Intel CEO: Clients Want Custom x86-Based SoCs

Gelsinger talks about Intel now and into the future.

In a conversation with a financial analyst, Pat Gelsinger, Intel's chief executive, shared some interesting details about the company's expectations for the future, talks with potential Intel Foundry Services customers and their needs, Intel's capabilities to address these needs, and the company's way of taking advantage of internal and external manufacturing.

Make Intel Bigger and Stronger

Historically, Intel has always built its core products, including some of the best CPUs for gaming, internally using leading-edge and advanced process technologies as well as outsourced some of its low-cost and non-core products to Taiwan Semiconductor Manufacturing Co. and United Microelectronics Corp.

But the economics of the semiconductor industry require Intel to get bigger and more flexible. To do, so it needs to adopt a different business model that it calls IDM 2.0 strategy. This approach entails Intel to produce most of its products in-house, outsource some of its products to contract manufacturers, and make chips for third-party customers.

Intel's IDM 2.0 strategy is certainly designed for the company's long-term success. It is extremely capital intensive, so in the coming years Intel will cease to buy back shares, but will invest in new manufacturing capacities instead. After all, leading-edge production technologies are so expensive to develop these days that Intel can only recoup its costs when used for very high volumes, so building up capacity is one of Pat Gelsinger's key tasks as Intel CEO.

Another thing that Gelsinger must do is ensure that Intel has the best engineers for its core businesses, which now include CPUs for client applications and datacenters, GPUs, networking, autonomous vehicles, and semiconductor manufacturing. For example, to strengthen the CPU unit, Intel brought back Glenn Hinton (the lead architect of Intel's Netburst and Nehalem microarchitectures) as well as Shlomit Weiss (who led development of Intel's Sandy Bridge and Skylake microarchitectures) earlier this year.

