Intel Posts $500 Million Loss for the First Time in Decades as Sales Drop 17%

CEO blames economic decline and execution issues.

Intel on Thursday posted its first loss in decades as sales of its processors for client PCs, and data centers dropped sharply in the second quarter because of what Intel calls "a rapid decline in economic activity" caused by inflation, geopolitical tensions, and the ongoing Russia-Ukraine war.

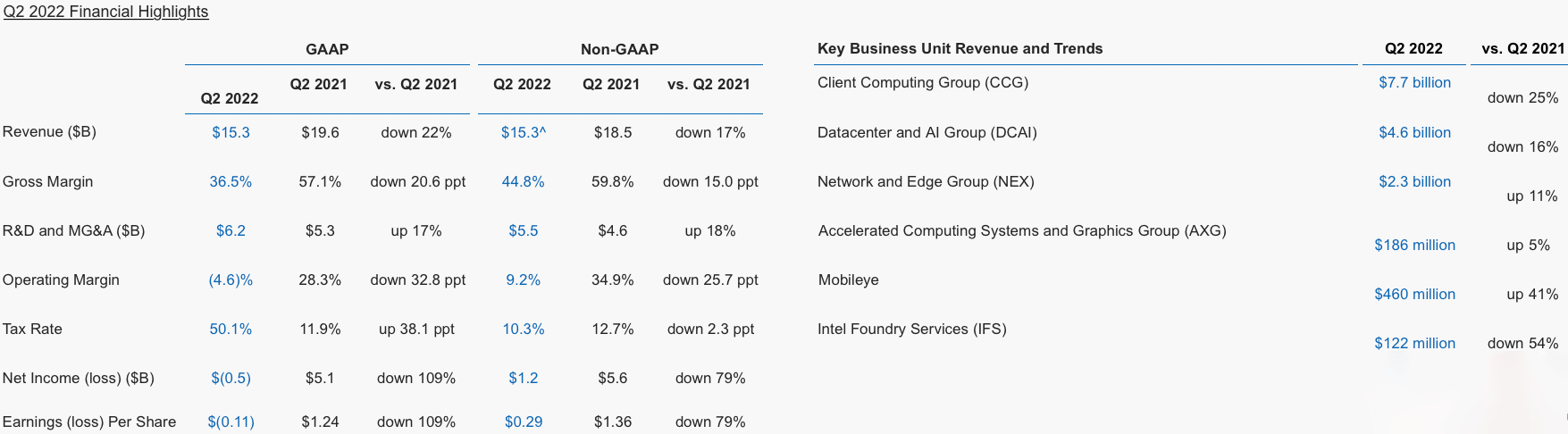

Intel's revenue in Q2 2022 totaled $15.3 billion, a 17% decline year-over-year (YoY) and a 22% drop sequentially. In addition, the company's gross margin fell 36.5% from 57.1% in the same quarter a year ago. The company also posted a loss of $0.5 billion, the company's first loss in decades. While Intel's quarterly loss looks shocking, it should be noted that the company had to make inventory reserves for upcoming product launches, which generated losses in accordance with GAAP.

"This quarter's results were below the standards we have set for the company and our shareholders," said Pat Gelsinger, Intel CEO. "We must and will do better. The sudden and rapid decline in economic activity was the largest driver, but the shortfall also reflects our own execution issues."

