Steep RTX 30-Series Discounts Suggest Impending 40-Series Launch

EVGA, along with the Newegg Shuffle, are shoveling out GPUs ASAP, to clear out inventory

Hot on the heels of Nvidia's devastating earnings report, the company appears to be desperately trying to sell its existing RTX 20- and 30-series GPUs as quickly as possible. Graphics card prices have plummeted this week, with the EVGA store and Newegg Shuffle leading the charge. This suggests that Nvidia is readying up its RTX 40-series launch for the near future, and its partners are looking to dump inventory.

At the EVGA store, many of Nvidia's RTX 30-series GPU models are on sale. Flagship AIB partner models such as the 3080 FTW3 Ultra Hydro Copper, and other FTW3 models, are now priced incredibly closely, often at the GPU's official MSRP. Several other models are priced well under MSRP, including the RTX 3090 Ti, 3090, and 3080 Ti. EVGA is discounting most of its 3090 tier cards as much as 42%.

Some of the discounts have changed over the past weekend, and some cards are now out of stock. Perhaps the most surprising discount comes from the RTX 2060 6GB. Prices for this GPU are now as low as $239.99, which is just $5 more than its smaller — and significantly slower, if you check our GPU benchmarks — brother, the GTX 1660 Super. In our testing, the 2060 was about 25% faster. It's also worth mentioning that the RTX 2060 12GB variant was selling for just $249 yesterday, though it's now at $319.

