AMD's Data Center Sales Set Records, Consumer Products Disappoint

AMD suffers from lower-than-expected client product sales, but data center products sell well.

AMD on Tuesday revealed its financial results for the third quarter of 2022. The company's revenue totaled $5.6 billion primarily because of weak sales of AMD's CPUs and GPUs for the client segment. Meanwhile, sales of AMD's data center products set another record as demand for EPYC CPUs, Pensando DPUs, as well as Xilinx field programmable gate array products remained strong.

"Third quarter results came in below our expectations due to the softening PC market and substantial inventory reduction actions across the PC supply chain," said Dr. Lisa Su, the head of AMD. "Despite the challenging macro environment, we grew revenue 29% year-over-year driven by increased sales of our data center, embedded and game console products. We are confident that our leadership product portfolio, strong balance sheet, and ongoing growth opportunities in our data center and embedded businesses position us well to navigate the current market dynamics."

Strong Data Center and Gaming Revenue

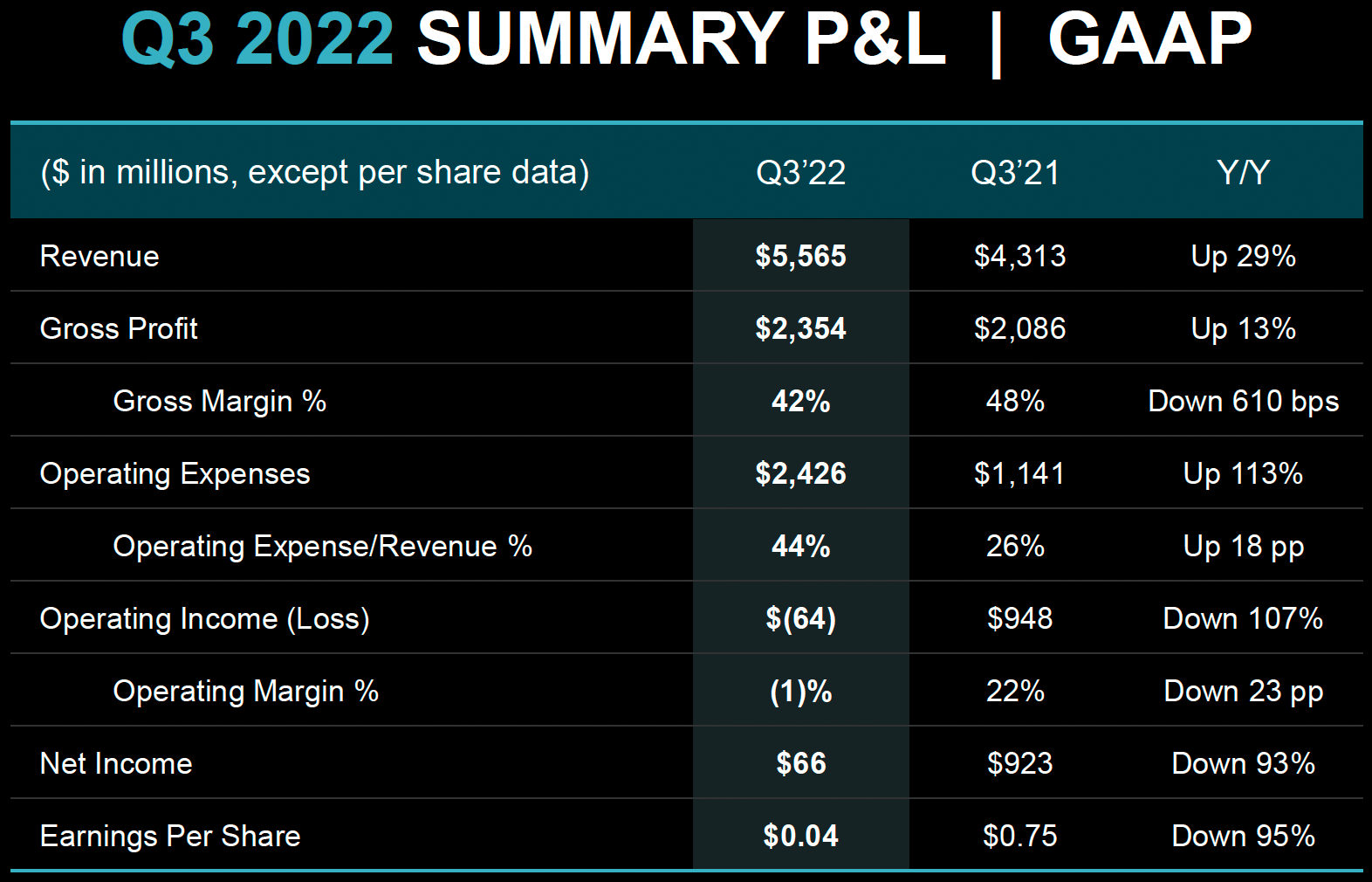

AMD's Q3 2022 revenue reached $5.565 billion, up 29% year-over-year but down $985 million compared to the previous quarter. The company's gross margin dropped to 42%, down from 48% in the same quarter a year ago. As for net income, it cratered to $66 million from $923 million in Q3 2022, whereas the company's earnings per share declined to $0.04, down from $0.75 a year ago. AMD stressed that its profitability decreased due to the amortization of Xilinx acquisition-related intangible assets and increased R&D investments, partially offset by a $135 million tax benefit in the quarter.

