Global PC Shipments recover to pre-pandemic levels — Q1 2024 sales show 8% growth over last year

Another positive sign for the PC industry.

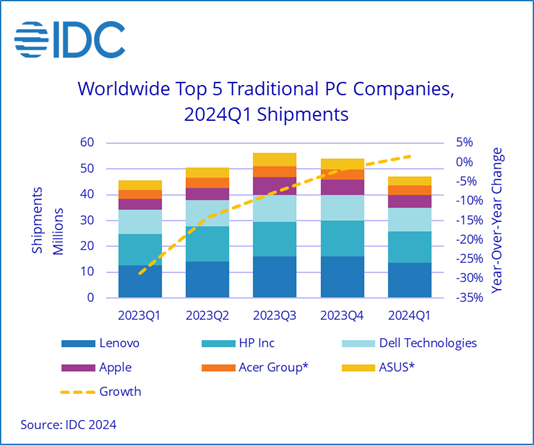

IDC's latest data shows positive growth in global PC sales during the first quarter of 2024, with a return to pre-pandemic sales volumes. After declining for the past two years, worldwide PC sales amounted to 59.8 million during Q1 2024, comparable to Q1 2019 sales when 60.5 million PCs were sold worldwide.

The global PC shipments include desktops, notebooks and workstations. Though tablets are usually considered personal computing devices, they're not included in IDC's stats. Among the top five OEM PC makers, Lenovo continues to enjoy its dominant position with 23% of the market share, followed by HP with 20%.

Growth in the global markets does not necessarily mean every company has benefited. Dell, Asus, and the "others" category all show a decrease in yearly sales during this quarter. Apple on the other hand shows the highest growth of 14.6%, likely thanks in part to the new M3 laptops.

Here's the look at the top five companies as tracked by IDC, with comparisons with Q1 2023:

| Company | 1Q24 Shipments | 1Q23 Shipments | 1Q24/1Q23 Growth |

|---|---|---|---|

| 1. Lenovo | 13.7 | 12.7 | 7.80% |

| 2. HP Inc | 12 | 12 | 0.20% |

| 3. Dell Technologies | 9.3 | 9.5 | -2.20% |

| 4. Apple | 4.8 | 4.2 | 14.60% |

| 5. Acer Group* | 3.7 | 3.4 | 9.20% |

| 5. ASUS* | 3.6 | 3.8 | -4.50% |

| Others | 12.6 | 13.3 | -5.00% |

| Total | 59.8 | 58.9 | 1.50% |

* — IDC declares a statistical tie when there's less than a 0.1% difference between vendors, which is why Acer and Asus are listed at number five.

"Despite China's struggles, the recovery is expected to continue in 2024 as newer AI PCs hit shelves later this year and as commercial buyers begin refreshing the PCs that were purchased during the pandemic," explained Jitesh Ubrani, a research manager for IDC's Worldwide Mobile Device Trackers. "Along with growth in shipments, AI PCs are also expected to carry higher price tags, providing further opportunity for PC and component makers."

Intel, AMD, and others have been talking a lot about the "AI PC" over the past few months. Definitions are still rather nebulous, and so far there's no killer app — Microsoft's Copilot isn't there yet, in other words. But things can change rapidly in the AI space, as the last year has aptly demonstrated.

Two years ago, IDC predicted that the market would begin to recover in 2024, despite 2022 and 2023 showing no signs of recovery. The market situation began to fall in 2020. During one quarter, all major companies experienced losses except Apple, Inc. Which isn't to say that Apple hasn't had bad quarters at other times.

US Sanctions Affecting Global PC Shipment Volumes

While global PC sales indicate positive growth, sanctions against China and Russia have likely affected these numbers despite the recovery. Many companies have pulled out of Russia and China, leading those countries to invest in domestic alternatives and giving smaller, local competitors the chance to gain a market share.

IDC notes that China is the largest market for desktop PCs, and before trade sanctions, there was already weak demand there, resulting in lower PC shipments in the region. However, such reports calculate statistics using shipments to distributors and consumers directly, and obviously smuggling operations and the like aren't part of the data gathering.

Overall, PC sales are strong, with new technologies potentially spurring an earlier upgrade cycle in some businesses. Q1 tends to be a weaker quarter for sales, with Q4 being the strongest, so it will be interesting to see how the rest of the year develops.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Roshan Ashraf Shaikh has been in the Indian PC hardware community since the early 2000s and has been building PCs, contributing to many Indian tech forums, & blogs. He operated Hardware BBQ for 11 years and wrote news for eTeknix & TweakTown before joining Tom's Hardware team. Besides tech, he is interested in fighting games, movies, anime, and mechanical watches.