.00% |

| Source: IDC Worldwide Quarterly AR and VR Headset Tracker, June 19, 2018 |

Kevin Carbotte is a contributing writer for Tom's Hardware who primarily covers VR and AR hardware. He has been writing for us for more than four years.

-

bit_user Even though I'm a believer in AR and VR, and I think most of us would probably agree it'll happen eventually, I'm a bit skeptical of these numbers.Reply

I want to know their basis for them. Also, how conservative are these estimates? What's their confidence in them? Please convince us it's not just wishful thinking.