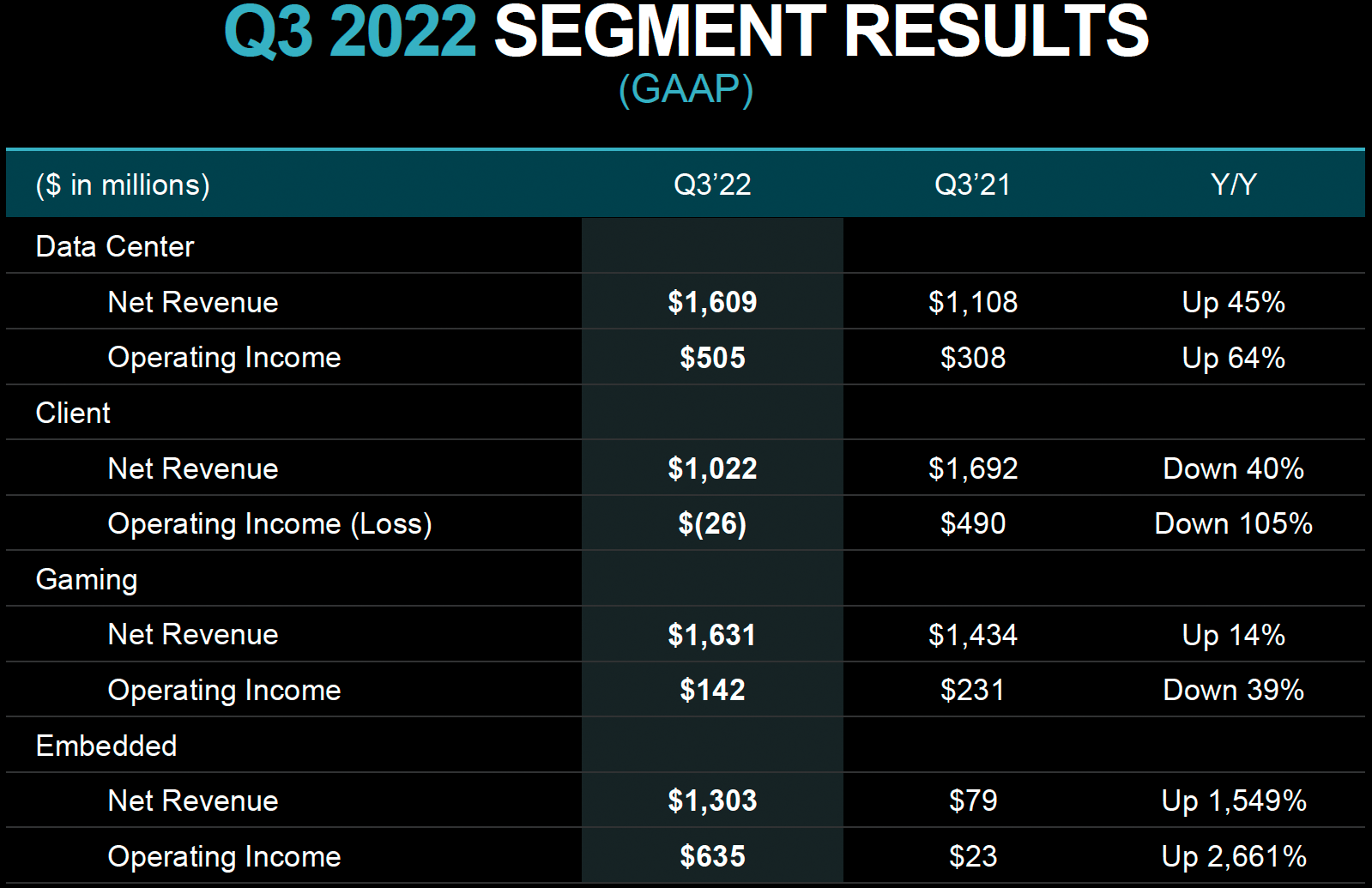

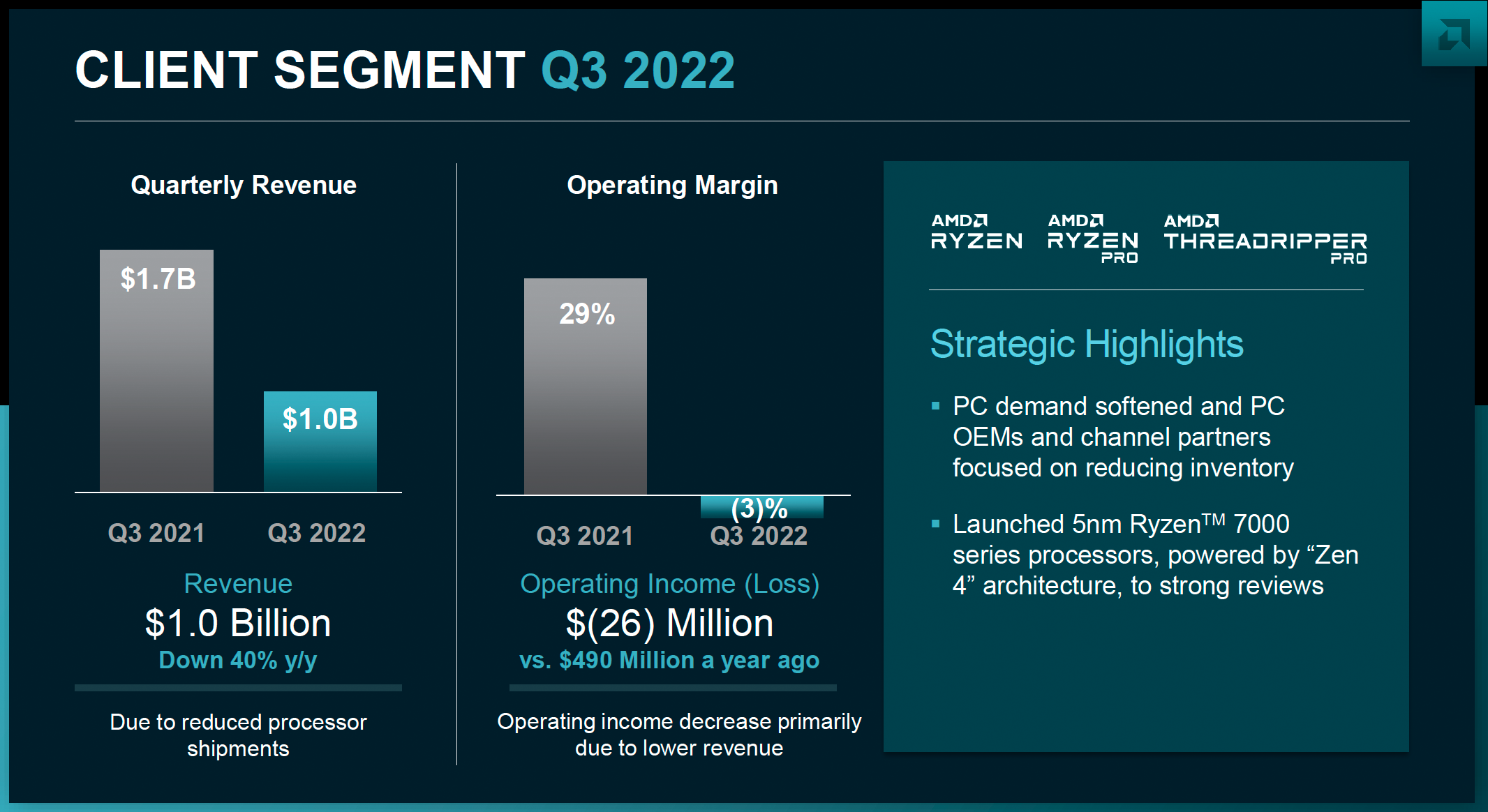

Demand for client processors and chipsets got significantly lower in the third quarter, which is why AMD's Client Computing revenue fell to $1.022 billion in Q3 2022, or a whopping 40% year-over-year. In addition, the company's client business unit lost $26 million during the quarter as the company's clients were trying to clear out inventory. Therefore AMD needed to offer specific incentives to sell products sitting in the company's stock.

