AMD To Chase Market Share Over High End With First Polaris Offerings

On the eve of Computex, AMD’s Radeon Technologies Group (RTG) will hold its Polaris Technology Summit in Macao. Those expecting an immediate direct competitor to Nvidia’s GeForce 1080, or a Fury X replacement with HBM2, haven’t been paying close enough attention. AMD continues signaling its intention to increase discrete GPU volume and market share rather than simply slugging it out with Nvidia on the high end.

For a company practically bleeding out during the past several financial quarters, any immediate wallet share success trumps winning mindshare at the sexier high end of the GPU market. Although AMD will eventually take on Pascal later this year with Vega, its first Polaris offerings (we'll likely hear more about Polaris 10 in Macao) will target the mobile arena, where AMD has traditionally done well with discrete GPUs, and what it calls the “mainstream performance” segment. Those markets promise higher volume and potential market share gains, even if they make for less glamorous headlines.

AMD Market Share Uptick

Last week, AMD pitched some analyst market share figures that showed the company increasing its discrete GPU market share in Q1 2016, despite an overall decline in the segment. The numbers, courtesy of Mercury Research, showed sequential rather than year-over-year growth for AMD, so they seemed at a glance to be a momentary blip. Further, the overall market decline came in a quarter where products built on new Nvidia and AMD GPU architectures were imminent, most likely putting a momentary freeze on expenditures.

Where there is hand-selected market data, there is almost certainly more worth digging into.

Specifically, Mercury Research reported a 10.2% decline in the discrete GPU market quarter over quarter (Q1 2016 vs Q4 2015). AMD's share was up 3.2 points, a fair portion of it in notebooks (7.3% increase), but some of it also on desktops (1.8% increase). Naturally, those share points came at the expense of Nvidia.

But things change a bit when measuring year-over-year (YoY) growth, which AMD wasn’t touting in its pitch. For example, for desktop discrete GPUs, growth was 5.5% (Q1 2016 vs Q1 2015), according to Mercury Research. Although that may seem a paltry uptick, Mercury’s Dean McCarron stated that the discrete desktop GPU segment had been down 20 percent for each quarter (measured YoY) for five quarters straight, starting in Q2 2014. Alas, during the Q1 2016 desktop GPU lift, AMD’s share remained flat at 22.7%. On the other hand, the company’s notebook discrete GPU share grew 4.3 points, from 34.4% in Q1 2015 to 38.7% in Q1 2016 (in a segment that was down in number of units YoY for both AMD and Nvidia).

In Search Of Growth

Because both AMD and Nvidia are launching new FinFET architectures imminently (we’ve reviewed Nvidia’s soon-to-ship GeForce GTX 1080), any market freeze would theoretically impact both companies. There have been reports that Nvidia halted some of its Maxwell production, but the company hasn’t verified this. AMD also recently dropped the MSRP of its Fury Nano by about $150, and other Fiji-based cards are also slightly less expensive.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

In other words, it’s difficult to find a single solid reason behind that sequential 1.8% market share gain.

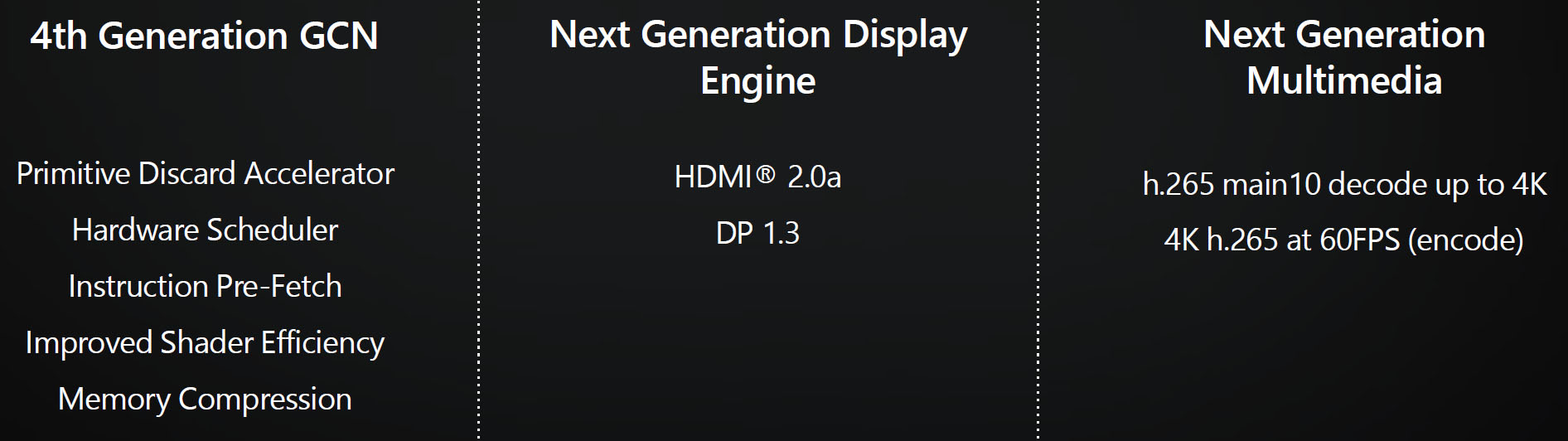

One reason AMD gave for market share growth is its numerous driver updates. Ever since the RTG split (reformation?), there has been a steady flow of driver updates (easily more than a half dozen), UI improvements, and an announcement slow-drip, orchestrated by RTG’s leader, Raja Koduri. That trickle has included specifics around display and video support, DX12 support (Ashes of the Singularity, Total War:Warhammer, Battlezone VR, Deus Ex:Mankind Divided), and Async Compute, which will get support in a number of titles later this year.

