Samsung Slashes NAND Output by 50%, Prices to Slowly Edge Higher

Fixing prices from the supply side.

According to a recent report via TrendForce, the NAND flash market will soon break away from its trend of decreasing prices. According to the market analysis firm, Samsung, the world's biggest NAND manufacturer by market share (31%), has taken a decisive counter against softening demand - and consequent falling prices. Unfortunately, that solution will impact customers' wallets at some point in the future.

Samsung's solution is to induce a supply-side shock by cutting NAND output by as much as 50% (mainly on processes under 128 layers). Decreasing production by that amount will undoubtedly lead to a negative balance between supply and demand. When supply is artificially capped, the higher demand will slowly push stocks lower, increasing the sales price. At the same time, expectations of rising prices will lead to clients increasing their purchases of NAND to escape the increased costs, which should lead to a slight "explosive" uptick in NAND demand.

That's the mechanism Samsung is leveraging to stem the bleeding prices of NAND, which has seen a severe decline in the last year. And to be fair, it's a commonly used one. Micron, for instance, has also resorted to artificially capping output (across both NAND and DRAM) for the same purposes. According to TrendForce, other NAND manufacturers are expected to follow Samsung's decision.

The NAND market glut of 2023 relates both to production (and the increasing density of high-layer-count NAND designs) and the AI boom. In its current state, AI workloads require somewhat disproportionate compute as GPU and CPU power is much more critical to performance than having a quick, hot-storage solution. The gold rush for Nvidia GPUs (and their cost, which has led Nvidia to lock-in some 823% in profit percentage) also brings opportunity cost with it: spending money on GPUs leaves less money available for more "classical" supercomputing systems. But the money goes where the money goes.

As it stands, TrendForce is expecting the announced NAND cuts only to begin impacting prices by Q4 2023, with an expected NANd price recovery in the 0-5% ballpark. TrendForce will revise its estimates if the prediction that other NAND manufacturers proves correct.

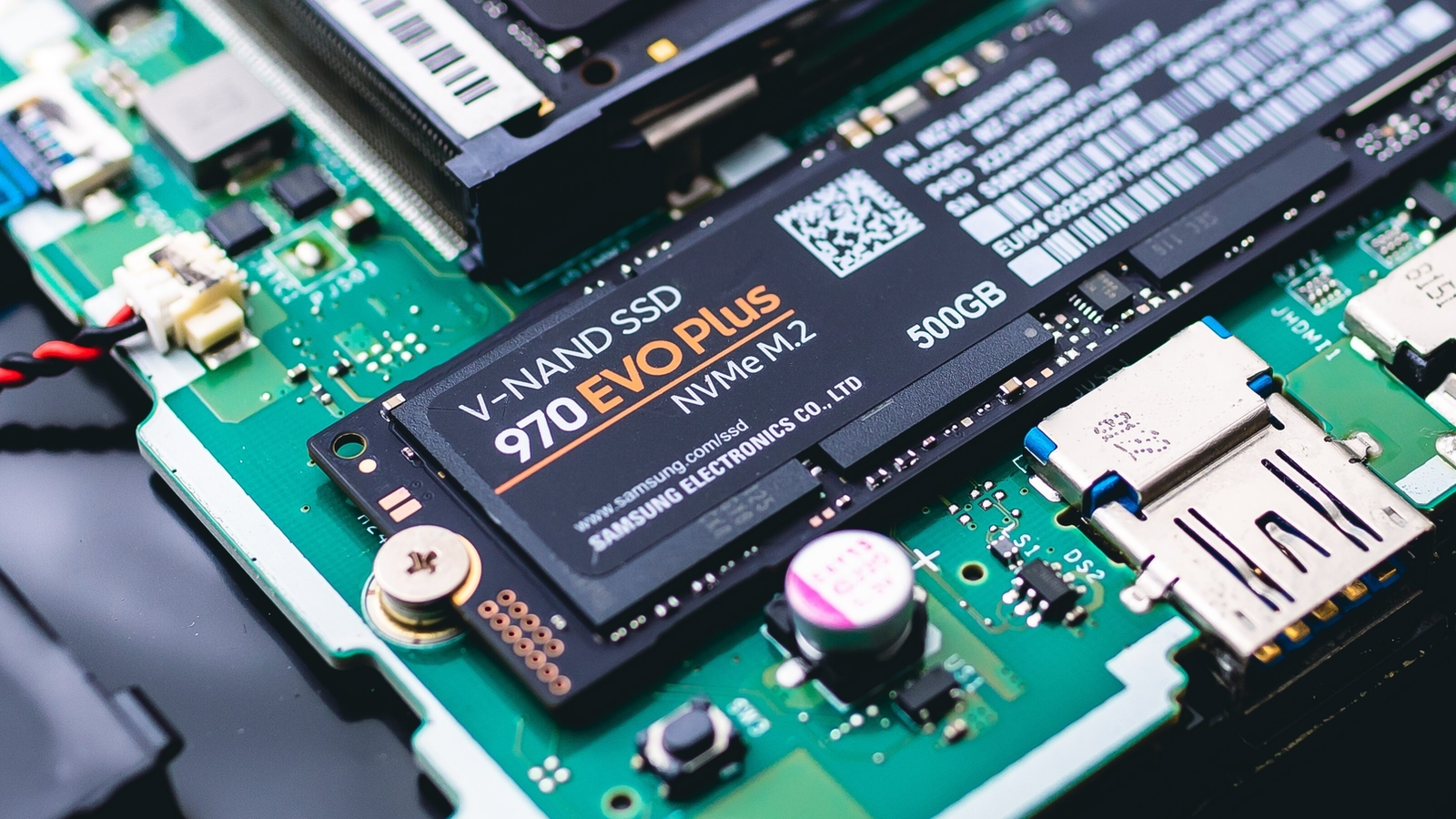

Considering all this, this might be a good time for anyone looking to improve their storage subsystem with the Best SSDs for their use case: from blindingly fast PCIe 5.0 NVMe SSDs to budget-conscious options, there's a product for everyone. Paraphrasing NVIDIA CEO Jensen Huang: the more you buy, the more you save. At least compared to the predicted increasing NAND prices of the future.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

ekio Wow what a toxic behaviour….Reply

We can’t scam people with huge margins anymore because the demand balanced the prices, let’s make it rare an expensive to fix that.

Samsung products : absolute no from now on! -

bit_user Reply

The article doesn't say if they're actually selling product below cost, but it's certainly plausible. That's unsustainable. You can't realistically expect them to continue producing themselves deeper and deeper into a hole, can you?ekio said:Wow what a toxic behaviour….

We can’t scam people with huge margins anymore because the demand balanced the prices, let’s make it rare an expensive to fix that.

Samsung products : absolute no from now on!

I can also tell you this: Samsung isn't alone. All of the NAND flash manufacturers have been cutting production.

Anyway, I did my part. I recently bought one of the last M.2 form factor enterprise drives: Samsung PM9A3 (110 mm):

https://semiconductor.samsung.com/ssd/datacenter-ssd/pm9a3/

Just make sure your board can handle a 110 mm M.2 drive, as not all motherboards can (the most common length is 80 mm).