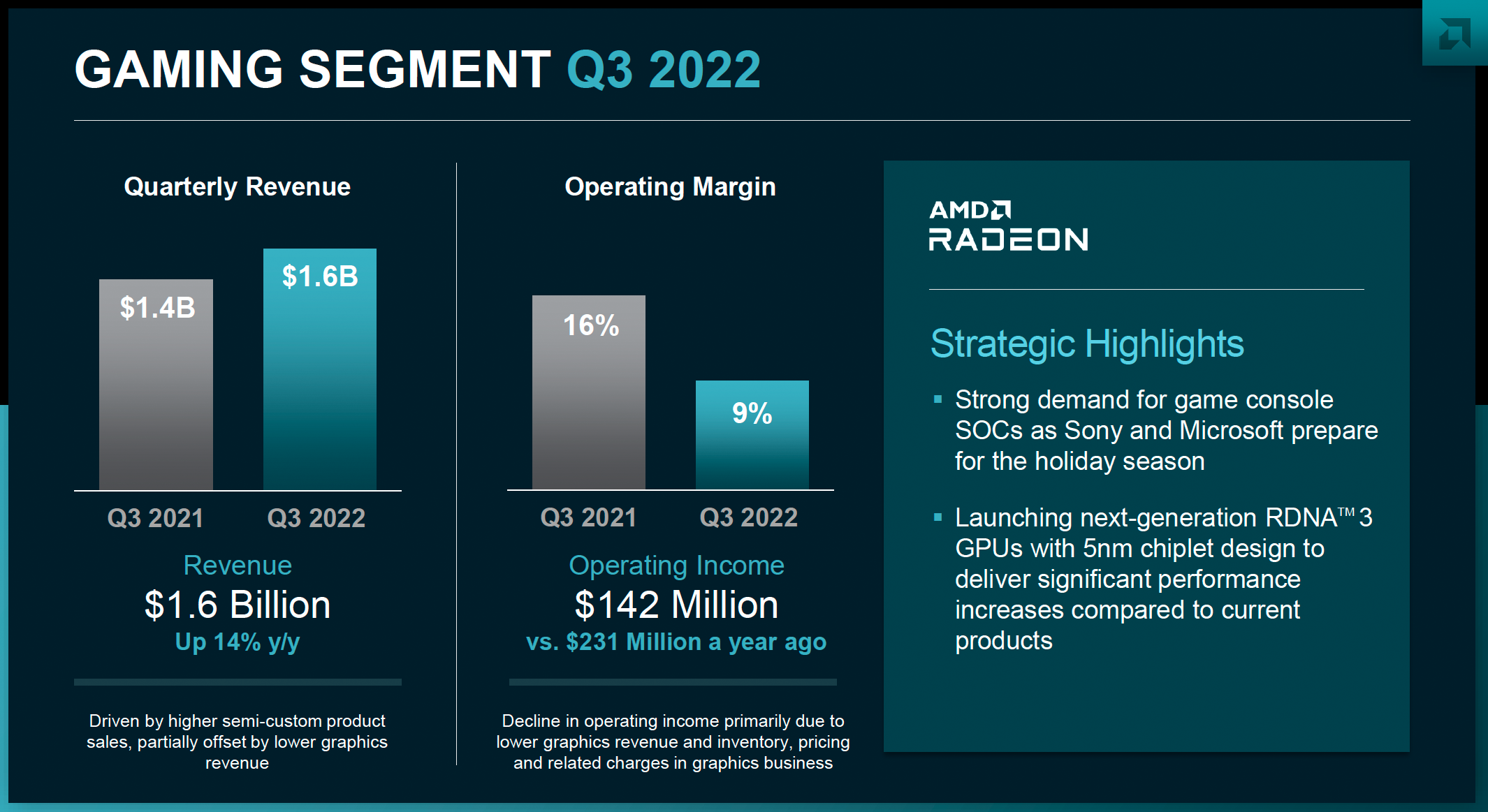

AMD's Gaming business — which includes client GPUs and console system-on-chips — continued to demonstrate mixed results during the quarter. The business unit earned $1,631 billion during the third quarter, up 14% year-over-year. But AMD's Gaming BU thrived not because demand for its Radeon RX 6000-series graphics processors was particularly strong but because Microsoft and Sony prepared for the holiday season and bought a boatload of system-on-chips for their Xbox and PlayStation game consoles in Q3 2022.

