Intel delays key Xeon data center processor amid massive losses — Clearwater Forest pushed back to 1H 2026

Intel on Thursday said that its codenamed Clearwater Forest processor for data centers will only be launched in the first half of 2026, roughly two years after the company introduced its Xeon 6-series CPUs and one or two quarters behind schedule. By contrast, Intel's Panther Lake product for client PCs — which uses the same 18A process technology — is on track for a 2H 2025 launch.

The delay of the key server processor comes amid the company's unveiling of Intel's financial results for the fourth quarter of 2024 and the entire year, which revealed massive losses. Paired with Intel's announced cancellation of its Falcon Shores AI GPUs, Intel's competitive posture for the exploding AI market is now severely weakened.

Clearwater Forest delayed

"We are also making good progress on Clearwater Forest, our first Intel 18A server product that we plan to launch in the first half of next year," said Michelle Johnston Holthaus, interim co-CEO of Intel, during the company's earnings call on Thursday. Holthaus cited difficulties with Clearwater's packaging technology but said the underlying 18A process node remains strong.

Currently, Intel is ramping up production of its energy-efficient Xeon 6 'Sierra Forest' and high-performance Xeon 6 'Granite Rapids' processors. It believes that these CPUs will be instrumental in stabilizing its market share this year. However, with the next-generation Xeon 7-series 'Clearwater Forest' and Xeon 7 'Diamond Rapids,' Intel probably expects to turn the tables and start regaining market share.

However, there may be a setback to this plan, as Intel originally promised to launch Clearwater Forest in 2025, but it now says that the new CPUs will be released in the first half of 2026. The delay will affect Intel's competitive position in the data center market and postpone potential design wins with interested parties.

