AMD Commands 81 Percent of Sales at Mindfactory as Supply Issues Dwindle

The supply issues that have been persistent in the Ryzen 3000 series since launch seem to be dissipating, and that has allowed AMD to keep the pressure on Intel.

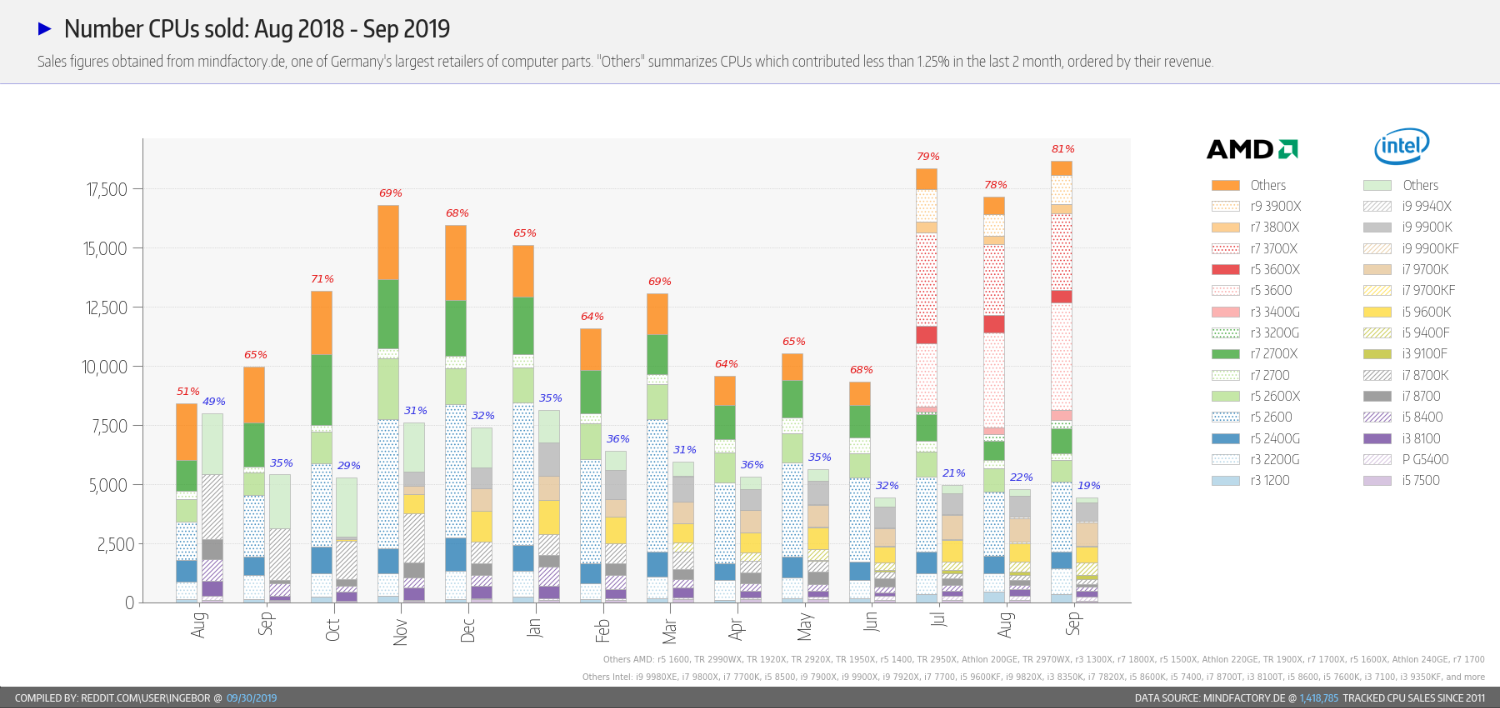

AMD has reached a new record for market share on German retailer Mindfactory; the new record of 81% market share topped the previous record set in July when Ryzen 3000 launched.

AMD's sales had dipped in August, likely due to supply issues concerning the Ryzen 7 3700X and Ryzen 9 3900X, but now AMD has resumed the pace it took in July. Intel CPU sales have also been dropping gradually since July, but the Core i9-9900K and i7-9700K remain as popular as ever. However, the i5-9600K is losing ground, likely due to the Ryzen 5 3600. The 3600 is actually selling much better than it did in July, though this is likely down to higher demand and not better supply, unlike the 3900X and 3700X.

