China commerce minister frustrated by US 'interfering' in international lithography exports via third countries

American sanctions hurt China's semiconductor sector badly, it seems.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

China's Commerce Minister Wang Wentao recently voiced serious concerns to U.S. Commerce Secretary Gina Raimondo regarding the American-imposed restrictions on the export of advanced lithography machines to China. The telephone conversation not only highlighted the deepening tensions between the U.S. and China over semiconductor technology exports to China, but also included other issues, such as the development of artificial intelligence technologies and the balance between national security and economic cooperation, reports Reuters.

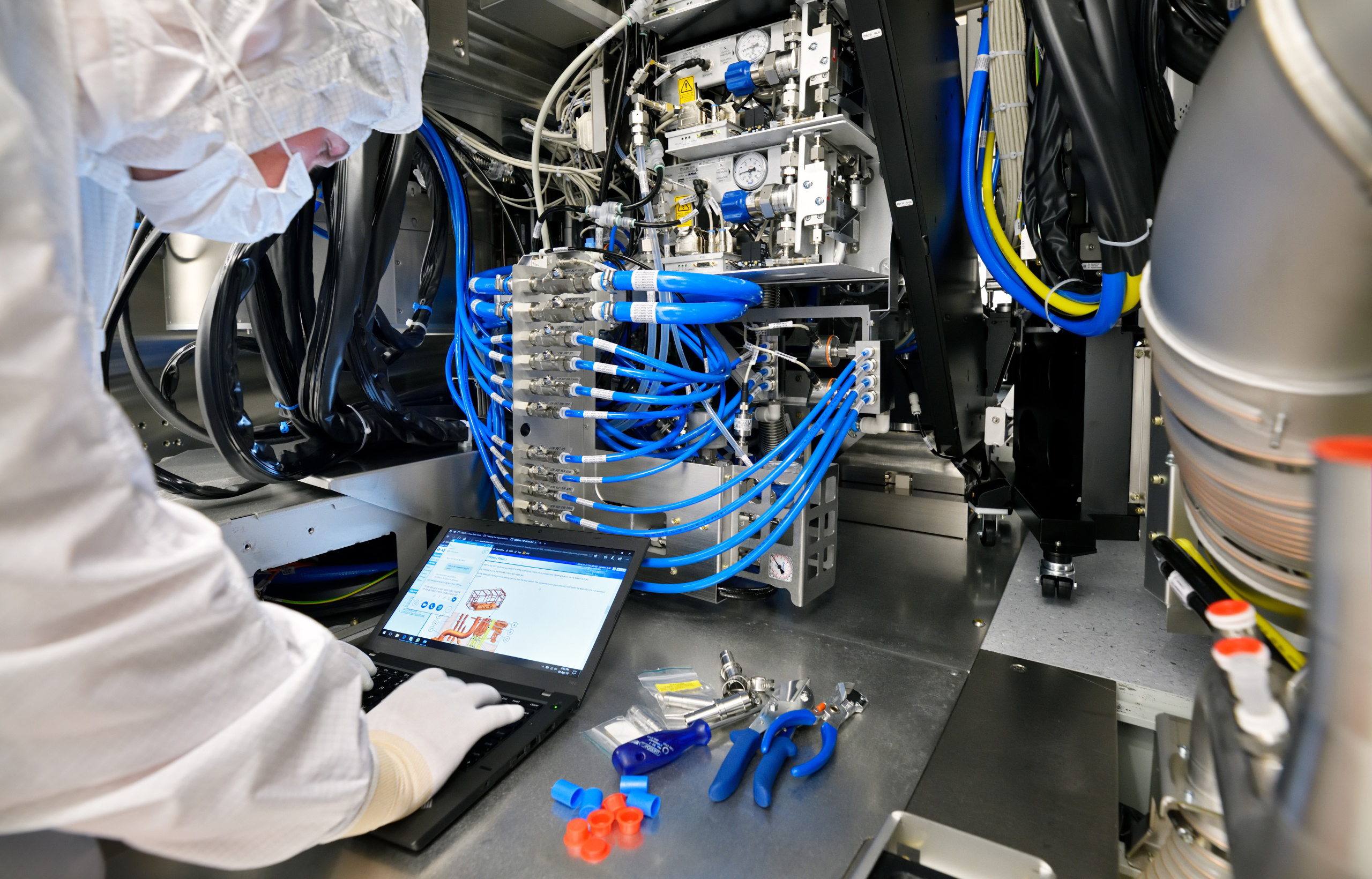

Wang Wentao's main concern was centered around the U.S. restrictions that prevent third-party countries like Japan and the Netherlands from exporting advanced lithography machines to China. The Dutch government, under U.S. influence, recently revoked an export license that allowed ASML to ship advanced Twinscan NXT: 2050i and 2100i deep ultraviolet (DUV) lithography tools to China-based clients. For now, this decision does not significantly impact China's semiconductor industry in general since only Semiconductor Manufacturing International Corp. (SMIC) can realistically use these tools. However, the curb impacts SMIC's ability to develop more advanced process technologies (read: sub-7nm nodes) and curtails the potential developments of other Chinese chipmakers.

China's reliance on ASML is underscored by the fact that in the third quarter of 2023, the Chinese market constituted 46% of ASML's total sales. This statistic reflects the significant role that Chinese demand plays in the global semiconductor equipment market these days, and how U.S. policies are affecting not just Chinese interests but also those of multinational corporations like ASML.

Shu Jueting, a spokesperson for China's Commerce Ministry, publicly expressed China's deep concerns regarding the U.S.'s direct involvement in obstructing the exports of lithography machines from Dutch companies to China. China views these actions as an unjustified interference in normal trade practices and a misuse of export control mechanisms.

Meanwhile, the U.S. government positions its curbs against the Chinese chipmaking sector as a part of its strategy to limit China's access to high-performance processors, particularly those used for artificial intelligence (AI) and high-performance computing (HPC) applications, since both can be used for cyberwarfare and /or the development of weapons of mass destruction. In addition to restricting U.S.-based companies, the U.S. has been actively urging its allies to implement similar curbs to curtail China's technological advancements.

The phone call between Wang Wentao and Gina Raimondo also outlined China's worries about a U.S. Department of Commerce investigation into the sourcing of legacy chips by American companies and their reliance on exports from China. Since many American companies are involved in important sectors like the automotive and defense industries, the U.S. government aims to mitigate national security risks it associates with China through this survey. Yet, since the U.S. might impose tariffs on China-made chips or even restrict their usage for certain devices, they certainly might affect Chinese chipmakers, which makes the country's government (which has poured tens of billions of dollars into the domestic semiconductor industry) nervous.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.