Shipments of Core and Xeon Decline for First Time in Years

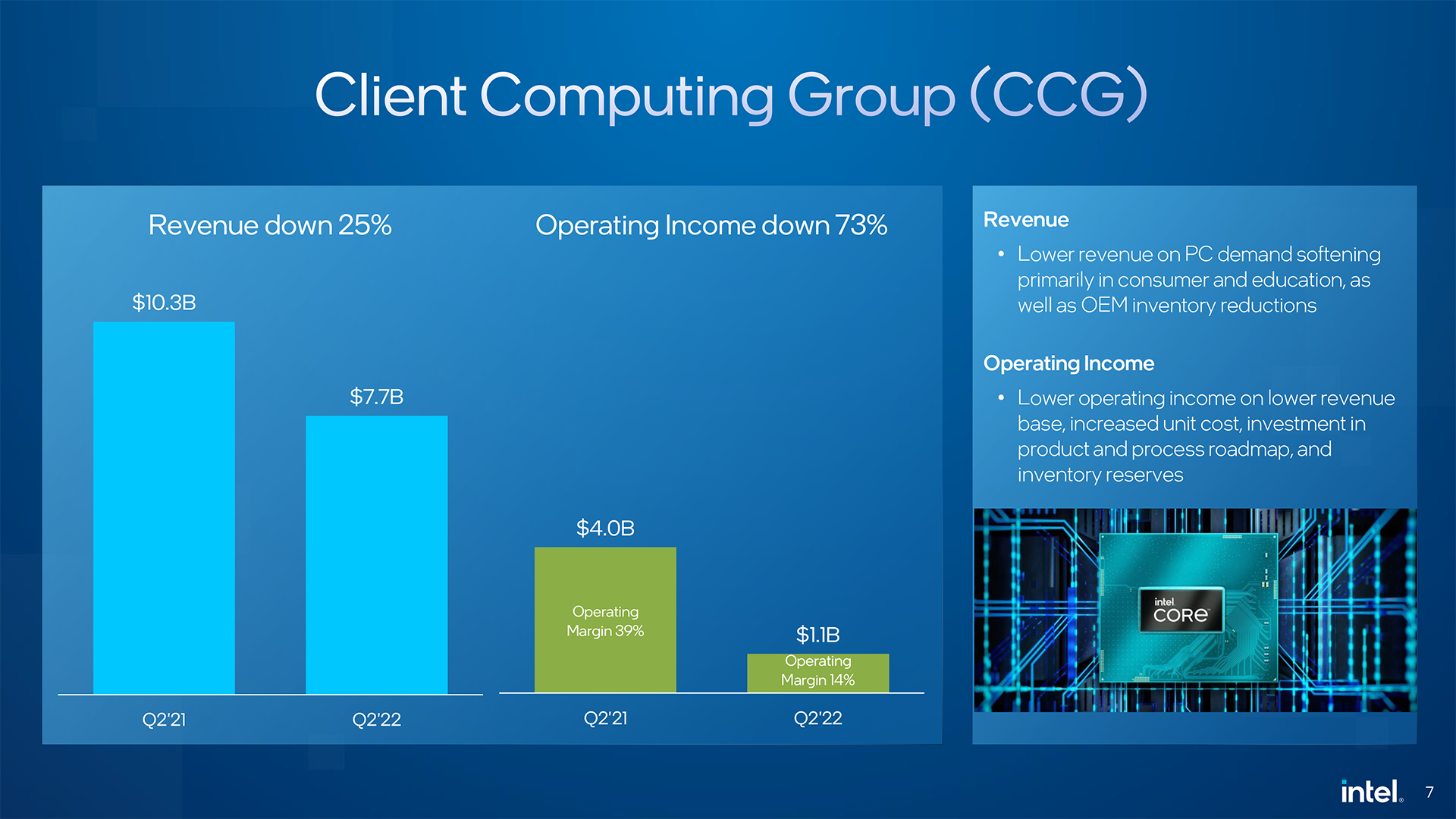

Intel's main cash cow — the Client Computing Group (CCG) — earned $7.7 billion in revenue in Q2 2022, down 25% from the same quarter a year ago. There are several reasons why Intel's client CPU and chipsets sales dropped so significantly. Firstly, demand for PCs was down in Q2 both sequentially and YoY. Secondly, because PC OEM makers are uncertain about demand in the coming quarters, they buy fewer CPUs than they consume, prefer to use their existing stocks, and drain existing inventory. It means that as soon as their stashes drain, they will increase their purchases from Intel.

