Intel's Q2 2021: PCs up 33 Percent, Servers Continue Decline

More money, looming problems

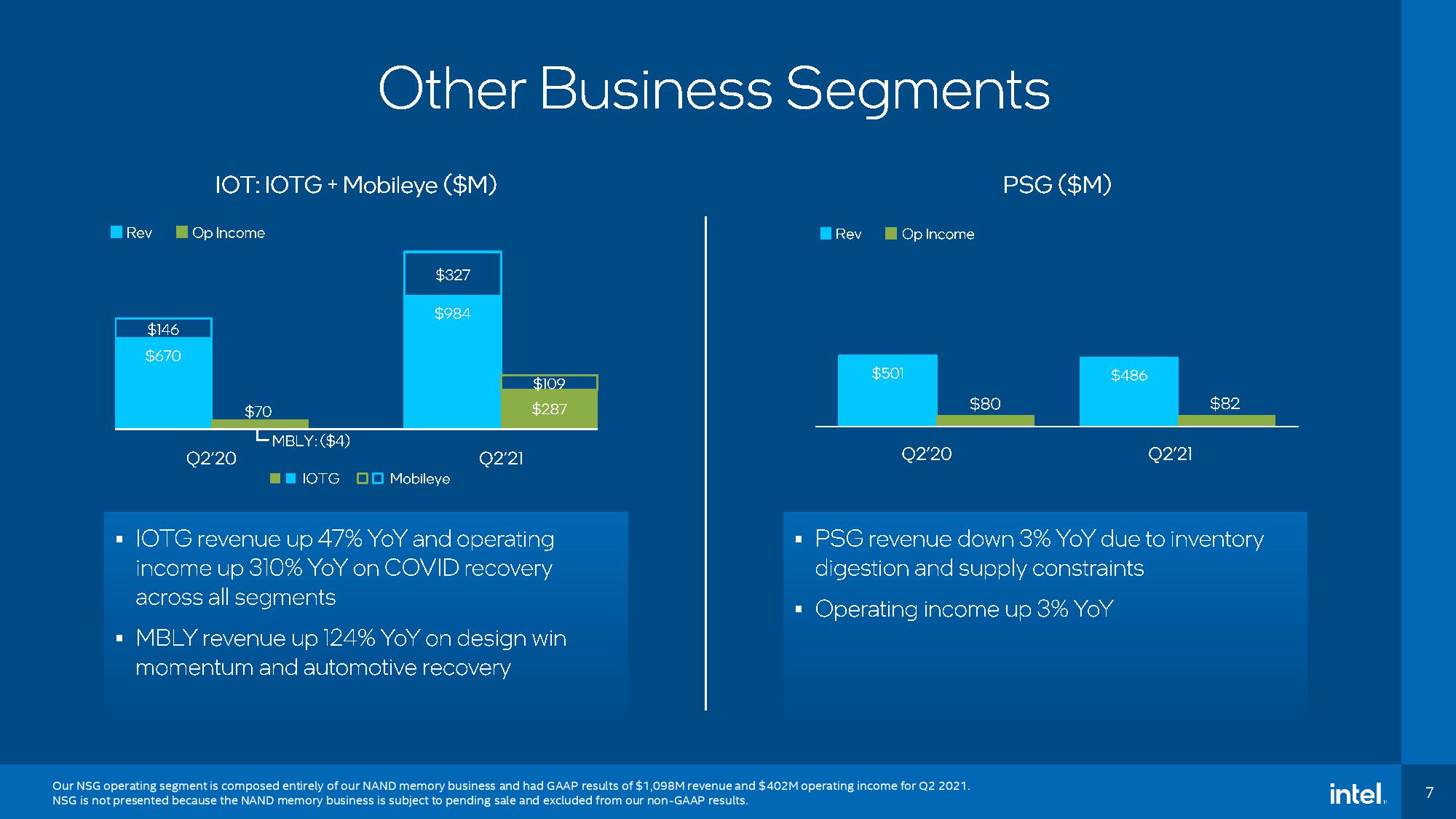

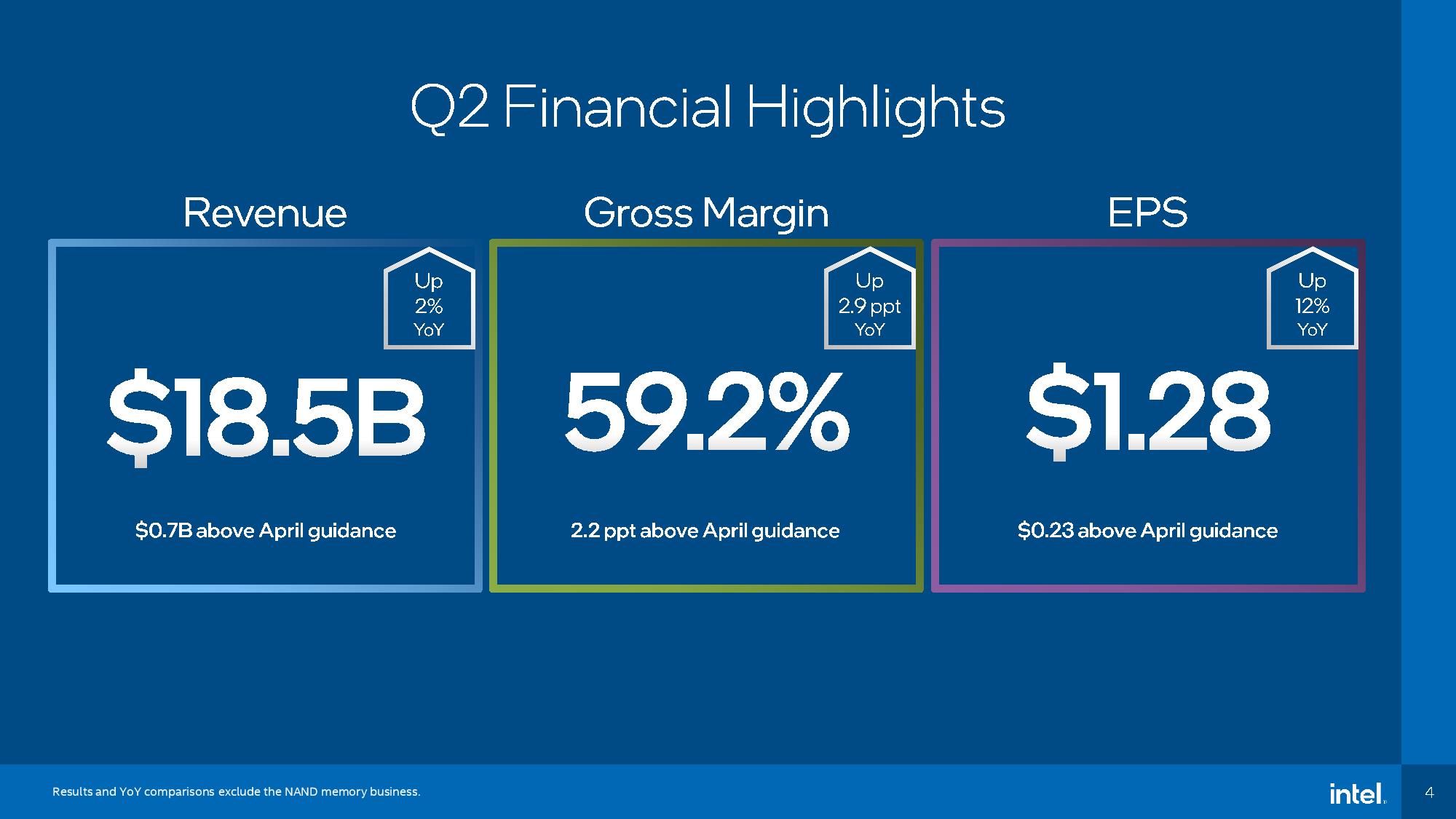

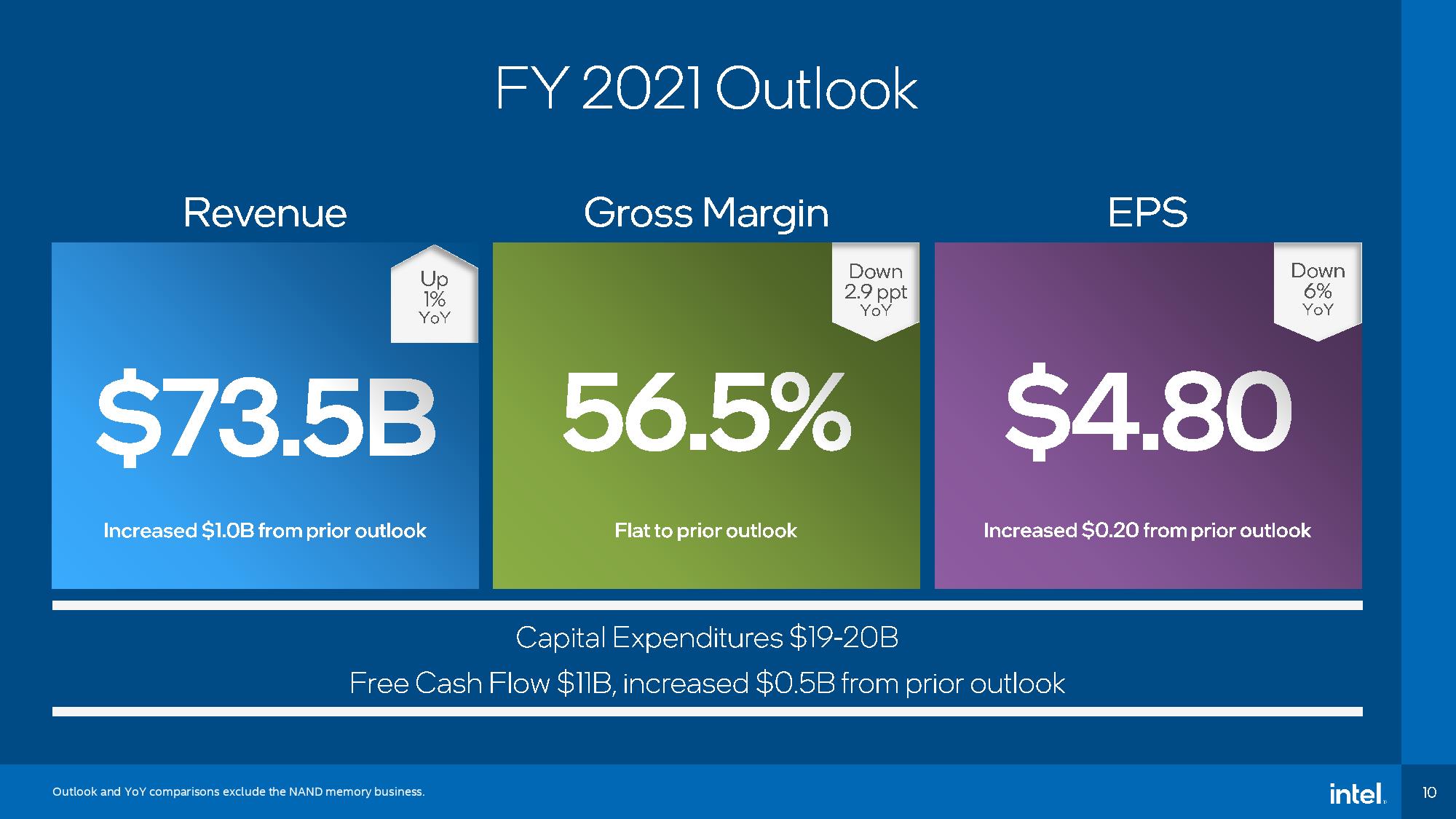

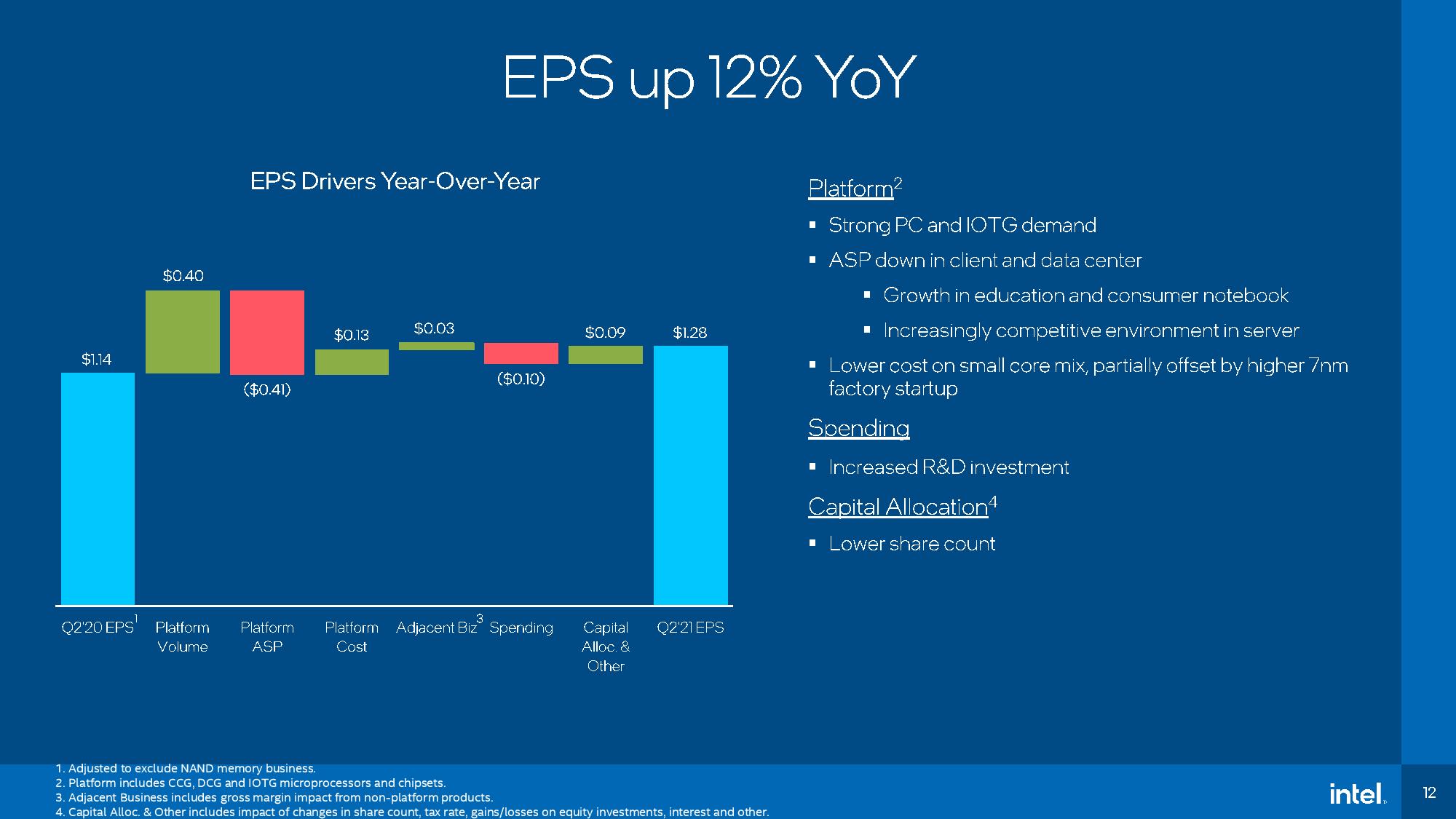