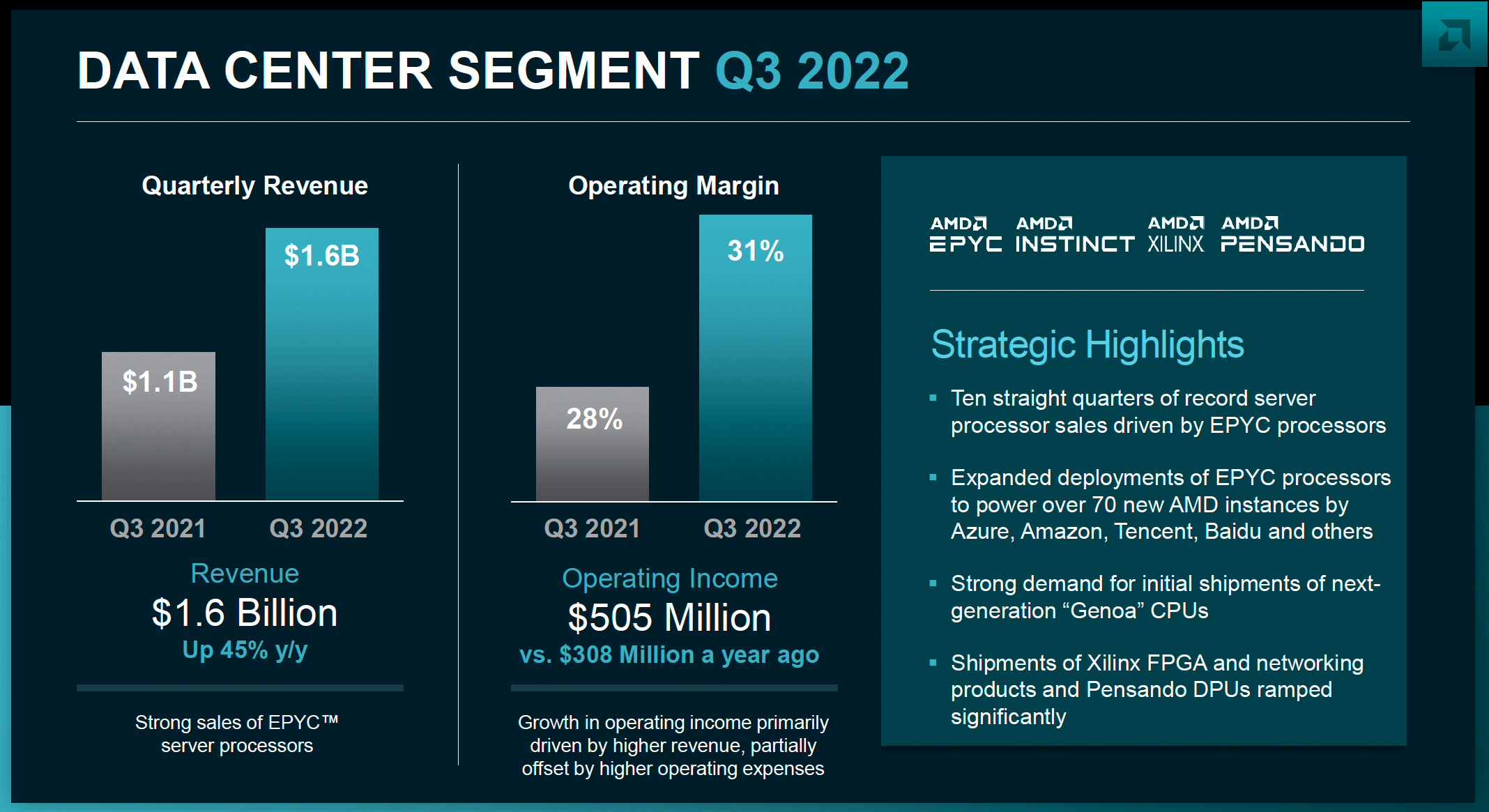

AMD's Datacenter business unit has been the company's main success story in recent years. The third quarter was not an exception; the BU's sales totaled $1,609 billion, up 45% year-over-year, whereas its operating income topped $505 billion, a 64% YoY increase. It is particularly important that while AMD began shipments of its next-generation EPYC 'Genoa' processors to select customers in Q3, those volumes were barely significant. The company said that its Datacenter business unit was supply constrained during the quarter and that in Q4 2022, those constraints will be less severe, allowing the company to grab some additional market share from its arch-rival Intel.

