GPU Shipments Soar in Q2 with 123 Million Units Delivered

Nvidia is still at the top, with AMD and Intel just behind

GPUs are one of the most sought-after PC components in today's market, with the best graphics cards perpetually sold out. The launches of AMD, Nvidia, and Intel's recent GPU efforts have shown that the market is very big, and today we found out just how large it is. According to the most recent Jon Peddie Research data, the GPU market has experienced substantial growth in Q2 2021, with over 123 million units sold.

Out of all PC components, graphics cards are perhaps one of the most demanded ones. With the current scarcity of GPUs still present, consumers are buying every GPU they can get their hands on. Of course, that assumes they can even find one, as retailers sell out every stock they receive.

Jon Peddie Research, a research and market analyst firm that specializes in the technology field, has published its latest report about the GPU growth in the second quarter of 2021. And the data is showing some pretty interesting numbers.

When it comes to the total number of GPUs sold in Q2, the report notes that the sales were equal to 123 million units. That is 123 million chips being distributed across the globe. Compared to the same period of Q2 2020, this year's saw a 37% increase Year-over-Year (YoY). Overall, it is estimated that the annual GPU compounding rate will grow 3.5% during 2020-2025 to reach the total number of 3,318 million units shipped in that period.

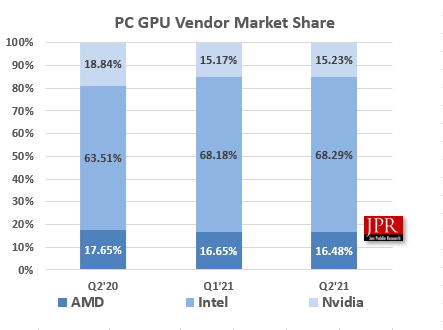

Breaking down the GPU market share by the vendor, AMD's share declined by 0.2%, Intel grew by 0.1%, and Nvidia also experienced growth of 0.06%. For the number of units shipped, the overall market shows a 3.4% growth. AMD increased its shipments by 2.3%, Intel's shipments rose by 3.6%, and Nvidia soared the highest with a 3.8% increase.

The above figures account for all GPUs, including integrated graphics. Since virtually all Intel desktops and laptops include processor graphics, that skews things in Intel's favor. In the table below, you can find a comparison of the discrete GPU market, where only AMD and Nvidia are competing for now. It will be interesting to see how Intel does in this area once its Arc GPUs start shipping next year.

| Header Cell - Column 0 | Q2'20 | Q1'21 | Q2'21 |

|---|---|---|---|

| AMD | 20% | 19% | 17% |

| Nvidia | 80% | 81% | 83% |

As far as PC CPUs are concerned, the research shows a 42% growth year-over-year. However, no further data is provided, as this report mostly focused on the GPU side of the story. The GPUs themselves represent a market in high demand, with no signs of slowing down.

Total share of the market has skewed toward Nvidia slightly compared to last quarter, and more so compared to last year. As we've noted elsewhere, the Steam Hardware Survey along with units sold via eBay, which we track in our GPU price index, both indicate Nvidia has sold far more Ampere GPUs than AMD has sold RDNA 2 GPUs. The above table includes previous generation GPUs as well, with no way to track exactly what's being sold, but right now Nvidia accounts for 83% of the dedicated GPU market.

What we'd really like to know is just how many GPUs from the latest generation have been sold. The full JPR report might contain that data, but it wasn't provided to the public. It also doesn't give any indication of how many of the GPUs have gone to cryptocurrency miners vs. gamers and other users. We suspect it's far more than AMD or Nvidia would care to admit.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

-

VforV Reply

Hope is one thing and reality is another.Hunterhawk said:I hope it's not for mining, it's for gaming

At least half, if not more were for mining and I'm inclining on the "more" side... :cautious: -

Kamen Rider Blade We need accountability, what % of Discrete GPU's went to Miners & Scalpers.Reply

We need a proper breakdown of those numbers from each vendors and ways to prevent that from happening again along with legislation, fines, & regulation against Miners & Scalpers. -

fball922 I find the shortage of GPUs really annoying, but I don't really understand the whole need for "accountability" over who is buying what. To me, it would make the most sense for the GPU manufacturers to raise their wholesale prices astronomically to find what the market supports. That eliminates the "scalpers," who are just simple middlemen taking advantage of the difference between MSRP and real market prices. GPU manufacturers have no reason to limit their wares to particular buyers, except maybe as a PR move to build their brand loyalty, but the cost of that at these prices might be too high. It would be like selling your house in this crazy market, but limiting your buyers to people making under $100k and putting a cap on the price at $250k or putting a "no-flip" clause in the sale agreement. It doesn't make sense.Reply

Gamers have no "right" to any of the GPU supply, IMO. It is annoying, but what if AMD or NVidia simply said "we are out of the GPU industry and now sell only general use hardware that is really good at mining and can also render 3D graphics"? Just because the hardware was developed for gaming doesn't mean it belongs to gamers, or that is its only legitimate use. -

InvalidError Reply

You need to keep in mind that the 123 million units figure counts IGPs, which would include every Intel non-F CPU and every AMD APU. You probably have your first ~100M units right there.Hunterhawk said:I hope it's not for mining, it's for gaming

Then, whatever is left would also include ultra-budget MXxxx on-board graphics, GT710-730, GT1010-1030, etc. entry-level "I just need video outputs" stuff too. RX6000 and RTX3000 series stuff would be some fraction of that. -

Upacs ReplyKamen Rider Blade said:We need accountability, what % of Discrete GPU's went to Miners & Scalpers.

We need a proper breakdown of those numbers from each vendors and ways to prevent that from happening again along with legislation, fines, & regulation against Miners & Scalpers.

Why, so you can play your favorite games as silly FPS? who says you have the more right to use a GPU to play games vs someone else using the GPU whichever way they see fit (mining or otherwise?) or are you just being a crybaby?

What we need is for Nvidia/AMD to raise prices to whatever the market will bear. This will have several effects:

Kill scalpers

Increase their profits, which means they can invest into further product development

Fatter profits will incentivize others to enter the market and produce other products - more choice is better for all

Economics 101. You are welcome -

InvalidError Reply

What the 2017 tax cuts for the wealthy and "employee retention" loans from 2020 have proven is that practically all cheap capital large corporation can score ends up in stock buybacks and other means of inflating executive compensation and benefits before all else.Upacs said:What we need is for Nvidia/AMD to raise prices to whatever the market will bear. This will have several effects:

Increase their profits, which means they can invest into further product development -

Kamen Rider Blade Reply

There's more than one way to solve the problem, I'm not content letting the market regulate itself given how disastrous it's been for gamers and regular folks.Upacs said:Why, so you can play your favorite games as silly FPS? who says you have the more right to use a GPU to play games vs someone else using the GPU whichever way they see fit (mining or otherwise?) or are you just being a crybaby?

What we need is for Nvidia/AMD to raise prices to whatever the market will bear. This will have several effects:

Kill scalpers

Increase their profits, which means they can invest into further product development

Fatter profits will incentivize others to enter the market and produce other products - more choice is better for allEconomics 101. You are welcome

If you like the current market, you should be happy not being able to buy a GPU for your personal use; but for us "Normal Folks", there's better ways to solve this GPU Shortage for normies.