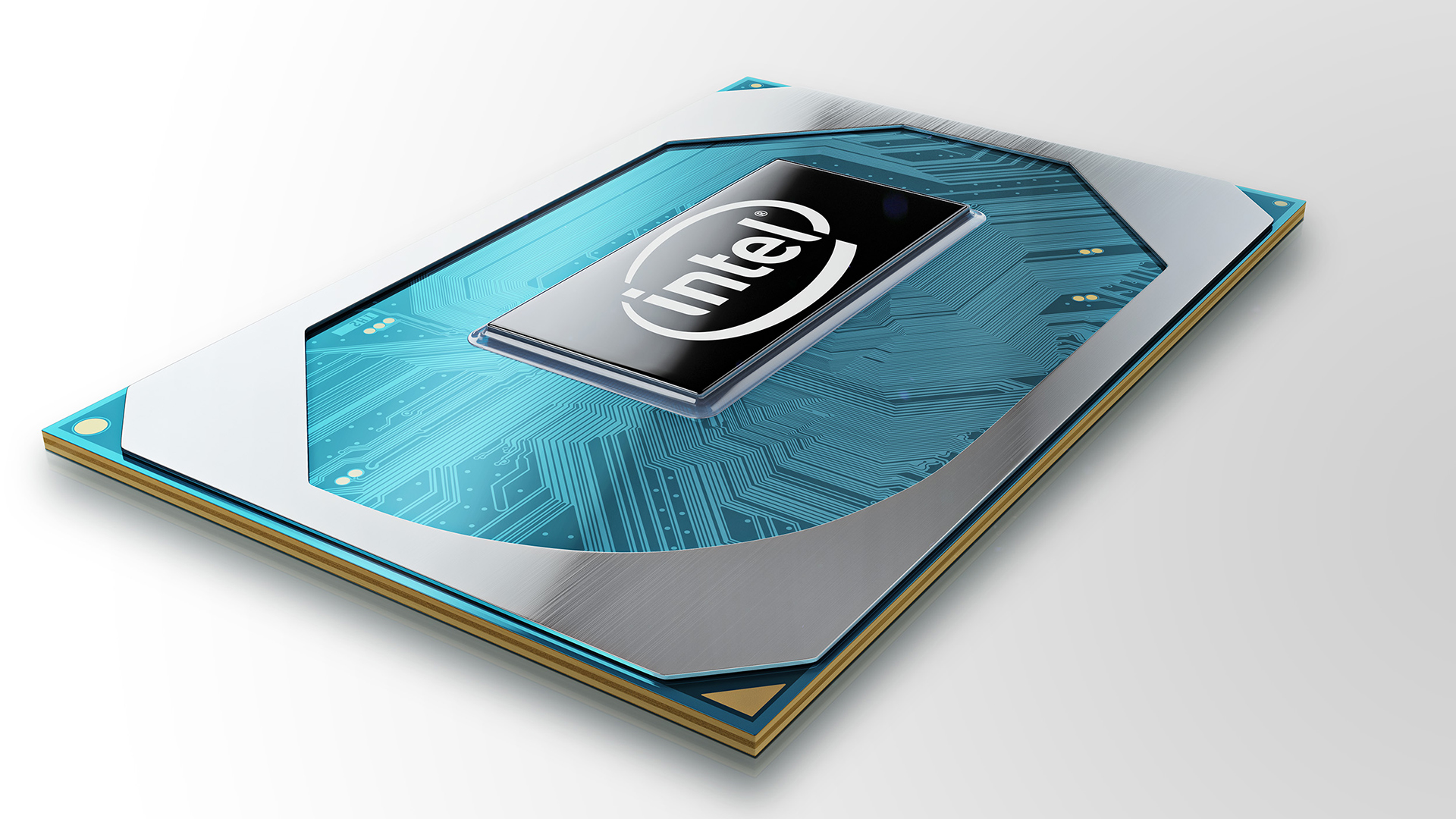

While some tend to think that x86 is losing to Arm in terms of performance and flexibility, which is why Arm is the future, the reality is quite different. Most owners of client PCs would prefer to keep using x86 CPUs because of software compatibility. On-premises datacenters would also stick to x86 for the same reasons. Furthermore, Intel says that even those customers who are looking for full-custom system-on-chips prefer x86, which is what Intel is going to offer.

Gelsinger: We'll Have Many 'Zen Moments' in the Future

Architecture is arguably the most important ingredient of a successful product. Intel has plenty of talented CPU engineers, but it was using various versions of the Skylake microarchitecture (introduced in 2014) for so long that many of its products lost their appeal particularly in the enthusiast segment. This allowed AMD to capture a lucrative chunk of the market with Ryzen processors based on various iterations of its Zen microarchitecture.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

AMD's return to the game in 2017 caught Intel off guard to a large degree because the company did not expect Zen to offer such a significant performance uplift compared to previous-generation Bulldozer/Excavator microarchitecture. In the recent history of CPUs, there was only one comeback that was this surprising: Intel's introduction of its Conroe microarchitecture that not only left the company's own Netburst-based CPUs in the dust, but dethroned AMD's K9 (Athlon 64/Athlon 64 FX) overnight.

Interestingly, but some industry analysts now call an unexpected comeback a 'Zen moment' even when they ask Intel about its future breakthroughs. Being a huge company with plenty of engineering resources, Intel understood Zen threat early enough and while Ice Lake/Sunny Cove as well as Tiger Lake/Willow Cove were good CPUs, Alder Lake/Golden Cove is expected to be Intel's true breakthrough.

"So, the three major [Alder Lake] architectural announcements we think are pretty Zen-like in that sense where you have defined major new efforts," Pat Gelsinger said in a conversation with Pierre Ferragu, an analyst with New Street Research (via @witeken). "Trust me, we have a few [more] that are still cooking back in the labs that […] we think are pretty dramatic step[s] forward, well beyond anything that we have talked about yet. And some of those we might not talk about for a couple of years yet, but innovation, you know, the geek is back."

The fact that Intel's CEO uses 'Zen moment' term is pretty intriguing, it may emphasize that Pat Gelsinger acknowledges AMD's success with Zen. But development of Alder Lake began long ago, so its probable success will be deservedly attributed to Intel's previous management. For Pat Gelsinger, this upcoming launch is only the beginning. Yet, the CEO clearly knows where he needs to lead the company.

Pat Gelsinger: 1/3 of IFS Customers Want x86 SoCs

One of the key elements of Intel's IDM 2.0 strategy is the company's newly created Intel Foundry Services (IFS) group that will manufacture chips for others. This group can operate as a classic foundry making any chips its clients want: Arm-based system-on-chips, RISC-V-based controllers, tensor processing units (TPUs), or graphics processing units (GPUs), just to name a few options.

But Intel can naturally add a unique sauce to its IFS offering: highly competitive general-purpose x86 cores as well as an extremely broad portfolio of its silicon-proven IPs. Earlier this year Intel said that it was in discussion with over 100 of potential IFS customers and recently it revealed that about 1/3 of them were interested in custom x86-based SoCs.

"Of the 100+ customers, I'd say about a third of them are interested in that x86ish of our ecosystem," said Gelsinger.

In fact, Intel may not only provide its IFS customers x86 cores and other IP, but allow them to customize x86 cores and build full-custom solutions based on off-the-shelf technology.

