US CHIPS and Science program puts R&D funding on hold — highlighting intense demand that far exceeded initial expectations

CHIPS Program Office to host a webinar to clarify its R&D support strategies.

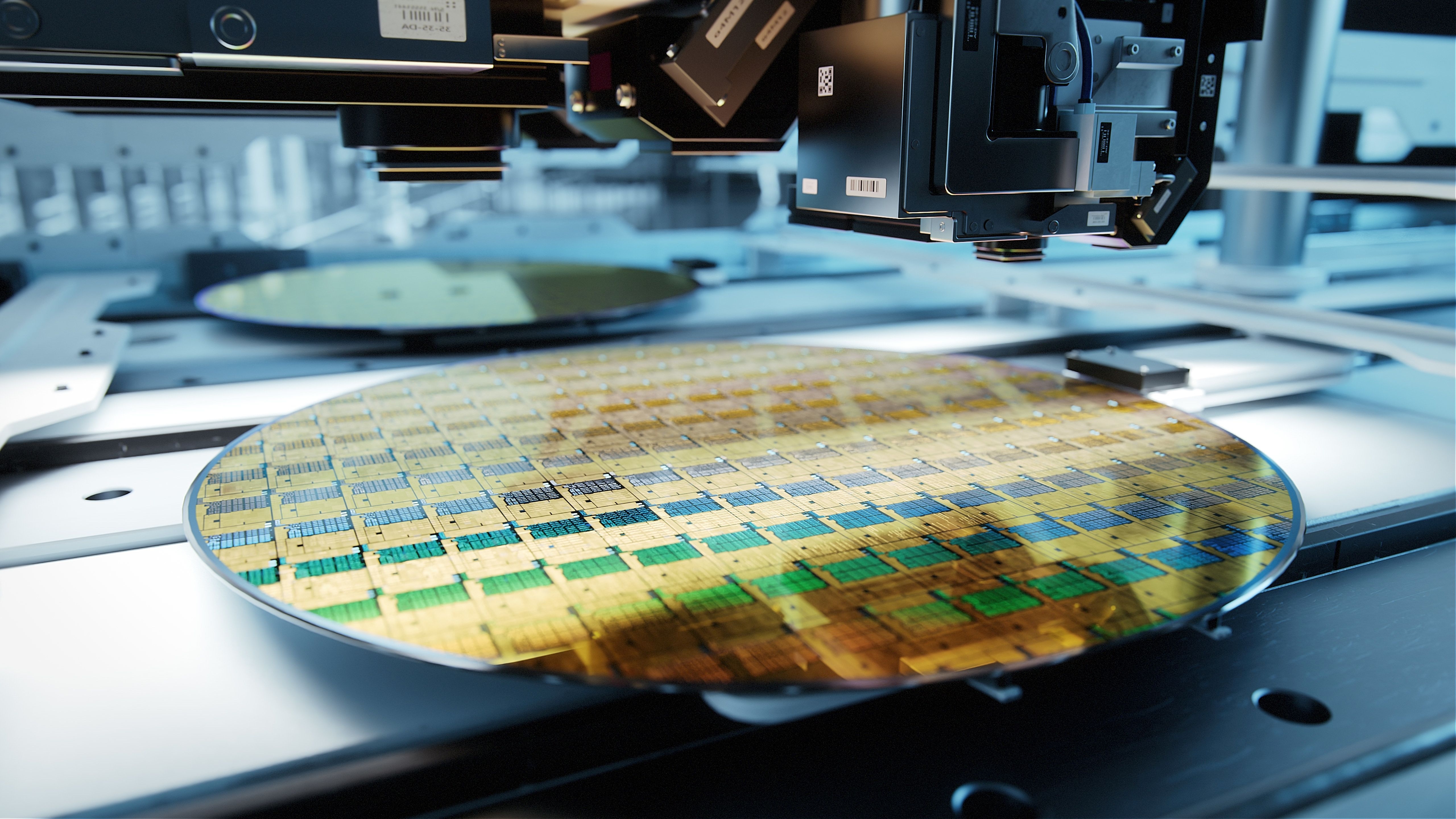

Due to the 'overwhelming' interest in CHIPS funding, the Commerce Department has temporarily halted its plans to provide financial support for semiconductor research and development facilities, reports the American Institute of Physics.

The Commerce Department has put a hold on its plans to offer financial support for R&D fabs. This pause is attributed to the unexpectedly high interest in the $39 billion incentive initiative under the CHIPS and Science Act, as well as changes brought by the final requisitions bill for fiscal year 2024. Despite this setback, the department remains committed to investing $11 billion in semiconductor R&D through other programs established by the Act.

The overwhelming response for funding from the semiconductor industry has led to this strategic pause. The CHIPS Program Office, responsible for managing the incentive program, announced this decision in a newsletter. It highlighted the intense demand that far exceeded initial expectations. This demand surge reflects the semiconductor sector industry's eagerness to expand and modernize its R&D facilities with federal funding.

In the face of this high demand, the Commerce Department has decided to continue its support for semiconductor R&D, albeit through different avenues. Specifically, it has earmarked $11 billion for R&D activities, separate from the facility incentive program. This continued investment aims to assist U.S.-based chip developers and producers even as the government reassesses its funding strategy for facility upgrades and expansions.

Commerce Secretary Gina Raimondo elaborated on the funding dilemma in a recent speech, noting the challenge in allocating the program's funds amidst requests that have significantly surpassed the available budget.

"The bad news is that we’ve received over 600 statements of interest and the reality is that a significant majority of those who are expressing interest are not going to receive funding – including many strong proposals by excellent companies," Raimondo said. "I have also said many times that the point of this program was never to provide the semiconductor industry with every dollar it requests; it is to make targeted investments for our national security objectives. At the outset, we said that we expected to invest about $28 billion of the program’s $39 billion in incentives for leading-edge chip manufacturing. But leading-edge companies alone have requested more than $70 billion, meaning we’re having many tough conversations."

To address these challenges and outline future directions, the CHIPS Program Office is set to host a webinar on April 9. The session will focus on the National Semiconductor Technology Center and aim to clarify the office's strategy for supporting the semiconductor industry's R&D efforts.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

hotaru251 ReplyDue to the 'overwhelming' interest in CHIPS funding,

really?? You offer up literal tons of $ and didn't expect everyone to jump for it? -

chaz_music I worry that these proposals are not looking for ways to provide foundry services for "jellybean" parts, i.e., LM324, LM78xx, discrete semis, and other common parts needed for many US products. During the pandemic, many of these parts were on allocation just like other parts. Many US semiconductor companies have outsourced the manufacturing of these parts to Asia, causing a resource gap for US tech companies needing these parts.Reply -

DavidMV Replychaz_music said:I worry that these proposals are not looking for ways to provide foundry services for "jellybean" parts, i.e., LM324, LM78xx, discrete semis, and other common parts needed for many US products. During the pandemic, many of these parts were on allocation just like other parts. Many US semiconductor companies have outsourced the manufacturing of these parts to Asia, causing a resource gap for US tech companies needing these parts.

TI, Global Foundries and others can and do cover most of those. The real weakness is displays. We need a display panel facility.