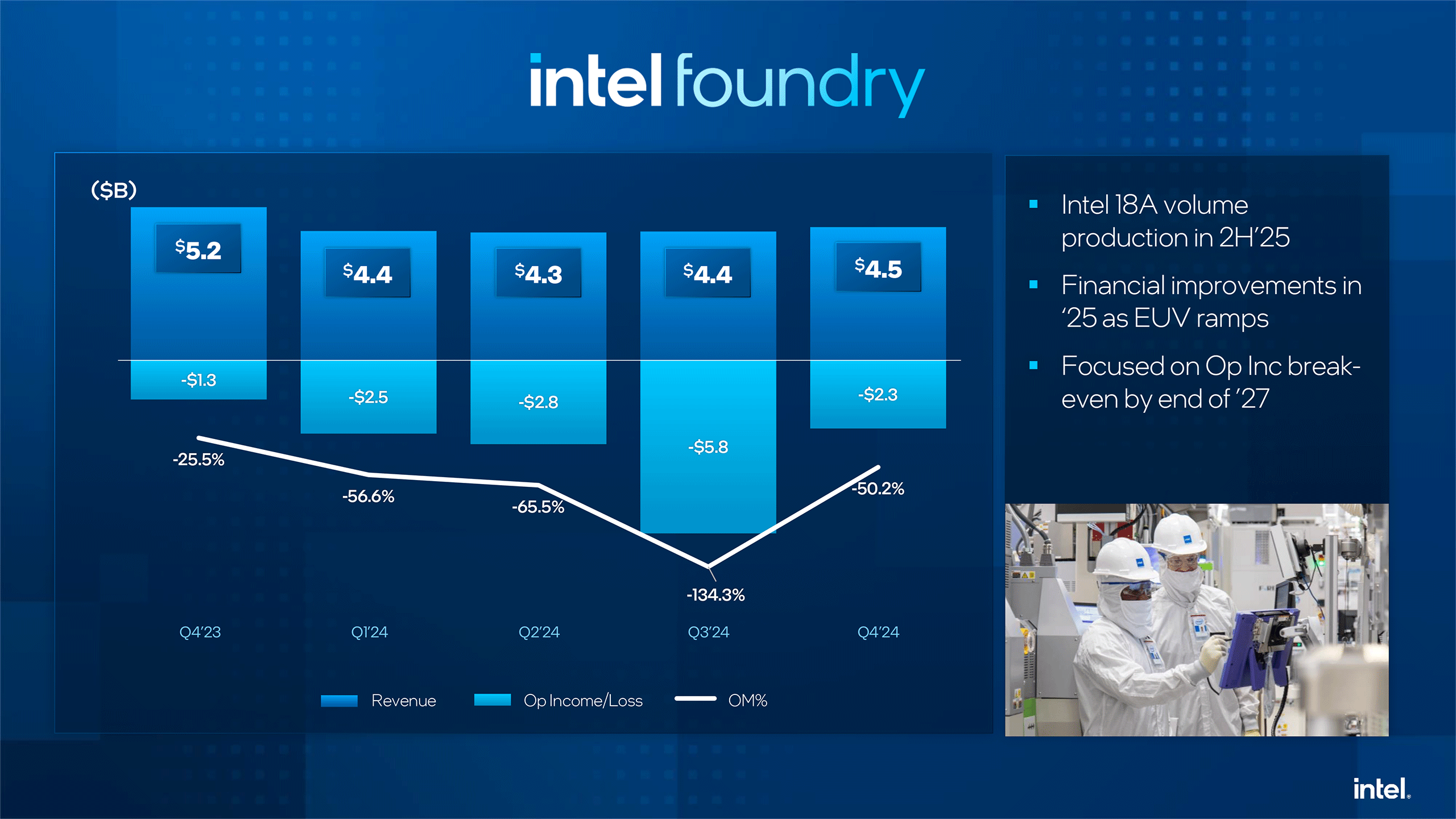

Clearwater Forest holds additional significance for Intel, as this is the first data center CPU with compute chiplets manufactured on the Intel 18A process technology (1.8nm-class) and featuring a Foveros 3D base die fabbed on the Intel 3 production node. If the company can mass-produce Clearwater Forest cost-effectively, it will be a major testament to its 18A manufacturing process—which happens to be the first technology developed both for Intel and its foundry customers—as a success. This could also attract potential clients to Intel Foundry. For now, Intel is optimistic about 18A.

"18A has been an area of good progress," said David Zinsner, interim co-CEO and chief financial officer of Intel, during the call. "Like any new process, there have been ups and downs along the way, but overall, we are confident that we are delivering a competitive process."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Intel's 2024 Revenue Flat, But Losses Climb to $18.8 Billion

The company's losses stem from major investments in new fabs and production capacity in the U.S. These investments will only pay off if Intel's execution over the next couple of years is solid and its 18A technology is competitive in terms of performance and cost.