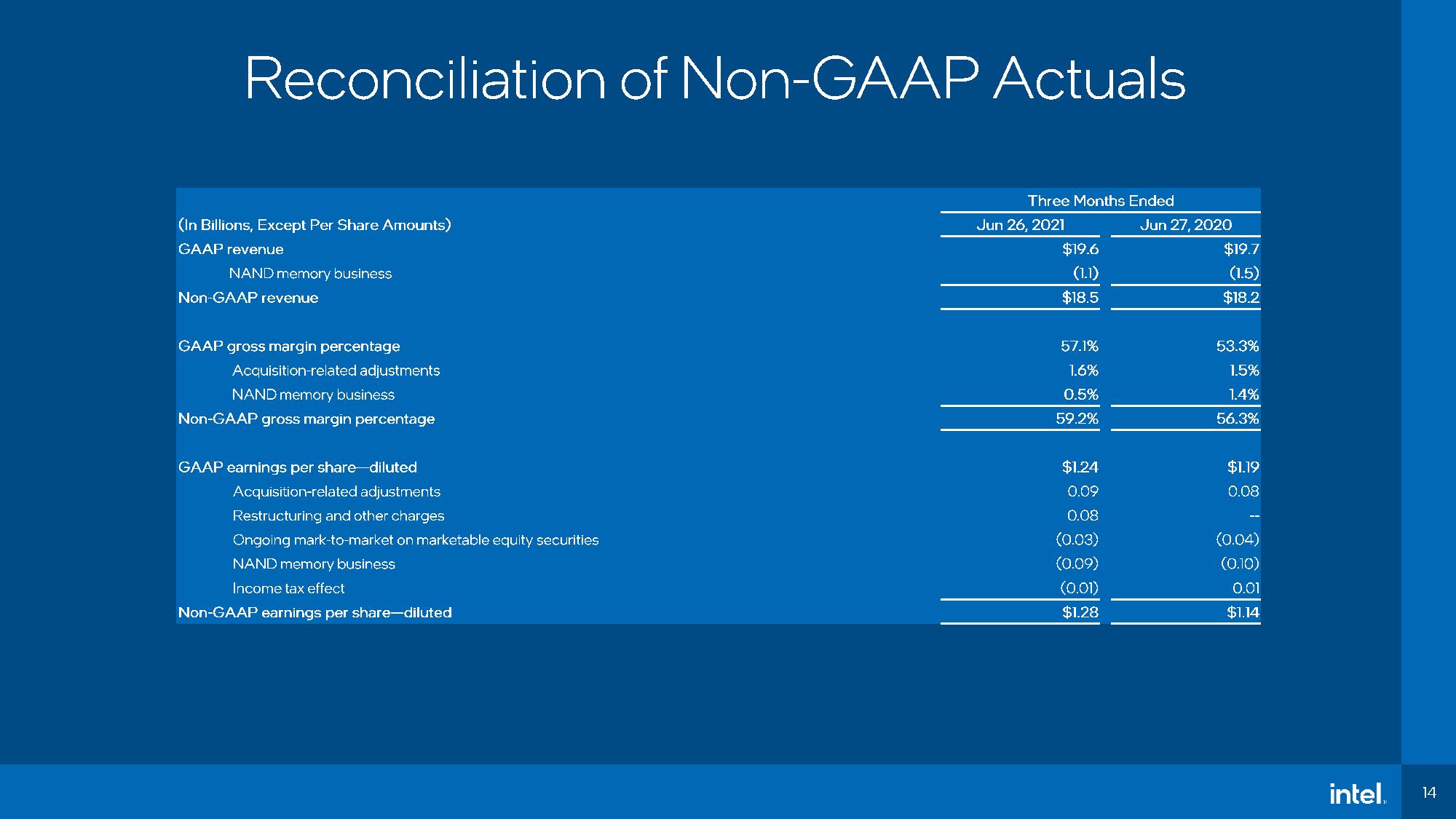

Intel released its Q2 2021 earnings report today, notching its tenth consecutive quarter that beat estimates, raking in $19.6 billion. Intel reported that its PC volumes increased 33% on the year, spread across gains in both laptops and desktops. However, Intel's server unit continued to post weak results, and the company reduced its gross margin outlook. Intel CEO Pat Gelsinger also declined to comment on recent reports that the company is in talks to purchase GlobalFoundries for $30 billion.