Ever-improving drivers is hardly a reason to assign even a minor market shift, but breadcrumbs and transparency can stir hope and maybe some confidence. A 1.8% sequential uptick in market share is nice, but it’ll take a few quarters of that to make any real impact. It seems AMD’s leadership is well aware of this, if you listened closely to the company’s most recent quarterly earnings call and comments from CEO Lisa Su regarding GPU market share:

“I will say that we certainly have aspirations to regain shares to our historic levels. It will take us some period of time. So, it'll happen over multiple number of quarters. We're optimistic about the second half of the year, and we think Polaris is positioned well. We're particularly positioning in some of the mainstream segments that are higher volumes that would drive share growth faster. And we'll have to see how that plays out in the second half of the year."

The Polaris Path

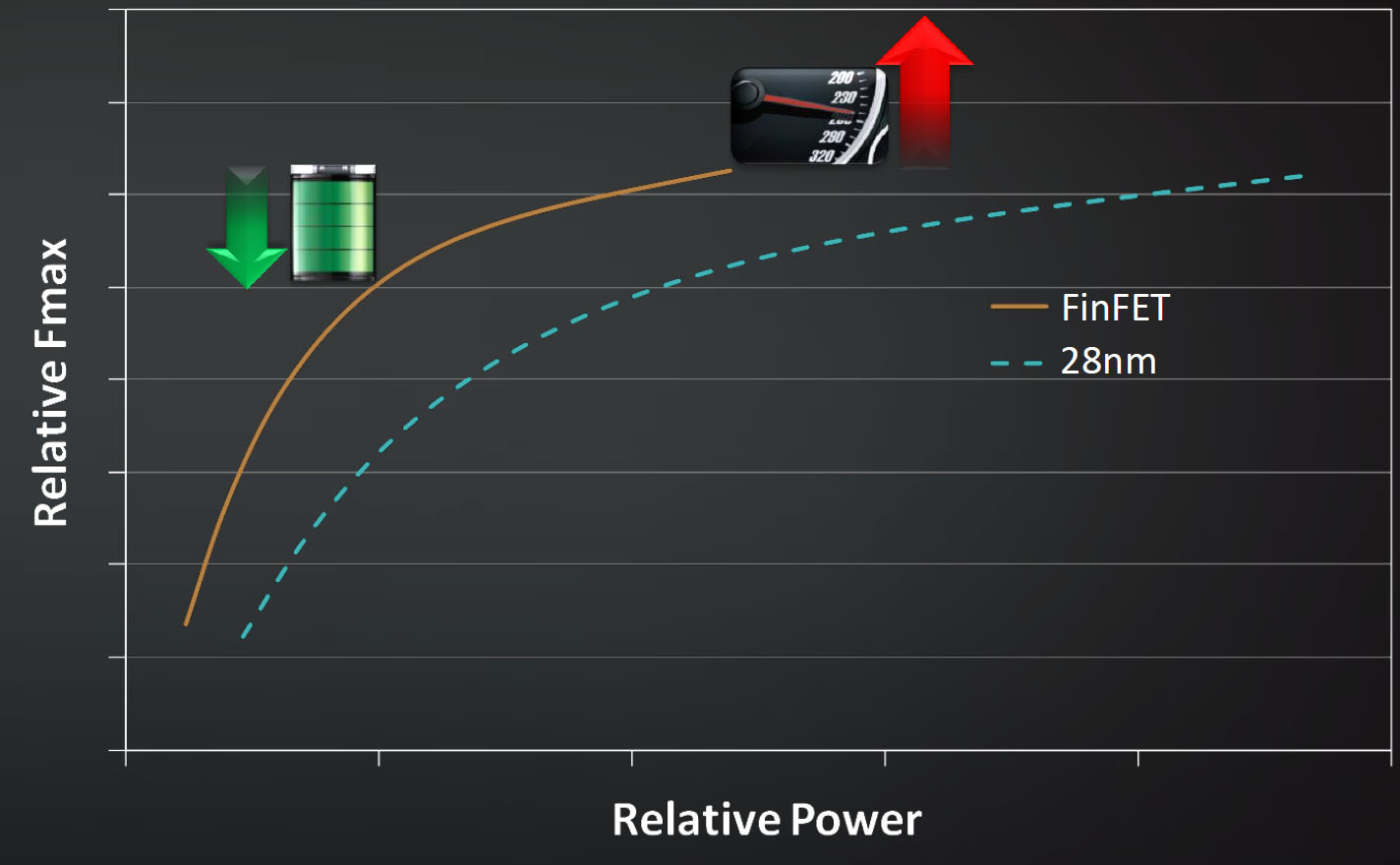

Nvidia grabbed this season’s first big headlines, starting with the GeForce GTX 1080, based on the company's new 16nm FinFET process. The performance numbers we saw (25-35% gains in many cases) spoke pretty emphatically about Pascal on the higher end of the performance curve.