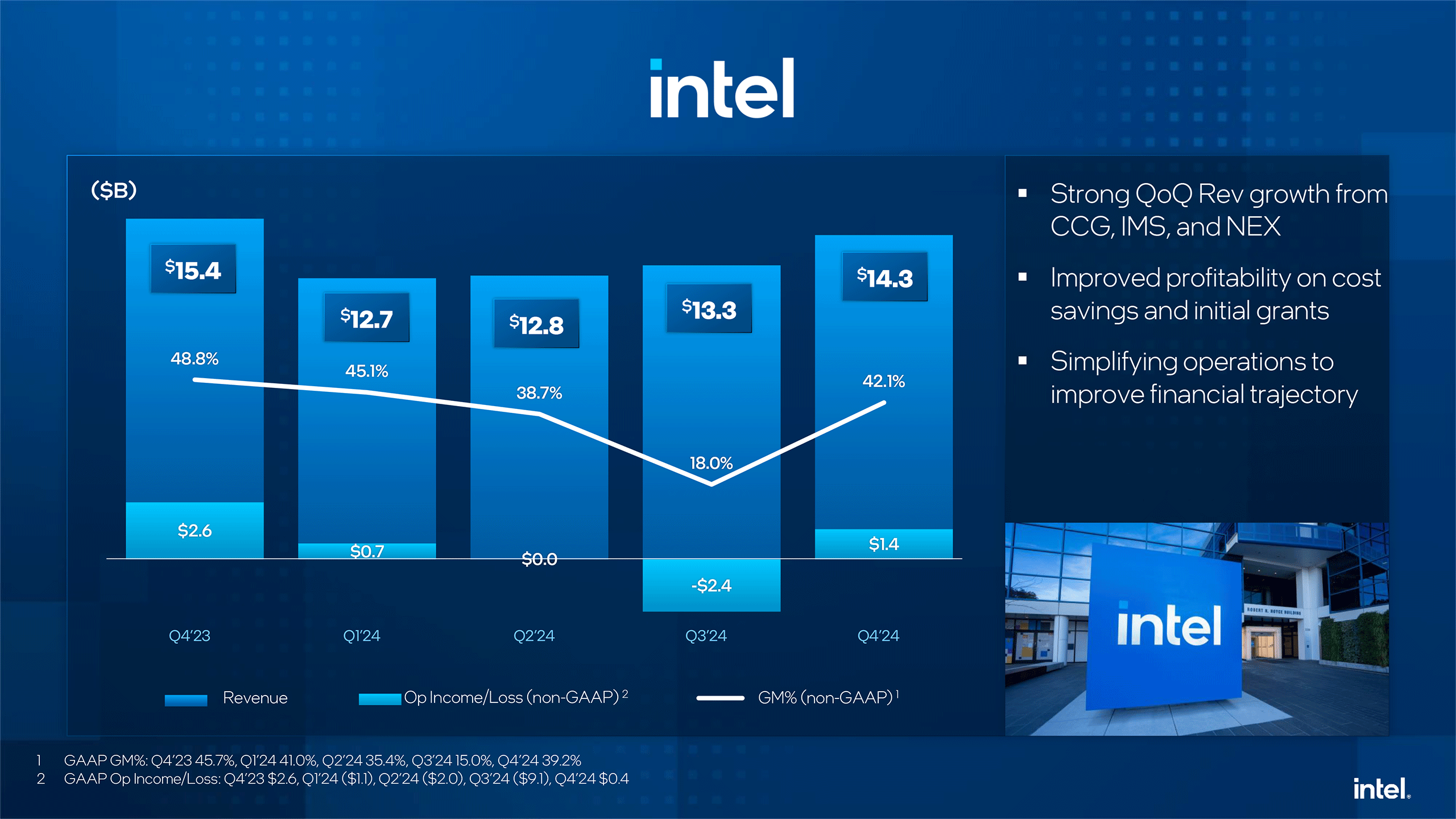

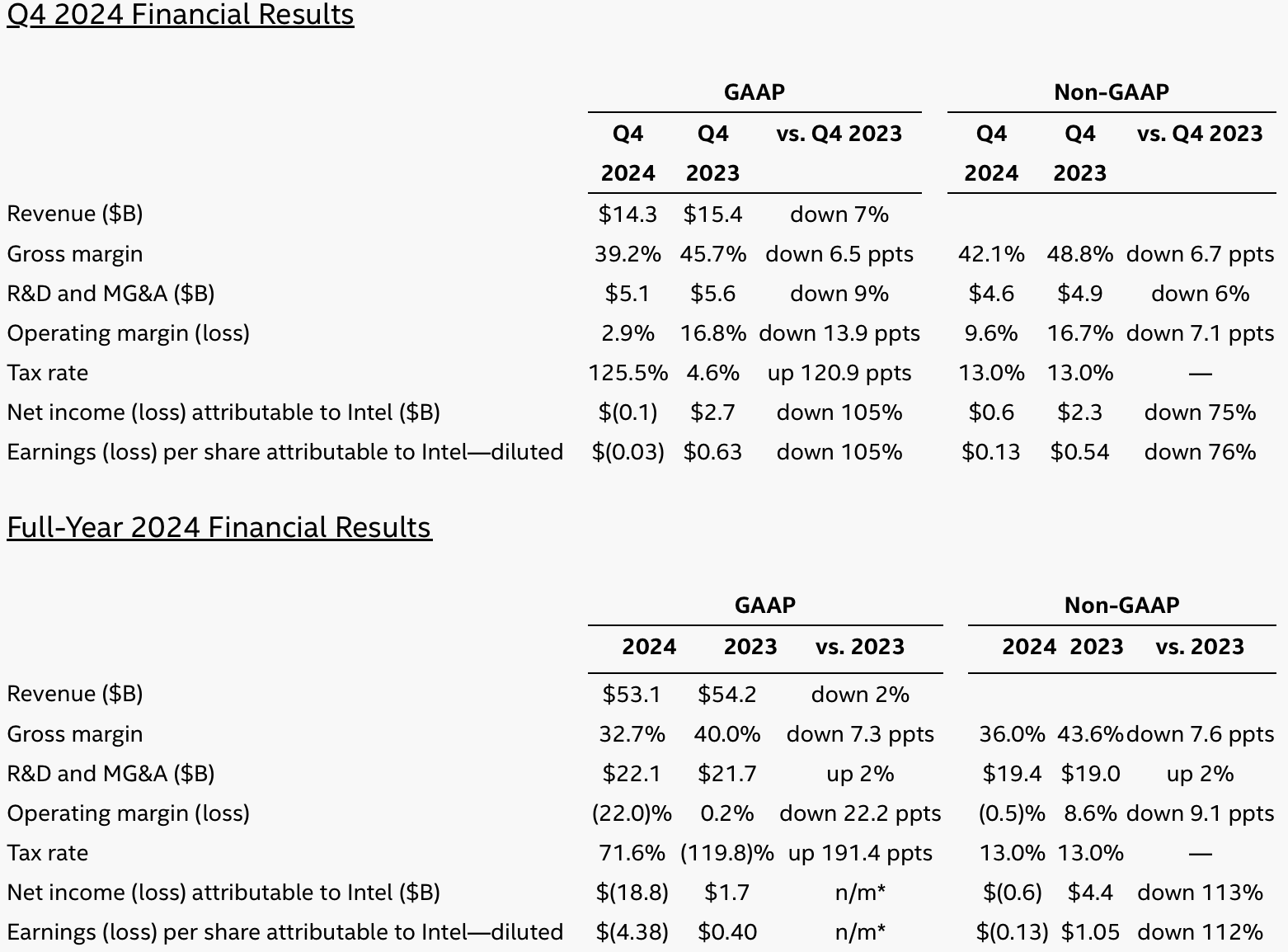

The delay of a key product comes at a particularly bad time for Intel. The company's revenue for 2024 totaled $53.1 billion, down 2% year-over-year, which may be considered relatively flat. However, the company's net loss climbed to $18.8 billion compared to a modest $1.7 billion profit the previous year.

Intel's fourth-quarter results for 2024 showed that the company earned $14.3 billion in revenue, up $1 billion from the previous quarter but down 7% from the same quarter a year ago. During Q4, the company posted a $100 million loss, whereas in Q4 2023, its profit was $2.7 billion.

