Backblaze Q3 2022 HDD Report, Balancing Price and Reliability

For cloud storage, cheap may trump reliable

Backblaze has updated its hard drive report for Q3 of 2022, showing its most reliable and least reliable drives over the past quarter and year. Backblaze also shared its hard drive purchasing strategy, weighing in on how to get the most reliable drives at the best price.

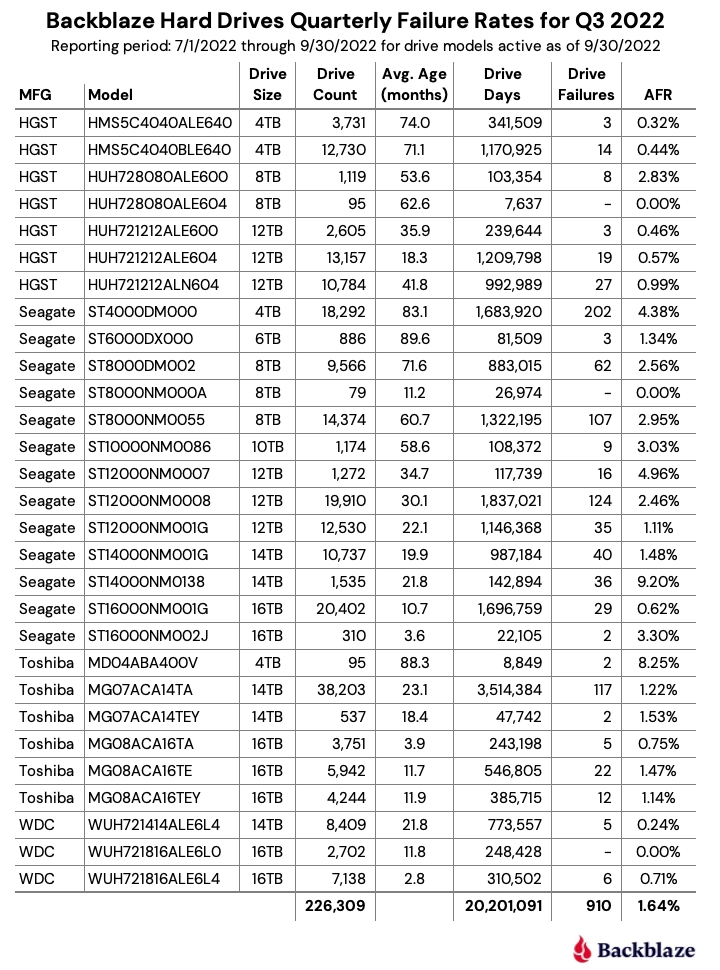

For the latest update, Backblaze notes it removed 388 drives that were used for testing purposes, leaving the cloud storage provider with 226,309 hard drives to analyze.

The best performing drives, in terms of reliability, were the 8TB HGST HUH728080ALE604, 8TB Seagate ST8000NM000A and 16TB Western Digital WUH721816ALE6L0 drives. These three all had zero failures during the third quarter of this year. However, Backblaze says the Western Digital drive is the only model with enough lifetime usage data to have a legitimate failure rate record, so keep that in mind.

Other drives worth mentioning include the 12TB HGST, along with the 14TB and 16TB drives from Western Digital, and one of the 16TB Seagate models (the other has relatively few units and two failures, leading to a very high annualized failure rate for now). These drives have shown solid reliability in its storage servers, with an AFR rating of less than 1% and a confidence interval of 0.5% or less.

Backblaze Servers Have Predominantly Used Seagate Drives

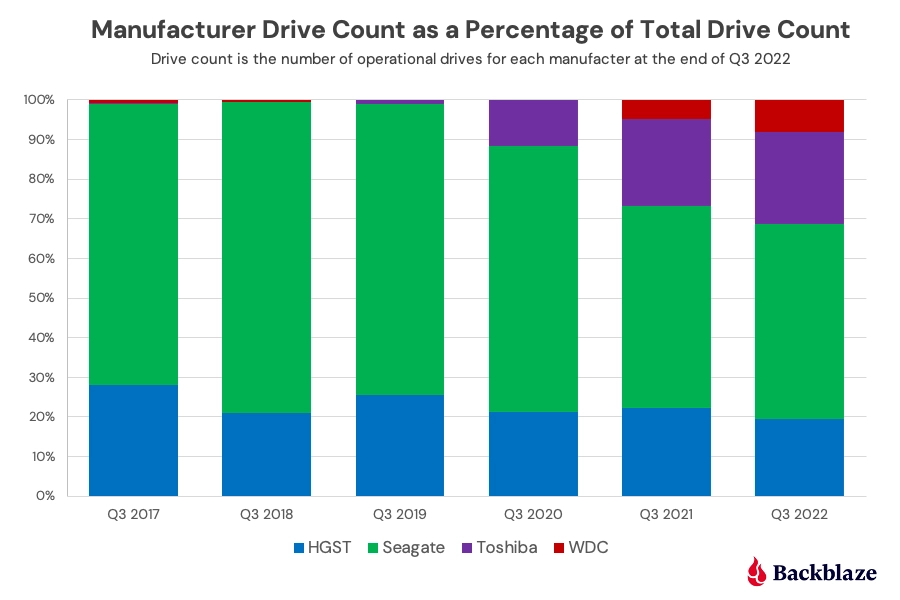

Moving on, Backblaze also shared a graph of its drive models based on the brand, and how the company has shifted to different brands over the past six years of operation. From Q3 2017 through Q3 2019, Backblaze's storage servers were predominantly populated with Seagate-branded hard drives, which making up around 70% of the companies entire storage volume.