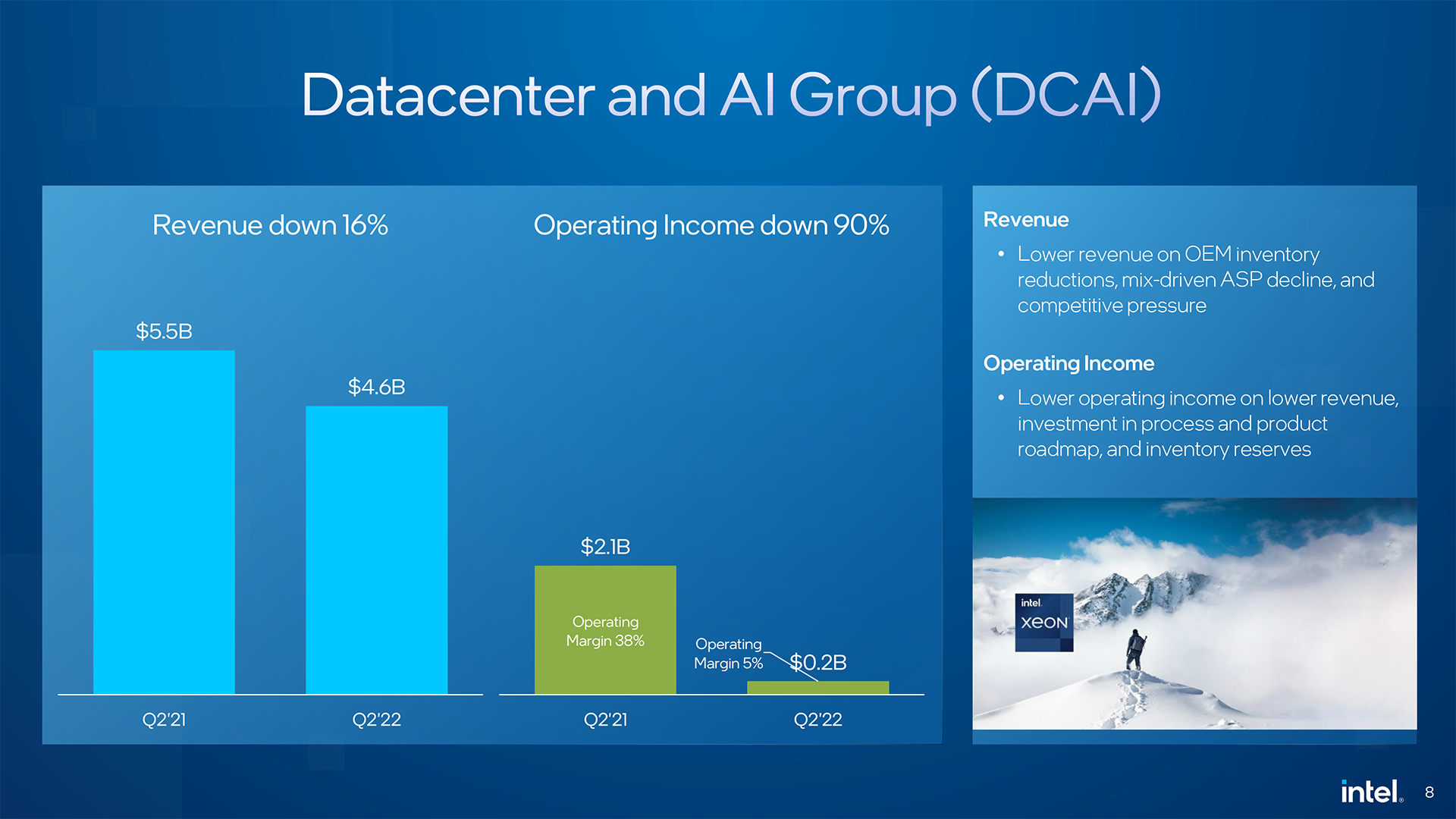

Intel's Datacenter and AI Group (DCAI) sales of datacenter hardware declined to $4.6 billion in Q2 2022, down from $5.5 billion in Q2 2021, a drop of 16% YoY. Intel mentioned three reasons for the decline: competitive pressure from AMD, mix-driven average selling price (ASP) decrease (which might be caused by the necessity to adjust prices or tailor offerings to respond to competition), and OEM inventory reductions.

