Intel cancels Falcon Shores GPU for AI workloads — Jaguar Shores to be successor

A radical temper of expectations.

In a surprising twist, Intel announced on Thursday that its Falcon Shores GPU for AI and HPC applications will not be released to the market but will remain an internal test processor to develop the hardware and software foundations for its successor, codenamed Jaguar Shores. This decision makes Intel's struggling Gaudi 3 processor, which has suffered from limited uptake amid the company's disclosed software issues, the company's only viable solution for AI applications for the next two years. Meanwhile, the company will work on developing rack-scale solutions, the only true way to compete with AI behemoth Nvidia.

"Many of you heard me temper expectations on Falcon Shores last month," interim co-CEO Michelle Johnston Holthaus said during the company's earnings call on Thursday. "Based on industry feedback, we have decided to leverage Falcon Shores as an internal test chip. Without bringing it to market, we will support our efforts to develop a system-level solution at rack scale with Jaguar Shores to address the AI data center more broadly."

The company originally expected Falcon Shores to serve the AI and HPC markets currently covered by Gaudi processors. However, a quarter ago, Intel's interim co-CEO told analysts and investors to temper their expectations, as Falcon Shores would mostly serve as a vehicle to develop a hardware and software ecosystem around its hybrid processors.

Apparently, after careful consideration, Intel decided not to launch Falcon Shores commercially at all but to use it solely for internal development to perfect hardware and software rather than launching a half-baked product commercially that could potentially damage the company's reputation.

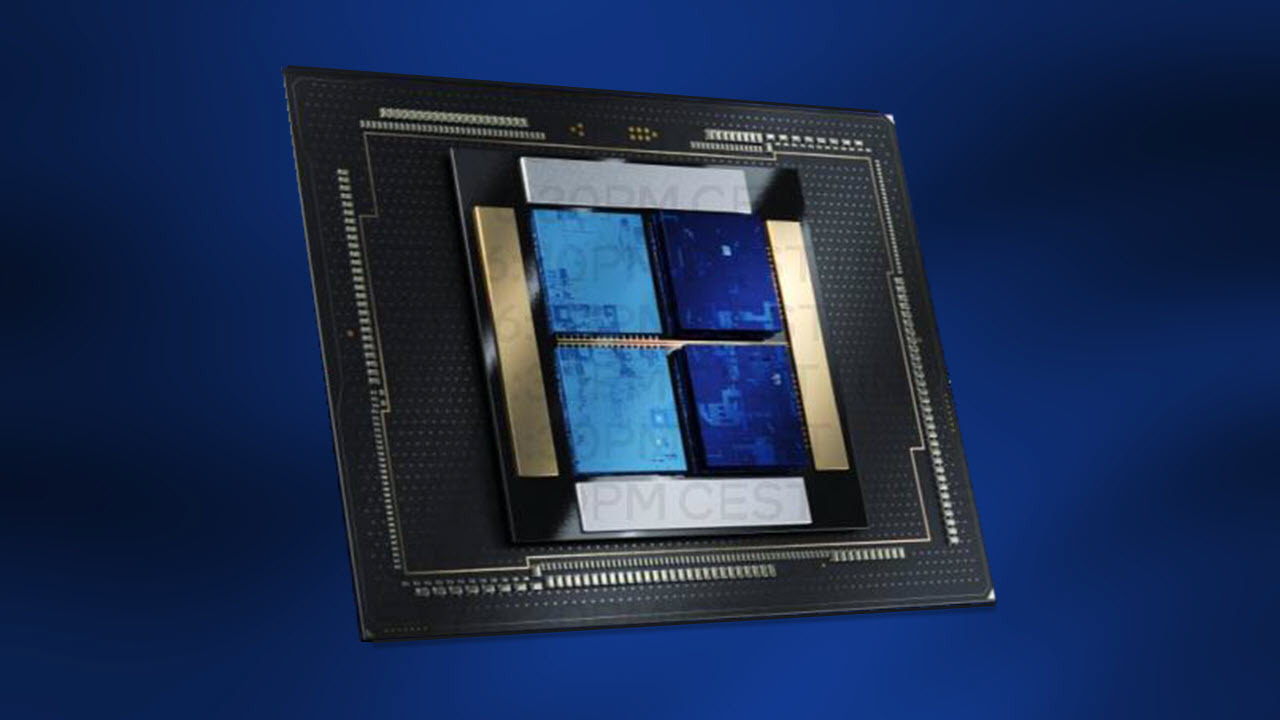

Intel described Falcon Shores as its first multi-chiplet design featuring Xe-HPC (or Xe3-HPC) GPU chiplets for highly parallel AI and HPC workloads. The product was meant to greatly increase performance and performance-per-watt efficiency compared to Intel's AI and HPC processors, though the company refrained from giving actual numbers.

Oddly, Intel stated that Falcon Shores would be an "internal test chip." When developing an ecosystem, some processors that are not launched commercially are still shipped to external partners, including independent hardware vendors (IHVs) and independent software vendors (ISVs). For example, Intel's first-generation Xeon Phi processor (derived from the company's Larrabee GPU project), codenamed Knights Ferry, was not offered as a mainstream, fully supported commercial product. It was provided in limited quantities to select developers and research partners to begin porting and optimizing code for Intel's Many Integrated Core (MIC) architecture, which later became the commercial Xeon Phi product family.

Since Falcon Shores and its successor, Jaguar Shores, have entirely new GPU microarchitectures, Intel would typically send samples of these processors to ISVs to ensure their software can work efficiently with the hardware. Also, since Intel is focusing on rack-scale solutions, it would stand to reason that it would also supply samples of Falcon Shores to its IHV partners. However, with Falcon's new designation as an internal test chip only, that strategy doesn't appear to be planned.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

thestryker I can't help but wonder if the enterprise compute strategy was derailed by shareholders wanting maximum return and the rapid rise of AI volume. HPC should have rather reliable returns and margins though certainly not high volume. AMD's APU strategy seems like an extremely good one for the classic HPC space, but Intel punted on theirs around a year after announcing it. That's when the split strategy of seemingly going all in on Gaudi while developing next generation enterprise GPU compute happened.Reply

Of course with Aurora just now being announced with full availability perhaps underlying issues were discovered. Given the problems they had with the Alchemist design this is also rather believable. -

Root Canal Reply

Rialto Bridge gone, Falcon Shores gone.. Intel should start somewhere, but they keep kicking the can.bit_user said:In a move almost as unsurprising as it is sad... -

bit_user Reply

Intel wasted a critical decade by messing around with Xeon Phi when they should've been following a more classical dGPU approach. Then, with Ponte Vecchio, they decided to try to catch up in a single generation. The result was a wildly overambitious project. That backlogged a bunch of stuff behind it, and now they're left with a train wreck on their hands.thestryker said:I can't help but wonder if the enterprise compute strategy was derailed by shareholders wanting maximum return and the rapid rise of AI volume.

And what happens when one product line looks like it's in trouble? Others try to cover for it, such as with features like AMX. I'm pretty sure that's how we ended up with delays in Sapphire Rapids, not to mention why it wasn't very competitive on core counts or cost. If Intel had a credible datacenter GPU, instead of Xeon Phi, maybe they wouldn't have bothered with AMX.

I honestly haven't followed Gaudi enough to know whether it fell into some of the same pitfalls as Ponte Vecchio. I do think Intel should've had a clearer vision for how their datacenter GPUs would coexists with Gaudi, because there was an awful lot of overlap that maybe someone thought was just being cautious, but I'm sure it didn't help the schedule or costs, any.