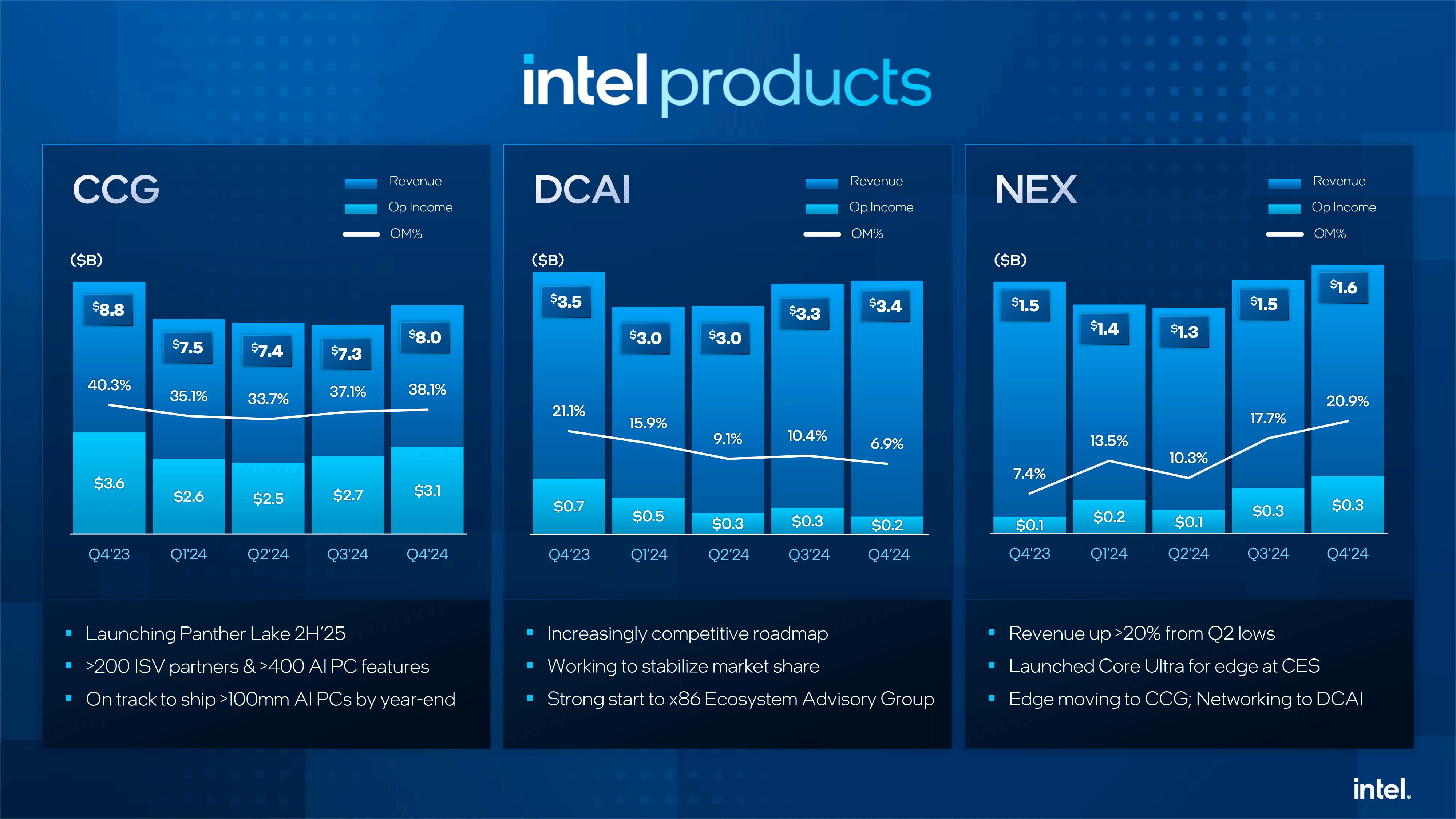

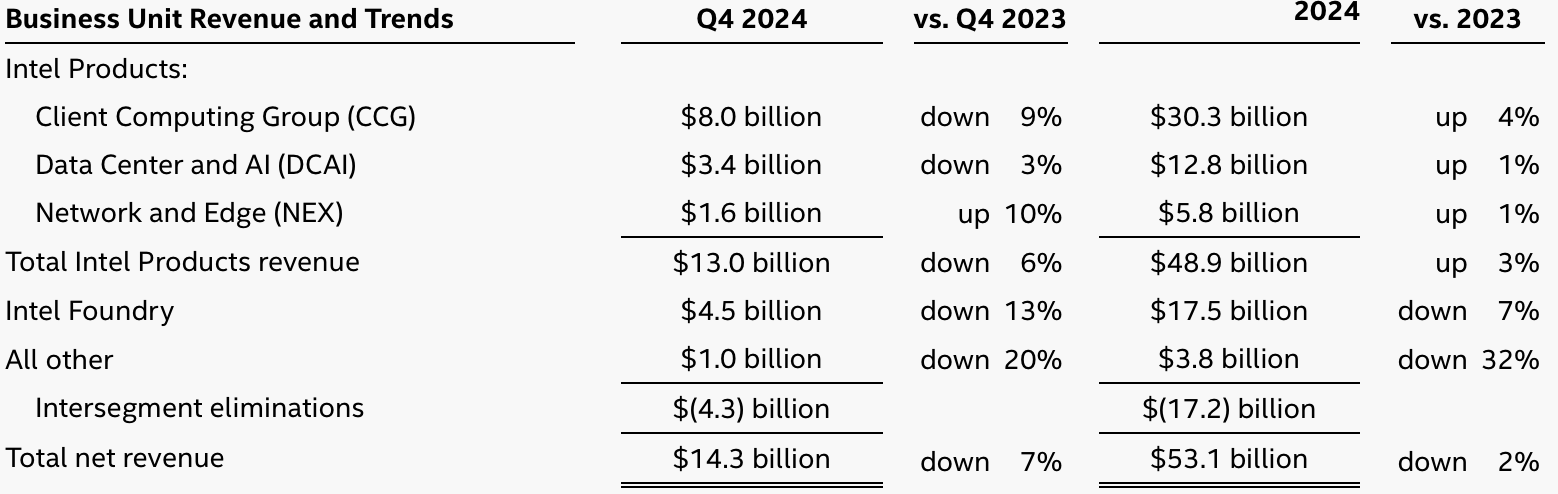

Revenue for Intel's Client Computing Group (CCG) increased to $8 billion while generating an operating income of $3.1 billion, which is down from $8.8 billion in revenue and $3.6 billion in Q4 2023. Intel suspects that a portion of its Q4 revenue increase was due to its clients hedging against potential tariffs.

Intel's Data Center and AI Group (DCAI) is less vulnerable to tariffs, so its revenue stood at $3.4 billion, up from $3.3 billion in the previous quarter but down from $3.5 billion in the same quarter a year before. However, the group's profitability hit a new low of $200 million.

Intel's Networking and Edge Computing (NEX) business revenue increased to $1.6 billion, rising both sequentially and year-over-year. The unit's profitability also increased to $300 million, marking its best performance in recent quarters.

Intel Foundry earned $4.5 billion in revenue and recorded a $2.3 billion loss. On an annual basis, Intel Foundry's revenue declined from $5.4 billion, while its losses widened to $2.3 billion. However, the company saw quarter-over-quarter improvement, increasing revenue from $4.4 billion and reducing losses from $5.8 billion. Intel attributes this improvement to an increased EUV wafer mix and higher equipment sales by IMS Nanofabrication. For the full year, EUV wafer revenue grew from 1% of total revenue in 2023 to over 5% in 2024.