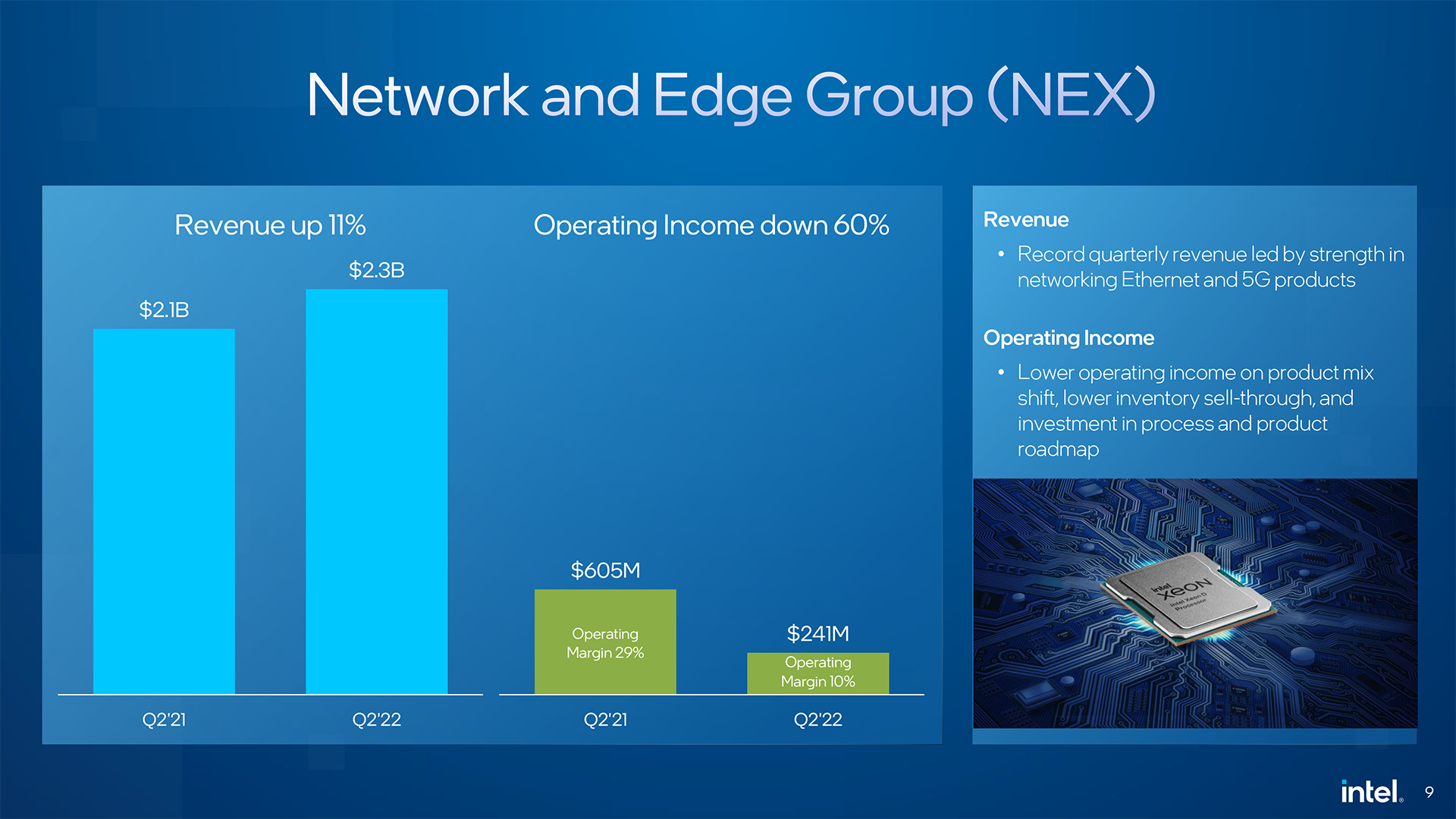

The revenue of Intel's Network and Edge Group (NEX) was perhaps a ray of light in the company's otherwise gloomy earnings report as the business unit managed to increase its revenue to $2.3 billion, up 11% year-over-year. Intel says that NEX's good results were driven by solid sales of its 5G (which probably means compute solutions for infrastructure equipment) and Ethernet products. Meanwhile, Intel's NEX also began shipments of its codenamed Mount Evans 200Gb SoC IPU and started to ramp up shipments of the latest Xeon D-1700/2700 parts based on the Ice Lake-D microarchitecture.

