Talking Heads: Motherboard Manager Edition, Q4'10, Part 2

Alright, enough about integrated graphics. We don't think they're taking over the world, either. This time, our industry insiders talk to us about the new AMD Operton offerings, SFFs, netbooks, future motherboard designs, and product diversification.

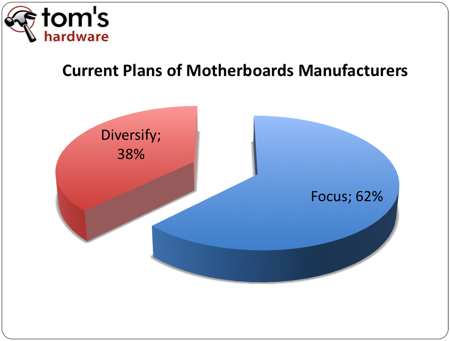

Product Portfolio Diversification

Question: In previous years, we saw many motherboard manufacturers diversify into non-traditional market spaces. Is your company’s current business strategy focusing on diversification or the core products?

- Focusing on the motherboard industry.

- Both. We don’t necessarily think it is one or the other. Sometimes it is about diversifying the core products into other channels or strengthening existing market share with a different approach.

- We are still focusing on our core business.

- We are still focusing on our core product. The reason we are still active in the industry is because we are specialized. This is our weapon--our advantage that others don't have. That is why we have seen some motherboard manufacturers quit, even when the market was still strong. We are going to keep enriching our products to get more market share from our competitors.

- 80% of our efforts on core products and 20% of our efforts on a diversified product line.

- Motherboard manufacturers can easy join the notebook/ITX and AIO markets.

- We're not currently expanding beyond our core business because we're still growing and expanding our product breadth and customer base in our primary market.

Portfolio diversification is one of the keys to growing product offerings and the bottom line. Years ago, several motherboard manufacturers got involved in LCDs, wireless devices, and SFFs. Some have blossomed in these areas, and others have completely retreated back to the core business, or worse, discovered that expanding the product portfolio was their downfall as they hemorrhaged operating revenue.

The motherboard industry in 2010 looks vastly different than it did in 2005; we have fewer players on the scene, all of which have wised up to a more dynamic market. Since the economic climate has stabilized, if companies are going to invest in other products, now would be the time to draw up plans. Of the tier-one vendors, we are getting a mixed bag of signals. These are the players that really have the least to lose and the most to gain from new products. Some are saying maintaining focus on the core business is still the primary goal. Another says it is tepidly testing the waters by setting aside a percentage of operating revenue specifically for diversification R&D. A third says it can have it both ways by using subsidiary names to sell new motherboard designs in untapped markets.

Asus and MSI are really the only two motherboard manufacturers who are actively trying to make headway into the notebook sector. Both are trying to figure out how to better-engage customers at Fry’s and Best Buy. This is a challenge everyone is facing, and it isn’t about product quality or product design. It has more to do with brand recognition for a product not typically associated with their name. Even AMD has had trouble trying to connect with customers, and that is one reason behind the conception of the company's Vision campaign. Looking at the numbers, Asus and MSI have their work cut out for them if they want to touch the shipment numbers on the order of Acer. Their attempt to diversify is ultimately dependent on how many units they can keep shipping. This will depend on good notebook designs, excellent customer service, and good communication.

Tier-two vendors are largely hunkering down and focusing on their motherboard business. This really isn't a surprise. These companies have the most to gain and the most to lose. In this economy, its hard to justify doubling down at the poker table. Considering we won't see a full market recovery at least within the next two quarters, it's doubtful that we will see any of the tier-two vendors do anything beyond motherboards at this point. In another year or two (perhaps in 2012) things may change.

Obviously, diversification is s double-edged sword. On the one hand, a company cannot ignore opportunities for new revenue streams. On the other hand, they cannot afford to waste resources on risky endeavors. Right now seems to be a good time to lean toward caution, so an 80/20 split on focus isn’t bad if companies are looking to their long-term opportunities. The tier-two companies in this economy are best off with near to no diversification attempt, at least on the investment capital side. The lessons of Abit, AOpen, Albatron, Chaintech, DFI, Epox, Shuttle, Soltek, and Soyo should serve as a reminder of what can go wrong.

It is interesting to point out our private talks seem to indicate that diversification is going to impact different regions in different ways. For emerging markets, there will be a heavier emphasis on competitively pricing. For developed markets, such as Europe and the US, we are looking at a move toward richer feature sets.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Current page: Product Portfolio Diversification

Prev Page The Future Of Motherboards And Their Makers Next Page Small Form Factor, One-Hit Wonder?-

pandemonium_ctp Excellent read. I love seeing you guys get real world answers from companies willing to participate. It really shows where the industry is heading.Reply

This means having a small budget can’t stop you from building a reasonably heavy-duty computer. If you don’t believe us, look at our latest $400 System Builder Marathon configuration.

