Nvidia Stock Falls Amidst Fears Of A Cryptocurrency Mining Bust

Nvidia posted yet another string of records during its Q1 2018 earnings call, but the company's stock tumbled 7.85% after it revealed that $287 million of its revenue was generated from direct sales to cryptocurrency miners. The company expects crypto revenue to fall by two-thirds during the current quarter.

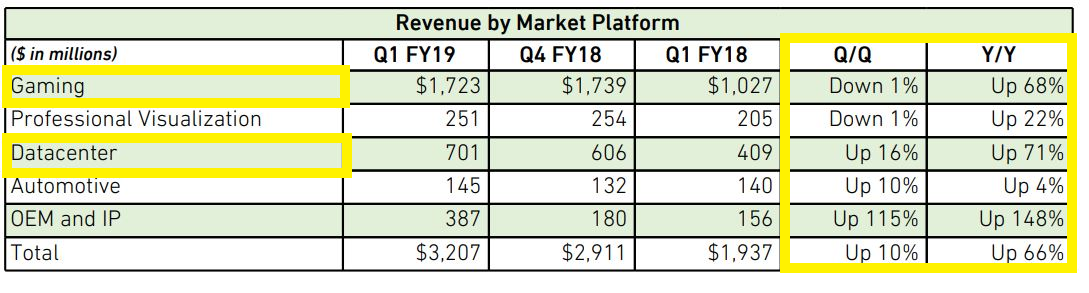

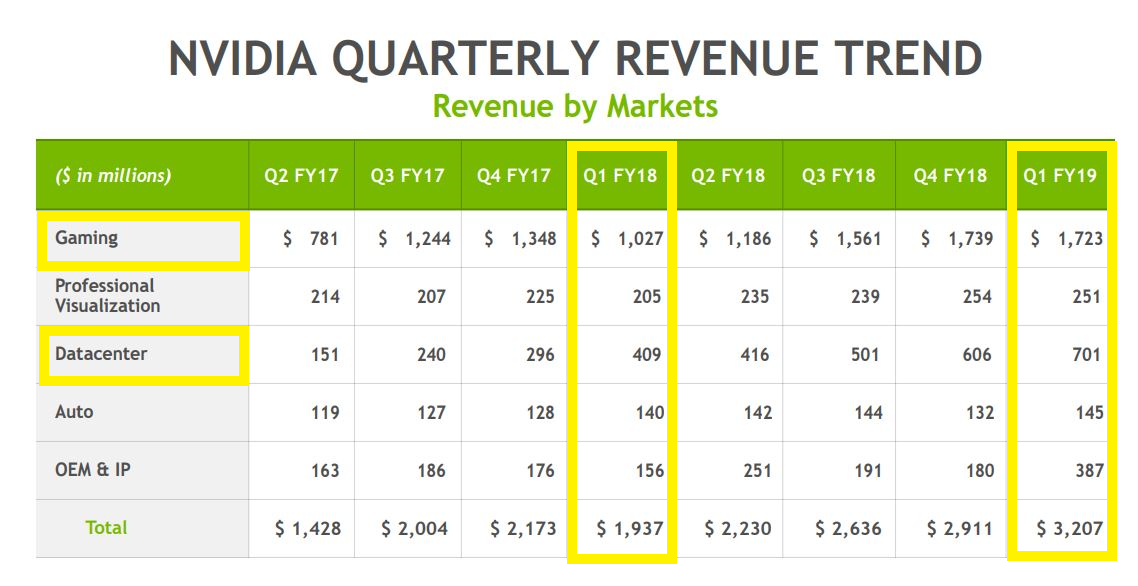

Nvidia raked in a record $3.21 billion in Q1, a 66% year-over-year increase. Profit also increased a whopping 145% year-over-year to $1.24 billion.

The company's OEM and IP segment grew 148% during the same period. This segment includes Nvidia's OEM GPU sales and Tegra, but it also includes sales of CMP SKUs, which are specialty cards for professional mining outfits in the volatile cryptocurrency segment. Nvidia says these cards accounted for $298 million of the OEM and IP segment revenue, marking the company's first public comments on its crypto-derived revenue.