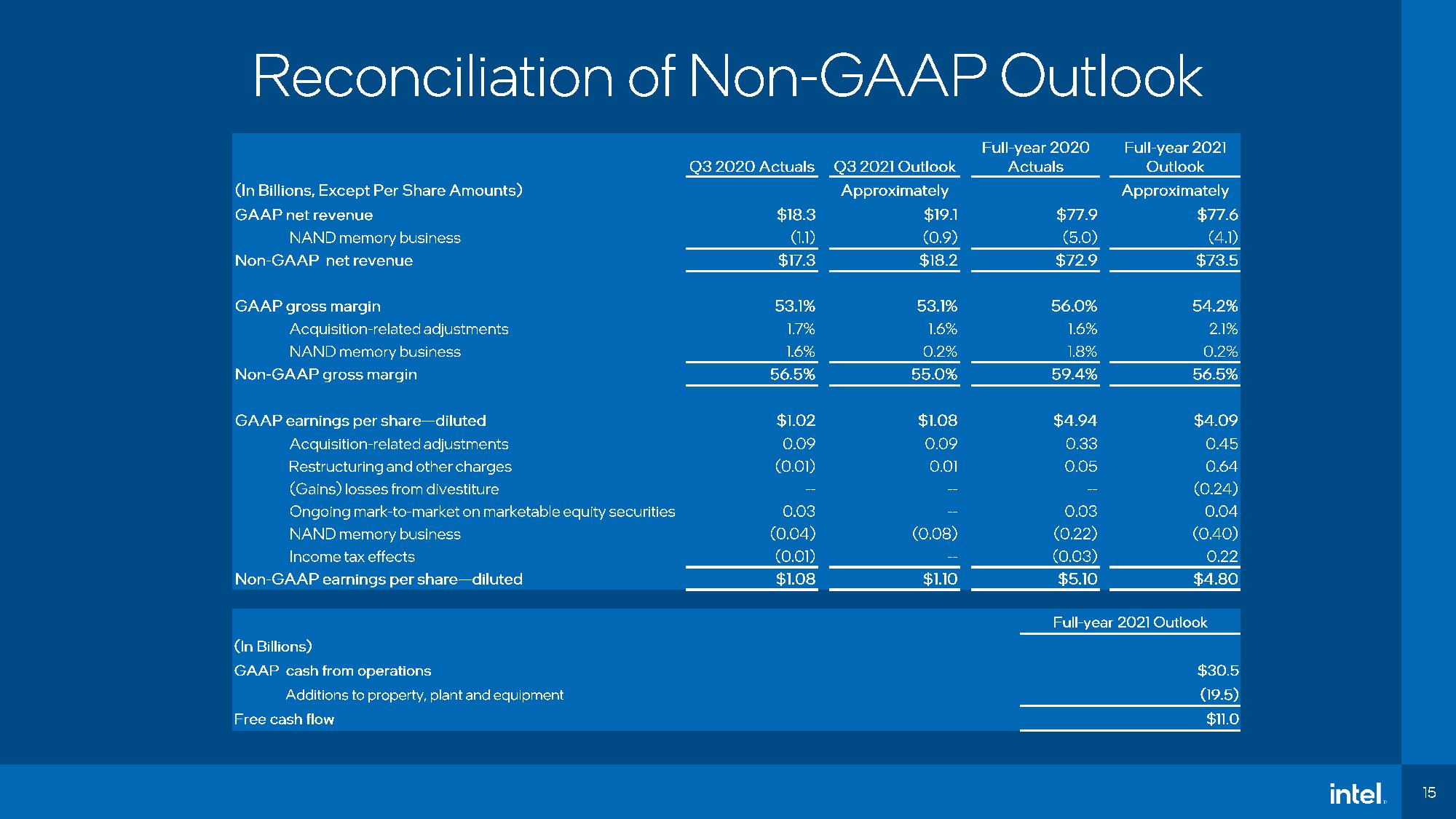

Intel says it will ship several million Alder Lake chips to its partners in the second half of this year, and that it has already shipped 50 million Tiger Lake chips into the market. However, the company also warned that it would see 'particularly acute' chip shortages for desktop PCs in the third quarter. Intel remains bullish amid these challenges, though, as it raised its full-year outlook by $1 billion to $73.5B.