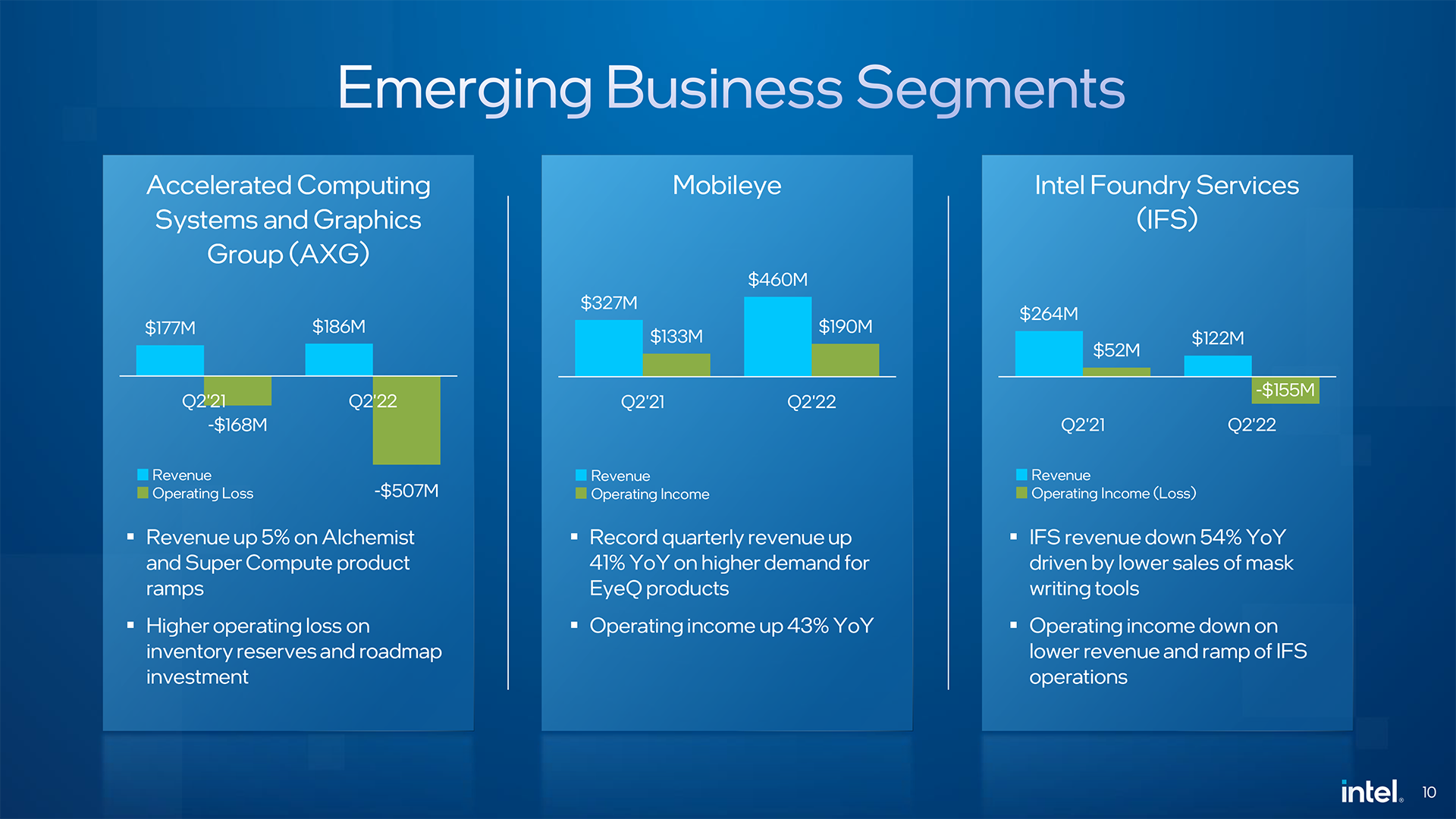

One of Intel's most ambitious projects in recent years is indisputably its client and data center GPU endeavor led by Raja Koduri. But entering the GPU market is expensive, which is why the company's Accelerated Computing Systems and Graphics Group (AXG) lost a whopping $507 million in Q2 2022 on sales of $186 million (up from $177 million in Q2 2021) as Intel is ramping up shipments of Arc Alchemist, shipping its Blockscale mining ASIC, and is beginning to ship its supercomputing products. The loss is generated primarily by additional investments in R&D and prototyping and inventory reserves for the high-volume Arc launch in Q3.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The Intel Foundry Services has landed orders from Qualcomm and Mediatek, two major fabless developers of chips that sell hundreds of millions of chips a year. But IFS yet has to become a big business for the blue giant. As a result, Intel's foundry business unit sales dropped to $122 million, and it lost $155 million in Q2 2022. In addition, Intel says that demand for its photomask writing tools declined in the second quarter, yet the company had to continue investing in IFS.

Another bright spot in Intel's Q2 financial report is Mobileye's revenue of $460 million, a 40% increase year-over-year driven by high demand for EyeQ products. In addition, the unit's operating income totaled $190 million, which is a 43% increase YoY.

Gloomy Expectations

