All About Bitcoin Mining: Road To Riches Or Fool's Gold?

By now, you've probably heard all about Bitcoins. But what are they? And are people actually striking it rich "mining" these things? Today, we'll find out with a first-hand look into the world of this crypto-currency, straight from a Bitcoin miner.

Financial Aspects: Revenue

Bitcoin Exchanges

Some Bitcoin miners simply keep the Bitcoins they mine, typically in a Bitcoin wallet on a PC (hopefully, they don’t forget to make backups of their wallets). Other miners may need to pay off their investment in mining hardware and want to cash out.

The way to do that is to sell Bitcoins (or fractional Bitcoins) at one of the Bitcoin exchanges, which work similar to stock exchanges. One of the oldest and most popular exchanges is MtGox.com, based in Japan. Once you have created an account there, you can transfer Bitcoins from your wallet to your MtGox account.

Click on "Funding Options" on the left, whereupon a menu appears that defaults to "Add Funds". In the drop-down box titled "Please Choose a Funding Method", select "Bitcoins". Immediately, a freshly-generated address appears. Copy this address and paste it into the "Send to" address of your Bitcoin wallet, type in the amount of Bitcoins to send and click on "Send". It can take one or even two hours until all six required confirmations have been received and the Bitcoins show up in your MtGox account. Then you can click on "Trade" and sell your Bitcoins at the prevailing market price.

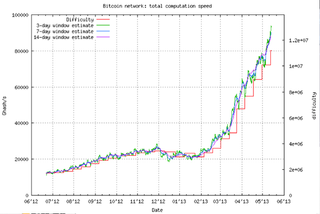

Historical and Expected Difficulty Rise

The relentless rise in mining difficulty is the dirty little secret of Bitcoin mining. It's a mechanism that most new miners underestimate. In order to prevent inflation, Satoshi’s distributed Bitcoin system tries to keep the rate of new block generation constant, regardless of how popular Bitcoin mining becomes (namely, at the average rate of one new block each and every 10 minutes). If more than 2,016 blocks are generated during a two-week period, the mining difficulty is increased. If less than 2,016 blocks are generated per fortnight, the mining difficulty is decreased, though this happened only a few times since 2009. Since all blocks are part of the public block chain, the number of blocks that have been generated in the past few days or weeks is completely transparent.

As the chart shows, global hash rate and mining difficulty has risen by a factor of five over the past eleven months. Even more alarming, we can also see that the rate of increase has been accelerating in the past two months. In those 60 days, the difficulty rose by a factor of almost three. Expect this trend to continue at a similar, or even increasing pace. By fall, the global hash rate, and thus the mining difficulty, is expected to rise by a factor of approximately ten, due to the advent of ASIC miners.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

In other words, if you currently mine with one FPGA-based BFL Single at 830 MH/s, you contribute slightly less than 0.001% to the global hash rate. Once difficulty has risen by a factor of ten compared to now, your Single will contribute but 0.0001% of the global hash rate. Needless to say, your Bitcoin revenue will plummet by a factor of ten right along with it.

Current page: Financial Aspects: Revenue

Prev Page FPGA- And ASIC-Based Mining Devices Next Page Financial Aspects: Costs-

esrever How does mining new coins make sense if there will ever only be 21 million? I am so confused by that point.Reply

Another thing is, with an economic system like this, a billionaire can easily manipulate market prices and make extremely large amount of money and still be completely fine due to this being in a grey area of the law. You can't pump and dump stocks legally but it seems pretty easy for something like this considering you can dump the bit coins off as currency in any country. -

s3anister Reply10943052 said:How does mining new coins make sense if there will ever only be 21 million? I am so confused by that point.

To quote the Bitcoin wiki page: "The last block that will generate coins will be block #6,929,999 which should be generated at or near the year 2140."

So to directly answer your question, the whole reason for mining bitcoins is because you'll most definitely be dead before the last block chain is even completed. -

vmem Reply10943126 said:Shitcoins definitely = fools gold!

Huge waste computing power IMO

someone needs to rewrite the algorithm and somehow hook up block generation to folding@home or some similar constructive use of the computational power.

-

smeezekitty Reply

That would be a great idea. Verifying a relatively small hash to screen out the cheaters then perform something useful like F@H.10943157 said:10943126 said:Shitcoins definitely = fools gold!

Huge waste computing power IMO

someone needs to rewrite the algorithm and somehow hook up block generation to folding@home or some similar constructive use of the computational power.

-

dannyboy3210 A very interesting read. I had been reading about Bitcoins (mainly because I just couldn't figure out what they were exactly), but this clears a lot of things up.Reply

Also, at the bottom of page 5, in the Comparison of FPGA and ASIC Chips table it says "Power Fraw". -

slomo4sho Fiat currencies... I guess for some people the dollar wasn't worthless enough.Reply

It is amazing how you can lose your "wallet" and your funds permanently disappear from the pool. -

toarranre Never heard of this and I'm quite confused by it. Use graphics cards to find units of a currency that from what I can tell must be extremely succeptable to artificial inflation or all out collapse.Reply

Most Popular