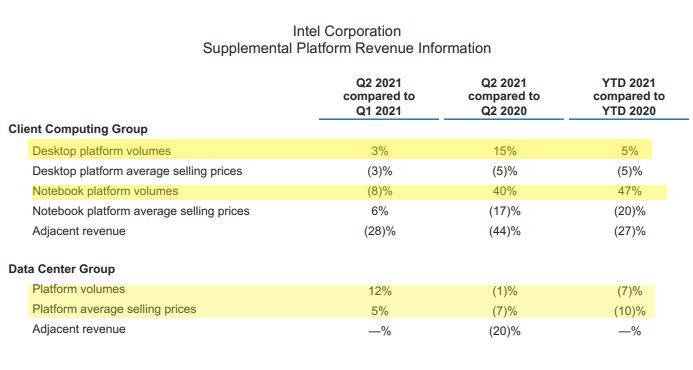

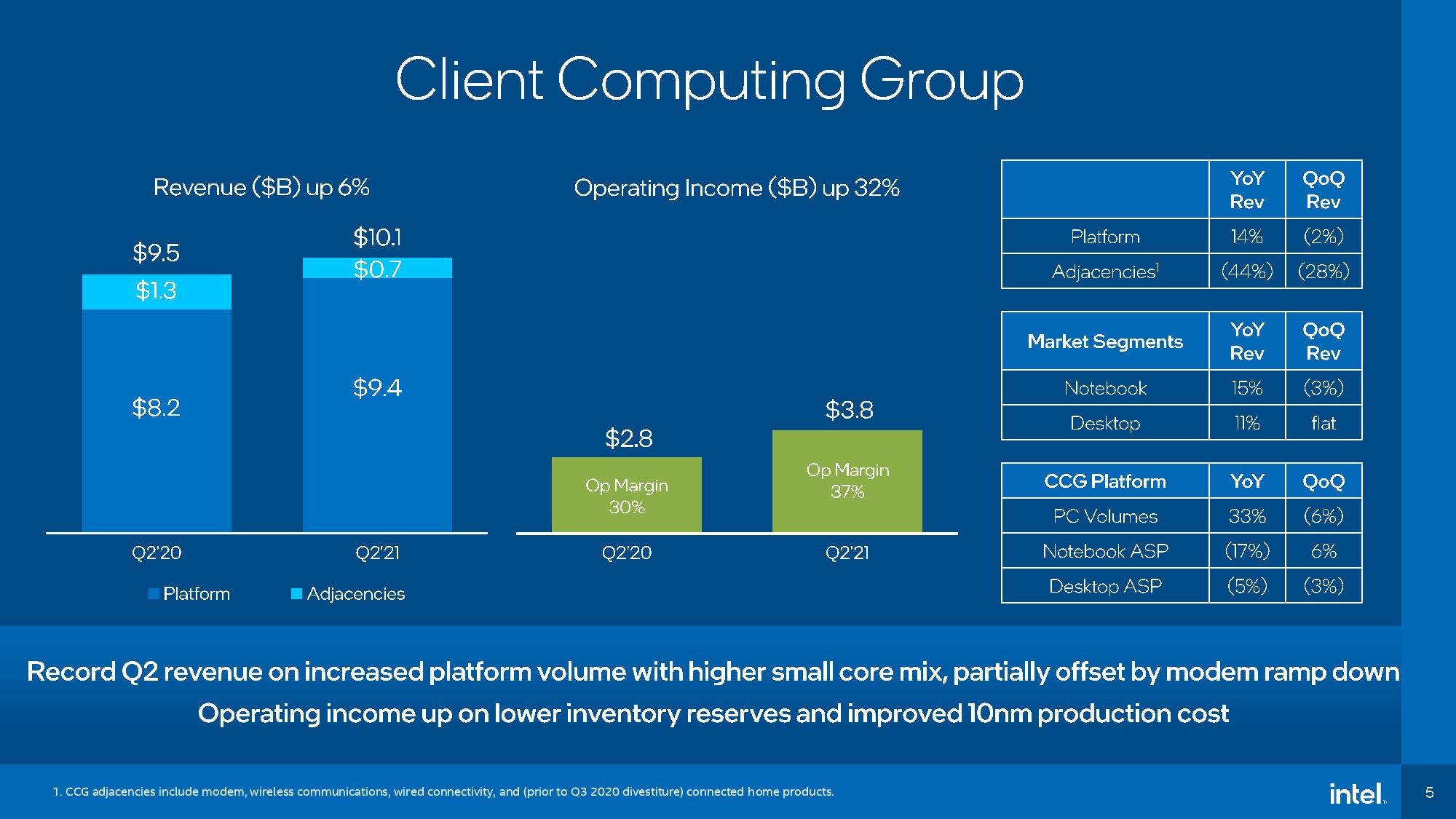

Intel's desktop PC volumes were up 15% for the year, while notebooks jumped an incredible 40% year-over-year (YoY). Those gains came at the expense of price cuts, though, as Intel's average selling prices (ASPs) declined 5% and 17% for desktops and notebooks, respectively, indicating that Intel is reducing pricing to stay competitive with AMD.

Intel says it set a record for its PC revenue during the quarter and gained more PC market share. Intel's ability to carve out nice sequential gains in chip sales isn't entirely surprising as it has maintained strong supply levels during the chip shortage. In contrast, AMD has suffered from extreme shortages.