Intel now projects its Q3 2022 revenue to be in the range between $15 billion and $16 billion, down sharply from $19.2 billion in the same quarter a year ago. In addition, the company's gross margins are expected to be 43.2%, a drop from 56% in Q3 2021 but a notable increase from Q2 2022.

Due to catastrophic Q2 results and macroeconomic uncertainties, Intel expects its 2022 revenue to total $65 billion – $68 billion, down 9% - 13% YoY and $8 billion – $11 billion lower than initially expected. As a result, the chip giant anticipates its 2022 margin totaling 44.8%.

"We are being responsive to changing business conditions, working closely with our customers while remaining laser-focused on our strategy and long-term opportunities," said Gelsinger. "We are embracing this challenging environment to accelerate our transformation."

In a bid to respond to market weakness, Intel plans to reduce its near-term spending as well as review production cost-cutting measures. In particular, the company is reducing its 2022 CapEx budget from $27 billion to $23 billion. Meanwhile, Intel will not sacrifice its long-term spending and big projects like new fabs in the U.S. and Europe.

"We are taking necessary actions to manage through the current environment, including accelerating the deployment of our smart capital strategy, while reiterating our prior full-year adjusted free cash flow guidance and returning gross margins to our target range by the fourth quarter," said David Zinsner, Intel CFO. "We remain fully committed to our business strategy, the long-term financial model communicated at our investor meeting, and a strong and growing dividend."