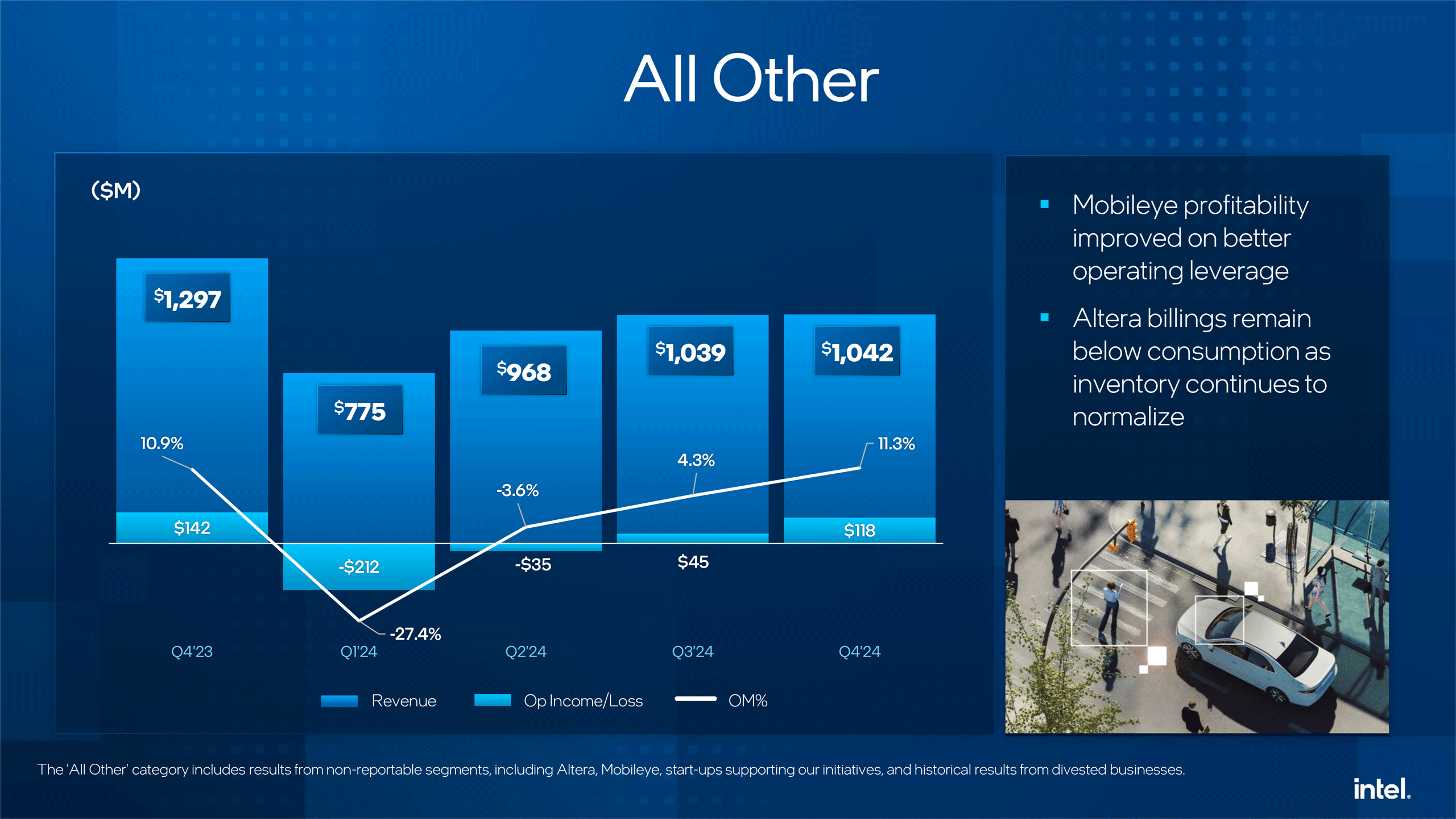

Altera delivered revenue of $429 million, up 4% sequentially, with an operating margin of 21% compared to 2% in Q3. Mobileye reported revenue of $490 million, up 1% sequentially, with an operating profit of $103 million.

Humble Outlook

Intel expects its revenue to be between $11.7 billion and $12.7 billion for the first quarter of 2025, down $0.5 billion from Q1 2024. Also, Intel expects its GAAP gross margin to fall to 36%.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bit_user Way worse than their Falcon Shores cancellation. Intel desperately needs Clearwater Forest to help stave off the assault from ARM and AMD. Pretty soon, the RISC-V bros will be joining the ranks of their competition. I wonder if the delay has anything to do with how the CPU chiplets are being stacked on cache dies.Reply

You almost have to laugh at the sad farce that Intel has become, or else you might just cry. -

jp7189 Despite the public wording, I don't think this makes 18A sound healthy. Historically, the high margin datacenter products have stayed in house, and consumer products have been outsourced to TSMC. I'm willing to bet they are designing Panther with hope for 18A, but with an eye on TSMC, and that gives them the confidence to keep Panther on target. Whereas Xeon 7 has no such safety net in the plan.Reply -

jheithaus Falcon Shores was hopeless. Xe+ x86 + gaudi sounded like a power point presentation completely divorced from technical reality. In view of the consumer success of Xe2, INTC should just scale Xe2 complexity over time and spin out (ipo) Habana. Regardless, INTC should have kept Xeon on schedule. The OT, the rushed steppings, get it done.Reply -

thestryker Reply

They canceled the "XPU" version of Falcon Shores in 2023 this one was just the GPU.jheithaus said:Falcon Shores was hopeless. Xe+ x86 + gaudi sounded like a power point presentation completely divorced from technical reality. -

DS426 It takes a lot of validation before ramping server CPU's, so I guess I'm not surprised. I'm also thinking 18A is being pushed back slightly, which pushed back Panther Lake but not enough to launch after Q4 2025.Reply

Intel can't afford any more delays on their 18A products. To see DCAI rake in almost no earnings and CCG slightly up but Arrow Lake is sizzling out as months of updates haven't really improved its performance... they don't have a lot to ride on thru 2025. -

bit_user Reply

They confirmed that Panther Lake is using 18A (presumably for the compute tile) and launching in the latter half of this year. That's pretty good.jp7189 said:Despite the public wording, I don't think this makes 18A sound healthy.

Well, now that their foundry nodes support standard toolchains, it's much easier for them to port designs to one fab or the other. That said, I'd be pretty surprised if they went to TSMC with Panther Lake.jp7189 said:I'm willing to bet they are designing Panther with hope for 18A, but with an eye on TSMC,

Lunar Lake was targeted at TSMC pretty much from day one. Intel said its designers were given the direction to use the highest-performing node, period. At the time they made that decision, TSMC's node looked better than Intel 3, which was the best alternative Intel would've had available.