Absolutely agree. This is basically where I've been placing my builds for the last 10 years; at the bottom of the price curve where performance hits the sweet spot for price. I alone typify that logic.

The industry has always been on a smaller, faster, cheaper trend, and that's never going to change. Netbooks are here to stay, until something smaller, faster, and cheaper replaces them.

Smartphones/PDA? They've existed for a long time now. The problem is the technology wasn't around to give them the power they needed to do everything a Netbook can do. That is rapidly changing. I hate to say it, but I disagree with Netbooks being a long-term investment. The consumer now is driven by convenience. If my smartphone can be my multimedia outlet, document editor, day planner, browser, camera, accessory portal (ear pieces/headsets, printers, scanners, etc...) and telephone, they why would I want to lug around seperate devices for each of those?

If you can play 720p and 480p with decent bit-rates for $100 to $200 less, why not? This type of buying decision is naturally going to be a short term phenomenon.

Very short-term. At the way things are going, that will be one to two years worth of earnings at the most. Hardly worth the R&D IMHO.

I think the most valuable feature for future motherboards is saving power and enhanced performance.

This is the bottom line for everything, basically. This motto can not falter.

The fact that hybrids migrate graphic functionality to the processor might not actually change that much. As one person noted, the construction of the motherboard hasn’t gotten any simpler. Quite the opposite, in fact. We are now looking at motherboards that are more complex than ever before.

Complexity is definitely the direction the industry has taken. However, I would think if a manufacturer wanted to baseline a board with IGPs, they would do so in terms of finding a way to allow additional discrete GPU and/or CPU installments for those that tinker. I know this has been tried in the past, but I'm not talking about simple onboard graphics processors.

The baseline board would be for the general consumer and could handle day-to-day tasks found in every household. While additional GPU and CPU configurations that would work in conjuction with the onboard processors appeals to the specializing category. We just need a manufacturer to take that step to allow them to co-exist in the same environment and provide that extra benefit of accessorizing. -

dennisburke The Future Of Motherboads And Their MakersReply

The P55 is a great middle of the road platform, and if one graphics card (even two) is enough to wet your whistle, you could'nt ask for more.

I think brand loyalty comes about by great customer support and innovation, and it doesn't hurt to have a well used and supportive attached forum.

I've hide my eggs with Intel, WD, Corsair, ASUS, and EVGA for many years now, and they are safe. -

Onus I agree with everything the first poster said, except for one STRONG disagreement; that he is the only one who typifies that logic. "How low can you go" is a recurring theme in every build I do, especially for myself. If I want more future resistance, I'll go a step or three above that, but the base thinking still tends to be at the bottom in terms of cost (including power usage).Reply

In an economy where it is more important that things last, what I want to see is a focus on durability. Gigabyte advertises this very well, but I find that ASRock has many of the same elements (e.g. all-solid, Japanese caps, ferrite chokes) and costs a lot less. -

Th-z I am surprised MB makers didn't talk about speeding up the boot process, or UEFI, if it can speed up the boot time. I think really fast boot up is what everybody really wants. Now we can get SSD to speed up the loading for the OS part, but the very first thing when you turn on the computer, you still have to wait couple seconds for the slow BIOS to finish its tests, etc. That's probably the one thing that hasn't improved a lot when comparing to the speed improvement in other components.Reply -

WarraWarra Wow extremely confusing heading for this article.Reply

Thought it is some software that does what with motherboards ?

And talking heads music band has got what to do with this ?

http://en.wikipedia.org/wiki/Talking_Heads

If not for the weird article name the rest is very nice.

Good to see Toms getting serious about hardware and reality from a users point of view.

5* -

Stardude82 I don't know if competition in motherboards has decreased that much.. Zotac and EVGA are new. It's not like the CPU market which went from 4 competitors to 2.Reply -

palladin9479 Hm might want to look at that ULV comment in reference to Intel. With such small and highly integrated parts you can't just use a processors wattage requirements but instead use the platforms requirements. In this case I believe Via's Nano processor wins.Reply -

chumly I am impatiently waiting for UEFI as well. I think it would be amazing to have a 4TB single hard drive. BIOS is ancient, it needs an update. I also don't believe that the competition in the market of GPUs is reflected at all in the Motherboard market, especially on the AMD side. Nforce boards are terrible in both price and features. It seriously affects my decision on which new GPU to purchase.Reply