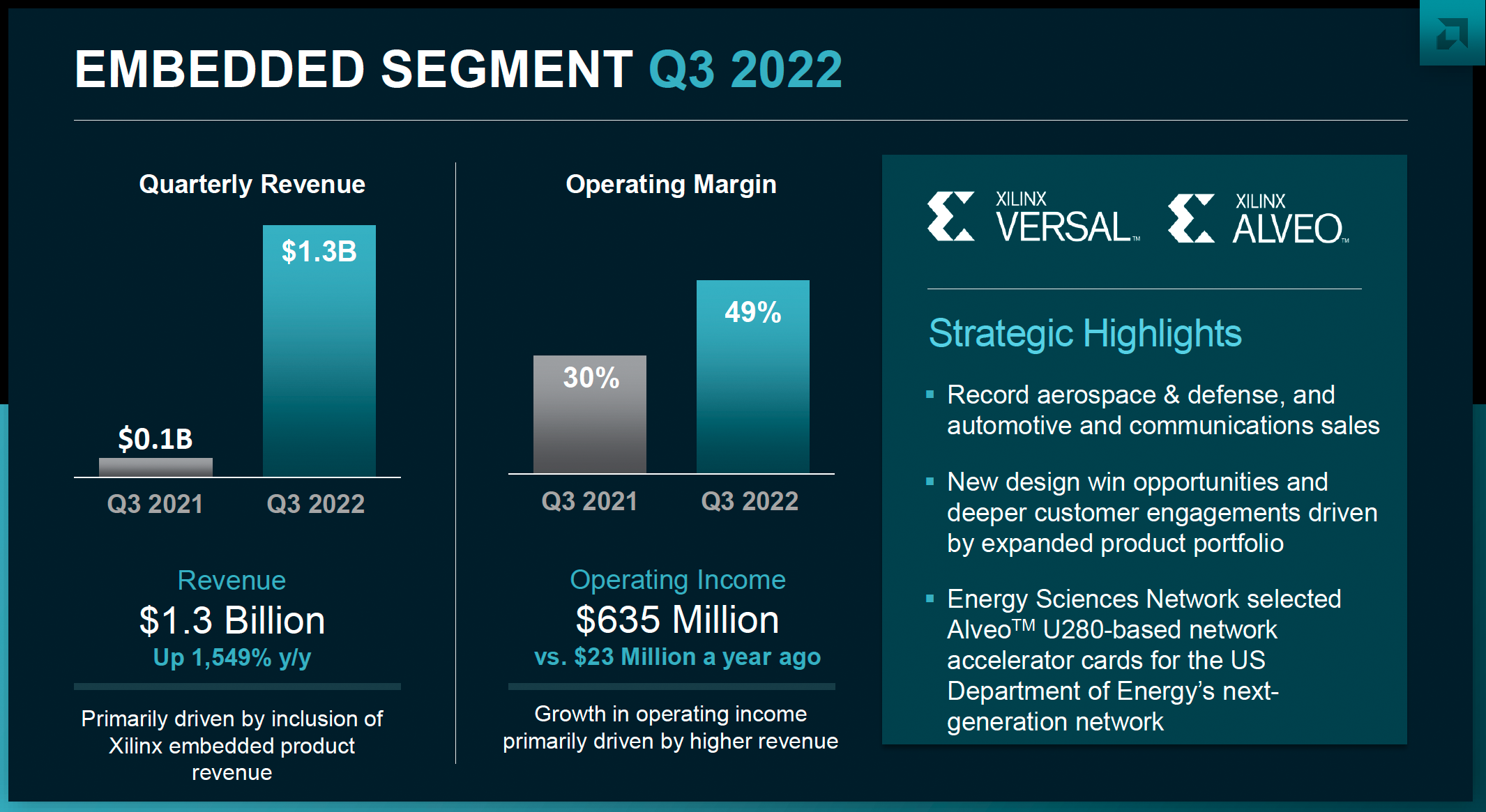

AMD's Embedded business, which sells products developed by AMD and various solutions designed by Xilinx, earned $1.3 billion, up 1,549% year-over-year since in Q3 2021, AMD's Embedded BU only sold the company's CPUs and GPUs, which are not particularly popular.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Cautious Outlook