Arrow Lake was indeed a surprise, since it was planned to use Intel 20A. However, Intel decided it would be cheaper for them to just use TSMC than do volume product on a special node they're not using for any other products. And it was easy, because they already had the layout for Lion Cove and Skymont, on TSMC N3B, from Lunar Lake. So, I'll bet that rather than port the entire CPU tile from 20A to N3B, they just took the cores from Lunar Lake and redid the rest of Arrow Lake's CPU tile on N3B.

That's a theory, but given how small the CPU tiles for mobile processors are, their yield tolerance is much higher than big server CPU tiles. Also, they don't need to have ramped production volume as much as they do for server CPUs.jp7189 said:that gives them the confidence to keep Panther on target. Whereas Xeon 7 has no such safety net in the plan. -

bit_user Reply

They dropped the x86 tiles a long time ago. AFAIK, Falcon Shores was supposed to just be Xe-based. Where did you hear about Gaudi being in the mix?jheithaus said:Falcon Shores was hopeless. Xe+ x86 + gaudi

I think the opposite. In spite of Nvidia's success, GPUs aren't the optimal architecture for AI. The main advantage of Xe is that it can do both AI and HPC, but I think Intel just needs to give up on HPC, for now.jheithaus said:In view of the consumer success of Xe2, INTC should just scale Xe2 complexity over time and spin out (ipo) Habana. -

thestryker Reply

I wish I could disagree with you because I find it super compelling from a technology standpoint. I view it similarly to 3D XPoint though: even if something is a good piece of technology that doesn't make it a viable business.bit_user said:The main advantage of Xe is that it can do both AI and HPC, but I think Intel just needs to give up on HPC, for now.

This was the first thing I thought of as well since they haven't stacked cache like that on a CPU. The other thing is each base tile has 4 compute tiles on it and I don't recall seeing if the cache design was supposed to be shared among those tiles or if it was separate cache for each. Both would definitely have their own validation complexity but if it was separate for each compute tile that's also extra failure points.bit_user said:I wonder if the delay has anything to do with how the CPU chiplets are being stacked on cache dies. -

bit_user Reply

It pains me to say it, because I've done a bit of OpenCL and SYCL programming on Intel's GPU stack and would quite like to see them continue with this development. If you take HPC off the table, I'm not sure they can justify continuing development on the oneAPI stack.thestryker said:I wish I could disagree with you because I find it super compelling from a technology standpoint.

: (

They did mention something about packaging, so perhaps it's plausible.thestryker said:This was the first thing I thought of as well since they haven't stacked cache like that on a CPU.

I think it's probably a federated L3, like what AMD does. Intel kept using a unified L3 domain for way too long. It worked well for them, but I think they got burnt by carrying it forward into the multi-die era.thestryker said:The other thing is each base tile has 4 compute tiles on it and I don't recall seeing if the cache design was supposed to be shared among those tiles or if it was separate cache for each.

Heck, even on the desktop, L3 bandwidth is where Arrow Lake really falls apart. Ryzen 9000 shows AMD's approach is much stronger, here.

Source: https://chipsandcheese.com/p/examining-intels-arrow-lake-at-the -

jp7189 Reply

They confirmed Arrow on 20A. As I recall it, the public expected Arrow on Intel up until launch day.bit_user said:They confirmed that Panther Lake is using 18A (presumably for the compute tile) and launching in the latter half of this year. That's pretty good.

I would also say packaging has been a bright spot while node advancement has not. For them to switch it up and blame packaging for the delays this time seems like a ploy to save face on what they consider to be a more important part of the business.

Let me ask this... what is Intel's most advanced healthy node? ..and by healthy I mean profitable to produce low margin consumer chips in high volume. The last one I'm absolutely sure about is Intel 10, but you could make an argument for Intel 7 (renamed to 4), but not in the 60% margin territory that have historically aimed for. It sounds like Intel 3 is still ramping and only for high margin products. Unless they have an absolutely brilliant breakthrough, I wouldn't expect 18a to yield well enough for consumer chips this year. I would love to be wrong, but that's what the indicators are saying to me.