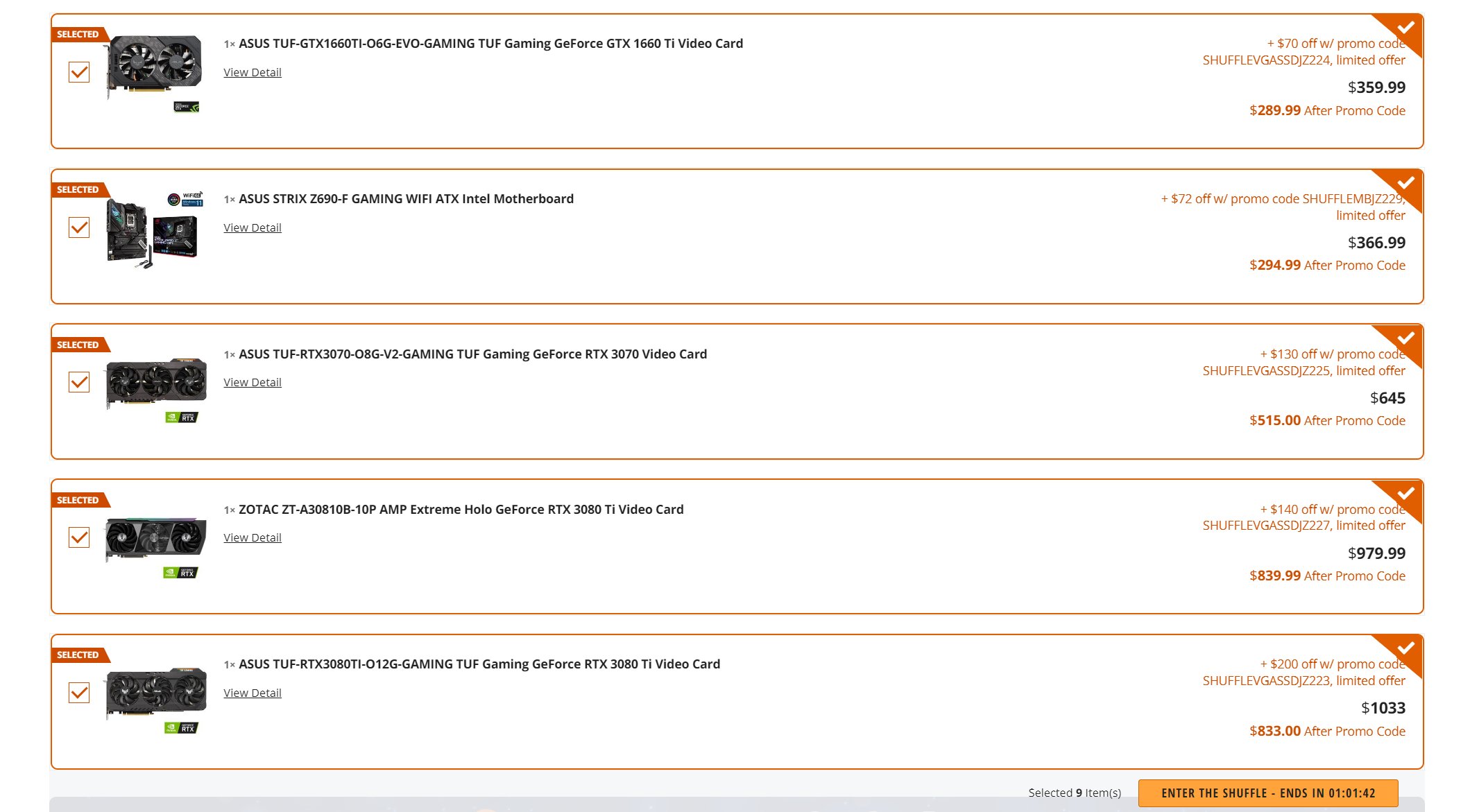

The Newegg Shuffle also had some great deals, with an Asus RTX 3080 Ti Tuf model discounted as low as $833, a Zotac RTX 3080 Ti Extreme model for $839, an RTX 3070 Tuf for $515, and an RX 6600 Dual for just $249. All prices include promo codes featured on each listing, though of course you had to get lucky to get the GPUs at those prices.

Nvidia's Preliminary Q2'23 Financial Losses

Nvidia's financial revenue stream for 2022 is not looking good. In a recent preliminary financial results report, the company announced a whopping 44% quarterly loss in gaming revenue. Total revenue was down from $8.1 billion to $6.7 billion, a 19% quarterly decline, which gaming revenue plummeted from $2.04 billion to 3.64 billion.

This impending loss of funds is the result of the cryptocurrency crash of 2022. That has resulted in significantly reduced demand for Nvidia's GPUs, right when supply started to improve, leaving the company with excess soon-to-be-outdated parts. Nvidia CEO Jensen Huang announced channel price adjustments for its gaming partners, to combat the sting of reduced GPU demand, which is likely what we're seeing from EVGA and others right now.

Nvidia still appears to have a 2022 release window for the RTX 40-series, probably sooner than later, which also accounts for the highly discounted 30-series prices. The RTX 40-series has been rumored for a Q4 of 2022, possibly as early as September, so it makes sense to clear out the existing inventory in preparation for those cards.

But don't expect cheap RTX 40-series GPU pricing out of the gate. Many gamers are likely still looking to upgrade, and the new Nvidia Ada architecture sounds very promising. Nvidia pre-ordered a lot of TSMC 5nm wafers at the height of the global GPU shortage in 2021, but those wafers could end up being allocated to data center and mobile parts in order to keep average selling prices up. However, even the launch of RTX 40-series apparently won't make up for the pending quarterly results.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Aaron Klotz is a contributing writer for Tom’s Hardware, covering news related to computer hardware such as CPUs, and graphics cards.

-

bigdragon The 40-series production contracts were likely locked into place during the pandemic shortage and mining boom. This is why I don't think Nvidia can push back the 40-series launch until next year. I think we will see the 4090, 4080, and 4070 before the Christmas shopping season.Reply

I think this article is right about the need to reduce inventories. The 30-series is clogging up shelf space and warehouse inventories right now. The high-end is especially bad. Now that mining and scalping is out of the picture, PC GPUs are being forced to compete with their much more affordable console competitors -- who also happen to have a steady stream of new games.

