AMD takes market share from Intel in server, desktop, and notebooks — new Mercury Research data shows Q4 2023 data

4th Gen EPYC and Ryzen 7000 series processors have been a winning combo.

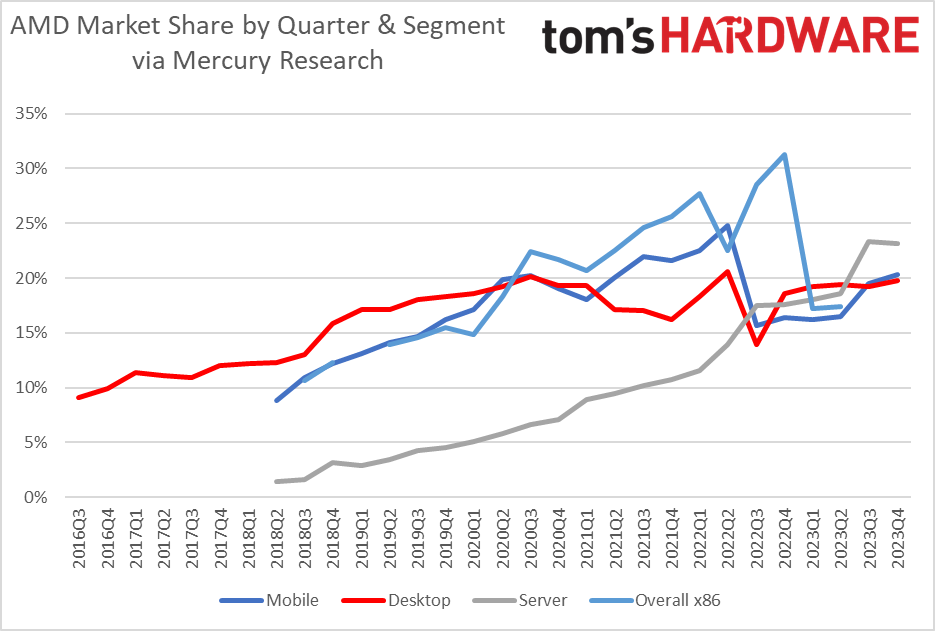

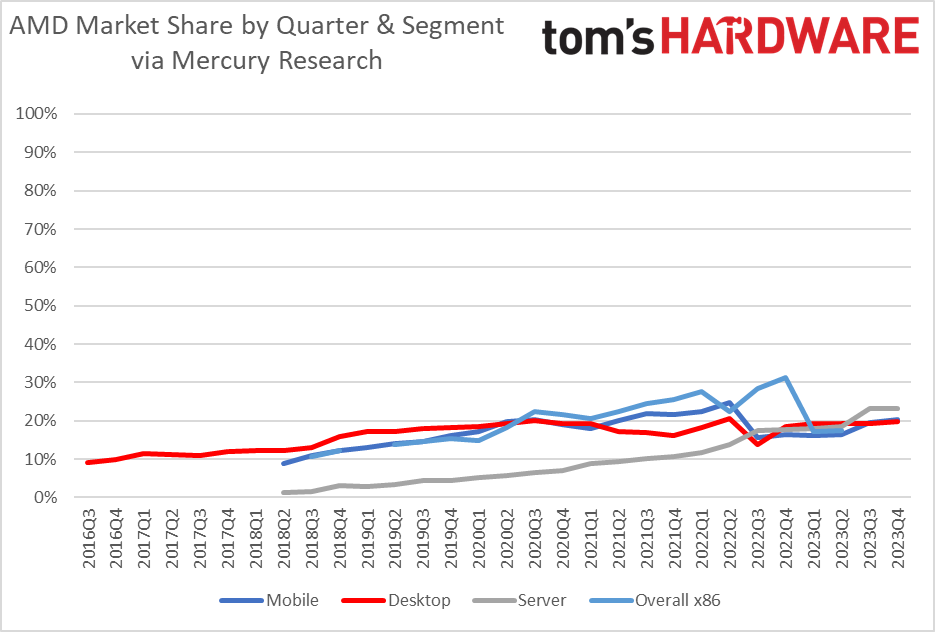

Strong green shoots of recovery have been seen in the computing and semiconductor markets, and new data from Mercury Research makes it clear that AMD is going to be one of the major beneficiaries. “AMD gained significant server, desktop, and notebook revenue share year-on-year,” noted AMD in an email that shared data from Mercury Research. AMD’s unit share figures were positive, too. Solid demand for both 4th Gen EPYC and Ryzen 7000 series processors have been behind AMD’s apparent success, asserts the market research outfit.

