Chinese chip-related companies shutting down with record speed — 10,900, or around 30 per day, shut down in 2023

It's not just the U.S. sanctions.

The number of chip companies in China has been declining ever since the U.S. started imposing sanctions against the semiconductor sector in 2019 - 2020. The situation got worse in 2022 - 2023 as demand for chips slowed. More than 22,000 chip-related firms have disappeared since 2019, but 2023 saw record-setting extinction according to DigiTimes (citing TMTPost).

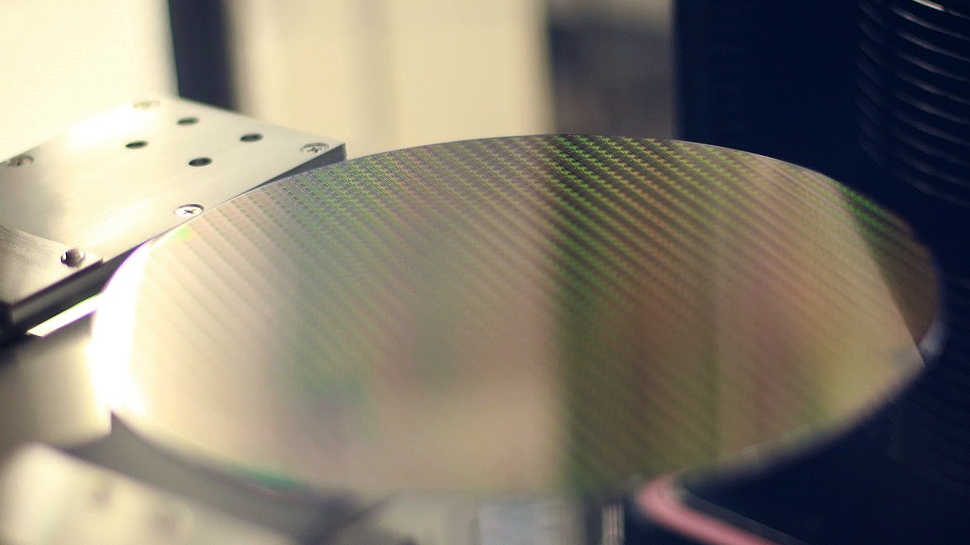

A record 10,900 chip-related companies have lost their registration in 2023 so far — a big jump from the 5,746 companies that folded in 2022, according to the report. That means an average of 30 Chinese chip-related companies closed their doors each day in 2023. This is part of the five-year trend, which saw over 10,000 Chinese chip-related companies close in 2021 - 2022. The spike in 2023 highlights the growing struggles in chip design, semiconductor manufacturing, and wafer fab equipment sectors.

Out of 3,243 chip design companies in China in 2023 (many of which emerged, at least partly, thanks to incentives from federal and local governments), more than half were making less than 10 million CNY (about $1.4 million USD) a year, according to Wei Shaojun, IC design lead at the China Semiconductor Industry Association and professor at Tsinghua University. Shaojun is not particularly fond of how the Chinese industry is developing.

These firms are not just struggling with sales. Most are losing money from unsold stock, due to market oversupply and a general downturn in the semiconductor industry from wider economic circumstances. A big part of the problem comes from a misstep in planning: In 2021 and 2022, many companies produced tons of chips, expecting high sales from the Covid-induced work-from-home trend. But as the pandemic waned, demand took a downturn and the market slumped in the end of 2022 / beginning of 2023, leaving companies with a lot of inventory they couldn't sell. And, of course, these products are losing value as time passes.

Another problem, for smaller companies especially, is lack of investments. The U.S. has restricted investments in the Chinese semiconductor industry (as well as AI and quantum computing technologies), and European investors are not inclined to invest in Chinese chip companies with U.S. sanctions in place.

Larger companies like YMTC have spent billions finding alternative suppliers and procuring third-party tools to stay in business, while Huawei built a secret fab network; smaller companies don't have the resources to keep up. And while the Chinese government is investing in the chip industry — the China Integrated Circuit Industry Investment Fund dropped $1 billion in HLMC a week ago — it can't pour money into every chip startup out there.

It's been a tough year for China's chip industry — especially for the smaller players. The record number of companies shutting down reflects the hard times they're facing: low demand, overstock, and difficulty in obtaining funding. This has forced many out of the game and has shifted China's semiconductor industry into mostly big companies instead of smaller startups.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

- Sarah Jacobsson PurewalSenior Editor, Peripherals

-

atomicWAR I don't see these shut downs as a bad thing even if the embargo's are only partly to blame. Besides despite these shut downs China has been advancing faster than anyone could have guessed. If anything all of this has increased China's standing in home grown CPU/gpu performance.Reply

This is not an ideal solution when the opposite was the intended effect. A closer look at these restrictions (present and future) needs to be taken and gone over with a fine toothed comb under the assumption they could again do the wrong thing so contingencies should be put in place in case that happens. Not sure what said contingencies should be but hey I can't do all the heavy lifting? Thoughts from others more versed in this? -

George³ Imagine for a moment that it is not just a closure, but a consolidation of resources and human capital. Progress in garage companies in this industry can no longer be made as in the last century.Reply -

ivan_vy Reply

thousands of companies wanting a piece of cake, obviously many will close down the road, happen with any trend like the cryptocoins with gpufarms and ASIC miners.atomicWAR said:I don't see these shut downs as a bad thing even if the embargo's are only partly to blame. Besides despite these shut downs China has been advancing faster than anyone could have guessed. If anything all of this has increased China's standing in home grown CPU/gpu performance.

This is not an ideal solution when the opposite was the intended effect. A closer look at these restrictions (present and future) needs to be taken and gone over with a fine toothed comb under the assumption they could again do the wrong thing so contingencies should be put in place in case that happens. Not sure what said contingencies should be but hey I can't do all the heavy lifting? Thoughts from others more versed in this?

Despite the pandemic and sanctions, the trend is uprising.

https://www.semiconductors.org/chinas-share-of-global-chip-sales-now-surpasses-taiwan-closing-in-on-europe-and-japan/ -

TechLurker This isn't really new; there were reports last year that China's Big Fund attempt to start a massive local tech industry mostly failed, in the sense that a lot of money was just taken and stolen by a lot of no-name start-ups with vague ideas.Reply

And that was on top of the COVID lockdowns also further screwing up their Big Fund project.

At this point, China's actually better served consolidating and funding only the actually viable companies while they try to recover the stolen funds from others. -

Mindstab Thrull Maybe it's because I was born and raised in North America, but I barely even remember they being more than half a dozen major CPU companies for personal computers - AMD, Intel, IBM, Texas Instruments, Motorola, and I think I'm missing one (was Cyrix by IBM?). I think more than that is asking for trouble. And if you extrapolate to other companies - RAM, storage, assembly vs design, etc - I would assume China could support maybe a thousand companies. I think too many are trying to get into the glamorous industries and not ones the industry really needs. (Note I have not researched this at all. But it's a common trap everywhere.)Reply -

JarredWaltonGPU Let's also not forget that 2022 was when Ethereum mining ended, and China cracked down on cryptocurrency mining within its borders. I think it's a safe bet that there were at least hundreds of companies within China that were chip-related who closed up shop when mining became largely unprofitable.Reply -

nookoool I wouldn't be surprise that many of these "companies" are just re-bageing/re-branding or trying to scam government subsidies.Reply