I'm not sure why anyone would buy a 3090 Ti for $1150 or a 3080 Ti for $850 when the 40-series will give the same performance at half the price. These aren't deals yet. -

InvalidError Since Nvidia tried to dump 5nm wafer starts and TSMC told them to take a hike, what Nvidia must be the most worried about is having an over-supply of Ada chips while still sitting on heaps of Ampere stock.Reply -

ThatMouse Replybigdragon said:I'm not sure why anyone would buy a 3090 Ti for $1150 or a 3080 Ti for $850 when the 40-series will give the same performance at half the price. These aren't deals yet.

I bought the 3080 on a recent sale with the idea that the 4080 will be $900+ and be hard to find for the next 6 months. We will see, but I'm happy with my decision. -

KOSjet So a quarterly loss is very different from a drop in revenue. @AaronKlotz, you may want to correct this difference.Reply -

LastStanding As much as I would just enjoy witnessing NVIDIA, etc, TRULY get hit hard financially, don't be fooled by these water cooler (gossip) numbers, though.Reply

NVIDIA is still very strong in the black and these today numbers are just the results of some investors selling off some of its shares to profit from, one in a lifetime, NVIDIA's wild success these past few months (especially in 2021) and they'd likely buy back more shares before Ada releases.

Remember, at this same time in 2020, NVIDIA's share price/M-Cap was ~$160B, but since then, NVIDIA's shares were increased and overvalued by shady analysts up to 500%+ (in 12/21, same company, selling the same products, just a refresh, and no new line of tech gadgets) so, considering that and what its share price is today, NVIDIA is still profiting very well over the noise. -

Darkbreeze Reply

LOLInvalidError said:Since Nvidia tried to dump 5nm wafer starts and TSMC told them to take a hike, what Nvidia must be the most worried about is having an over-supply of Ada chips while still sitting on heaps of Ampere stock.

This, is what happens when companies move away from just trying to supply a product and make as much (Which is OFTEN a LOT) as they can off it while it's desirable, to trying to get greedy and make unrealistic progressions into parts of the market that there is no clearly defined leverage in , yet. And it usually ends up poorly for the aggressor. So, hard to feel sad for them. -

mickrc3 I needed GPUs for two computers intended for occasional gaming so I picked up some from EVGA Friday when the deals started. $220 each for the EVGA RTX 2060 6GB KO Ultra Gaming. Yes, soon to be 2 generations from the cutting edge, but these are going into two hand-me-down X470 motherboards with Ryzen 7 2700X CPUs that previously fitted out with an AMD Radeon RX 470 and a GeForce GTX 970. These will be given to nephews currently running Athlon II systems which I also built for them a half dozen years ago.Reply -

TJ Hooker Reply

What numbers are you referring to? Because the article talks about graphics card prices and revenue, neither of which have anything to with share price/selloffs.LastStanding said:NVIDIA is still very strong in the black and these today numbers are just the results of some investors selling off some of its shares to profit from, one in a lifetime, NVIDIA's wild success these past few months (especially in 2021) and they'd likely buy back more shares before Ada releases. -

BILL1957 Reply

Most of the time what they call a "loss" is nothing more than they made that much less profit than was originally forecast for the period.TJ Hooker said:What numbers are you referring to? Because the article talks about graphics card prices and revenue, neither of which have anything to with share price/selloffs.

They have actually lost nothing just made a bit less than they were hoping for.

Then also you have to remember talking about EVGA is not the same as talking about Nvidia.

Evga is a separate company that happens to make GPU cards designed by Nvidia using some components supplied by Nvidia.

When EVGA was selling a 3080 GPU through their web site last year for $1400 no one is reporting on the amount of profit margins or the billions they were making then!

Same with the 3090, EVGA never sold one card for the Nvidia msrp of $1499, please don't expect me to start crying now! -

InvalidError Reply

Except that if EVGA overpaid for Nvidia's GPU kits, EVGA needs Nvidia to refund some of the overpaid money to afford dropping prices low enough to actually sell the stuff. It isn't a strictly one-way street. Part of Nvidia's lowered gross income likely comes from having to issue discounts to help AIBs clear inventory.BILL1957 said:Then also you have to remember talking about EVGA is not the same as talking about Nvidia.

Evga is a separate company that happens to make GPU cards designed by Nvidia using some components supplied by Nvidia.