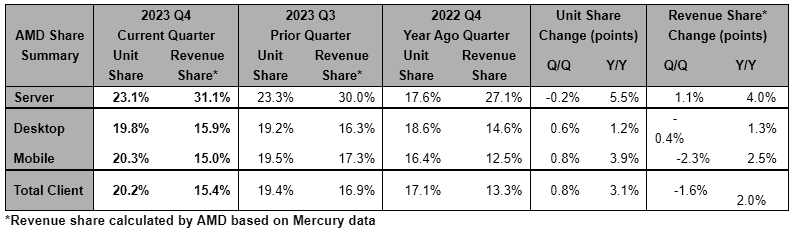

Desktop PC, Mobile, Client Revenue / Unit Share

Starting with the client side of the business, Mercury’s figures show AMD’s revenue share increased 2.0% YoY, and its unit share increased 3.1% YoY to 15.4% and 20.1%, respectively. Those who keep a close eye on the PC market will know that the client PC market was somewhat challenging through most of 2023. However, reports from various segments, such as the once-troubled memory makers, are making it clear that there is a lot of optimism for 2024.

Remember, 2024 is said to be the year of the AI PC; among other things happening this year, we could see Windows 12 arrive. If that happens, Microsoft will spur upgraders to buy new systems or processors with NPUs on board, and at least 16GB of RAM may be required for some features. Some of those expected events are not set in stone at the time of writing, but it is looking positive for the PC business.

| Row 0 - Cell 0 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 1Q18 | 4Q17 | 3Q17 | 2Q17 | 1Q17 | 4Q16 | 3Q16 |

| AMD Desktop Unit Share | 19.8% | 19.2% | 19.4% | 19.2% | 18.6% | 13.9% | 20.5% | 18.3% | 16.2% | 17.0% | 17.1% | 19.3% | 19.3% | 20.1% | 19.2% | 18.6% | 18.3% | 18% | 17.1% | 17.1% | 15.8% | 13% | 12.3% | 12.2% | 12.0% | 10.9% | 11.1% | 11.4% | 9.9% | 9.1% |

| Quarter over Quarter / Year over Year (pp) | +0.6 / +1.2 | -0.2 / +0.5 | +0.1 / -1.02 | +0.6 / +0.9 | +4.7 / +2.4 | -6.6 / -3.1 | +2.2 / +3.4 | +2.1 / -1.0 | -0.8 / -3.1 | -0.1 / -3.1 | -2.3 / -2.1 | +0.1 / +0.7 | -0.8 / +1.0 | +0.9 / +2.1 | +0.6 / +2.1 | +0.3 / +1.5 | +0.3 / +2.4 | +0.9 / +5 | Flat / +4.8 | +1.3 / +4.9 | +2.8 / +3.8 | +0.7 / +2.1 | +0.1 / +1.2 | +0.2 / +0.8 | +1.1 / +2.1 | -0.2 / +1.8 | -0.3 / - | +1.5 / - | +0.8 / - | - |

| Row 0 - Cell 0 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | Q419 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 |

| AMD Mobile Unit Share | 20.3% | 19.5% | 16.5% | 16.2% | 16.4% | 15.7% | 24.8% | 22.5% | 21.6% | 22.0% | 20.0% | 18.0% | 19% | 20.2% | 19.9% | 17.1% | 16.2% | 14.7% | 14.1% | 13.1% | 12.2% | 10.9% | 8.8% |

| Quarter over Quarter / Year over Year (pp) | 0.8 / 3.9 | 2.9 / 3.8 | 0.3 / -8.3 | -0.2 / -6.3 | +0.8 / -5.1 | -9.1 / -6.4 | +2.3 / +4.8 | +0.9 / +4.4 | -0.4 / +2.6 | +2.0 / +1.8 | +1.9 / +0.01 | -1.0 / +1.1 | -1.2 / +2.8 | +0.3 / +5.5 | +2.9 / +5.8 | +0.9 / +3.2 | +1.5 / +4.0 | +0.7 / +3.8 | +1.0 / +5.3 | +0.9 / ? | Row 2 - Cell 21 | Row 2 - Cell 22 | Row 2 - Cell 23 |

