Nvidia's RTX 2070 and 2080 Sales Disappoint, Gaming Revenue Down 45%

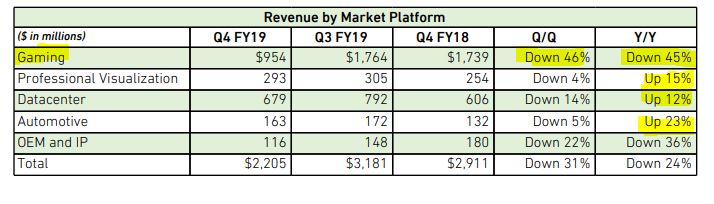

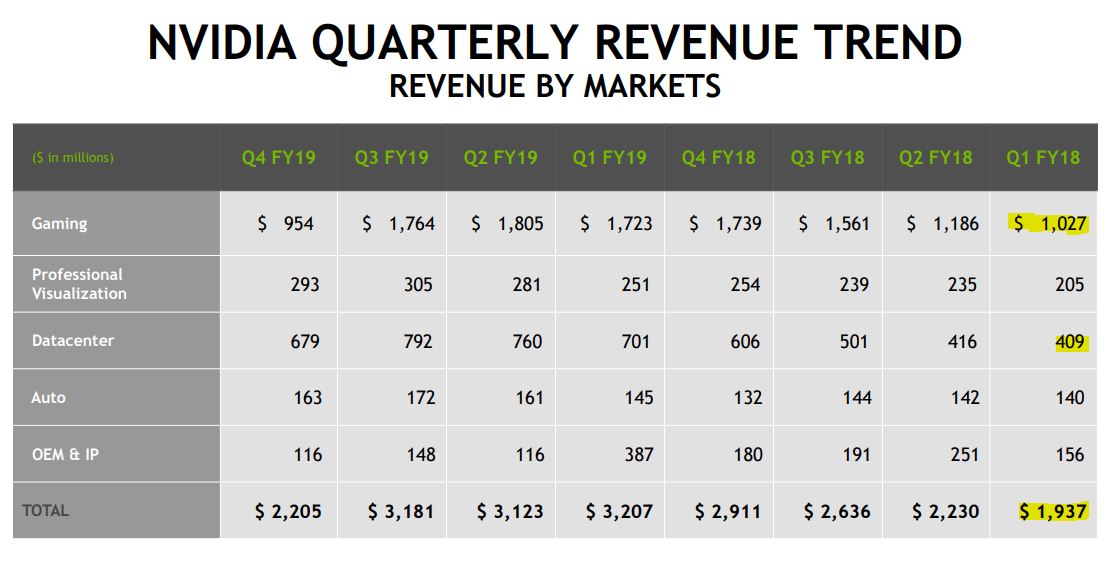

Nvidia presented its fourth quarter and fiscal 2019 earnings today, which reflected a surprising 45% year-over-year loss in gaming GPU revenue.

Overall the company performed better than expected after it lowered its earnings projections last month, with the $2.21 billion fourth quarter beating expectations and leading to a jump in its share price in after-hours trading (despite the 24% year-over-year reduction in quarterly revenue). The company also chalked up a solid 21% gain in full fiscal year revenue.

Nvidia blamed the severe gaming downturn on several factors, including sales of its Turing RTX 2070 and 2080 graphics cards that were below the company's expectations for the launch of a new architecture. Nvidia opined that gamers might be waiting for more real-world examples of ray-traced games, which were notably absent at the launch of the Turing GPUs, before purchasing a new graphics card.

Nvidia CEO Jensen Huang also pointed out that, for the first time in the company's history, its newest architecture launched with only high-end models available. The early RTX 2070 and 2080 cards came as specialty high-end and overclocked models that retail well above MSRP, while the lower-priced models didn't make their way to market until months later, leading to stunted sales.

Nvidia also delayed the release of the mainstream RTX 2060 cards due to the oversupply of GTX 1060 cards in the channel, which was largely due to the collapse of the cryptocurrency market. "The inability to launch [the] 2060 was a big inhibitor for us, but we did so at CES," said Huang about the models address the broadest swath of the gaming GPU market.

Market oversupply continues to haunt Nvidia, leading the company to reduce shipments as it sells off excess inventory. The company predicts that GPU channel inventories will stabilize by the end of Q1. Nvidia also cited continued macro-economic pressures in China as a challenge as the country's economy slows amidst an ongoing trade war with the United States.

Some of the downturn in gaming GPU sales comes as a byproduct of the declining cryptocurrency market. Miners often use graphics cards for multiple purposes, such as gaming for enthusiasts and cloud applications for commercial users, so gauging a customers' intent when they purchase a graphics card is difficult. That makes projecting supply and demand difficult, and it also means that some of the lost mining revenue could be mixed into the gaming revenue calculations.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Huang is upbeat about the prospects for ray tracing as more games emerge that support the new technology, like Battlefield V and Metro Exodus, with more coming over the next few months. Support for ray tracing is also coming to the Unreal Engine and Unity game engines, which should help increase adoption.

AMD's new 7nm graphics cards present a threat to Nvidia's lineup, particularly in the data center, but Huang said that "we don't see them" in competitions for high-performance computing and deep learning sales. That runs counter to Lisa Su's recent statement that AMD's 7nm Radeon Instinct GPUs are already enjoying "brisk uptake."

In regard to increased pressure in the data center from competing GPUs, Huang later reiterated that "our primary competitor is CPUs, and that's really the starting of it, and the ending of it." Huang also said that expectations were high for AMD's new GPUs, but "it didn't turn out quite that way." Huang cited Turing's superiority in energy efficiency and performance as its key advantages.

Huang also pointed out that the company still has four growth markets under its belt, with gaming, data center, professional graphics cards, and automotive applications predicted to grow over the coming year. Gaming notebooks also continue to grow (up 50% year-over-year), largely driven by new Max-Q designs.

Nvidia's data center revenues also declined 14% on the quarter (up 12% year-over-year). That largely comes as a byproduct of cooling sales to hyperscalers, but the company expects that situation to improve over the coming months.

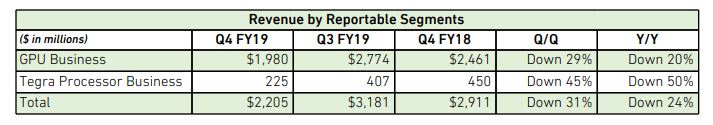

Nvidia's gaming segment comprises 43% of its total revenue, so the 45% year-over-year decline is troubling. The company's $1.98 billion in GPU revenue fell 20% on the year, primarily from the declining sales of gaming GPUs, but the company projects revenue to be flat or only slightly down for the full year.

Want to comment on this story? Let us know what you think in the Tom's Hardware Forums.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.