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

InvalidError Looking forward to seeing how Intel's plans to raise retail prices will square off against sales already receding by 16-25% at current pricing.Reply

This shouldn't be surprising anybody, the ~30% bumper sales from COVID WFH and stimulus handouts were never going to convert into sustained repeat sales. Especially not in the immediate wake of everyone who hadn't semi-recently upgraded rushing to upgrade at the same time, monster inflation on essential goods and a global economic slowdown. -

btmedic04 I'm willing to bet untel is seriously eyeing up its graphics division for the chopping block. Arc is underperformed and super late to the partyReply -

escksu Replybtmedic04 said:I'm willing to bet untel is seriously eyeing up its graphics division for the chopping block. Arc is underperformed and super late to the party

Nope it won't. Arc is not the main product of graphics division. Its real product is ponte vecchio. -

spongiemaster It was just reported in another article that Intel wrote off $559 million in Optane inventory in Q2. All around terrible quarter for Intel. At some point they're going to have to start delivering on all their promises. Where is Sapphire Rapids? Where are the GPU's? Looks like Raptor Lake is on schedule, but that's basically an Alder Lake refresh. The real question is, is Meteor Lake still on schedule which is on a new node?Reply -

TerryLaze 50% tax...Reply

Also they are building new FABs, all of their income is being spend on" Net additions to property, plant and equipment"

-

KyaraM Reply

LMFAObtmedic04 said:I'm willing to bet untel is seriously eyeing up its graphics division for the chopping block. Arc is underperformed and super late to the party

What are you betting? =) -

-Fran- I'm suprised this didn't happen before, TBH. Given how their roadmaps have been continuously moving backwards, it's a tad impressive they held on for this long.Reply

Also, funny how Pat sounds a bit more down to earth now after boasting so much when he came along, lol. Still, the rumour mill says he's doing good things inside, so let's hope he'll get to laugh at the end. Just not too much, lel.

Regards. -

InvalidError Reply

A 500M$ loss on graphics is tiny compared to the billions of dollars Intel pumped into its wireless business and IA64 before giving up. I doubt anyone who's followed tech for the last 20 years had any expectations of Intel getting anywhere near par on its first generation of products attempting to break into a new market. New entrants practically always have to slog it out for 3-5 years before getting any brand recognition and traction assuming there are no show-stopping issues.btmedic04 said:I'm willing to bet untel is seriously eyeing up its graphics division for the chopping block. Arc is underperformed and super late to the party

From Intel's interview with GN, it sounds like Intel is committed to graphics at least until Drood, so we're likely at least another four years and couple of billion dollars away from Intel quitting graphics again if it doesn't work out. -

KyaraM Reply

Exactly this. Only morons would expect instant success, even if it is Intel. Just look at how long they dragged around other failed products, should give an indication of how long they are willing to try. Intel-GPUs won't go anywhere anytime soon. Besides, they aren't even that bad. At this point in time, the issue seem to be software, not hardware. The hardware looks great, I mean, it's developed by professionals from the field, and tests showed that with some rather easy and minor tuning (OC A380 testing), they are serious competition at a considerably lower price point especially in DX12 games (the GN interview stated a converted price of 125-135$ for the A3 380). Even the power consumption is set lower than the competition. The cards got potential, they just need to pull their heads out of their butts and get them out already.InvalidError said:A 500M$ loss on graphics is tiny compared to the billions of dollars Intel pumped into its wireless business and IA64 before giving up. I doubt anyone who's followed tech for the last 20 years had any expectations of Intel getting anywhere near par on its first generation of products attempting to break into a new market. New entrants practically always have to slog it out for 3-5 years before getting any brand recognition and traction assuming there are no show-stopping issues.

From Intel's interview with GN, it sounds like Intel is committed to graphics at least until Drood, so we're likely at least another four years and couple of billion dollars away from Intel quitting graphics again if it doesn't work out.

However...

Drood

Sorry for nitpicking, but it's Druid :)