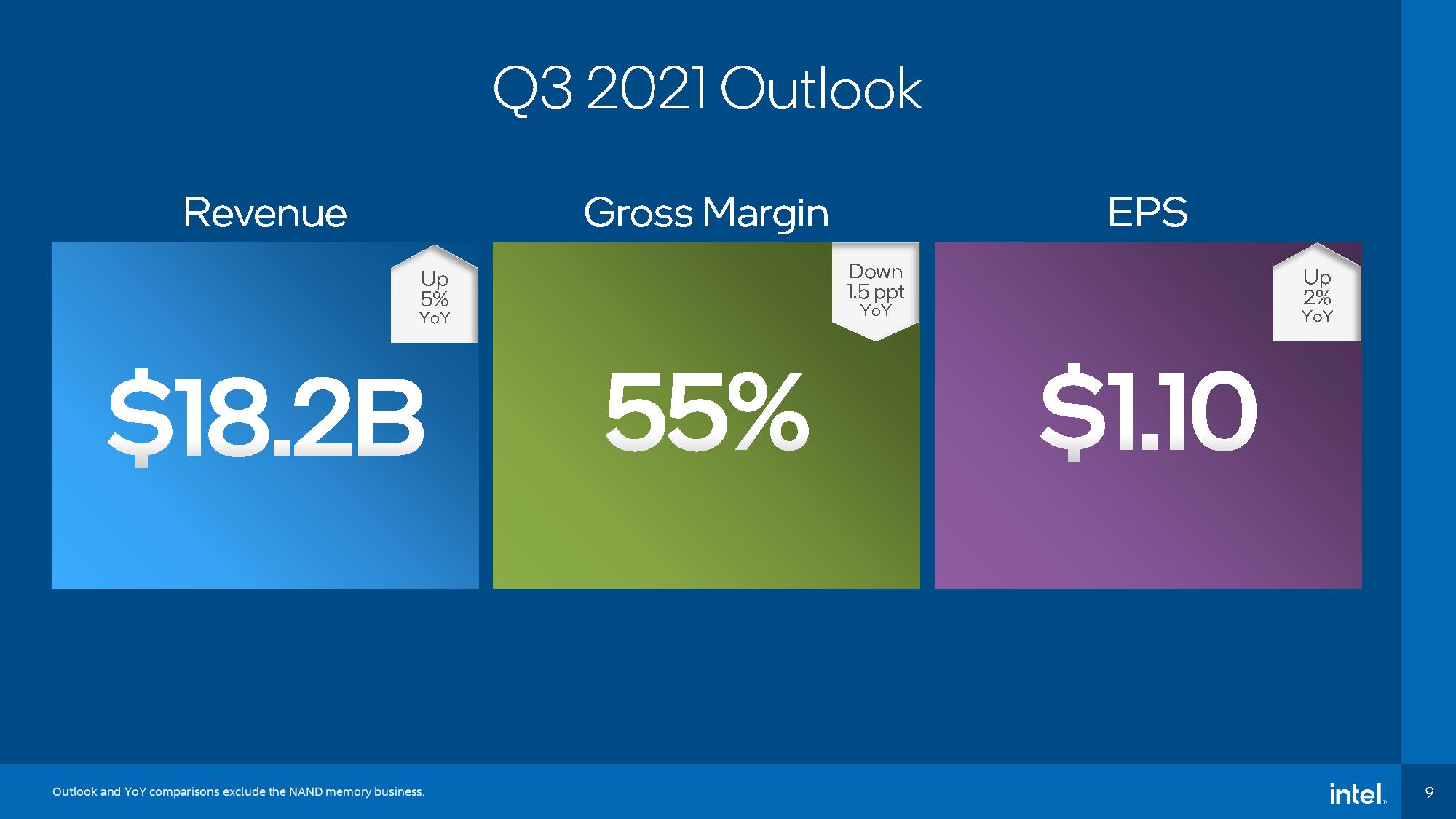

However, Intel says it will see 'particularly acute' shortages of its client chips in Q3. Additionally, increasing supply chain costs are chewing into its margins, largely because it isn't passing those increased costs along to its customers. Gelsinger said he expects the broader industry chip shortage to 'bottom out' this year but that it would require an additional year, or more, for the market to stabilize completely.

Intel also announced that it now fabs more 10nm wafers than 14nm, and that it has reduced 10nm manufacturing costs by 45% year-over-year.

