China's CXMT begins mass-producing HBM2 memory well ahead of schedule — 2026 was the previously telegraphed target

This could be a big deal for the Chinese tech industry.

ChangXin Memory Technologies (CXMT), a leading memory maker from China, has begun mass production of HBM2 memory, reports DigiTimes. If the story proves accurate, the Chinese company will be about two years ahead of the expected timeframe for production of the memory chips, which are crucial for cutting-edge AI and high-performance computing processors.

Earlier this year, Tom's Hardware reported that CXMT began to acquire tools necessary to make high-bandwidth memory (HBM) products; it typically akes at least a year (and more likely two) to start mass production with decent yields. CXMT has ordered equipment from suppliers in the U.S. and Japan, with U.S. companies including Applied Materials and Lam Research receiving export licenses to supply fab tools.

Producing HBM is a complex process: The memory devices are larger than the commodity DRAMs that CXMT typically produces, and making and assembling base dies is challenging. Apparently, China's desire for self-sufficiency in memory technology is so high that CXMT began to produce HBM2 memory well ahead of schedule, albeit with unknown yields.

High-bandwidth memory: Cutting edge tech

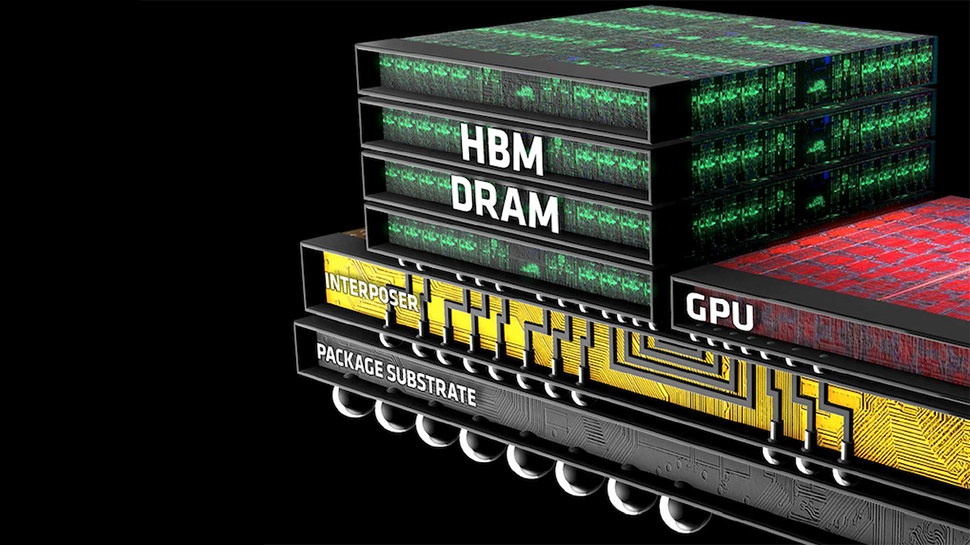

HBM stands out as the top performer in terms of bandwidth due to its 1024-bit wide interface and relatively high data-transfer rates, which range from approximately 2 GT/s to 3.2 GT/s per pin in the case of HBM2. Its wide interface and vertical stacking design mean that producing HBM devices does not necessitate the latest lithography technology, but it requires sufficient manufacturing capacity: HBM DRAM integrated circuits are physically larger than the typical commodity DRAMs that CXMT makes. In fact, leading global DRAM manufacturers often use established technologies for their HBM2E and HBM3 products, so we would expect something similar from CXMT.

HBM production requires advanced packaging techniques, however. Connecting 8 or 12 memory devices vertically using small through silicon vias (TSVs) is a complex process. Still, despite this complexity, assembling an HBM-like known-good stacked die (KGSD) module is actually less challenging than manufacturing a DRAM device using 10nm-class process technology.

With HBM2 production today, CXMT still lags behind global competitors like Micron, Samsung, and SK Hynix in DRAM technology, as these companies are already mass-producing HBM3 as well as HBM3E memory and are gearing up to mass-produce HBM4 with 2048-bit interfaces in the next couple of years.

But for China in general, HBM2 is a crucial technology for its advanced AI and HPC processors. Huawei's Ascend 910-series processors use HBM2 memory and producing such memory domestically is a big deal for the Chinese tech industry.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

usertests Put it in consumer products and I'll care. Which can happen if something in particular happens.Reply -

terell It's more out of a necessity than desire to be self-sufficient (though that is big too). Huawei and Biren (another AI accelerator maker) are under sanctions. High performance AI accelerators can't be imported either.Reply

Sanctions are working.

Instead of "import HBM while developing domestic substitution" we have "make it at any yield and bill waste to CCP". That's about the best we can do, unless we go way of Nord Stream or Stuxnet.