When AMD first unveiled details about Polaris earlier this year, right as CES began, it focused on the architectural improvements running on the new 14nm process (GlobalFoundries), but even then the focus was on performance per watt.

AMD is starting out on the desktop with that mainstream performance segment, targeting roughly $150-$300 products, sources say. We'll see Polaris 10 come in as a more efficient GPU (a 2.5x performance per watt improvement, according to AMD), but not something that'll go head to head with the 1080. More importantly, AMD doesn't want to see its next architecture eat into sales of its current high-end products just yet. Those products, which have held their own against Nvidia in many of our benchmarks (especially at higher resolutions), are still too new to the market.

AMD believes that Nvidia, by starting with the GTX 1080, is still a couple of quarters away from any volume play for Pascal, thus giving AMD the opportunity to first challenge Maxwell, rather than Pascal, and most importantly, to win immediate market share.

Further, as Nvidia begins to flesh out its Pascal lineup, including filling out the lower end, AMD will unveil Vega at the higher end, with HBM2 and performance that takes off where Fiji began. At GDC, it even teased Navi for 2018, touting next-generation memory.

In other words, those who want to see AMD go head to head with Nvidia on all fronts, especially the more glamorous ones, will have to wait until later this year. In its quest for transparency and the slow drip, AMD has said as much all along.

Fritz Nelson is the Editor-In-Chief of Tom's Hardware. Follow him on Twitter, Facebook and Google+. Follow us on Facebook, Google+, RSS, Twitter and YouTube.

-

tntom Glad they are upfront with this otherwise I would interpret it as AMD falling behind. Which... they are but it is also intentional strategy.Reply

Anyways just bought me a GTX950 over AMD GPU because I needed a particular power budget regarding PSU. Hope Polaris is power efficient. -

turkey3_scratch AMD is confident that they have an open market segment in low to mid end, but right when they release their cards Nvidia will whip out the 1050 and 1060 probably.Reply -

InvalidError Reply

If Nvidia prices the 1050 and 1060 following the 950 and 960, there will be plenty of room for AMD to undercut Nvidia at a given performance level with the R7-450/460/R9-470.18030924 said:AMD is confident that they have an open market segment in low to mid end, but right when they release their cards Nvidia will whip out the 1050 and 1060 probably. -

turkey3_scratch Reply18030959 said:

If Nvidia prices the 1050 and 1060 following the 950 and 960, there will be plenty of room for AMD to undercut Nvidia at a given performance level with the R7-450/460/R9-470.18030924 said:AMD is confident that they have an open market segment in low to mid end, but right when they release their cards Nvidia will whip out the 1050 and 1060 probably.

True true. -

AMD's stock price increased quite a bit. Who knows, but one thing is sure, the next few generations of graphic cards will be great, on both sides. We will get 10-bit 4k resolution soon folks, at 60 fps min! It's a great time to be a pc master race.Reply

-

VaporX ReplyGlad they are upfront with this otherwise I would interpret it as AMD falling behind. Which... they are but it is also intentional strategy.

Anyways just bought me a GTX950 over AMD GPU because I needed a particular power budget regarding PSU. Hope Polaris is power efficient.

I am curious what limitation you where facing? I have seen a 380 running on a 350 watt PSU with no issues.

-

turkey3_scratch Reply18031099 said:Glad they are upfront with this otherwise I would interpret it as AMD falling behind. Which... they are but it is also intentional strategy.

Anyways just bought me a GTX950 over AMD GPU because I needed a particular power budget regarding PSU. Hope Polaris is power efficient.

I am curious what limitation you where facing? I have seen a 380 running on a 350 watt PSU with no issues.

"350W PSU" is an extremely generalized term. -

thor220 ReplyAMD is confident that they have an open market segment in low to mid end, but right when they release their cards Nvidia will whip out the 1050 and 1060 probably.

I doubt that Nvidia will be able to compete in that market well given that their die size is 33% bigger than last gen. If Nvidia does come out with 1050 and 1060s it'll either be to low quantity or some time from now as they will have to redesign and gear up another production line. -

turkey3_scratch Reply18031753 said:AMD is confident that they have an open market segment in low to mid end, but right when they release their cards Nvidia will whip out the 1050 and 1060 probably.

I doubt that Nvidia will be able to compete in that market well given that their die size is 33% bigger than last gen. If Nvidia does come out with 1050 and 1060s it'll either be to low quantity or some time from now as they will have to redesign and gear up another production line.

Bigger die size, though, with the node size decrease means a ton of potential for more transistors. Think of it, they could probably pack 6X as many transistors in that chip that way. That's a massive performance potential. Of course, that won't be the reality, but I think if they pull it off right, they can do well with a die size increase while having a more power efficient chip. Plus, an increased die size means better contact with the heat sink and better cooling, in a sense.