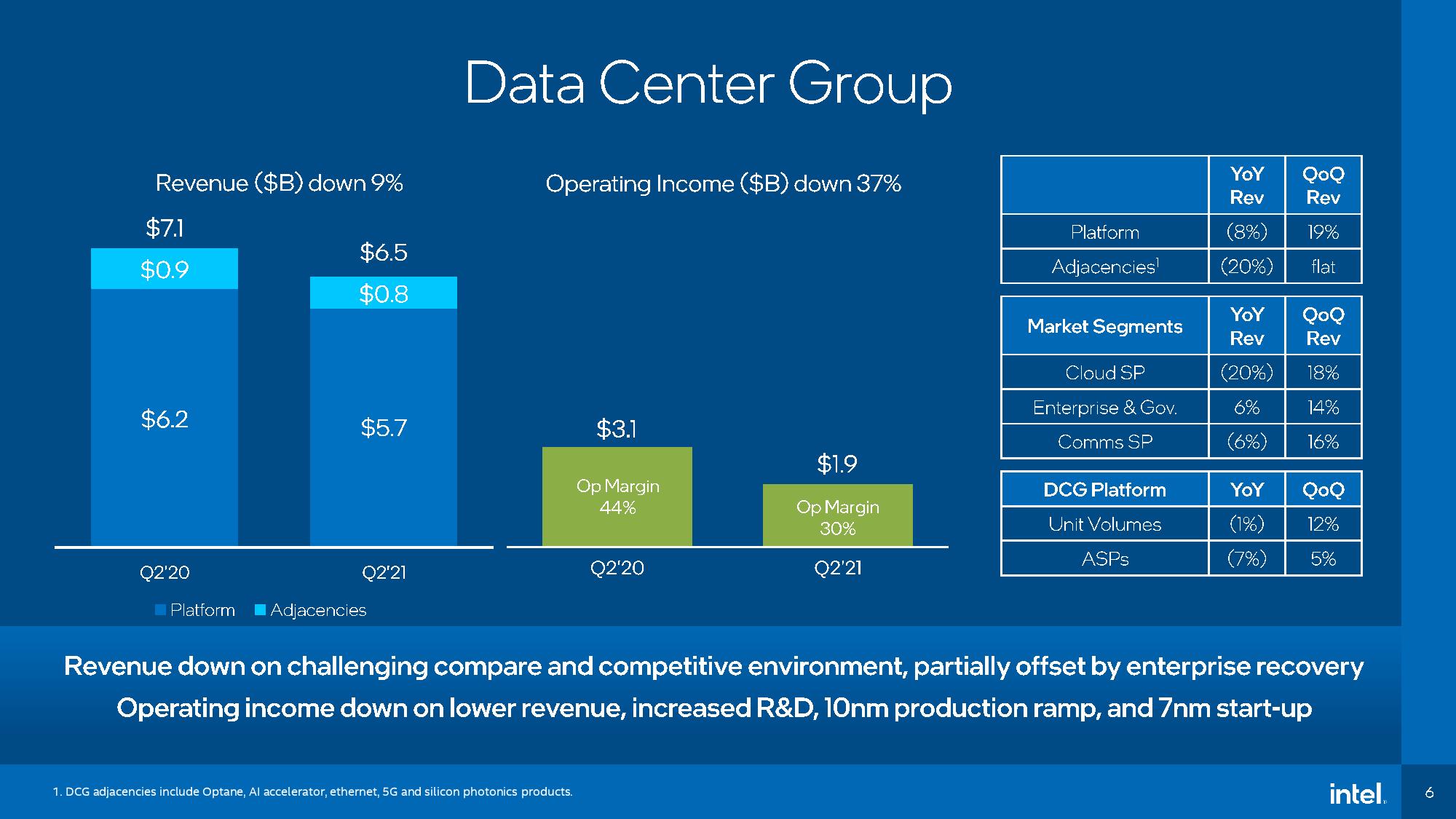

Intel's Data Center Group (DCG) chugged along with $6.5 billion in revenue during the quarter, down 9% compared to the prior year. Intel cited challenges compared to the prior year and a more competitive environment for the downturn, a nod to AMD's potent EPYC processors that continue to nibble away market share. Intel's lower sales in the server segment came in the wake of its prior quarter, which saw a 20% YoY revenue decline.