HGST took second place with an average of 25% of Backblaze's storage capacity. Toshiba and Western Digital meanwhile made up an incredibly small amount of capacity, with less than 5% of the total hard drive capacity combined.

These ratios began to change in the 2020s, with Toshiba taking huge chunks out of Seagate's drive capacity. It was at more than 10% volume by Q3 2020, and that growth trend continued in 2021 and 2022, with Toshiba reaching around 23% drive capacity and Western Digital growing to around 8% drive capacity by Q3 2022.

The current status shows that Seagate has lost a lot more of its drive share, dropping to just under 50% of Backblaze's overall capacity. HGST's slice of the pie has dropped to under 20% as well, though the yearly fluctuations are relatively flat compared to the other brands.

Backblaze's Oldest Drives Are Really Showing Their Age

Backblaze continues by sharing details on its three oldest drives in its workforce today, the Seagate 4TB ST4000DM000, 6TB ST6000DX000, and Toshiba 4TB MD04ABA400V. These drives are experiencing an increased annualized failure rate (AFR) in this quarter specifically.

The Seagate 4TB went from 3.42% in Q2 to 4.38% in Q3, while the 6TB model increased from 0.91% AFR in Q2 to 1.34% AFR in Q3. Finally, the Toshiba 4TB drive went from zero failures last quarter to a whopping 8.25% in Q3. However, Backblaze notes that the high failure rates for the Toshiba drive are related to the limited number of drive days in the quarter, with its rather low drive pool of 95 drives in total.

These numbers are still much higher than last quarter, with Backblaze concluding that all three drives seem to be wearing out at a noticeably higher rate after 7 years of operation, presumably due to their spindles, actuators, and media starting to wear out from non-stop spinning.

Backblaze also states that its quarterly AFR has increased versus last quarter. The Q3 2022 AFR for all drives was 1.64%, compared to Q2 2022's 1.46% AFR overall, and 1.10% AFR from a year ago. Backblaze says this is due to the aging of the entire drive fleet, and as a result we should expect this number to go back down soon as older drives are flushed out and replaced with newer drives.

How Backblaze Decides What Drive Models to Purchase

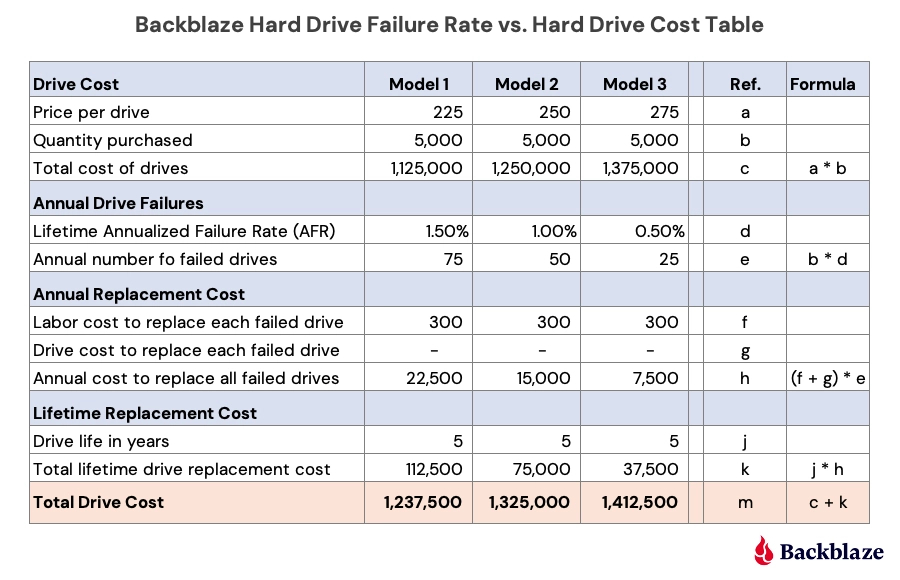

Backblaze takes all of its drive statistics and failure rate analysis into consideration when making purchasing decisions on hard drive replacements for its cloud storage servers. It's worked out a mathematical formula that tells the company which drive models are the most efficient in terms of cost, including whether or not to buy drives that are known to have a higher AFR but at a lower price compared to others.

Backblaze gives a fictitious example of three different 14TB drives priced at $225, $250, and $275. Then it uses details for 5,000 of each drive with theoretical AFR of 1.50% for the cheapest drive, 1.00% for the middle drive, and 0.50% for the most expensive drive. That works out to 75, 50, and 25 drives that fail annually per model.

Now it factors in the labor cost to swap drives ($300 each), with the assumption that the drive costs is zero as the drives would still be under warranty. Multiply this by the number of drive failures, then forecast the next five years, and you get the final overall cost.

With this hypothetical scenario, it turns out that the cheapest drive, even with triple the rate of failure compared to the most expensive drive, still ends up being the best drive for Backblaze's purposes. Simply put, the low price outweighs the cost it takes to replace drives over time.

It's an interesting insight into how Backblaze strategizes its purchasing decisions for its cloud storage servers. Just because a drive is more reliable doesn't necessarily make it the best choice for the job, particularly when looking at potentially purchasing thousands of drives. Of course, home and office users might end up with very different rankings of the drives — and don't forget to have a backup strategy, like perhaps one of the best NAS devices.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Aaron Klotz is a contributing writer for Tom’s Hardware, covering news related to computer hardware such as CPUs, and graphics cards.

-

bit_user ReplyHGST's slice of the pie has dropped to under 20% as well, though the yearly fluctuations are relatively flat compared to the other brands.

You can't buy HGST drives, any more.

Western Digital bought them about a decade ago. For a while, the merger got held up by regulatory agencies, but commenced about 5 years ago. There was a period of time when some WD-branded drives were HGST, while others weren't. However, the time of separate hard drive engineering groups at WD seems to have long passed.