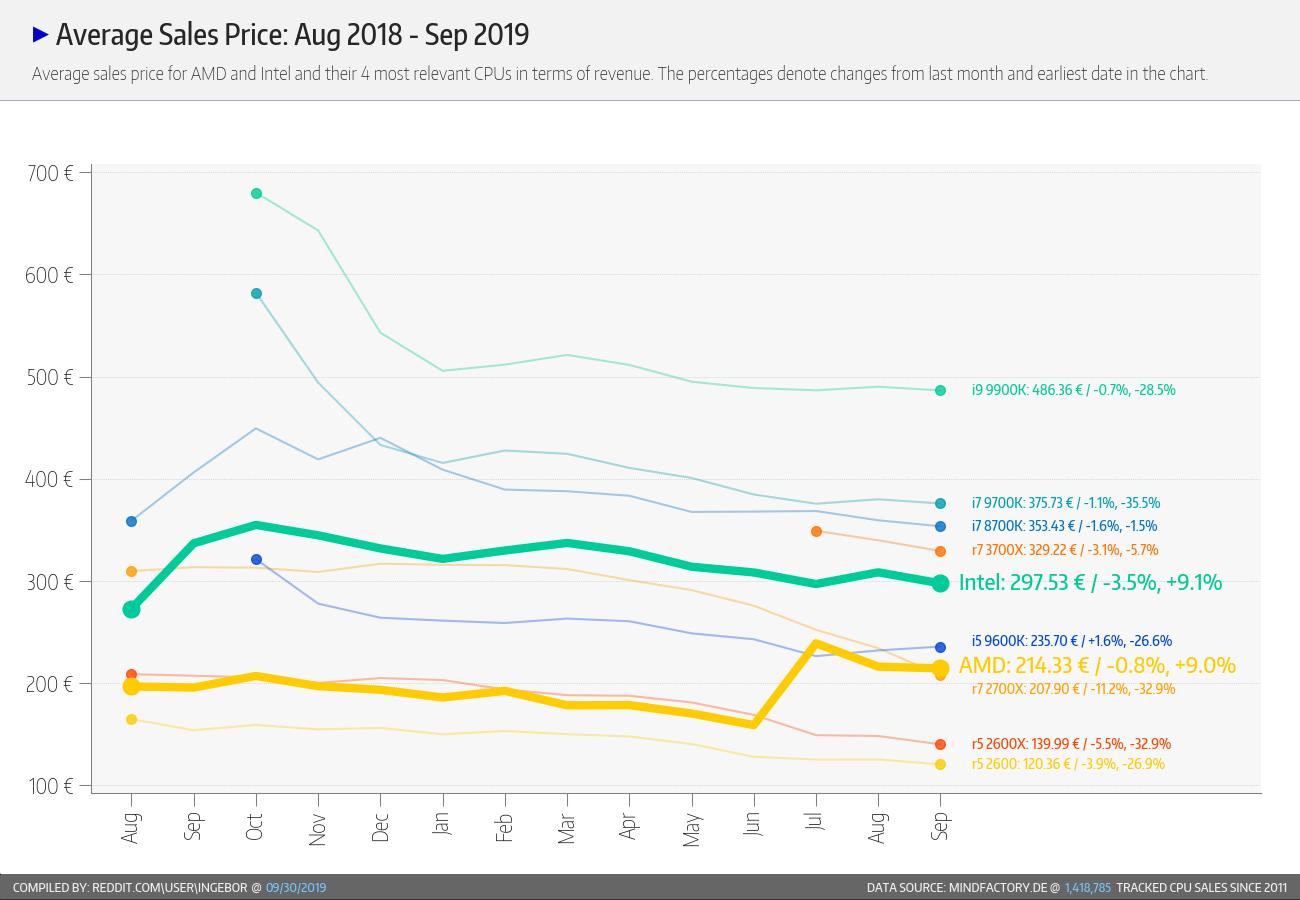

AMD hasn't seen an increase in revenue, however, as many Ryzen 3000 CPUs have been getting small price cuts of 5-10% at many retailers. For example, the 3600 is usually found at $190 instead of $200, and the 3800X can be found for $380 and not its recommended price of $400. The 3900X is a notable exception to these discounts since it's still hard to find in the first place, even with increased supply. Compared to July, AMD is making slightly less revenue overall even though they are selling more CPUs, and especially more Ryzen 3000 CPUs instead of the cheaper 2000 series CPUs.

There is still clearly untapped demand for Ryzen 3000 CPUs and if AMD can solve these supply issues sooner rather than later, they may be able to inflict significant damage on Intel's bottom line as the next generation of Intel CPUs closes in. You'll also notice that Intel's chips have been slowly declining in retail pricing over time, which is another impact of Ryzen's success. However, if Intel is fully prepared to launch its next-gen CPUs before AMD can satisfy the market, they can also inflict damage on AMD's bottom line.

In either case, the two CPU vendors are now engaged in an intensifying price war, which benefits everyone.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Matthew Connatser is a freelancing writer for Tom's Hardware US. He writes articles about CPUs, GPUs, SSDs, and computers in general.

-

jimmysmitty AMDs supply issues will be difficult to smooth out. They are using TSMC for their CPUs but they also have to compete with nVidia and Apple along with their own GPUs for products and of course any other companies that want to use TSMC for their products.Reply

One route could be to go with multiple FABs, like Apple did with some iPhone CPUs a few years back, but that means there will be a much more pronounced difference between them and people will prefer one over the other.

Otherwise they will have to either hope TSMCs yields go up or they open another FAB to produce more chips. Either way it will take time and being unable to fill orders will hurt a bit. -

InvalidError Reply

They are able to fulfill orders, you only need to order six months ahead of time.jimmysmitty said:Either way it will take time and being unable to fill orders will hurt a bit.

The "preferring chiplets from one fab over the other" thing has one simple solution: move entire product lines over (ex.: GPUs and APUs) instead of partial production to free up wafers on TSMC for chiplets. Another option might be to make every multi-chiplet CPU a mix of both for twice the silicon lottery fun.