Server Revenue / Unit share

| Row 0 - Cell 0 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 4Q17 |

| AMD Server Unit Share | 23.1% | 23.3% | 18.6% | 18% | 17.6% | 17.5% | 13.9% | 11.6% | 10.7% | 10.2% | 9.5% | 8.9% | 7.1% | 6.6% | 5.8% | 5.1% | 4.5% | 4.3% | 3.4% | 2.9% | 3.2% | 1.6% | 1.4% | 0.8% |

| Quarter over Quarter / Year over Year (pp) | -0.2 / 5.5 | 4.7 / 5.8 | 0.6 / 4.7 | +0.4 / +6.3 | +0.1 / +6.9 | +3.6 / +7.3 | +2.3 / +4.4 | +0.9 / +2.7 | +0.5% / +3.6 | +0.7 / +3.6 | +0.6 / +3.7 | +1.8 / +3.8 | +0.5 / +2.6 | +0.8 / +2.3 | +0.7 / +2.4 | +0.6 / 2.2 | +0.2 / +1.4 | +0.9 / +2.7 | +0.5 / +2.0 | -0.3 / - | +1.6 / 2.4 | +0.2 / - | Row 2 - Cell 23 | Row 2 - Cell 24 |

AMD’s server business is doing even better than the client side with its EPYC processors. AMD highlights that its 31.1% revenue share in the server market is a record for the company. It climbed 4.0% in revenue share YoY to reach this point and, consequently, is raking in record earnings from this segment.

Server unit share was even better than revenue share for AMD. We see that the red team server unit share grew 5.5% YoY to 23.1% in Q4 2023. This is a big gain in another hotly-contested market. AMD highlights that the small QoQ unit share decline, also evident in the tabulated data, “reflects a larger number of our competitor’s server processors being sold into non-data center applications and higher Atom shipments.” The unnamed major competitor is, of course, Intel.

If you want a closer look at Intel’s performance, look at our recent analysis of its Q4 FY2023 figures, published in late January. In brief, Intel experienced a lackluster 2023 on the whole but saw things spring back to life in the last quarter of the year. In contrast with AMD, though, its data center business saw a decline (down 10% YoY), partially blamed on a smaller overall market and inventory corrections.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

digitalgriffin Report Credits Desktop 7000 series.Reply

How do we know it's not people going for the last upgrade of AM4 (ie: 2600X->5800X/5800X3D etc) -

redgarl Reply

What are they going to after? LGA1700?digitalgriffin said:Report Credits Desktop 7000 series.

How do we know it's not people going for the last upgrade of AM4 (ie: 2600X->5800X/5800X3D etc)

Please... the 7800x3D is like the CPU for gaming. -

usertests AMD has 23.1% server unit share, but 31.1% of the revenue according to a third party. Guess Intel is giving some Xeons away. Can I get a free Xeon workstation?Reply -

d0x360 The biggest issue I can see is TSMC. They have been fantastic but won't transition to any new processes until 1nm so that could give Intel a built in advantage. Owning a fan certainly has its benefits and AMD along with anyone else that relies on TSMC also is at their mercy when it comes time to invest in billions of dollars in new equipment.Reply -

Vanderlindemedia I've replaced 10 year old xeons after approx 9 years of use, with Epyc.Reply

It's mind blowing how fast and how much value you get for the money. -

salgado18 EC2 machines on AWS are cheaper to run on EPYC hardware, due to lower power usage. I only use them, and imagine everyone else doing the same, unless they need a specific feature of Xeons, which most won't.Reply

Ryzens are also a lot more efficient for notebooks, and their only downfall is the lack of options, since Intel still dominates most models.

In desktops, not only there are the 3D models, Ryzen needs less cooling and PSU, with the same or better performance. And AM4 is still a great value purchase today.

And Intel's only bet is to make hybrid processors, with powerhungry cores mixed with weak ones causing many kinds of odd performance behaviour, especially in power constrained scenarios.

Until Intel builds a new architecture, and AMD screws up (I hope they don't), AMD has the best processors available. -

watzupken At this point, Intel is slowly but surely losing its grip on their lucrative server/ data Center market. They’ve lost the advantage when it comes to offering a better product and cutting edge fab to give them an advantage over their competitors. As a result, they lost their ability to price in a fat profit margin. With Intel turning their focus on fabs, this is a make or break decision for them. I feel taking their key focus off their CPU business may be a costly if not fatal mistake.Reply -

Jimbojan Intel may have lost its server shares due to its 10nm chip, but it will be gaining share from Intel 4 and Intel 3 in 2024. When the server chips are upgraded to Intel 3, it will be more power efficient than most AMD's and those from ARM. AMD was able to use TSMC 7nm and now 5nm to gain share, but from 2024 on, Intel will be far more advanced than most chips including those from AMD and ARM.Reply -

artk2219 Reply

I guess we'll see, they'll have to offer at least something if they want to start clawing back some market share.Jimbojan said:Intel may have lost its server shares due to its 10nm chip, but it will be gaining share from Intel 4 and Intel 3 in 2024. When the server chips are upgraded to Intel 3, it will be more power efficient than most AMD's and those from ARM. AMD was able to use TSMC 7nm and now 5nm to gain share, but from 2024 on, Intel will be far more advanced than most chips including those from AMD and ARM.