"We are going to monetize x86 cores in our products, but we are also going to enable them to be monetized on other people's products where they can innovate around them," said Gelsinger. "We have gotten quite a lot of interest from some of our traditional customer saying, so 'I can go create my own version of Xeon?' And the answer is yes. 'I could mix it with some of my unique requirements for networking?' Yes. 'I could deprecate some of the transistors I am not using in those configurations.' Yes. […] I'll say [we are] breathing life back into the x86 in a number of domains, because that was only possible on the Arm ecosystem before."

Take Advantage of Standard Foundry Ecosystem

Intel used to be ahead of the industry with leading-edge process technologies and products to a large degree because it built almost everything in house. Since Intel adopted new fab equipment earlier than other semiconductor companies and was larger than any foundry out there, it could ask makers of fab tools to tailor their products for its needs. On the one hand, Intel got exactly what it needed and, on the other hand, forced other semi companies to tune their nodes and process recipes for their tools and essentially follow standards set by Intel.

But Intel lost the battle for smartphones and tablets. Its Atom SoCs were not as power efficient as Arm-based SoCs and could not provide the same set of features. Initially, Apple planned to put an x86 chip into iPhones, but Apple and Intel failed to agree on the price, which is why the former installed a Samsung-designed Arm SoC into its first smartphone. Then Steve Jobs wanted to use Atom in iPad, but Tony Fadell persuaded him that using an advanced Arm SoC made more sense. By the time the smartphone market exploded in 2011, Apple introduced its 2nd Generation A-series SoC, Qualcomm had its Snapdragon S4 SoC with custom Arm cores, and there were half of a dozen relatively high-performance Arm SoCs from other vendors. Most of these chips were made by TSMC and Samsung Foundry and just a couple of years down the road these SoCs outsold Intel's CPUs when smartphones outsold PCs.

These mobile SoCs needed a new process technology every year and demand for smartphones gave foundries a great boost. To develop these chips in a timely manner, companies like Apple, Samsung, Qualcomm, and MediaTek needed very sophisticated and efficient electronic design automation (EDA) tools, which companies like Cadence and Synopsys delivered.

"One thing that mobile did is it created the scale to the TSMC ecosystem, which was all of the support entities and then it created what I would call intelligent, fabless players that worked with TSMC to get their capabilities to the level that, you know, it became kind of self-reinforcing," said George Davis, CFO of Intel. "We come into the market now in a situation where competitors have the benefit of all of that."

TSMC executed perfectly and introduced a new process technology for its clients every year, EDA tool vendors supported these nodes with a new set of tools, mobile SoC vendors churned out new products every year. This is when the ecosystem essentially became self-reinforcing.

By contrast, Intel had to delay its first mainstream and high-end 14 nm CPUs by a year to 2015 and rolled out the technology together with TSMC's N16 and Samsung's 14LPE. Back then, Intel still had a massive lead in terms of transistor density, power, and performance. But the foundry ecosystem was already a perfect machine that was bigger than Intel and executed better than Intel.

Delaying a new node by a year or even more is not a big problem for an IDM in normal situations and this has happened to Intel, Samsung, Texas Instruments, and others without causing any significant problems. The problem for Intel is that, given its size, it has to compete against multiple companies at once: AMD, Nvidia, Xilinx, Broadcom and Samsung, just to name a few. And when all these companies can take advantage of the self-reinforcing foundry ecosystem, but Intel cannot, it finds itself in an unfavorable position.

To take advantage of the ecosystem and to make itself more competitive in the foundry industry, Intel needs to become a part of the foundry ecosystem. This includes deploying industry-standard EDA tools and equipment used by other contrast makers of semiconductors. In fact, that has been something that Pat Gelsinger has been working on for the past few months.

"One of the things Pat has done is he accelerated our engagement with the ecosystem to make sure that we are getting the same benefit out of this amazing ecosystem that has been built over the last 13 years," said Davis. "We are much closer today than we were before with the EDA vendors, much closer today with the equipment suppliers. We used to tell them what to do, now we are making sure that we understand what the best practices are, how do you get the most productivity out of tools."

Furthermore, now that Intel offers manufacturing services for fabless companies, it must enable its clients to build their products using familiar EDA tools that are compatible with their flows. To that end, it needs to make it internal flows and processes compatible with those in the foundry industry.

The Best Node for Every Product

Using proprietary EDA software and fab tools is good as long as your process technologies meet expectations, you are confident that there is no need to outsource manufacturing of a particular design, and you are not going to make chips for others. Intel has been using custom EDA programs, process development kits, and equipment throughout its history, but with its IDM 2.0 strategy that involves both internal and external manufacturing, it has to migrate to off-the-shelf software and tools.

