GPU Market Nosedives, Sales Lowest In a Decade

Intel solidifies GPU positions amid graphics market slump.

Shipments of integrated and discrete graphics processing units dropped to a 10-year low in the third quarter as PC OEMs reduced procurements of CPUs, and gamers lowered their purchases of existing graphics cards while waiting for next-generation products. In contrast, miners ceased to buy graphics boards due to changes that happened to Ethereum. In general, sales of standalone graphics cards for desktops hit a multi-year low.

Usually, PC makers increase procurement of PC hardware components in the third quarter as they assemble computers to sell them in back-to-school and holiday seasons when sales are high. But as demand for PCs softened recently, manufacturers initiated inventory corrections and lowered their components buying to sell off what they already have.

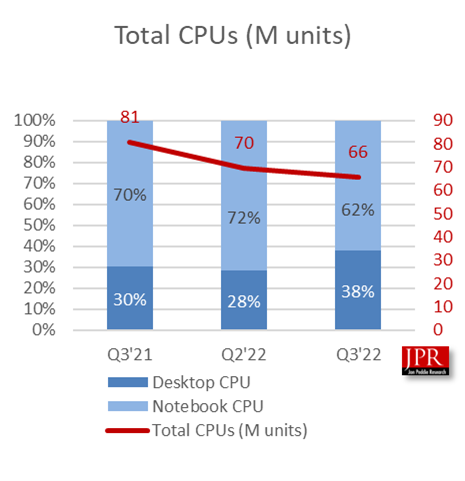

As a result, sales of integrated and discrete GPU dropped to 75.5 million units in Q3 2022, down 10.5% sequentially and 25.1% year-over-year, according to Jon Peddie Research (JPR). In addition, shipments of desktop GPUs fell by 15.43%, and notebook GPUs decreased by 30%, which is the most significant drop since the 2009 recession, JPR notes.

"The third quarter is usually the high point of the year for the GPU and PC suppliers, and even though the suppliers had guided down in Q2, the results came much below their expectations," said Jon Peddie, president of JPR.

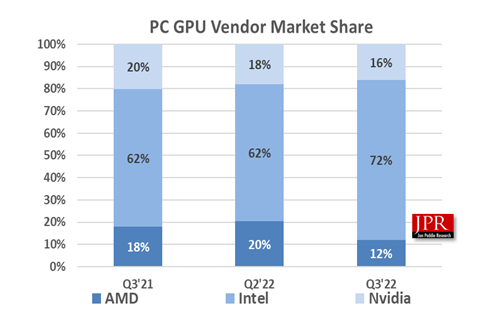

Since Intel is the largest producer of CPUs, it is also the largest supplier of PC graphics processors. The company increased its domination and commanded 72% of the PC GPU market in Q3 2022 as shipments of its GPUs rose by 4.7%. By contrast, Nvidia's share dropped to 16% as it lost 19.7% of sales, whereas AMD's share collapsed to 12% as its GPU shipments fell 47.6% sequentially.