Nvidia predicts those sales will decline by two-thirds during the current quarter, which is an unexpectedly sharp decline. The company also conceded that some of its gaming revenue also includes sales to casual miners, and given that professional miners plundering the commercial market spurred the graphics card shortage, it is possible that a portion of Nvidia's gaming revenue is also tied to professional miners. Not only is mining on the downturn, but new Ethereum-capable Bitmain ASICs also threaten to reduce demand for GPUs severely. That raises concerns with investors that Nvidia's $1.723 billion in gaming sales may suffer from the cryptocurrency downturn as well.

Gaming is Nvidia's largest revenue driver by far, generating 53.7% of the company's revenue in Q1, and that crucial segment jumped 68% year-over-year. But fears of drastic losses in that segment sent Nvidia's stock tumbling 7.85% in after-hours trading.

During the earnings call, Susquehanna's Christopher Rolland stated that, given AMD's projections that mining consists of 10% of its revenue, the ~$300 million in verified crypto sales would give Nvidia a two-thirds (or more) share of the unpredictable mining market.

But Nvidia CEO Jensen Huang is optimistic about the state of the gaming market and repeatedly cited battle royale games like Fornite: Battle Royale and PlayerUnknown's Battlegrounds as key drivers. The company also notes that it is replenishing stock and prices have now fallen to near-MSRP. Huang feels this could satisfy some of the pent-up demand from gamers who have been waiting for prices to recede to buy a new card.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Conversely, it's also possible that reduced mining demand will result in a flood of cheap used graphics cards on the market, which could reduce sales of newer models. Nvidia's two-year-old Pascal has proven to be immensely successful, but it's possible that some of the pent-up demand will be tempered by gamers that choose to wait for Nvidia's next-gen offerings.

Huang also finally made the company's first semi-in-depth public comments about the notorious GeForce Partner Program (GPP), but they weren't very revealing:

Yeah. Thanks for your question, Toshiya. At the core, the program was about making sure that gamers who buy graphics cards knows exactly the GPU brand that's inside. And the reason for that is because, we want gamers to – the gaming experience of a graphics card depends so much on the GPU that is chosen.And we felt that using one gaming brand, a graphics card brand, and interchanging the GPU underneath causes it to be less – causes it to be more opaque and less transparent for gamers to choose the GPU brand that they wanted. And most of the ecosystem loved it. And some of the people really disliked it.And so instead of all that distraction, we're doing so well. And we're going to continue to help the gamers choose the graphics cards, like we always have, and things will sort out. And so we decided to pull the plug because the distraction was unnecessary and we have too much good stuff to go do. (courtesy Seeking Alpha)

The rise of AI and ML workloads in the data center continues to fuel Nvidia's high-margin growth. Data center revenue increased an impressive 77% year-over-year. Huang noted that sales of DGX systems are now generating several hundred million dollars per year. That should accelerate as DGX-2 sales kick in. Huang said that the company has doubled sales of its chips to cloud data centers for deep learning, but investor response was muted due to lower-than-expected sales.

Nvidia also regained some of its revenue from automated driving income, but this 4% yearly increase in revenue indicates that this is a long-term investment for Nvidia.

Data center and automotive investments are important to NVidia's success, especially given that it could suffer at the whims of the cryptocurrency market over the coming quarters. Nvidia is tied to a singular type of product, graphics cards, while its competitors, such as Intel and AMD, are more diversified into other markets, like CPUs. Nvidia's decade-long investment in CUDA continues to pay off as it rakes in record amounts of revenue and profit, and it will undoubtedly help the company weather any revenue losses due to reduced crypto demand.