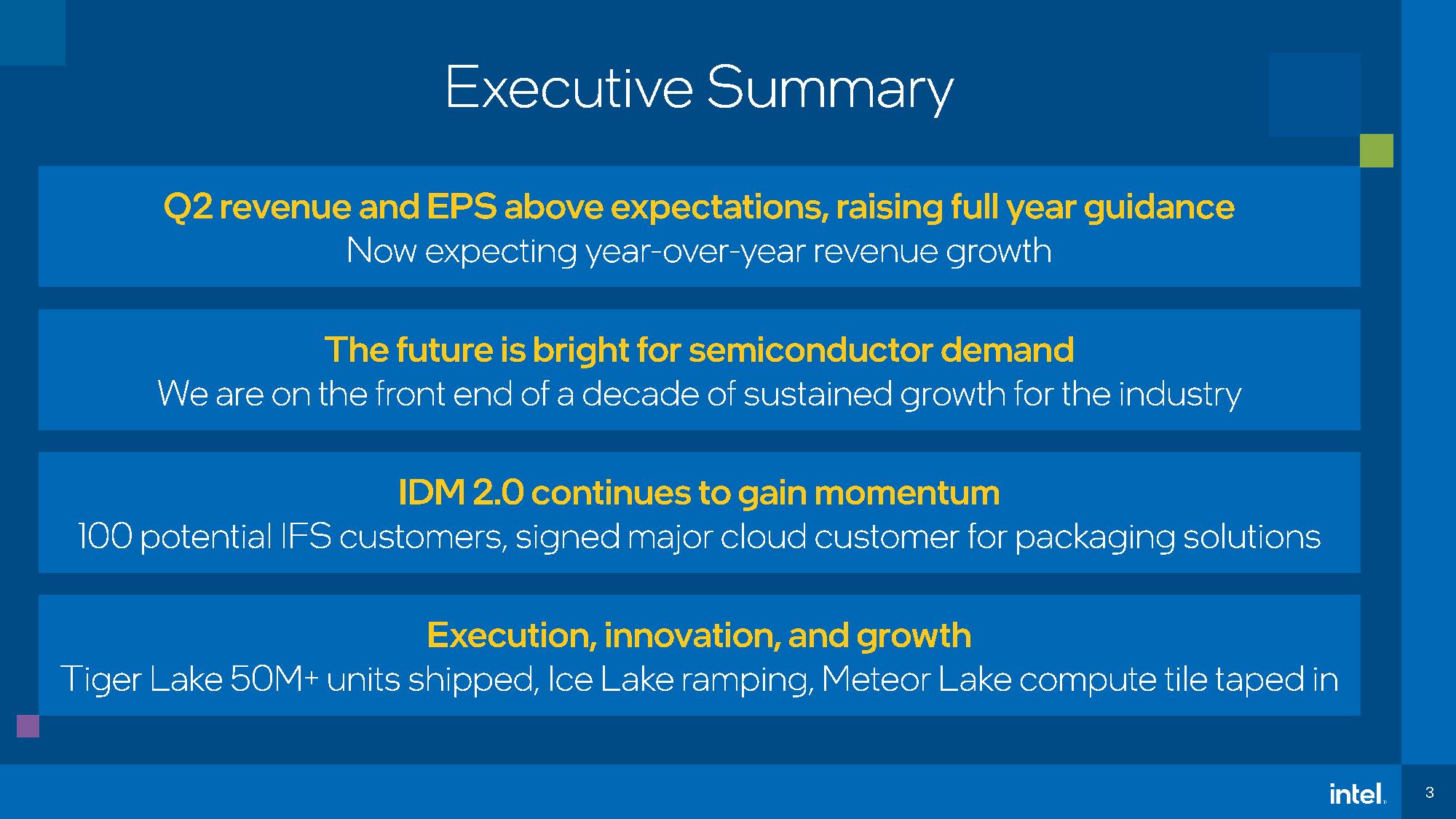

New Intel CEO Pat Gelsinger continues to restructure the company as he replaces and reinvigorates key leadership roles and begins to develop the company's IDM 2.0 initiative, which will find the company fabbing chips for other firms through a new Intel Foundry Services (IFS). Gelsinger announced that Intel recently signed its first cloud customer for its IFS chip packaging services and has 100 potential customers for its planned chip-fabbing services.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Intel will present roadmaps and an update on its process and packaging technologies during its Intel Accelerated Webcast on July 26 at 2pm PT. The event will be streamed via the Intel Newsroom, and we'll also have our own coverage of the event with additional analysis.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

plateLunch Might be time to buy some AMD calls. See if I can make enough to get me a new Vermeer system. Earnings on Tuesday the 27th.Reply -

Howardohyea I'm not surprised about Intel's server/datacenter market given how good AMD systems areReply

I wonder what will AMD's report look like compared to Intel's -

InvalidError Reply

The last year or so only had a massive bump from work-from-home surge, it'll die out within the next year as most WFH people are done setting up shop for the next several years and things return to normal for the rest of people.vern72 said:And a lot of people was counting the PC out! -

watzupken Reply

This is correct. OEMs are caught by surprise by the sudden surge in demand due to COVID which caught everyone by surprise too. So with all the lock downs, demand surged to all time high in recent years. But most people are not PC enthusiasts, and don't change PC often, so the hot demand is not going to sustain the test of time. And all the chip makers and analyst are predicting some red hot demand, and bumping supply like nobody's business. I suspect what is happening out of the norm is that OEMs are replenishing their inventory which was previously running low. As a result this is creating an impression of strong demand, i.e. high shipped numbers. At some point, they will be choking on too much chips.InvalidError said:The last year or so only had a massive bump from work-from-home surge, it'll die out within the next year as most WFH people are done setting up shop for the next several years and things return to normal for the rest of people. -

korekan Amd cpu is cheap. Servers nowadays mostly AMD since it has much bigger core. In a world with kubernetes, microservices, cores really count.Reply

Yea pc only surge because there is more demand because WFH and SFM. Once the pandemic over. They will dropped so bad that PC x86 will be on the museum.

Nvidia starting arm, microsoft continue arm. Once Qualcomm join in you can have a pc with only $300 and can play lastest gen gaming smooth for FHD. -

Chung Leong Revenue for DCG went up 43% in 2020 compared to 2019. It's bound to come back down.Reply -

InvalidError Reply

Why? Datacenter and HPC have had 30-70% YoY growth for the better part of a decade. They were the fastest-growing segment for many years before covid and will pretty much certainly remain so for the foreseeable future. All of those new "client PCs" and other online devices need something to connect to.Chung Leong said:Revenue for DCG went up 43% in 2020 compared to 2019. It's bound to come back down. -

USAFRet Declining data center server sales could also easily be a result of more virtualization.Reply

Replace 4x 5 year old boxes with one large one, and run the same functions in VM's. -

TerryLaze Reply

Covid started at the very end of 2019 with the first actions being taken at the start of 2020, there is no reason to believe that after covid is going to be worse than before covid.InvalidError said:The last year or so only had a massive bump from work-from-home surge, it'll die out within the next year as most WFH people are done setting up shop for the next several years and things return to normal for the rest of people.

Actually there was a slight decrease for intel over covid time, maybe due to added costs for logistics, maybe just by chance.

https://ycharts.com/companies/INTC/revenues