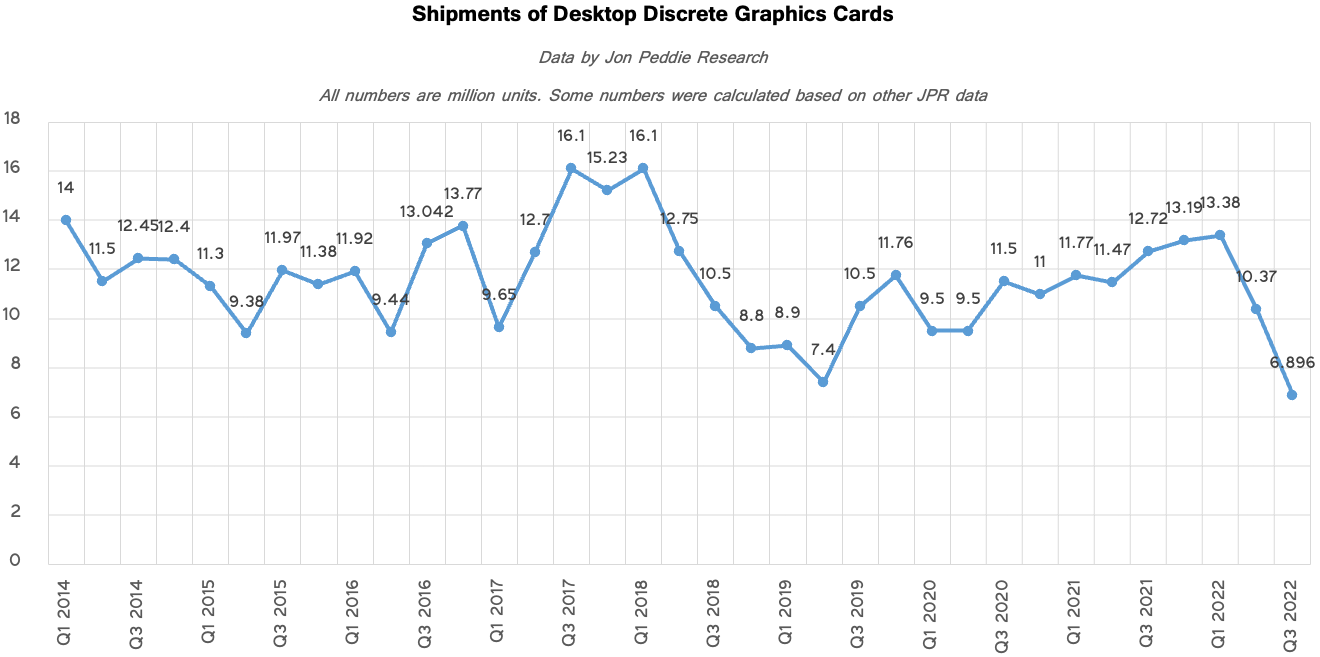

Interestingly, sales of standalone graphics cards for desktops (including the best graphics cards for gaming) decreased to 6.89 million, or by 33.5% quarter-over-quarter, the lowest quarterly result in years.

“All the companies gave various and sometimes similar reasons for the downturn: the shutdown of crypto mining, headwinds from China’s zero-tolerance rules and rolling shutdowns, sanctions by the US, user situation from the purchasing run-up during Covid, the Osborne effect on AMD while gamers wait for the new AIBs, inflation and the higher prices of AIBs, overhang inventory run-down, and a bad moon out tonight,” said Peddie. “Generally, the feeling is Q4 shipments will be down, but ASPs will be up, supply will be fine, and everyone will have a happy holiday.”

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

PlaneInTheSky GPU prices would need to be cut in half for me to even consider one. Both Nvidia and AMD are off their rocker, no one is buying at these prices.Reply -

Alvar "Miles" Udell There are -plenty- of people wanting a new GPU, but at over $1100 for what is effectively the upper mid range model is just insane, and AMD's pricing is just as bad. I have a 2070 Super and would love a 4080, but not unless it drops to the $750 mark.Reply -

hasten Reply

They will sell and have been. Find a 4090 in stock. Even the 80s are selling and they are the reciprical of the last generations 90 to 80 value prop. There is 1 model of the 80 in stock at my local MC otherwise the same lack of inventory. The AMD cards will be out of stock as quickly as they come in. People have been bitching about GPU prices since the dedicated gpu came to market. I had to save a ton and beg my parents to match for a bday or something to get my first 3dfx card, a Voodoo powered Creative 3D Blaster. It was amazingly expensive and awesomely powerful.PlaneInTheSky said:GPU prices would need to be cut in half for me to even consider one. Both Nvidia and AMD are off their rocker, no one is buying at these prices.

Where have you been the last 30 years? 😉

(BTW the 4090 is amazingly expensive and awesomely powerful, have one myself but didnt have to ask my rents this time hah) -

PiranhaTech If my GPU wasn't having problems, I probably would have held off.Reply

The RX 6700 XT would have been along what I wanted in terms of bracket and price. However, with the prices and December 13 (when AMD releases their card), I may have still waited. The RX 6700 XT is what I would have expected... at launch -

thisisaname They should release GPUs like the release the CPUs. They should release more of the product stack that just the top end!Reply -

InvalidError Reply

AMD's RX6600 at ~$220 is pretty decent bang-per-buck and is what the desktop RX6500 should have been in a healthy market. Nvidia's entire product stack though is completely out of wack.PlaneInTheSky said:GPU prices would need to be cut in half for me to even consider one. Both Nvidia and AMD are off their rocker, no one is buying at these prices. -

TJ Hooker It's a little confusing that the first figure is about CPU sale trends, which the article text does not discuss at all.Reply -

PlaneInTheSky ReplyThey will sell and have been. Find a 4090 in stock. Even the 80s are selling and they are the reciprical of the last generations 90 to 80 value prop.

LDLC, one of the biggest hardware retailers in Europe, has had 4080 in stock since launch. They currently have MSI, Gigabyte, Zotac, PNY, Gainward etc. All available and in stock.

LDLC never sold out of 4080, not even at launch day, which is abnormal for a GPU launch. Not many people are jumping to spend €1600+ on a GPU, most people are struggling to even pay their electric bills nowadays. -

M0rtis And the companies will solve this problem by cutting production in order to maintain these ridiculous prices.Reply