Releasing a new generation of graphics cards would help, too. Nvidia hasn't been pressured of late in the gaming market by AMD, but flagging GPU sales could finally bring the next generation cards to light. That would undoubtedly spur a broad refresh cycle, but for now, Nvidia hasn't made any new announcements.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

bloodroses "the company's stock tumbled 7.85% after it revealed that $287 million of its revenue was generated from direct sales to cryptocurrency miners."Reply

And in other news, water wet.

How the heck did the stock holders not know this beforehand until Nvidia 'revealed' it? -

gggplaya I don't know why they're citing fortnite as growth since you can play it on consoles, which gives less incentive to pc game.Reply -

dudmont The comments about GPP were hilarious. How dumb do they think consumers are? His remarks indicate we(the consumer/customer) are too stupid to figure out what chip is in what card. Or the other side of the coin, we're too stupid to figure out what his lame remarks mean in regards to our stupidity(figure that one out, I dare you!). I just wish AMD had something that could genuinely compete with the 1080TI right now and had something in the wings to compete with the next flagship. Best way to confirm to NVidia that I'm stupid, is to buy the competitor's product.Reply -

stdragon Reply20960110 said:How the heck did the stock holders not know this beforehand until Nvidia 'revealed' it?

HFT algorithms (and day traders) by definition don't care about long-term trends. They only focus on profit via the delta of buying low and selling high. So it's not like those that control the market don't know this. They know it. It's simply not in their interest to care. Now, for people like you and me that engage in the market at the human level, yeah, long-term matters.

Actually, if I recall, nVidia knows that this is a trap. It's why they didn't want to get involved in the crypto currency trend. On one hand, it's a major boost for the company. On the other, the whiplash from a correction later really takes the wind out from their sails.

I guess you could say that companies that engage in Cryptocurrency is a lot like doing coke. There's a major high at first, but the crash later leads to a long and lasting depression -

redgarl Stock is back to a overvalued 260$. Just throw AI somewhere in a conference call and investors are taking words for actual value. So far, Nvidia is just selling GPUs... fact. All other voodoo attempt is just to try to sell more GPUs in different format.Reply -

KidHorn Cryptocurrency was bound to bust sooner or later. I guess now is as good a time as any.Reply

If it brings video card and maybe memory prices down to earth, it will be a good thing. -

AlistairAB Reply20960297 said:Stock is back to a overvalued 260$. Just throw AI somewhere in a conference call and investors are taking words for actual value. So far, Nvidia is just selling GPUs... fact. All other voodoo attempt is just to try to sell more GPUs in different format.

Yeah, day to day prices in stocks don't mean much, be careful of explanations in general. The stock is already up 20 percent over the last 2 weeks, and the market was up every day for a week also, so this is more a response to that. -

kyotokid ...we can only hope. Although suddenly, the Nvidia store has all models of GTX 10xx cards available again after over two months of them being "not in stock".Reply

Sorry Nvidia, you lost a sale from me by making it seem that there would no longer be any more 10xx cards (I ended up buying a used Titan X for around the price of the Founders Ed. 1070). -

genz Reply20960229 said:20960110 said:How the heck did the stock holders not know this beforehand until Nvidia 'revealed' it?

HFT algorithms (and day traders) by definition don't care about long-term trends. They only focus on profit via the delta of buying low and selling high. So it's not like those that control the market don't know this. They know it. It's simply not in their interest to care. Now, for people like you and me that engage in the market at the human level, yeah, long-term matters.

Actually, if I recall, nVidia knows that this is a trap. It's why they didn't want to get involved in the crypto currency trend. On one hand, it's a major boost for the company. On the other, the whiplash from a correction later really takes the wind out from their sails.

I guess you could say that companies that engage in Cryptocurrency is a lot like doing coke. There's a major high at first, but the crash later leads to a long and lasting depression

The funny thing is that this is the first that Nvidia was hoping not to have. It wasn't so much a matter of if miners were buying cards, it was a game of hot potato on everyone declaring that there's no info on the subject so nobody could really make informed decisions (like pulling out stock) based on miners.

10% is a laugh btw, more like 50-60% of sales are miners, and then there's the resellers on eBay.