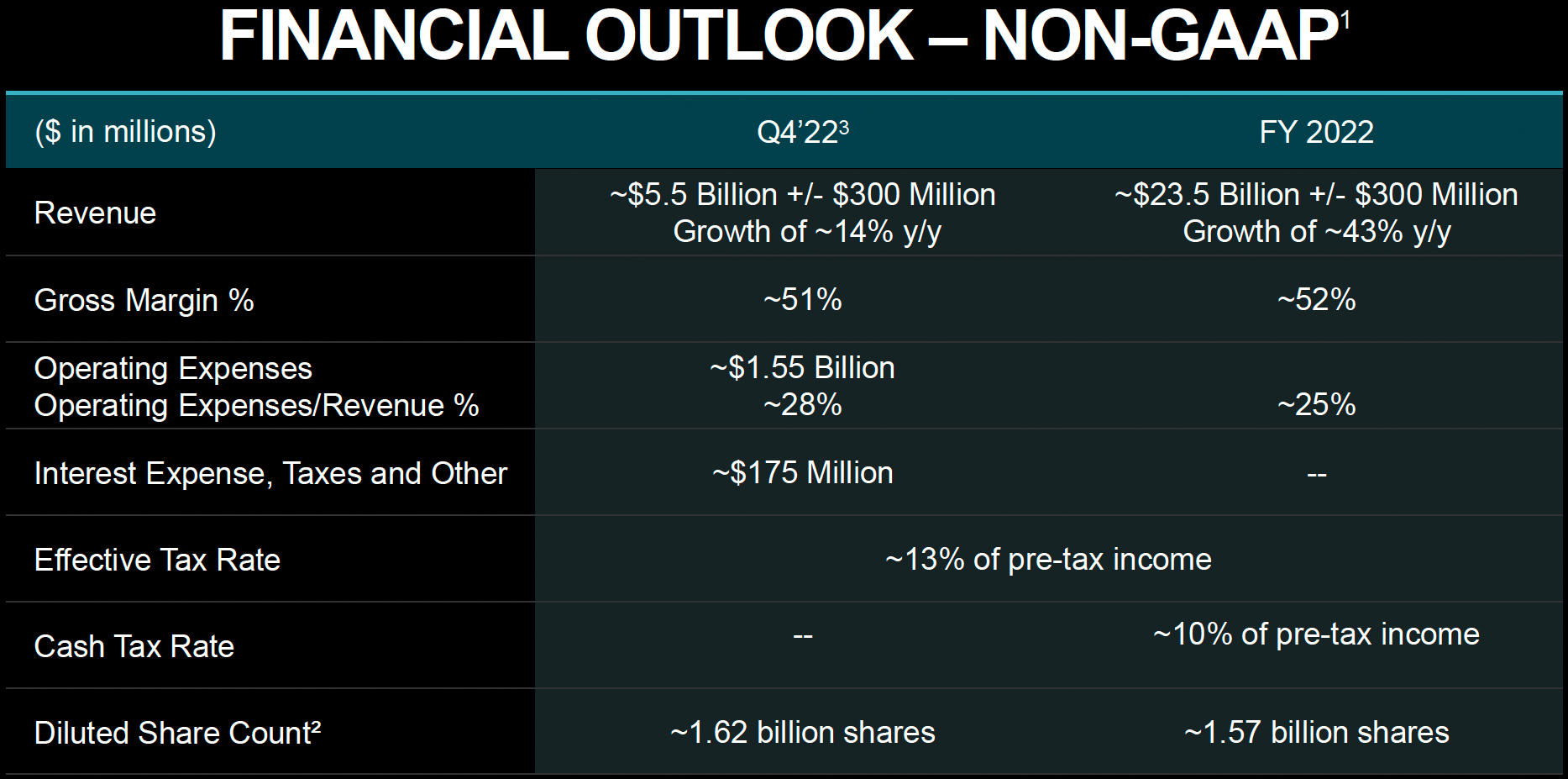

Although AMD is optimistic about the performance of its data center and embedded businesses in the fourth quarter, it does not expect much from Q4 2022. First, the fundamental weakness of the client PC market will hardly let the company sell loads of its client CPUs. Meanwhile, sales of console SoCs will be down sequentially. Higher sales will unlikely offset them if AMD's discrete graphics processors as the company typically ramp up its GPUs very slowly.

