Graphics Card Shipments Have Jumped 32% in 2022: Report

Supply and demand seem to be equalizing.

According to a report by Jon Peddie Research, the discrete graphics card market has seen a massive shift in value and product volume over the past year, in favor of consumers. Discrete graphics card shipments from AIB partners have escalated significantly, with JPR reporting a massive 32.2% year-over-year gain in overall shipments from both Nvidia and AMD. At the same time, the AIB market value dropped by $4 billion from $12.4 billion down to just $8.6, because of lower GPU prices this year.

This is good news for consumers, and means prices should continue to fall until they hit MSRP. The start of 2022 marked the first time in eight quarters that average selling prices (ASPs) of AIB partner cards finally began to drop.

JPR sees a bright future for the graphics card market and estimates it will grow from $46 billion right now to $57 billion by 2025, thanks to Intel's entry into the AIB partner market by 2023. This is despite the current market's drop in value from over the last quarter.

This hiccup is a result of the massive cost inflation of graphics cards we saw in 2020 and 2021, with the market now recovering rather quickly in 2022 from these super-inflated prices. But if JPR's predictions are true, the market will fully recover and regain all that value through GPU shipments instead. Again, this means GPU pricing should stay comparatively low as many many more graphics cards hit store shelves.

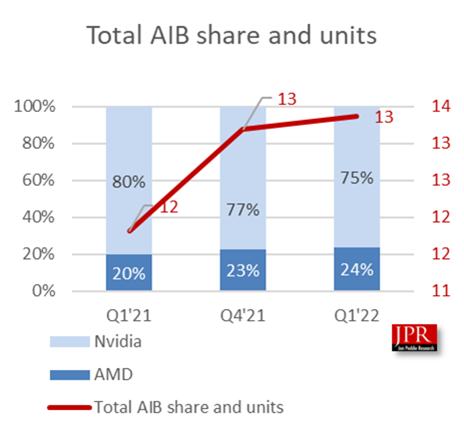

Market share between AMD and Nvidia has also shifted over the course of the past year. in Q1 of 2021 AMD had a 20% market share in the discrete GPU market, with Nvidia at 80%. In Q1 of 2022, market share shifted towards AMD a little bit, with AMD now at 24% market share and Nvidia at 75%. This isn't a massive shift, but it is a rather big one for AMD, since the company has been struggling to gamin market on the GPU front for years.

Overall, 2022 appears to be a year of recovery for the discrete GPU market. Shipments have escalated significantly since last year, and prices have dropped drastically at the same time. This may also be a good sign that next-generation GPUs will ship at MSRP and won't have the same supply problems as Nvidia's RTX 30 series did at the start of its launch. At the very least, barring any major changes on the mining or geopolitical fronts, current-gen GPU prices should keep trending in the direction of affordability.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Aaron Klotz is a contributing writer for Tom’s Hardware, covering news related to computer hardware such as CPUs, and graphics cards.

-

magbarn Are they truly making more now or did up to 1/3rd of the AIB shipments went straight to mining outfits and skipped the distributors during the cryptoboom?Reply -

Tonet666 Reply

Yes, I think the second one. straight to the miner.magbarn said:Are they truly making more now or did up to 1/3rd of the AIB shipments went straight to mining outfits and skipped the distributors during the cryptoboom? -

shady28 Agree with magbarn. I have a feeling these analysts either don't comprehend, or don't know how to separate, real consumer GPUs from miners. If they were really trying hard, they could probably just plot various GPU prices with the price of crypto and get a clue.Reply -

watzupken Reply

I have no concrete evidence, but I feel all these “supply shortage” was just a cover up so that they can move whatever stock of GPU they got to miners. Why? Cause miners are willing to pay a significant premium, less cost of distribution by selling and sending bulk GPUs to a few buyers , and there is less liability in the form of warranty for GPUs used for mining. It is a win-win-win situation for the manufacturers. Now that mining demand is gone, suddenly we have an abundance of GPU supply. The timing cannot be any better than this.magbarn said:Are they truly making more now or did up to 1/3rd of the AIB shipments went straight to mining outfits and skipped the distributors during the cryptoboom? -

magbarn Reply

Not to mention the sudden jump of Ampere numbers in Steam. That lets us know the cards are finally going to gamer's hands. Unless miners all decided to start playing Elden Ring!watzupken said:I have no concrete evidence, but I feel all these “supply shortage” was just a cover up so that they can move whatever stock of GPU they got to miners. Why? Cause miners are willing to pay a significant premium, less cost of distribution by selling and sending bulk GPUs to a few buyers , and there is less liability in the form of warranty for GPUs used for mining. It is a win-win-win situation for the manufacturers. Now that mining demand is gone, suddenly we have an abundance of GPU supply. The timing cannot be any better than this. -

shady28 Replywatzupken said:I have no concrete evidence, but I feel all these “supply shortage” was just a cover up so that they can move whatever stock of GPU they got to miners. Why? Cause miners are willing to pay a significant premium, less cost of distribution by selling and sending bulk GPUs to a few buyers , and there is less liability in the form of warranty for GPUs used for mining. It is a win-win-win situation for the manufacturers. Now that mining demand is gone, suddenly we have an abundance of GPU supply. The timing cannot be any better than this.

There's some anecdotal evidence of this. Recently there have been some articles about TSMC not being able to deliver volume in 2022 due to lack of input materials on their advanced nodes, however the same reports indicate that the highly advanced nodes (7nm, 5nm) have not been affected by this until now.

Only the less advanced nodes for things like display controllers and SoCs for car infotainment systems were affected over the past couple of years, mostly the 20 / 28 nm and larger nodes.

These GPUs are on the more advanced nodes. Put that together with the above two assertions and there should have been no GPU supply issues due to COVID. So I think you are right, and mostly Nvidia probably allocated the majority of their GPUs to crypto miners and not the retail gamer market. -

spongiemaster Reply

I don't believe Nvidia or AMD ever blamed supply shortages for the lack of GPU's being sold at retail. AMD didn't care in the first place, and Nvidia just said they were producing as much as they could and they couldn't meet demand. These companies sign contracts with suppliers a long time in advance. There were never any reports that either company wasn't receiving what they ordered. Demand simply outstripped predicted supply, and there was no way to ramp up production to meet that demand.watzupken said:I have no concrete evidence, but I feel all these “supply shortage” was just a cover up so that they can move whatever stock of GPU they got to miners. Why? Cause miners are willing to pay a significant premium, less cost of distribution by selling and sending bulk GPUs to a few buyers , and there is less liability in the form of warranty for GPUs used for mining. It is a win-win-win situation for the manufacturers. Now that mining demand is gone, suddenly we have an abundance of GPU supply. The timing cannot be any better than this.