Pat Gelsinger wants all of Intel's products to be the best and, to get there, he wants to make them using the most suitable process technologies. But to be able to outsource something to TSMC, its design must be developed using industry-standard tools designed for TSMC's production technologies.

"I am going to have the bulk of [my product line] built internally and be able to harvest those margins as well," said Gelsinger. "We are going to make selective use of foundries. […] If I need to use a foundry to have a unique product or a halo product and certain portions, absolutely. […] I really unleashed my engineering teams to say, 'you are going to deliver the best product. Period. You are unconstrained to pick the technologies to always be delivering the best products that you have in the category.'"

Summary

Being a big vertically integrated company, Intel has some serious challenges that are well beyond those faced by fabless chip designers, contract manufacturers, or IP developers.

Intel has to become a bigger maker of chips to stay among the few companies that can develop and use leading-edge fabrication technologies, which is why the company is getting into the foundry business, abandoning non-core businesses, and ceasing to buy shares back in a bid to focus on investment in manufacturing capacities.

Intel's foray into the contract manufacturing business opens some new doors to the company as it can work closer with various big customers (e.g., cloud giants) and can help them develop full-custom SoCs based on its IP, which spreads its technologies beyond traditional CPUs and platforms. If the strategy works, this will make Intel far more competitive against Arm. According to Intel, out of IFS's 100+ potential customers, about one third would want a custom x86-based SoC.

But while Intel will invest considerably more in its own manufacturing, it will still outsource some of its products if it needs to. The company clearly understands that its architectures are even more valuable than its manufacturing prowess, so it intends to make products using the best technology available.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Is this some new type of commercial? Other companies have been doing this for quite some time, AMD included. None had to use PR methods to this extent. It's making me nauseous.Reply

-

Sleepy_Hollowed Replytommo1982 said:Is this some new type of commercial? Other companies have been doing this for quite some time, AMD included. None had to use PR methods to this extent. It's making me nauseous.

yes, this was pretty insane. AMD has been doing custom SoCs for clients since the Xbox One/PS4 we’re starting to be developed, that intel hadn’t done this explains a lot of why Apple abandoned them for their own designs. -

Howardohyea Reply

but again, it's more of a foundry service than a "custom designed chip" which AMD doesn't offerSleepy_Hollowed said:yes, this was pretty insane. AMD has been doing custom SoCs for clients since the Xbox One/PS4 we’re starting to be developed, that intel hadn’t done this explains a lot of why Apple abandoned them for their own designs. -

RodroX I feel uneasy everytime a big corporation like Intel needs to go out to the media every week and throw a lot of statements/headlines about their new product/strategies and how good they will be.Reply

I mean if you have soo much awesome stuff why do you need to talk soo much. Get your stuff out in the wild (whenever you have it ready) and let it talk by itself. -

waltc3 If it wasn't for AMD I wonder if we'd still be on a ~2GHz iteration of the original Pentium...;) It seems like Intel needs AMD to show it what to do and where to go every so often or the company just stagnates. Intel will find keeping up with AMD this time around to be much different than the last time AMD spurred Intel to take AMD's x86-64 and go to Core 2/Sdram when what Intel wanted the world to buy was Itanium/Rdram--often lovingly termed "Itanic"...;) (Which finally sank for good not long ago.)Reply

About the time Intel will be having its "Zen moment," AMD will be having its Zen4 moment--or maybe its Zen 5 moment. Will be very interesting to watch. -

watzupken Intel wants their Zen moment, but they failed to understand that AMD being the underdog then was not just trying to compete with performance, but was offering a lot better value than Intel. In terms of what they offer, AMD really went big, i.e. introducing an 8 core processor while Intel is still happily peddling 4 core processors to us for more than a decade.Reply

Anyway, as to Intel's fab strategy, I am not very sure if, (1) they know they customers that well, and, (2)if their competitors are comfortable using their fab since Intel is a major competitor. There may be companies that want x86 custom chips, but I feel the trend is that people are moving away from x86 because they are less efficient than x64. Companies that have invested in custom x64 chips definitely did their homework when it comes to performance, power efficiency and cost, before they choose to produce their own custom SOC for workload specific to their usage. -

haribos Reply

Exactly, they seem desperate trying to stay relevant.RodroX said:I feel uneasy everytime a big corporation like Intel needs to go out to the media every week and throw a lot of statements/headlines about their new product/strategies and how good they will be.

I mean if you have soo much awesome stuff why do you need to talk soo much. Get your stuff out in the wild (whenever you have it ready) and let it talk by itself.