For Q4 of 2022, AMD expects revenue to be approximately $5.5 billion ± $300 million, an increase of around 14% YoY and flat sequentially. For the full year 2022, AMD projects revenue to be approximately $23.5 billion ± $300 million, an increase of about 43% over the previous year, primarily driven by the success of AMD's data center and embedded products.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

escksu This is about as good as it gets for AMD and the drop in consumer CPU/GPU will continue and perfectly understandable.Reply

1. The exceptionally high demand for CPU and GPU was fuelled largely by COVID. So that demand has pretty much ended and most people still have their systems which is around 2yrs old. So, not many pple will be upgrading.

2. Inflation and economy uncertainty.

Data center sales is expected. Since these servers are part of business continuity, they are subjected to regular refresh intervals. Cloud demand is also ever increasing and alot less affected by covid. -

-Fran- It's interesting to see their consumer side lose (edit: make less?) a bit of money, but not surprising. Intel has been playing the right cards to exploit their weakness in their overall strategy. Data center though, they're growing very nicely.Reply

Still, a long long way from being remotely close to Intel, lol.

Regards. -

samopa In the world of virtualization (which are used by most data center), number of core is significant factor followed by power efficiency. No matter how good Intel processor are, if they can keep up the number of core per processor and power per core ratio, they will loose to AMD.Reply -

escksu Reply-Fran- said:It's interesting to see their consumer side lose (edit: make less?) a bit of money, but not surprising. Intel has been playing the right cards to exploit their weakness in their overall strategy. Data center though, they're growing very nicely.

Still, a long long way from being remotely close to Intel, lol.

Regards.

Its expected and not due to Intel. Both companies have much lower sales compared to previous year for obvious reasons. As I mentioned in my post, COVID created exceptionally high demand for consumer CPUs/GPUs. So it's going to be quiet now. And then inflation + uncertainty in economy will dampen things further. -

escksu Replysamopa said:In the world of virtualization (which are used by most data center), number of core is significant factor followed by power efficiency. No matter how good Intel processor are, if they can keep up the number of core per processor and power per core ratio, they will loose to AMD.

That's why Intel is moving away from this model of general purpose CPUs. We are all waiiting to see what sapphire rapids can do. -

Alvar "Miles" Udell After some of the things they pulled (Zen 3 on X370 backtrack, duff 5950Xs that don't perform to specs, elimination of Threadripper, horrid product segmentation of Socket AM5, etc...) I'm very pleased at this result and hope the downward trend continues. This coming from a previous 20 year AMD fan.Reply -

JamesJones44 Replyescksu said:Its expected and not due to Intel. Both companies have much lower sales compared to previous year for obvious reasons. As I mentioned in my post, COVID created exceptionally high demand for consumer CPUs/GPUs. So it's going to be quiet now. And then inflation + uncertainty in economy will dampen things further.

Not to mention the Crypto winter and the Ethereum move away from GPU proofing which fell under the consumer category durning those times as well. It's really a double whammy on the consumer end for AMD. -

BogdanH Before continuing: I never was a "fan" of any company -I buy whatever covers my needs at best price/performance ratio (as far my wallet allows).Reply

-no idea what you're talking about. To me, it looks like you pulled some "negatives" from elsewhere.Alvar Miles Udell said:After some of the things they pulled (Zen 3 on X370 backtrack, duff 5950Xs that don't perform to specs, elimination of Threadripper, horrid product segmentation of Socket AM5, etc...)

As far I can read, Zen3 was the most succesful AMD CPU ever (and actually still is) and those who decided for 5950X seems to be quite happy.

IMHO, classic Threadripper has become obsolete with introduction of latest AMD/Intel CPU's. And those who really need more than 16 cores (are you the one?) can decide for Threadripper Pro.

AM5 socket... I don't understand what you mean with "segmentation".

I'm very pleased at this result and hope the downward trend continues. This coming from a previous 20 year AMD fan.

-you do realize how childish that sounds, right?

Bogdan -

Jimbojan Intel's 7nm Raptor Lake is already more power efficient than AMD Zen 4, in the next generation, Meteor Lake will be even more power efficient than AMD's 5nm chips.Reply

AMD's PC revenue is down 60% from last quarter, while Intel only goes down by 20%, mainly because of Intel has better performance and valued products. AMD's data center was able to maintain $1.6B because Intel Sapphire Rapids is delayed, but it will come in Jan. 2023, from there, AMD's data center product will go down just like the PC share to go down. Intel is moving faster than TSMC/AMD in product design; this situation will be become clearer in a year or so, as Intel move to 2nm design and getting more customer design wins.