AMD Warns of $1.1 Billion Revenue Shortfall, Cites Weak PC Market

The weak PC market continues to bite chipmakers.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

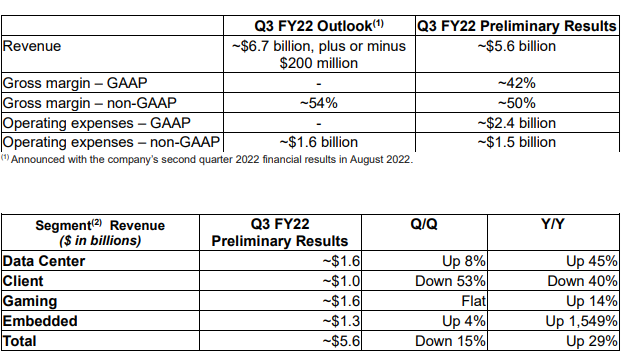

AMD pre-announced portions of its Q3 earnings performance today, revising its projected revenue from $6.7 billion during the quarter to $5.6 billion, a $1.1 billion reduction. AMD also warned investors that its non-GAAP gross margin would weigh in at 50%, a reduction from the projected 54%. The company cited lower sales in the consumer PC market than expected and significant inventory corrections in the PC supply chain. However, it noted that its data center, gaming and embedded segments are still performing to expectations.

AMD's warning lowers its revenue projections from a year-over-year growth rate of 55% to 29%, so the company will continue to expand despite the headwinds. AMD specifically called out lower shipments and reduced average selling prices (ASPs) for its client processors as the source of the revenue miss. This problem has also vexed other semiconductor manufacturers like Intel and Nvidia due to bulging inventories as demand recedes.

The excess inventory forces retailers and OEMs to then cut prices to move inventory, thus resulting in reduced ASPs. The reduced ASPs also factor into AMD's lowered gross margin, which is now expected at 50% instead of 54%. AMD is also taking $160 million in charges for the "inventory, pricing, and related reserves in the graphics and client business."

AMD's shortfall comes in the wake of an impressive Q2 performance that found its revenue increasing 70% year-over-year as it continues to chew away market share from Intel even though sales of desktop CPUs were the lowest in 30 years. However, the company's Q2 disclosures foreshadowed potential looming issues — most analysts felt that the company's Q3 guidance was already below expectations.

AMD's revised projections call for its client business unit, which comprises its consumer CPU business, to be down 53% quarter-over-quarter and 40% year-over-year. Meanwhile, its gaming business, which encompasses its consumer GPUs operations, will remain flat.

AMD's CPUs business is impacted the most, though the company said the $160 million charge includes actions it has taken in its graphics business.

AMD's competitors in both the CPU and GPU realms have suffered similar revenue shortfalls recently due to the weakening PC market and resulting inventory corrections. In August, Nvidia pre-announced a $1.4 billion miss due to plummeting GPU sales in the wake of a cryptomining collapse, ultimately resulting in poor quarterly results that found the company's stock being heavily punished. CPU heavyweight Intel also posted its first quarterly loss in decades, losing $500 million as its sales dropped 17%.

Multiple economic factors have roiled markets worldwide, including inflation and supply chain disruptions, setting the stage for the rapid deceleration of the PC market. AMD says it will share more information regarding its downgrade and future outlook during its earnings call on November 1, 2022.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

Alvar "Miles" Udell Yes, it's supply chain issues and has absolutely nothing to do with the fact that Socket AM5 and the Radeon 7000 series are going to be a very sluggish sellers.Reply -

PiranhaTech When Covid hit, not only did we have the crypto boom, but lots of people wanted gaming PCs and wanted to start streaming. The streaming side was getting ridiculous because lots of streamers wanted $3000 PCsReply

It's slowed down in both crypto and people wanting gaming PCs. Some streamers regret not waiting for GPU prices to drop -

DavidLejdar I, for one, will likely spend some in Q4 of this year. Currently waiting for Intel to release their newest CPUs, to get an idea on how it compares in price and performance.Reply

And yeah, I am aware that I could save some money if I would go for last gen motherboard and CPU, with it being plenty good in particular for gaming. But around the mid-range, the price difference is usually not that big, and PCIe 5.0 for M.2 SSD is quite tempting to go for straight away. -

ohio_buckeye Honestly the pricing on their new platform and the crazy temps they want to run them at, not right now! Might be time for this long time amd user to give Intel a look.Reply -

lmcnabney Things will work through pretty well. The collapse of memory prices are helping their DDR5 problem. Console money has been steady. They will lose a tiny bit of market share in CPUs and are likely to gain market share with GPUs.Reply

Intel already made the same announcement back in early August. AMD tried to play it cool, but they knew it was coming. This time next year things will be back to normal, volumes will be going back up, but margins will be lower since the miners are gone. -

lmcnabney Reply

Temps aren't a problem. Running at under 95 is leaving performance on the table. They are just playing the power creep game like Intel has for years.ohio_buckeye said:Honestly the pricing on their new platform and the crazy temps they want to run them at, not right now! Might be time for this long time amd user to give Intel a look. -

ohio_buckeye I suppose I’m old school. I still remember the old athlon xp cpus that you don’t want to get above 60.Reply -

escksu Replylmcnabney said:Things will work through pretty well. The collapse of memory prices are helping their DDR5 problem. Console money has been steady. They will lose a tiny bit of market share in CPUs and are likely to gain market share with GPUs.

Intel already made the same announcement back in early August. AMD tried to play it cool, but they knew it was coming. This time next year things will be back to normal, volumes will be going back up, but margins will be lower since the miners are gone.

No, thats not going to happen. We are heading into recession. Both intel and AMD will be affected by recession. Its not going back to normal next year. It will be 2024/25 instead. 2023 will be even worse.